That’s a bold headline, especially if you are a retired enlisted military member only bringing in a little over a thousand dollars a month in retirement pay. But it’s true. Military retirement is worth well over a million bucks. In some cases, it is worth millions of dollars.

Before we get too deep into this, I want to define what I am talking about. I’m talking about two factors – the long-term value regarding how much you will receive in a direct pension over the lifetime of your retirement benefits and the value of the retirement benefits, including healthcare coverage and other benefits. Combined, these benefits are easily worth over a million dollars, even if you don’t have the spending power of a million dollars right now.

Take an example of retirement pay for an average military career. Since military members are eligible for retirement benefits at 20 years, we will use a reasonable rank and service time for our examples.

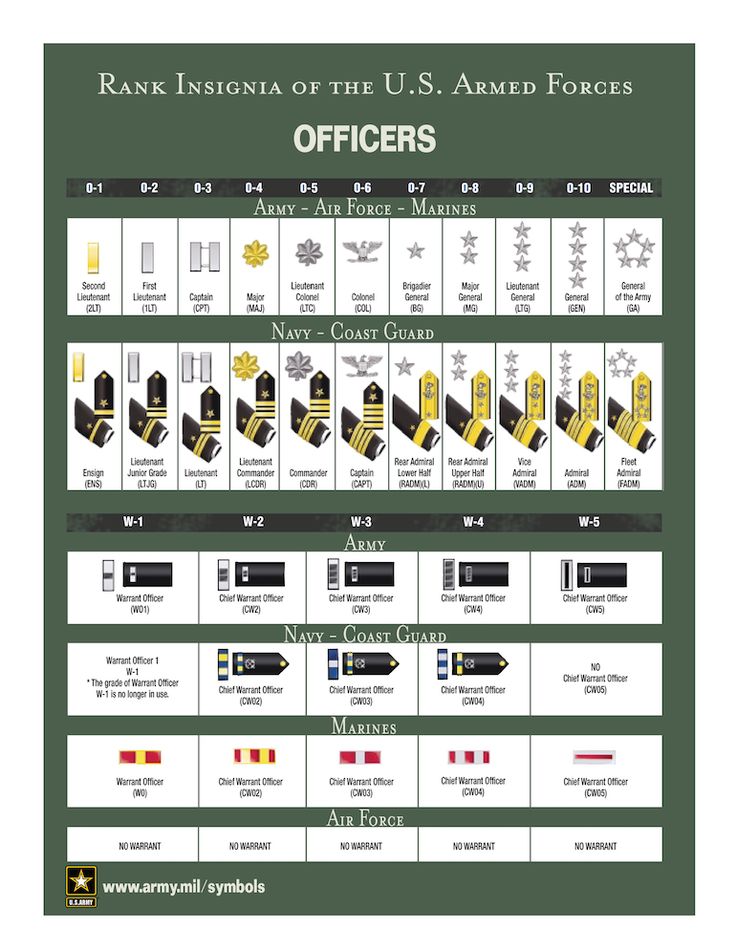

It is reasonable to assume that the average enlisted member will be able to retire at 20 years, having achieved the rank of E-7, and the average officer should be able to retire at 20 years at the rank of O-5.

Of course, there will be outliers based on when you served, your career field, and other factors, but these ranks and service times should apply to the majority of careers (if anything, I am aiming at the conservative side because many people choose to serve longer than the 20-year mark, earning an extra 2.5%-3.5% on their retirement pay per additional service year, depending on whether they take the high 36 retirement plan or the Redux retirement plan).

Track your TSP and other investments with Personal Capital’s free financial dashboard

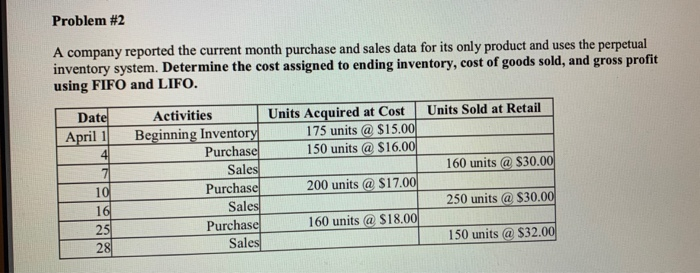

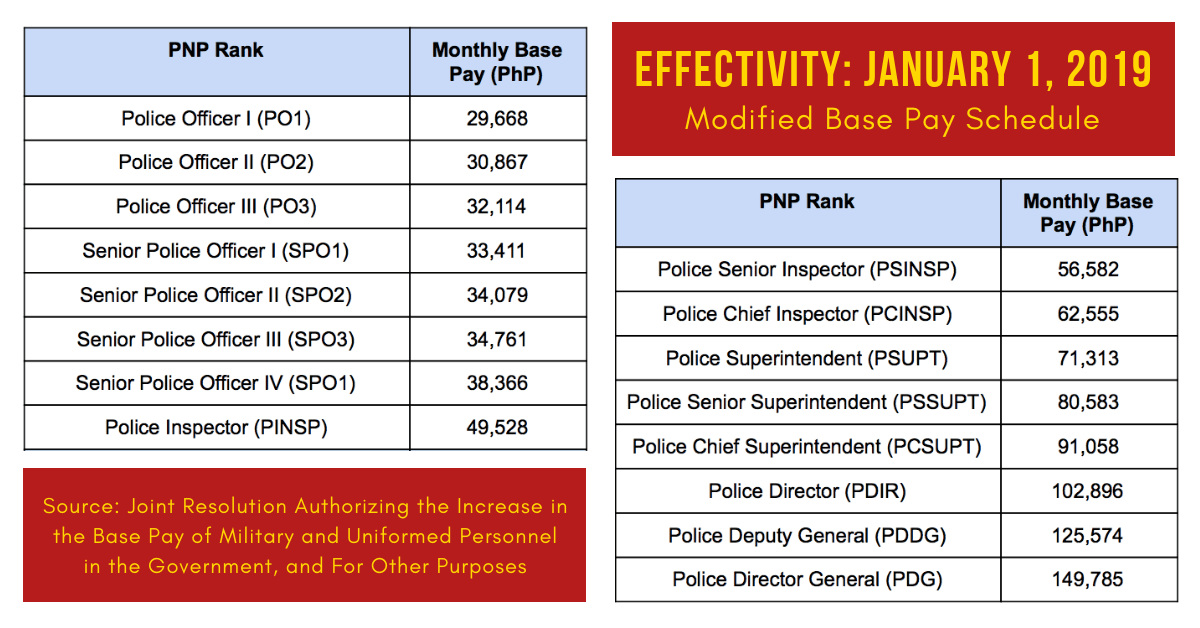

As we mentioned, we will look at a military retiree with 20 years of service at the ranks of E-7 for enlisted and O-5 for officers. The base pay for these ranks in 2009 is:

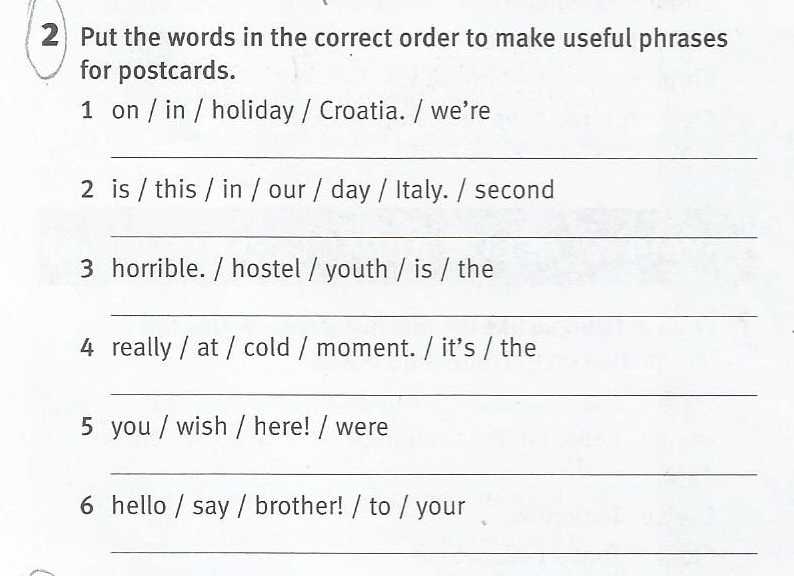

46

46Most retirees under the High-36 Plan will receive 50% of their base pay at 20 years, which would equal the following amounts:

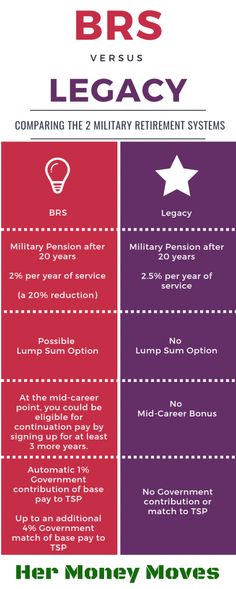

Those under the BRS would receive 40% of their base pay at 20 years (2% per year of service), which would be the following amounts:

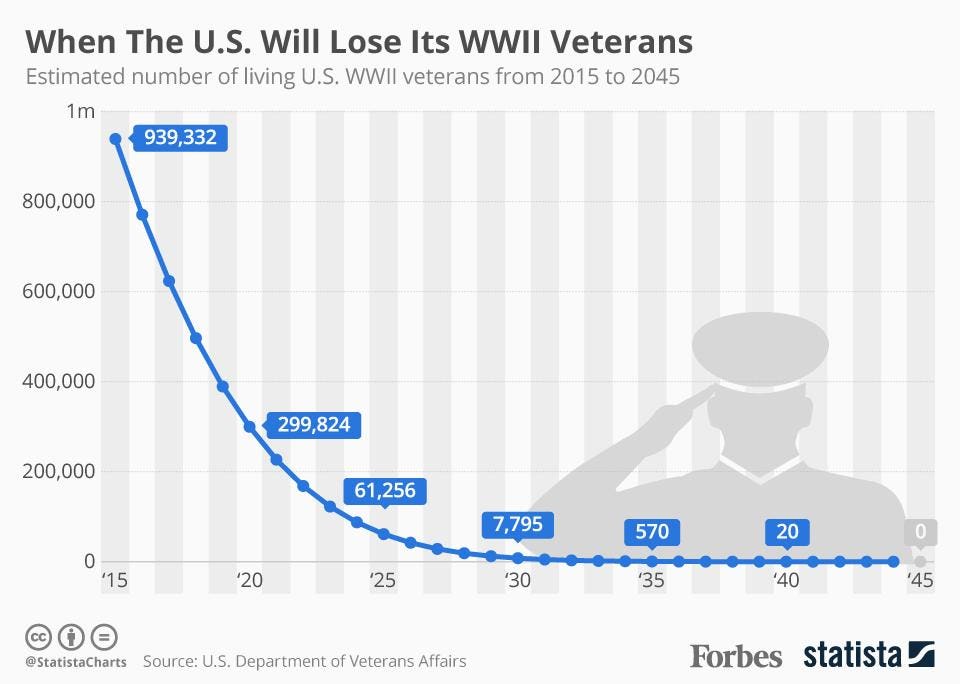

The next factor to consider is that military retirement pay will be there day in and day out. There are few places in the world that someone can receive a lifetime pension starting at or around age 40. Many military retirees will receive a monthly cash payment for over 40 years. When you add in the cost of living and inflation adjustments, we’re talking about some serious cash!

There are few places in the world that someone can receive a lifetime pension starting at or around age 40. Many military retirees will receive a monthly cash payment for over 40 years. When you add in the cost of living and inflation adjustments, we’re talking about some serious cash!

Using the numbers above from a recently retired E-7 or O-5, we get the following lifetime payments (note: these military retirement pay numbers are not adjusted for inflation and do not include any COLA increases; this is not a planning tool, but for illustration purposes only. Your specific retirement benefits will vary based on your situation):

40

40Even without COLA or other inflation adjustments, we can see that we are reaching some serious numbers. Each additional year you serve before you retire can add another 2.5% to your monthly and annual pay, and each higher pay grade you achieve can add hundreds or even thousands of dollars per year. As previously mentioned, the numbers used in this article are meant to be a conservative estimate.

<a href=”https://personalcapital. sjv.io/c/2958094/1199045/13439?u=https%3A%2F%2Fwww.personalcapital.com%2F”>Visit PersonalCapital.com</a>

sjv.io/c/2958094/1199045/13439?u=https%3A%2F%2Fwww.personalcapital.com%2F”>Visit PersonalCapital.com</a>

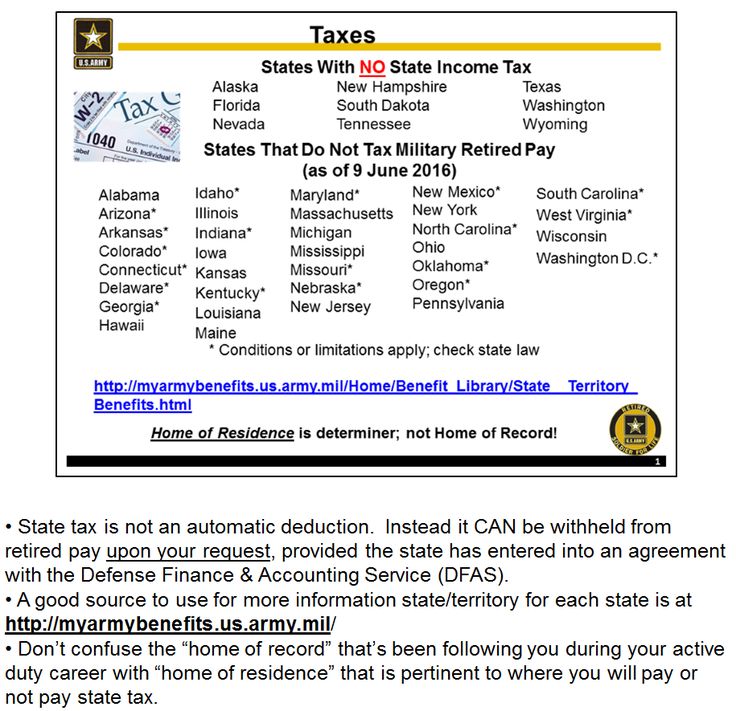

OK, there is a minimal TriCare payment, but compared to what civilians pay, it is basically a non-issue. Benefits for retired military members are also guaranteed – they won’t drop you after you have required expensive procedures or for pre-existing conditions. Guaranteed medical coverage is a massive blessing in today’s American society. Here is a little more information about the kinds of insurance available to civilians: comparing individual and group health insurance. Hopefully, that will help you better understand the value of military retiree medical benefits!

Military-sponsored medical benefits are incredibly valuable, especially as you get older and when they cover your spouse. There are very few civilian plans that are similar to this. Most people spend several thousand dollars per year for basic medical coverage, which doesn’t include out-of-pocket expenses for doctor visits, medical procedures, prescription medication, or other associated costs.

It would not be unreasonable to place a value of $15,000-$20,000 per year on military retiree medical benefits, even for a healthy individual. Add a spouse to the benefits, guaranteed coverage, and little to no out-of-pocket expenses for complex medical procedures. Other factors and the medical benefits alone can be worth hundreds of thousands of dollars or more throughout a lifetime (and sometimes into the millions of dollars for people who receive complex medical care over a long-term period).

I won’t even try to assign a value to these benefits because they don’t apply to all military retirees equally. Some people may practically live on base, visiting the base clubs, shopping at the exchanges, using the gyms, auto hobby shops, etc., and others may not live near a base. They may not be able to take advantage of any of these benefits. So this category falls in the “good deal if you can get it” benefit but is not a core part of the equation. But it is worth mentioning because many retirees save a lot of money each year by shopping on base.

But it is worth mentioning because many retirees save a lot of money each year by shopping on base.

One challenge to the analysis is that the military pension includes a cost of living adjustment, so the amount of the income stream has to rise every year by the rate of inflation.

Another problem is that no one knows how long the pensioner will live, so it’s difficult to predict how long the pension will be paid out.

Finally, the calculated lump sum must be invested in a safe and stable asset to ensure it survives for decades. Unfortunately, the safe and stable assets have a very low yield, so it takes a larger lump sum to produce an income stream big enough to pay the pension.

The answer to these puzzles involves the mathematical process of “discounting”.

Accountants and actuaries devote their entire careers to studying asset yields, human longevity, and other risks. They calculate the statistical probability that a specific lump sum can pay a particular pension for the necessary number of years.

The good news for pension recipients is that the calculations are much more accurate when the analysis is simultaneously applied to hundreds of thousands of pensions as a group. Even better, the Department of Defense can rely on the number-crunching skills of another giant bureaucracy of inflation-adjusted payments: Social Security.

The mathematical details of discounting an inflation-adjusted annuity are well beyond the scope of this post. There’s not an easy formula to convert that $100/day pension to a precise lump sum. However, a few more straightforward estimates are reasonably close to the more complicated methods.

The easiest estimate assumes that a military pension keeps up with inflation. This eliminates the more complicated factors of correcting future dollars for inflation. If a military pension keeps up with inflation then the pension’s value in today’s dollars stays constant. The lump-sum value of the pension is the total amount to be received during the rest of the veteran’s life:

A 38-year-old veteran receiving $3000/month with a COLA might reasonably look forward to 35 more years of life. The estimate of the present value of their pension would be

The estimate of the present value of their pension would be

The life-expectancy estimate ignores other discounting factors in favor of simplicity and speed. Its main advantage is that veterans can quickly estimate a lump sum for their expected lifespan. Veterans in good health with long-lived ancestors may decide that they have 40 or even 50 years of retirement, raising the current value of their pension.

Another quick estimate is to assume that the pension is the income stream from a lump sum of Treasury Inflation-Protected Securities (TIPS). TIPS are an extremely safe and stable asset with built-in inflation protection. The market for buying and selling TIPS is huge and liquid, so their prices are reasonably accurate.

One flaw of this estimate is that, unlike a military pension, when the pensioner dies, there’s still a lump sum of TIPS generating a stream of income. Another drawback is that a TIPS’ maturity (now a maximum of 30 years) is usually less than the pensioner’s remaining life expectancy.

Another drawback is that a TIPS’ maturity (now a maximum of 30 years) is usually less than the pensioner’s remaining life expectancy.

The advantage of this estimate is simplicity and speed:

A January 2009 Treasury auction sold 20-year TIPS at an inflation-adjusted annual percentage yield of 2.5%. So for that $3000/month pension,

Another estimate of the lump-sum value of an inflation-adjusted pension is a commercial annuity. The annuity market is generally regarded as liquid because insurance companies compete to offer the “best” price without losing money. However, they still charge more than the actual value of the annuity to make their profit.

Insurance companies could be unable to make annuity payments or even go bankrupt and should be considered a riskier source of annuity payments than TIPS or other government bonds.

One of the “less risky” annuities comes from an agency sponsored by the federal government– the Thrift Savings Plan. TSP annuities are purchased from an insurance company. The federal government does not guarantee them, but the insurance company is presumably charging a smaller fee (to sell a large volume of annuities), and the annuity’s cost would be closer to its value.

TSP annuities are priced monthly and do not offer complete protection against inflation. The advantage of estimating a pension’s lump-sum value from a TSP annuity is its lower price and the TSP website’s calculator. Assuming that the $3000/month pension is paid to a 38-year-old veteran and limited to 3% annual inflation:

$1.4 million is the price that a veteran would pay in the market to buy a TIPS portfolio or an annuity that would yield their inflation-adjusted pension of $3000/month for the rest of their life. Other research analyzes the theoretical cost of annuities and discounted values– only the cost and not its market price. (This includes a research paper on military pensions– the citation is in the book.)

Other research analyzes the theoretical cost of annuities and discounted values– only the cost and not its market price. (This includes a research paper on military pensions– the citation is in the book.)

These estimates range from about $1 million to $1.2 million. They’re only theoretical estimates. These annuities can’t actually be purchased like the assets of the other estimates, but they’re a more conservative estimate of the probabilities of longevity and other risk factors.

Let’s get back to the veteran who’s just finished 10 years of service and is wondering if it’s worth staying in the military for another decade. After analyzing the pension’s present value, which sounds more compelling now: $100/day, or lifetime income of over $1 million?

Thousands of dollars coming in regularly quickly add up over the years. Add in increases for inflation, essentially free health care, and other benefits, and you can see how a military retirement can quickly be worth millions of dollars over a lifetime.

I didn’t stay in long enough to qualify for military retirement benefits – I separated from the USAF with an Honorable discharge after 6.5 years of service. Part of me looks at the military retirement system with a bit of longing. It is an excellent system for those who qualify, and I would love to be able to receive military retirement benefits for the rest of my life. However, separating from the military was the best move for me at the time, and I have no regrets regarding my separation or my military service. I am proud to have served, and the military is a large part of who I am today.

*disclaimer about this article: The calculations are for illustrative purposes only and do not reflect the exact retirement benefits you will receive. This is a simplified look at military retirement benefits and does not take many factors into consideration, including taxes, disability benefits, inflation, COLA, and other factors.

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine (print and online editions), Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

See author's posts

The following chart summarizes the differences between the four regular and non-regular retirement plans and disability retirement.

| Final Pay | Defined Benefit that equals 2. 5% times the number of years of service times the member’s final basic pay on the day of retirement 5% times the number of years of service times the member’s final basic pay on the day of retirement | Primary retirement plan for Reserve members with initial date of entry into service prior to September 8, 1980 |

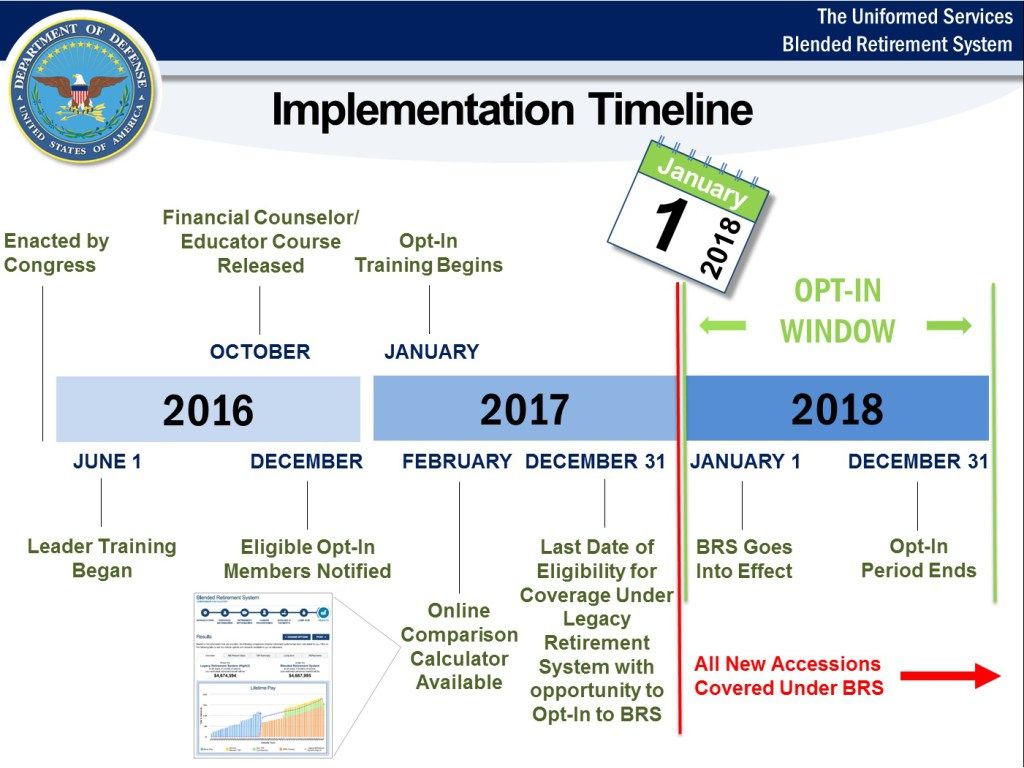

| High-36 | Defined Benefit that equals 2.5% times the number of years of service times the average of the member’s highest 36 months of basic pay | Primary retirement plan for members with initial date of entry into service on or after September 8, 1980, but before January 1, 2018 |

| REDUX | Career Status Bonus $30,000 lump sum payment at 15th year of service with obligation to serve through 20 years + defined benefit Defined Benefit is (b) At age 62 and after: | Optional retirement plan for active duty members with an initial date of entry into service after July 31, 1986, but before January 1, 2018. Eligibility to elect the Career Status Bonus ended as of December 31, 2017 Eligibility to elect the Career Status Bonus ended as of December 31, 2017 |

| Blended Retirement System (BRS) | Blended defined benefit and defined contribution plan. Defined Contribution: Defined Benefit: | Only retirement plan for members with initial date of entry into service on or after January 1, 2018 Optional retirement plan for members with an initial date of entry into service on or before December 31, 2017, who: |

| Disability | Retirement plan that equals to: *Retired Pay Base – determined under Final Pay, High-36, or BRS depending on military service date of entry **Multiplier Percentage can be either:

Note that in both cases the multiplier is limited to 75% by law | Determined medically unfit for continued service with a DoD disability rating of at least 30% |

The below chart provides the basic criteria to determine which retirement plan applies:

| Final Pay | Entry before September 8, 1980 |

| High-36 | Entry on or after September 8, 1980, but before August 1, 1986 OR Entered on or after August 1, 1986, and did not choose the Career Status Bonus and REDUX retirement system |

| CSB/REDUX | Entered on or after August 1, 1986, but before January 1, 2003 AND elected to receive the Career Status Bonus |

| Blended Retirement System (BRS) | Entered the Uniformed Services for the first time on or after January 1, 2018 (automatic enrollment), or entered before December 31, 2017 and elected to opt into BRS during the opt-in period |

| Disability | Determined medically unfit for continued service with a DoD disability rating of at least 30% |

All four of the regular and non-regular retirement plans determine initial monthly retired pay by applying a percentage multiplier to the retired pay base.

There are two methods for determining the retired pay base. They are the final pay method and the high-36 month average method. The final pay method, as the name implies, establishes the retired pay base equal to final basic pay. The high-36 method is the average of the highest 36 months of basic pay divided by 36. This is generally the last 3 years of service and is sometimes called high-3. The method used depends upon when the member first entered military service.

The method is determined by DIEMS (Date of Initial Entry to Military Service) or DIEUS (Date of Initial Entry to Uniformed Services). The date a member first entered uniformed service in any capacity establishes DIEMS. This date is fixed---it does not change. Departing the military and rejoining does not affect DIEMS.

Some individuals have unique circumstances that complicate determining their DIEMS. Here are a few examples:

Be aware that pay date (e.g., Pay Entry Base Date) may be different than DIEMS. Also, DIEMS does not determine when creditable service toward retirement is calculated---it only determines which retired pay base method applies.

For both the Final Pay and High-36 retired pay plans, each year of service is worth 2.5% toward the retirement multiplier. For example, 20 years of service would equal a 50% multiplier. The years of service creditable are computed differently depending upon whether retirement is from full time active duty or from a reserve career. These differences are explained under the Active Duty Retirement and Reserve Retirement pages.

For example, 20 years of service would equal a 50% multiplier. The years of service creditable are computed differently depending upon whether retirement is from full time active duty or from a reserve career. These differences are explained under the Active Duty Retirement and Reserve Retirement pages.

For the REDUX retirement plan, which applies only to certain active duty retirements as described above, the High-36 multiplier is reduced by one percentage point for each year that the member has less than 30 years of service at retirement. For example, 20 years of service would equal a 40% multiplier. This is discussed more fully under the Active Duty Retirement page.

For disability retirement programs, the multiplier will be the higher of (a) the disability percentage assigned by the Service at retirement not to exceed 75%, or (b) the result of multiplying the number of years of service by the applicable retirement plan multiplier (e.g., 2.5% for High-36 or 2.0% for BRS).

In any case, the longer an individual serves, the higher the multiplier and the higher the retirement pay. For example:

| Final Pay | 50% | 52.5% | 55% | 57.5% | 60% | 62.5% | 75% | 87.5% | 100% | 102.5% |

| High-36 | 50% | 52.5% | 55% | 57.5% | 60% | 62.5% | 75% | 87.5% | 100% | 102.5% |

| REDUX | 40% | 43.5% | 47% | 50.5% | 54% | 57.5% | 75% | 87.5% | 100% | 102.5% |

| BRS | 40% | 42% | 44% | 46% | 48% | 50% | 60% | 70% | 80% | 82% |

All military retirements are protected from inflation by an annual Cost of Living Adjustment (COLA), based on changes in the Consumer Price Index (CPI) as measured by the Department of Labor. Under the Final Pay, High-36, and BRS retirement plans, the annual COLA is equal to the percentage increase in the CPI year over year. Under REDUX, the COLA is reduced, as described in the table below.

Under the Final Pay, High-36, and BRS retirement plans, the annual COLA is equal to the percentage increase in the CPI year over year. Under REDUX, the COLA is reduced, as described in the table below.

| Final Pay | Annual COLA determined using the Consumer Price Index – Urban Wage Earners, published by U.S. Department of Labor, Bureau of Labor Statistics. |

| High-36 | Annual COLA determined using the Consumer Price Index – Urban Wage Earners, published by U.S. Department of Labor, Bureau of Labor Statistics |

| REDUX | Reduced annual COLA that is normally one percentage point less than the COLA determined for the other retirement plans (but not less than zero). Due to the reduced annual COLA, members participating in REDUX receive a one-time readjustment at age 62 to restore the difference in COLA to what it would have been under High-36. Thereafter, annual COLA reverts back to the lesser amount as above. |

| Blended Retirement System | Annual COLA determined using the Consumer Price Index – Urban Wage Earners, published by U.S. Department of Labor, Bureau of Labor Statistics |

| Disability | Annual COLA determined using the Consumer Price Index – Urban Wage Earners, published by U.S. Department of Labor, Bureau of Labor Statistics |

Select one of the following topic areas:

Helpful links:

According to the law, a military man who has retired receives a monthly allowance from the state.

Svetlana Fateeva

dealt with military pensions

Author profile

Military people retire not by age, but by seniority or disability, if they received it in the service. And their relatives - in connection with the loss of a breadwinner. The pension is assigned to military personnel who served in the internal affairs bodies, employees of the Russian Guard, the Ministry of Emergency Situations, the Ministry of Internal Affairs, the FSB, the FSIN. They can receive it when they leave military service. If a military man left the service and got a job as a civilian, then the right to an insurance pension will also appear.

The amount of the pension depends on the position and rank of the military, length of service and allowances. In the article I will tell you how to apply for a military pension, how it is calculated and what are the allowances.

Military pensions are described by laws that contain more than a hundred pages. In this article, I gave a constructor: what payments make up a military pension. For convenience, there are links to articles of the law in the margins, so if you want to know in detail, you can go there and read. Each particular case of calculating a pension has its own subtleties that will affect its size. Therefore, in order to accurately calculate your pension, it is better to consult with the pension authority of the law enforcement agency in which you served.

In this article, I gave a constructor: what payments make up a military pension. For convenience, there are links to articles of the law in the margins, so if you want to know in detail, you can go there and read. Each particular case of calculating a pension has its own subtleties that will affect its size. Therefore, in order to accurately calculate your pension, it is better to consult with the pension authority of the law enforcement agency in which you served.

When a soldier reaches a certain level of service, he is awarded a service pension.

Conditions for granting a pension. By law, a seniority pension is due to the military if:

Art. 13 of the law on pensions for persons who have completed military service

13 of the law on pensions for persons who have completed military service

According to military experience. Military experience, for example, includes:

st. 18 of the law on pensions for persons who have completed military service

Officers and military commanders are credited with up to 5 years of study before entering the service. One year of study will be equal to 6 months of service. For example, if a military man studied for 5 years, he will be credited with 2.5 years of service.

One year of study will be equal to 6 months of service. For example, if a military man studied for 5 years, he will be credited with 2.5 years of service.

Service in special conditions is included in the length of service on a preferential basis. This means that periods of service will be included in the length of service in longer periods than the calendar period. For example, for service in countries that fought hostilities, a month is counted as two.

Decree of the Government of the Russian Federation of September 22, 1993 No. 941 - on preferential calculation

Special conditions also include, for example, service in the regions of the Far North, in positions associated with increased danger to life and health.

When the pension will be granted. A military man submits documents for a seniority pension - and they are checked. The pension will be assigned within 10 days from the day of dismissal - but not earlier than the day before which the monetary allowance was paid upon dismissal. If you delay in applying for a pension, it will be assigned retroactively from the day when the right to it arose. You can receive payments up to 12 months before the day of application.

If you delay in applying for a pension, it will be assigned retroactively from the day when the right to it arose. You can receive payments up to 12 months before the day of application.

Art. 53 of the law on pensions for persons who have completed military service

The amount of pension for service depends on several factors:

For military personnel with 20 years of service, the pension will be 50% of the monetary allowance. For each next year of service, 3% will be added, but in total the percentage of monetary allowance cannot be more than 85%.

Art. 14 of the law on pensions for persons who have completed military service

For example, a military man has served 20 years. His monetary allowance is 42,000 R. The pension will be set at 50% of the monetary allowance - 21,000 R, but due to the reduction factor on hand, the military will receive less - I will talk about this in detail in another section. For each next year, 3% is added: for 21 years of service - 53%, for 22 years - 56%, etc., but not more than 85% of the allowance.

For each next year, 3% is added: for 21 years of service - 53%, for 22 years - 56%, etc., but not more than 85% of the allowance.

For military personnel with 12.5 years of service with a total length of service of 25 years, the pension will also be 50% of the monetary allowance, and only 1% will be added for each subsequent year of service. Theoretically, the military with such length of service can receive 100% of the monetary allowance, but only for 75 years of service.

The monthly payment, , which is indexed annually, is entitled to participants and disabled veterans of the Great Patriotic War and combat veterans. The maximum payment amount is 3088 R per month in addition to the pension. In 2022, taking into account indexation, the amount of payment for participants in the Great Patriotic War is 4746.29 R, for disabled veterans of the Great Patriotic War - 6328.41 R, for combat veterans - 3481.85 R.

Art. 23.1 of the Federal Law "On Veterans"

Increased military pension receive disabled people. How much it has increased is calculated as a percentage of the social pension. The amount of the social pension depends on the category of disabled citizens.

How much it has increased is calculated as a percentage of the social pension. The amount of the social pension depends on the category of disabled citizens.

Art. 16 of the law on pensions for persons who have completed military service

p. 1, art. 18 of the Federal Law "On state pension provision in the Russian Federation"

For example, a disabled person of the first group is entitled to a social pension of 11,212.36 R. If he was injured in military service, the pension will be increased three times:

11,212 R × 300% \u003d 33 636 R

| Disability group | For military personnel injured on duty | For military personnel with a disease, industrial injury, as well as for participants in the Great Patriotic War | For those awarded with the badge "Inhabitant of besieged Leningrad" |

|---|---|---|---|

| First | 300% | 250% | 200% |

| Second | 250% | 200% | 150% |

| Third | 175% | 150% | 100% |

The first disability group

for military injuries in the service of

300%

for the military with illness, labor injury, as well as for participants of the Second World War

250%

for the awarded the sign “Resident of the Blockade Leningrad City Leningrad »

200%

Second disability group

For the military who injured in the service of

250%

for the military with illness, labor injury, as well as for the participants of the Second World War

200%

for a resident of the Blockade Leningrad sign

9000,150%The third group of disability

For the military who were injured in the service

175%

0002 For those awarded with the sign "Inhabitant of besieged Leningrad"

100%

Disability pension is awarded regardless of the length of service. It is required if the military received a disability during the service or within three months after the dismissal. Disability must be the result of an illness or injury that the military received in the service.

It is required if the military received a disability during the service or within three months after the dismissal. Disability must be the result of an illness or injury that the military received in the service.

p. 2 art. 8 of the Federal Law "On State Pension Provision in the Russian Federation"

Disability is established by a medical and social examination or a military medical commission of the military district where the service takes place.

The amount of the pension depends on the disability group and the reasons for the disability. For conscripts, it is calculated as a percentage of the social pension.

Art. 15 Federal Law "On state pension provision in the Russian Federation"

| Disability group | Amount of pension due to military injury | Amount of pension due to illness received during service |

|---|---|---|

| First | 300% | 250% |

| Second | 250% | 200% |

| Third | 175% | 150% |

The first disability group

Due to the military injury

300%

Pension size due to the disease received during the service of

250% 9000%

The second disability group 9000 9000 9000 due to war injury

250%

The size of the pension due to the disease obtained during the service of

200%

Third disability group

Pension size due to military injury

175%

Pension size due received during service

150%

For example, for disabled people of the second group, the social pension is 5606. 15 R. For military personnel with a disability of the second group received due to a military injury, the pension will be calculated as follows:

15 R. For military personnel with a disability of the second group received due to a military injury, the pension will be calculated as follows:

5606 Р × 250% = 14 015 Р

For officers, ensigns, midshipmen and contractors, employees of law enforcement agencies, the disability pension is calculated as a percentage of the monetary allowance.

Art. 22 laws on pensions for persons who have completed military service

| Disability group | Amount of pension due to military injury | Amount of pension due to illness received during service |

|---|---|---|

| First | 85% | 75% |

| Second | 85% | 75% |

| Third | 50% | 40% |

The first disability group

The size of the pension due to military trauma

85%

Pension size due to the disease received during the service of

75%

The second disability group

Pension size due to military trauma

85%

Pension size due to the disease obtained during the service

75%

Third disability group

Pension size due to military trauma

9000 50 50 %The amount of the pension due to an illness received during service

40%

For example, a contractor receives a monetary allowance of 25,000 R. If he receives a disability of the second group due to a military injury, his disability pension will be calculated as follows:

If he receives a disability of the second group due to a military injury, his disability pension will be calculated as follows:

25,000 R × 85% = 21,250 R

Disability is established for a certain period, which is indicated in the certificate of the medical and social examination. When the deadline has passed, the military must undergo a re-examination to confirm the disability.

If the military misses the deadline, the payment of the disability pension may be suspended. If this happened for a good reason, for example, if the state of health worsened, then after re-examination, the pensioner will receive payments for the entire overdue period. If there was no good reason, the pension will continue to be paid when the pensioner confirms the disability.

Re-examination is not carried out if disability is established indefinitely, and also upon reaching 65 years for men, 60 years for women.

It happens that the state of health has changed. Then, at the personal request of the disabled person, his legal representative or in the medical direction, a re-examination is carried out. If the disability group is changed, the amount of the pension also changes.

If the disability group is changed, the amount of the pension also changes.

If a serviceman dies or goes missing, each disabled member of his family is assigned a survivor's pension. In this case, the pension is due:

st. 29 of the law on pensions for persons who have completed military service

The loss of a breadwinner is considered:

st. 28 of the law on pensions for persons who have completed military service

The amount of the pension depends on the cause of death of the breadwinner. If the military served under a contract, then a pension is given to each disabled family member as a percentage of the breadwinner's allowance. 50% of the military allowance will be assigned to the following categories of citizens:

st. 36 of the law on pensions for persons who have completed military service

If a soldier dies due to an illness received during the period of service, his family will be paid 40% of the military allowance.

If the military served on conscription, the pension will be calculated as a percentage of the social pension. It will be paid to each disabled family member in an amount that depends on the cause of death of the conscript:

item 4 of Art. 15 of the Federal Law "On state pension provision in the Russian Federation"

If family members lose their right to a pension, then payments will be reduced or stopped. For example, if the children of the deceased study full-time at a university, they are entitled to a pension up to 23 years. They will stop receiving their pension the next month after they turn 23.

If a military man, after being discharged from service, works as a civilian, he has the right to a second pension - an insurance one. At the same time, the work must be official - if the employer does not deduct pension contributions, there will be no right to an insurance pension.

About the second pension for military personnel

You can check how many contributions were paid to the Pension Fund of the Russian Federation in your personal account in the section "On the formed pension rights" or in the pension fund or MFC - you will need a passport and SNILS. You can register in the compulsory pension insurance system at the territorial pension fund or the MFC. You need to come there with a passport and fill out a questionnaire. You can also log in to the PFR website through the public services website if you are already registered there.

/guide/skolko-pensiya/

How to calculate the old-age pension

Click on the “Login” button in the upper right part of the screen After you are asked to log in through the public services website When you log in to public services, you will be asked to check whether your profile is filled out correctly . Change the details if required To receive a military pension and an insurance pension at the same time, you must meet the following requirements.

Age. Reaching the age of 61.5 years for men and 56.5 years for women, taking into account the length of service — for example, if a pensioner worked in the Far North or in difficult working conditions. Age is determined taking into account the transition period.

In Russia, there is a gradual increase in the retirement age. A transitional period has been introduced for these changes, which will be 10 years and end in 2028. As a result, the retirement age will be raised by 5 years and set at 60 for women and 65 for men. In the first half of 2022, the retirement age for women is 56.5 years, for men - 61.5 years. In the second half of 2022, only those who received this right earlier, but did not use it, will retire.

Annexes 5 and 6 to Law No. 350-FZ

Raising the retirement age

Civil service. The length of service for the insurance pension does not include periods of service in the army or work that are taken into account when calculating the military pension. In 2022, the minimum work experience is 13 years. It increases by 1 year each year until it reaches 15 years in 2024.

In 2022, the minimum work experience is 13 years. It increases by 1 year each year until it reaches 15 years in 2024.

Number of pension points. The minimum score in 2022 is 23.4. Their number will increase annually until 2025. By 2025, the minimum number of points will be 30. To check your points, you can contact the territorial pension fund with a passport and SNILS or in your personal account on the PFR website.

When you enter the compulsory pension insurance system, on the main page you can see how many pension points you haveThe formula for calculating the second pension is as follows:

Accumulated pension points × Value of one point

Calculate the amount of the second pension a point costs 107.36 R, the amount is indexed annually.

Usually a fixed payment is added to the insurance pension, but it is not paid to military pensioners.

What to do? 30.09.19

How to buy more pension points?

There are allowances for seniority and disability pensions. They are calculated as a percentage of the social pension.

They are calculated as a percentage of the social pension.

Art. 17 of the law on pensions for persons who have completed military service

When calculating a pension for the military, various payments are taken into account: allowances, increases and increases. These three terms are often confused, but they mean different things:

Do not confuse.

The allowance is due:

If one is disabled - 32%, two - 64%, three or more - 100%.

If one is disabled - 32%, two - 64%, three or more - 100%. For example, a disabled person of the first group will receive an allowance of 11,212 R - this is 100% of the social pension for this category.

Clause 2.1 Art. 18 Federal Law "On state pension provision in the Russian Federation"

There are other allowances: for long service, work with the state secret service, service in special conditions, etc. If a military man receives other income than a military pension, then allowances for dependents and disability are not paid.

Art. 2 of the Federal Law "On State Pensions in the Russian Federation"

Military pensions are increased for services to the country. For Heroes of the Soviet Union and the Russian Federation, holders of the Order of Glory of three degrees, the pension is increased by 100%, for Heroes of Labor - by 50%. The pension is increased by a multiple of the number of awards: for example, twice the Hero of the Russian Federation receives an additional 200% to the pension.

The pension is increased by a multiple of the number of awards: for example, twice the Hero of the Russian Federation receives an additional 200% to the pension.

Art. 45 of the law on pensions for persons who have completed military service

Champions of the Olympic, Paralympic and Deaflympics receive 50% of the pension. For awards with orders of Labor Glory of three degrees or "For Service to the Motherland in the Armed Forces of the USSR" - 15%.

The Deaflympics are games for people with hearing impairments

Social pension increases are received by:

All of them receive an increase of 32% in relation to the social pension. Those who served or worked during the Second World War for at least 6 months, as well as those who were unreasonably convicted and rehabilitated, receive an increase of 16%.

To calculate a military pension, you need to calculate the military allowance. To do this, you need to add salaries by position and rank with other payments. Then the allowance is multiplied by the reduction factor, the length of service and the district coefficient.

Law No. 460-FZ of December 11, 2018

After the pension is granted, the coefficient is increased by 2% annually until it reaches 100%. The state reserved the right to increase it by more than 2% if the inflation rate is high.

For WWII veterans, the reduction coefficient has been canceled since May 2019 - when calculating the pension for them, 100% of the monetary allowance is taken into account.

Monetary allowance consists of several parts:

st. 2 of the Federal Law on the monetary allowance of military personnel

Salaries by position

Salaries by rank

District coefficients. In some districts, coefficients for monetary allowance have been established. They are used if a pensioner lives in climatic, ecological and natural conditions that require additional costs - for example, in the Far North.

Amounts of district coefficients

A pension based on the district coefficient is received by military pensioners who:

st. 48 of the law on pensions for persons who have completed military service

The maximum value of the coefficient is 1.5. For example, in the Chukotka Autonomous Okrug, the coefficient is 2, but due to restrictions, it will be reduced to 1.5.

The length of service is calculated as follows: 50% is given for the first 20 years of service, and then 3% is added for each next year. For example, after 21 years of service, the length of service will be 53%, after 22 years - 56%, etc.

As a result, the following formula is obtained:

(Position salary + Military rank salary + Other payments) × Reducing factor × Length of service × Regional coefficient = Military pension

An example of calculating pension for a lieutenant colonel in the position of battalion commander with a length of service of 22 years. By military rank, a lieutenant colonel is entitled to a salary of 12,480 R. He has the position of a battalion commander - for a position of 18th category, a salary of 24960 R. For 22 years of service, the lieutenant colonel will receive an allowance of 30% of the amount of salaries by position and rank:

By military rank, a lieutenant colonel is entitled to a salary of 12,480 R. He has the position of a battalion commander - for a position of 18th category, a salary of 24960 R. For 22 years of service, the lieutenant colonel will receive an allowance of 30% of the amount of salaries by position and rank:

(24 960 + 12 480) × 30% = 11 232 R

This is what pension our lieutenant colonel will receive from October 1, 2019 - with a decreasing coefficient of 73.68%:

(24,960 R + 12,480 R + 11,232 R) × 73.68% × 56% × 1 = 20,082 R

To receive a pension according to the length of service, , you need to submit documents to the pension authority of the law enforcement agency in which the military served: the Ministry of Defense, the Ministry of Internal Affairs, the Federal Penitentiary Service or the FSB. Documents can be submitted in person or sent by mail. You will need:

The application for the appointment of a pension

Order of the Ministry of Defense dated 05/23/1999 No. 225

Sample of the calculation of length of service

for a disability pension to this list will be added:

For the survivor's pension , the following will be added to the list:

Together with the application, documents are submitted to increase payments and allowances - for example, documents confirming the special conditions of military service.

To assign a second pension , an application is submitted to the territorial pension fund. Here's what to bring there:

Documents for a second pension

Sample application for granting a pensionPension departments in state structures are responsible for calculating and paying military pensions - for example, the pension department in the military registration and enlistment office at the place of registration. The payment of a pension does not depend on other income.

Art. 56 of the law on pension provision for persons who have completed military service - the procedure and terms for paying a military pension

A military pension is received for the current month to an account with Sberbank or at a convenient branch of the Russian Post in person or by proxy. Payment terms are determined by agreement between the pension authority, the bank and the post office.

Military pension is withheld on the basis of court decisions. No more than 50% of the pension can be withheld.

Art. 62 of the law on pensions for persons who have completed military service

62 of the law on pensions for persons who have completed military service

Most often, alimony is withheld. They are kept from regular payments: from military and insurance pensions, from salaries and from business income. For one child - a quarter of the income, for two - a third, for three or more - half. At the same time, some payments are not taken into account when collecting alimony - for example, payments in connection with a military injury.

Federal Law "On Enforcement Proceedings"

The state annually indexes the cost of one point - in 2022, a point costs 107.36 R. In 2022, pensions for working pensioners will not be indexed. An indexed pension will be accrued to a pensioner only after dismissal.

From March 1, 2022, military pensions were indexed by 8.6% and recalculated from January 1, 2022.

Law No. 460-FZ dated December 11, 2018

And from October 1, 2022, the reduction coefficient will increase to 77. 41% of the monetary allowance.

41% of the monetary allowance.

Government Decree No. 1466 of December 1, 2018

Military pensions are paid to the card of the Mir national payment system.

A selection of the most important documents upon request Payments upon the death of a military pensioner (legal acts, forms, articles, expert advice and much more).

Register and get trial access to the ConsultantPlus system for free on 2 days

Open a document in your ConsultantPlus system:

Situation: To whom and how is the pension and additional payments to it paid after the death of a pensioner?

("Electronic journal "Azbuka Prava", 2022) In the event of the death of a military pensioner, the receipt of a pension not paid to him occurs differently. It is issued to the family members of the deceased, if they buried him, without being included in the inheritance. To receive a pension, you need to contact the department, In other cases, the amount of the pension is paid to the heirs on a general basis (Articles 50, 63 of the Law of 12.02.1993 N 4468-1).

It is issued to the family members of the deceased, if they buried him, without being included in the inheritance. To receive a pension, you need to contact the department, In other cases, the amount of the pension is paid to the heirs on a general basis (Articles 50, 63 of the Law of 12.02.1993 N 4468-1).

Register and get trial access to the ConsultantPlus system for free to 2 days

Open the document in your ConsultantPlus system:

(item-by-article)

(Mironova T.K., Arzumanova L.L., Peshkova (Belogortseva) Kh.V., Rozhdestvenskaya T.E., Bondareva E.S., Gusev A.Yu., Luminarskaya S.V.) , Menkenov A.V., Rotko S.V., Sapozhnikova N.I., Chernus N.Yu., Elaev A.A., Zagorskikh S.A., Kotukhov S.A., Sokolov R.A.)

(Prepared for the ConsultantPlus system, 2021) By decision of the UPFR in the Nevsky district of St. Petersburg L.N. was denied the appointment of an old-age insurance pension with the preservation of the right to receive a pension from the Ministry of Defense in the event of the loss of a breadwinner. The indicated refusal of L.N. considers illegal, because her husband - L.V. in the period from 1954 to 1987, he served in the Armed Forces of the USSR, was dismissed due to reaching the age limit for military service, upon dismissal he was granted a pension. In 2010 L.V. died, after his death L.N. a payment of 40% of the military pension of the deceased spouse was assigned, the plaintiff is a pensioner, a disabled person of group III, does not work, currently receives a military pension of the deceased spouse, as well as a social disability pension.

The indicated refusal of L.N. considers illegal, because her husband - L.V. in the period from 1954 to 1987, he served in the Armed Forces of the USSR, was dismissed due to reaching the age limit for military service, upon dismissal he was granted a pension. In 2010 L.V. died, after his death L.N. a payment of 40% of the military pension of the deceased spouse was assigned, the plaintiff is a pensioner, a disabled person of group III, does not work, currently receives a military pension of the deceased spouse, as well as a social disability pension.

Decree of the Government of the Russian Federation of 08/02/2005 N 475

(as amended on 12/29/2021)

"On the provision of family members of the dead (deceased) military personnel and employees of some federal executive bodies compensation payments in connection with the costs of paying for the use of residential premises, the maintenance of residential premises, the contribution for the overhaul of common property in an apartment building, utilities and other types of services "If there is no information in the Unified Information System about bank account details, consent to the use of which is given in order to receive measures of social protection (support) and social payments, and information about the account with a credit institution, which is used by the territorial body of the Pension Fund of the Russian Federation to credit family members of dead (deceased) military personnel with pensions and other social payments, transfer of funds as compensation The payment of allowances is made to the account of a family member of the dead (deceased) serviceman in a credit institution, indicated in the application.