If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

Editorial Disclosure We have not reviewed all available products or offers. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

by Maurie Backman | Published on Oct. 31, 2021

Many or all of the products here are from our partners that pay us a commission. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.Image source: Getty Images

Here's why it pays to downsize while you're still working.

It's common practice for people to downsize their homes once they enter retirement. For one thing, retirees with children often reach empty-nester status by the time their careers come to a close and therefore don't need as much space at home. Also, retiring can mean moving over to a fixed income, and a limited one at that. As such, retirees are often forced to tighten their budgets, and downsizing is a good way to spend less.

If you plan to downsize during your senior years though, you may want to make that move before your retirement becomes official. Here's why.

Many seniors enter retirement with their mortgages paid off, so when they go to downsize, they're often able to sell their existing homes at a high enough price to buy a smaller one outright.

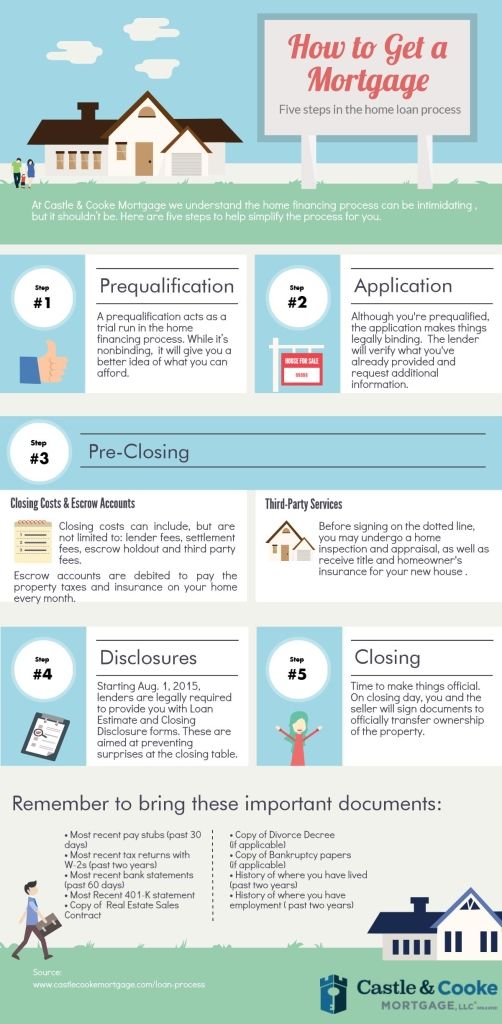

But not everyone enters retirement mortgage free. If you have a home you don't expect to have paid off in time for retirement, and you're also planning to downsize once you stop working, then you may need a mortgage to finance your smaller home. You may be more likely to qualify for a mortgage as a working professional than as a retiree.

You may be more likely to qualify for a mortgage as a working professional than as a retiree.

One factor that mortgage lenders look at when evaluating applicants is income. And that makes sense. When a lender loans you money, it wants reassurance you'll be able to pay it back.

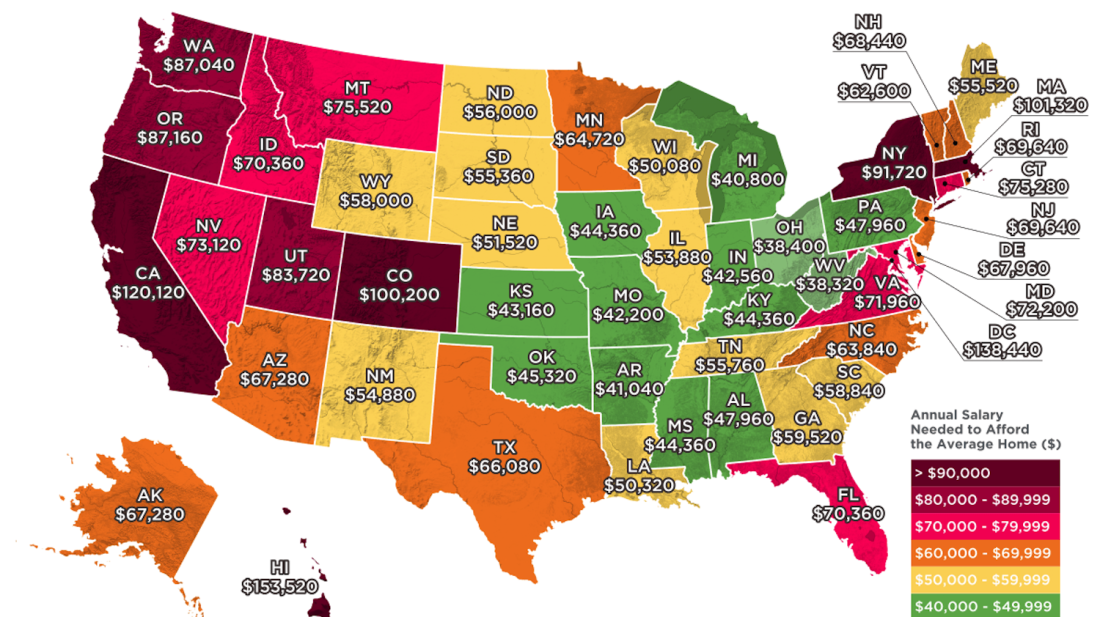

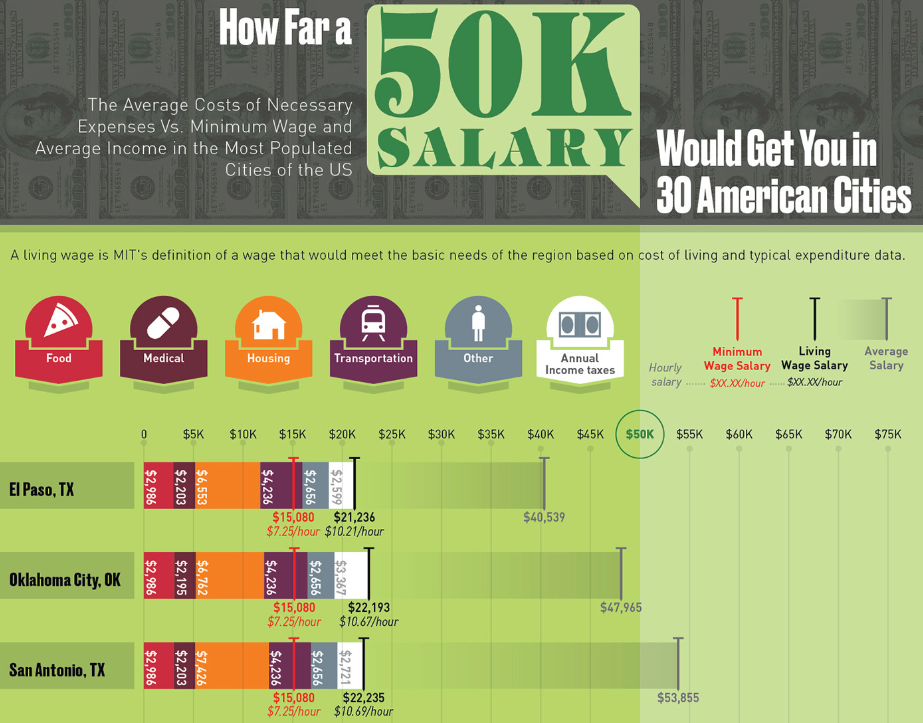

Say you currently earn a salary of $70,000 a year, but you're only in line for 40% as much income, or around $28,000 a year, once you retire and rely on Social Security. To be clear, that's not a random estimate. Social Security will generally replace about 40% of your pre-retirement income if you're an average wage earner.

More: Check out our picks for the best mortgage lenders

If you expect to live mostly on Social Security once you retire, it means that if you wait until then to apply for a mortgage, you'll have less income on file to present to a lender. That could make it more difficult to qualify for a mortgage if you need one.

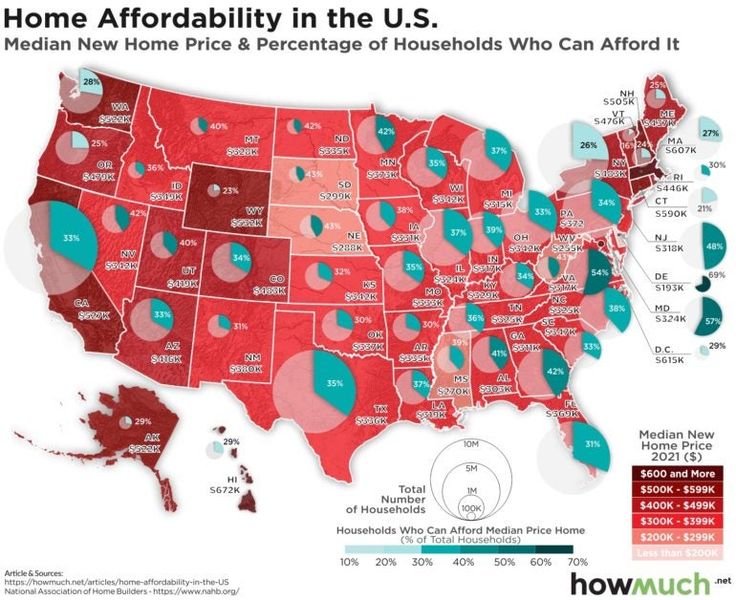

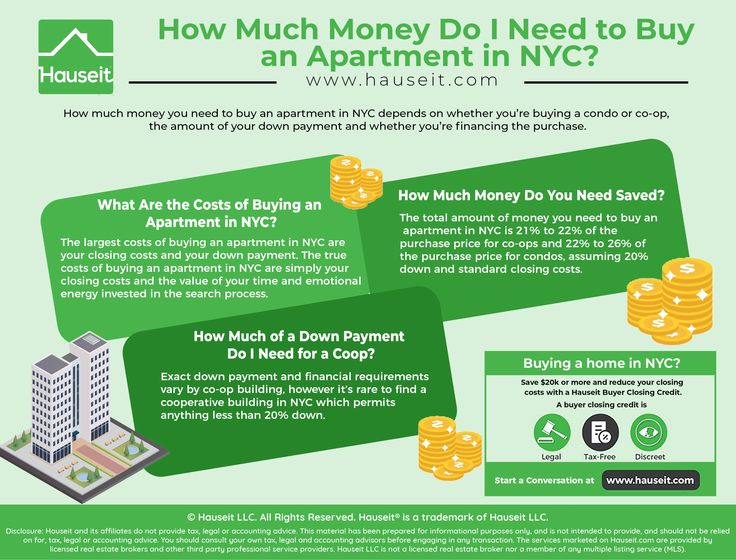

Not only might it pay to downsize your home before retirement, but it also pays to run some numbers to see what sort of home you can afford. Within the realm of downsizing, homes can vary in size, amenities, and price. It's important to do some number-crunching ahead of time to see what options your budget allows.

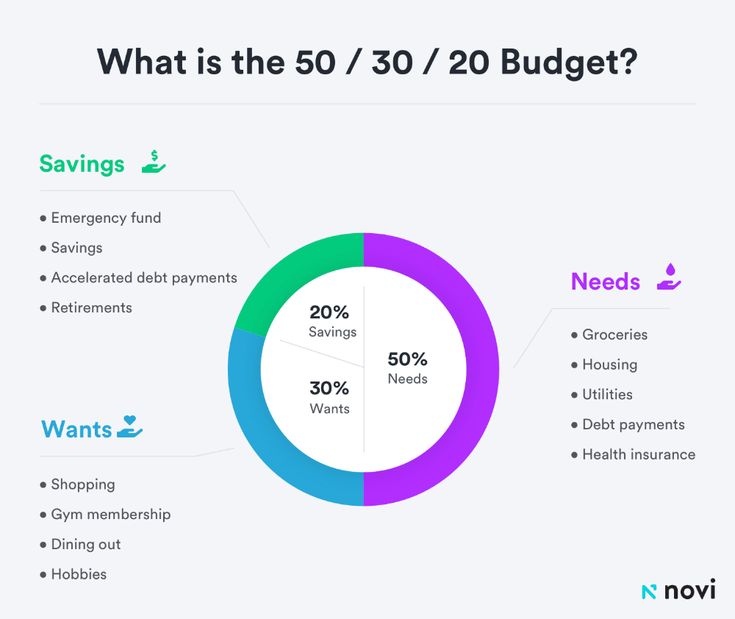

As a general rule, your housing costs, including your mortgage, property taxes, and insurance, should not exceed 30% of your income. If you're living on a $30,000 annual retirement income, it means your housing expenses shouldn't cost more than $9,000 a year, or $750 a month. You may need to get on board with buying a condo, for example, if a townhouse is out of reach financially.

Downsizing in retirement is a move that can make a lot of financial sense. But if you'll need a mortgage to buy your next home, you may want to apply while you still have a steady paycheck from work. Doing so could increase your chances of getting approved.

Doing so could increase your chances of getting approved.

Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool.

Share This Page Email IconShare this website with emailWe're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

The Motley Fool has a disclosure policy.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2023 The Ascent. All rights reserved.

About The Ascent

About Us Contact Us Newsroom How We Make Money Editorial Integrity Ratings Methodology RSS Feed

Learn

Credit Cards Banking Brokerage Cryptocurrency Mortgages Insurance Loans Recent Articles

When Bob and Sally came into the office, their finances were a mess. They had recently retired and were withdrawing nearly 10% annually from their retirement savings. At their current withdrawal rate, they would be out of money by the time they hit 75. To make things even worse, they weren’t able to enjoy any of the luxuries they had when they both were working. No traveling, no going out to nice restaurants, and barely able to get by even after a high retirement account withdrawal rate. The problem? They had finally bought their dream home right before retirement, and after going over budget, the mortgage payment was killing them.

They had recently retired and were withdrawing nearly 10% annually from their retirement savings. At their current withdrawal rate, they would be out of money by the time they hit 75. To make things even worse, they weren’t able to enjoy any of the luxuries they had when they both were working. No traveling, no going out to nice restaurants, and barely able to get by even after a high retirement account withdrawal rate. The problem? They had finally bought their dream home right before retirement, and after going over budget, the mortgage payment was killing them.

This article will help guide you in determining how much your home payment should be for a comfortable retirement.

The 20% rule of thumb while workingWhen someone is working, my general rule of thumb is that a person should not spend more than 20% of their income on a home. For example, if your family income is $100,000, your total mortgage payments, including taxes and insurance, should not be over $20,000 per year, or $1,667 per month. The last thing you want to have happen is that so much is going out between mortgage payments, taxes, and other debts, that you don’t have any money left over for some of the fun stuff. Now, this is just a rule-of-thumb, and 20% can be tweaked based on your situation. For example, maybe you are younger and expecting your income to go up, so you can spend a little more. Or, maybe you have high student loan payments or other debts, and you would prefer to spend less on the mortgage or rent. I have heard other people use a 28% rule-of-thumb before, but I think that is too high, and feel like erring on the conservative side makes sense as I have seen high mortgage payments wreck people financially. So, what changes in retirement?

The last thing you want to have happen is that so much is going out between mortgage payments, taxes, and other debts, that you don’t have any money left over for some of the fun stuff. Now, this is just a rule-of-thumb, and 20% can be tweaked based on your situation. For example, maybe you are younger and expecting your income to go up, so you can spend a little more. Or, maybe you have high student loan payments or other debts, and you would prefer to spend less on the mortgage or rent. I have heard other people use a 28% rule-of-thumb before, but I think that is too high, and feel like erring on the conservative side makes sense as I have seen high mortgage payments wreck people financially. So, what changes in retirement?

Not necessarily, but there are some benefits that you have in retirement that you don’t have while you are working

While you are working, you may only see 50% or less, of your actual income. For example, let’s say that your income while working is $100,000. Your effective federal tax bracket would be around 10%, plus 4.25% on state taxes, 7.65% on social security and medicare taxes (FICA), and another 10% to 20% going to the 401(k). With taxes and retirement savings, 30% to 40% of each paycheck is gone before you ever see it. This is the reason that I would like to see people keep their home payments to no more than 20% of gross income. Things are more attractive though for a retiree with the same income.

For example, let’s say that your income while working is $100,000. Your effective federal tax bracket would be around 10%, plus 4.25% on state taxes, 7.65% on social security and medicare taxes (FICA), and another 10% to 20% going to the 401(k). With taxes and retirement savings, 30% to 40% of each paycheck is gone before you ever see it. This is the reason that I would like to see people keep their home payments to no more than 20% of gross income. Things are more attractive though for a retiree with the same income.

The truth is that you keep more of your money in retirement. For example, part of your social security benefit is federal tax-free, and all of it is exempt from Michigan state taxes. You don’t have the 7.65% FICA tax and you are no longer making 401(k) contributions. While working, you may see 30-40% of each paycheck eaten by taxes and savings. In retirement, you will probably see less than 15% of this same amount of income go to taxes, and of course, no savings. Therefore, you can spend more of your income in retirement on a home, but of course, there is a large catch. Your income in retirement is typically lower than when you are working.

Therefore, you can spend more of your income in retirement on a home, but of course, there is a large catch. Your income in retirement is typically lower than when you are working.

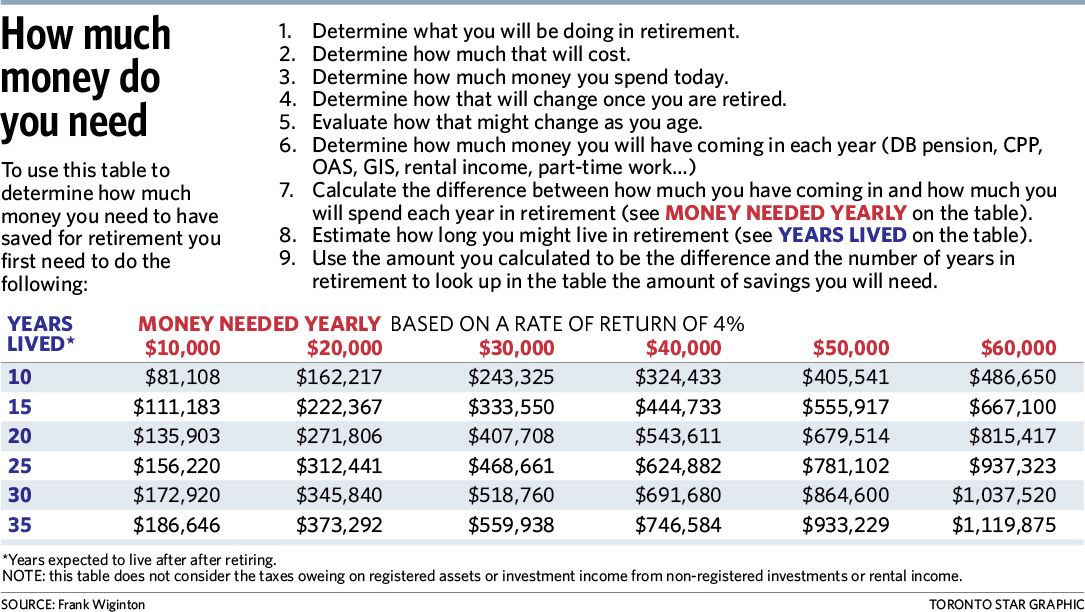

First, to calculate how much you can afford, you need to have an idea how much you will earn in retirement. While working this is typically pretty easy, but not as easy when you are retired. There are usually three sources of retirement income:

Calculating your social security and pension is fairly easy, but trying to figure out how your savings is converted into income, is a little tricker. I have written before how I believe a 5% savings withdrawal rate should be considered a fairly safe withdrawal rate. Therefore, multiplying your retirement savings by 5% should give you a rough estimate of how much income you can generate from your savings.

Here is an example of a couple entering retirement and their anticipated income.

Social Security: $36,000

Pension: $24,000

Savings Withdrawal ($1,000,000 of assets): $50,000

This couple should expect $110,000 in income in retirement. Once you determine your retirement income, you can figure out how much home you can afford.

The 25% rule of thumb while retiredMy suggestion is to limit your mortgage, or rent, payment to less than 25% of your total retirement income. 25% still is low enough, that for many of us, after a mortgage and income tax payments, less than 40% of your income is going away to taxes and mortgage payments. Hopefully, that will still leave you with plenty for traveling and other hobbies. Yes, you are spending more of your pay on a home then what I would recommend while working, but you have fewer taxes and savings on the same amount of income.

Depending on your situation you could potentially push it to 30%, but I would get pretty nervous with anything higher. You may even want to error on the more conservative side if you have fairly high, over 10%, of your retirement is spent on healthcare costs.

You may even want to error on the more conservative side if you have fairly high, over 10%, of your retirement is spent on healthcare costs.

Let’s look at the couple above who has $110,000 in retirement income. Given the 25% rule of thumb, they can afford $27,500 per year on mortgage/rent or $2,291 per month.

The 25% rule of thumb is not for everyoneLiving in Michigan, we are fortunate to have lower home prices than most parts of the country. This has allowed my family to have a very low mortgage payment compared to our income. My wife has family all around the country, and they laughed at how much our home cost until they saw it. Now, I think they are just jealous. This doesn’t mean that we save all of this extra money. Instead, it has given us the freedom to spend money on things that we love doing. I love to ski and she loves the ocean, and we can take that extra vacation. She loves to cook, and enjoys nicer restaurants, and having more disposable income allows us that extra night out each month. You may prefer to have a smaller mortgage payment so that you can take that extra vacation, buy a Corvette, or do what you love to do.

You may prefer to have a smaller mortgage payment so that you can take that extra vacation, buy a Corvette, or do what you love to do.

Or, maybe for your family, your home is your oasis. You want to buy a place on the lake, and that is where you spend all of your vacation and time. It is the place where all of the kids and grandkids consider to be the home away from home. In that case, maybe you do want to push it a little and spend a little more on your home. Retirement is about choices. You will have a fairly fixed income, and how you spend that income is up to you. For most of us though, having too high of a mortgage payment so that you can’t enjoy the other things in life is also not a great choice. That’s why I recommend not spending more than 25% of your retirement income on your home.

Bryan Haggard CFP®, CFA is a Michigan based fee-only financial planner. He specializes in working with families to help them live a stress-free retirement. Interested in putting together a plan to help you meet your retirement goals? Schedule a time to meet below.

Interested in putting together a plan to help you meet your retirement goals? Schedule a time to meet below.

Schedule a Meeting

Image by esudroff from Pixabay

Like Loading...

1. When will applications for Lonely Pensioner's Benefit start?

The pensioner does not have to apply for the allowance himself – the Social Insurance Board will pay the allowance after verification of the data.

2. How can I check who is registered (registered) in the same housing as me, since I don't remember this myself (a)?

To check the address of residence or to enter it in the Population Register, contact the city government of the part of the city where you live. nine0005

3. My grandson (my granddaughter) is registered in my apartment, who has not actually lived with me for many years. I live alone, am I eligible for benefits?

A pensioner who really lives alone, but a child, grandson, granddaughter or other person who does not actually live there is registered (registered) at the same address does not meet the conditions for receiving benefits.

4. My husband and I have been living in separate apartments for a long time, but we are not divorced. Am I eligible for benefits? nine0005

When paying benefits, it is not the family status of pensioners that is taken into account, but residence. If, according to the data of the Population Register, only you are registered in the apartment, you are entitled to the allowance.

5. If a private residential building has two owners and, according to the Population Register, they live at the same address, is there then a right to a pensioner living alone allowance?

If a private residential building has two owners and, according to the Population Register, they live at the same address, then they do not live alone, and therefore do not meet the conditions for receiving benefits. If the households located in the same building are listed as separate addresses in the Population Register, then the pensioner meets the conditions for receiving the allowance. nine0005

6. Is a pensioner living separately on the second floor of a private residential building entitled to receive pensioner living alone?

Is a pensioner living separately on the second floor of a private residential building entitled to receive pensioner living alone?

A pensioner who lives separately on the second floor of a private residential building, but at the same address with which, according to the Population Register, other residents are registered, does not meet the conditions for receiving benefits.

7. My address is inaccurate and the same as the name of the local government - for example, Audru parish - will I receive the pensioner's pension allowance? nine0005

Living alone means that a person is registered at the address of his place of residence. An address that matches the name of a local government is not considered a single residence.

8. How much pension can I receive in order to receive the Lonely Pensioner's Benefit? What amount of pension is taken into account - net or gross?

Pensioners are entitled to the allowance if the amount of the granted pension and its monthly net amount is less than 1. 2 times the average old-age pension in Estonia. In 2021, the amount of 1.2 times the average pension is 636 euros. The net amount is the amount of the pension from which income tax has been deducted. nine0005

2 times the average old-age pension in Estonia. In 2021, the amount of 1.2 times the average pension is 636 euros. The net amount is the amount of the pension from which income tax has been deducted. nine0005

9. Are pensioners living in a care home (nursing home) entitled to benefits?

All persons who have reached retirement age and who are recipients of an old-age pension and receive a 24-hour care service, i.e. living in a care home (nursing home), whose pension is less than 636 euros, will receive a pensioner's pension allowance. Residential residence details from April 1st to September 30th will be verified and if the person meets the conditions for receiving benefits, they are eligible to receive benefits. nine0005

10. My parents live together in the same apartment and my father has been appointed guardian of my mother. Is the mother or father entitled to benefits?

In addition to pensioners living alone, guardians and wards also have the right to receive a pension living alone. This means that if both the guardian and the ward live in the same dwelling, and one or both of them are pensioners, they are entitled to the pensioner living alone allowance. If other tenants are registered (registered) at the same address as the guardian and the ward, the pensioner does not meet the conditions for receiving benefits. nine0005

This means that if both the guardian and the ward live in the same dwelling, and one or both of them are pensioners, they are entitled to the pensioner living alone allowance. If other tenants are registered (registered) at the same address as the guardian and the ward, the pensioner does not meet the conditions for receiving benefits. nine0005

11. Two old-age pensioners live at the same address, and one is registered for the other by a custodian on the basis of an agreement with the local government: are the custodian and ward entitled to benefits?

A guardianship contract does not give the right to a pensioner living alone if the guardian and the ward live together at the same address.

12. I have been living alone for some time, but in May I will be moving to a new place of residence, where I will also live alone. Do you check when you receive benefits that I was living alone before May? nine0005

If a pensioner lived alone in his first place of residence and later, when changing his place of residence, he lives alone again, he is entitled to the pensioner living alone allowance.

13. I live alone, go to work, and my pension is less than 636 euros - will I receive benefits or will my benefits not be paid due to work?

When paying benefits, it does not take into account whether a person who has reached retirement age is working or not. Earned income is not taken into account to encourage working at retirement age, so it doesn't matter if the pensioner is working full-time or part-time. The Lonely Pensioner's Allowance is not subject to income tax, and the allowance paid is not included in income when calculating the living allowance (indigence allowance). nine0005

14. When will the benefit be paid?

If all conditions for receiving benefits are met between April 1 and September 30, benefits will be paid in October.

15. On the basis of what law is the allowance for a pensioner living alone?

The allowance of a pensioner living alone is regulated by the Social Welfare Act (Sotsiaalhoolekande seadus), articles 139 1 -139 3

can I put the data in the population register in order? nine0005

If a person is registered in the apartment who no longer lives there and who no longer has the right to use this dwelling as their place of residence, the owner of the apartment has the right to submit an application for changing the address data in the population register to the rural municipality or city government.

The owner of the dwelling has the opportunity to send a request to a specific city or rural municipality administration, depending on the location of the dwelling, in the following ways:

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to manage

personal finances Learn

how to protect your

rights nine0099 Financial

calculators How to

talk to children

about money

From October 1, 2021, you can read up-to-date financial literacy materials on the website

MOIFINANCE.