You've attempted to enter your information too many times. Please call customer service at 1-877-642-2357 for assistance.

You've attempted to enter your information too many times. Please call customer service at 1-877-642-2357 for assistance.

You've attempted to enter your information too many times. Please call customer service at 1-877-642-2357 for assistance.

Your account is not eligible for online activation. Please call 1-877-642-2357 for assistance with your account.

To start the activation process, select one of the options below.

Please note that if you have a supplementary card, activation can only be completed by the person whose name is on the card.

Activate without logging in

Sign in to Activate

I know my PIN

I don't know my PIN

To activate your card, follow these 3 easy steps!

Card Number

Please enter a valid Card Number

The information you have entered is invalid. Please try again or call customer service at 1-877-642-2357 for assistance.

{{activateCtrl. apiErrorMessage}}

apiErrorMessage}}

3-Digit Security Code

Please enter all 3 digits of your credit card CVC number {{activateCtrl.apiErrorMessage}}

Please enter your Personal Identification Number (PIN) below to activate your card.

If you don’t know your PIN please follow the instructions by clicking “I forgot my PIN” link to verify your identity and create a new PIN to continue with the activation process.

Cardholder Name:

{{activateCtrl.customerName}}

Card Number:

{{activateCtrl.maskedCard}}

My PIN is:

Please enter a 4-digit PIN

{{activateCtrl. apiErrorMessage}}

apiErrorMessage}}

I forgot my PIN

In order to continue we’ll need to confirm your identity for security purposes. We have sent a unique security code to your email address on file.

{{activateCtrl.maskedEmail}}

Please enter the security code received in your email.

Security Code

You must enter the code you received in your email. The code you've entered is invalid, please try again.

Resend code

If the contact information we have is incorrect or you haven't received the code we sent, please call us at 1-800-459-6415 for help.

You can now set your 4-digit credit card PIN. We recommend not entering a PIN number that is easily guessable when changing your PIN.

Enter a new 4-digit PIN:

Please enter a 4-digit PIN

Due to system limitations, this PIN is unacceptable. {{activateCtrl.apiErrorMessage}}

{{activateCtrl.apiErrorMessage}}

Re-enter PIN:

Please enter a 4-digit PIN PIN does not match

If you would like a physical Triangle Rewards card, you can pick one up at Canadian Tire, Sport Chek, Gas+/Essence+ Atmosphere, Sports Rousseau, Hockey Experts, L’Entrepôt du Hockey, Mark’s/L’Équipeur, Party City, Pro Hockey Life and participating Sports Experts locations.

|amp|

You can collect Canadian Tire Money® by showing your Triangle App, Triangle Rewards card, or key fob upon checkout, or by simply paying with a Triangle credit card at Canadian Tire, Sport Chek, Mark’s/L’Equipeur, Party City, Gas+/Essence+ , Pro Hockey Life, Atmosphere, Sports Rousseau, Hockey Experts, L’Entrepôt du Hockey and participating Sports Experts locations across Canada. This also includes all online purchases at CanadianTire.ca, Marks.com, partycity.ca, SportChek.ca, prohockeylife.com, Atmosphere.ca and sportexperts.ca.

This also includes all online purchases at CanadianTire.ca, Marks.com, partycity.ca, SportChek.ca, prohockeylife.com, Atmosphere.ca and sportexperts.ca.

You must be a member in the program in order to collect and redeem Canadian Tire Money. To become a member you’ll need to register. Redemption is not available through online properties.

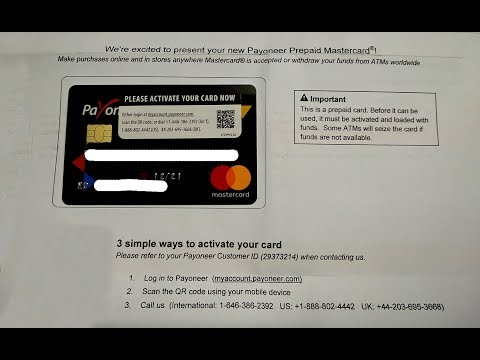

1. Visit triangle.com/activate

2. Select the “Your credit card has been received” option

3. Then select “activate” from the menu

4. Enter both your triangle card number and the security code

5. Select the “proceed” option

6. Enter the necessary details.

7. Then, generate a four-digit PIN.

8. The activation process will initiate itself.

Triangle mastercards can be used for a variety of purposes, but activation is where the majority of users struggle. If you are unable to access the internet or WiFi to activate your triangle or CTB card, you can also use your mobile phone.

Simply dial 1-800-459-6415, which is the number of the Canadian Tire customer service department, and you will be assisted and guided through the activation process.

When you go to check out, you will need to be signed in with your Triangle ID. Don’t have a Triangle ID, its quick and simple to set up during the check out process. You need to be a member in the Triangle Rewards program to be able to collect or redeem CT Money. This means you will need to register your Triangle Rewards card before you can start redeeming your CT Money.

If you have a Triangle credit card, you’ll need to be signed in and enter your credit card number in the method of payment in order to redeem. Within the check out process, your CT Money balance will be shown, and you can select the amount you would like to redeem. Details on the amount redeemed will be provided in your order confirmation. You can not redeem CT Money on shipping and handling. Currently tires and wheel purchases are excluded. Please see full program details for all eligible merchandise at Triangle.com

You can not redeem CT Money on shipping and handling. Currently tires and wheel purchases are excluded. Please see full program details for all eligible merchandise at Triangle.com

Yes, customers can close their account at any time. There is no fee for closing an account, but they will lose any Canadian Tire Money® that they have collected. If a customer would like to cancel an account they should call Customer Service at 1-800-226-8473 Monday to Friday 8:00 am to 9:00 pm (EST) and Saturday and Sunday 9:00 am to 5:00 pm (EST). Please note that if you have a Triangle branded credit card and close your Triangle Rewards account, you will also be closing your credit card account.

Since July 20, customers holding Mir cards from several Russian banks have the opportunity to pay for purchases using Apple Pay. Banks have been preparing this launch for almost three months

Photo: Frank May / Global Look Press

Several Russian banks have connected their customers' Mir cards to the Apple Pay mobile wallet. RBC was told about this by two sources in the financial market. They specified that, in particular, Sberbank, VTB and Rosselkhozbank will connect to the service.

RBC was told about this by two sources in the financial market. They specified that, in particular, Sberbank, VTB and Rosselkhozbank will connect to the service.

Later, NSPK officially announced that the service became available to clients of eight banks — Sberbank, VTB, Rosselkhozbank, Promsvyazbank, Post Bank, Center-Invest, Tinkoff Bank and Primsotsbank.

The original version of the material said that from July 20, clients of Otkritie and Rosbank will also be able to download Mir cards to their iPhone. After the publication, bank representatives specified that the service would be connected soon, but not on July 20, and a specific date would be announced later.

Otkritie Bank is at the final stage of connecting the Apple Pay service for cards of the Mir payment system. Rosbank also plans to be one of the first to connect, MKB is going to introduce this service by the fall of this year, their representatives said.

www.adv.rbc.ru

RBC wrote in February that banks will be able to connect Mir cards to Apple Pay. Then the Mir payment system sent out a newsletter to banks, in which it said that from April 27 they would have the technical ability to start the process of connecting national cards to Apple Pay.

Then the Mir payment system sent out a newsletter to banks, in which it said that from April 27 they would have the technical ability to start the process of connecting national cards to Apple Pay.

Prior to this, Mir cards could only be used for contactless payments in Samsung Pay and Mir Pay wallets on Android smartphones.

Otkritie expects that the demand for the service from iOS smartphone owners will be significant. “We see real value in its implementation for holders of bank cards of the Mir payment system. Considering that NSPK is actively scaling its business outside of Russia, the implementation of the Apple Pay service will increase the convenience of making payments for customers abroad,” added the MKB representative.

VTB believes that the new option will also allow customers to easily abandon "plastic", says VTB board member Svyatoslav Ostrovsky. “In the total volume of contactless transactions, the share of spending made by VTB customers using smartphones is constantly increasing and already today reaches 60–70%,” he noted. Ostrovsky added that the bank is also seeing significant demand for Mir cards from those customers who receive or plan to receive payments from the state. “Only our bank has issued more than 10 million such cards,” he specified.

Ostrovsky added that the bank is also seeing significant demand for Mir cards from those customers who receive or plan to receive payments from the state. “Only our bank has issued more than 10 million such cards,” he specified.

RBC sent a request to other major banks and Apple.

Apple Pay was launched in Russia in 2016, but all this time Mir cards could not be added to it. At the end of 2019, the international consulting company Boston Consulting Group (BCG) named Russia the world leader in the number of secure tokenized transactions. According to a NAFI survey conducted in early 2021, the most popular service among Russians is Google Pay (it was used by 32% of those who made contactless payments), Apple Pay (30%) is in second place, and Samsung Pay (17%) is third. Moreover, Apple Pay and Samsung Pay are more often used in Moscow and St. Petersburg, and Google Pay is used in other large cities of Russia.

Mobile wallets are used to pay for goods and services using a phone: to do this, you need to attach a device with a card linked to it to a POS terminal. On the Internet, payment through the service does not require entering payment card data - it is enough to confirm the payment using a code or biometrics. When linking a card to these services, its number is not stored on the device, on the smartphone manufacturer's servers, or in the store's database. The operation is performed by transferring a unique token - a combination of numbers that is generated for each card connected to the payment service, which increases the security of transactions.

On the Internet, payment through the service does not require entering payment card data - it is enough to confirm the payment using a code or biometrics. When linking a card to these services, its number is not stored on the device, on the smartphone manufacturer's servers, or in the store's database. The operation is performed by transferring a unique token - a combination of numbers that is generated for each card connected to the payment service, which increases the security of transactions.

The National Payment Card System (NSPK) was founded in 2014 to serve bank payments in Russia after Visa and Mastercard stopped accepting cards from banks that fell under Western sanctions due to the annexation of Crimea. The first cards were issued at the end of 2015: according to the law, payments from the budget must be transferred to them, so the majority of users of national cards are public sector employees, pensioners, students, etc.

According to the NSPK data, as of January 1, 2020, about 95 million cards. In total, according to the results of the third quarter of 2020, Russian banks issued 293.1 million bank cards. Last year, the quantitative share of Mir cards amounted to 30.6% of the market, and in terms of transaction volumes - 24%, Dmitry Buvin, commercial director of NSPK, told Banki.ru. The rest of the share is mainly shared between Visa and Mastercard. In addition to Russia, Mir cards are accepted by some terminals in ten more countries: mainly the CIS countries, as well as Turkey and Vietnam.

In total, according to the results of the third quarter of 2020, Russian banks issued 293.1 million bank cards. Last year, the quantitative share of Mir cards amounted to 30.6% of the market, and in terms of transaction volumes - 24%, Dmitry Buvin, commercial director of NSPK, told Banki.ru. The rest of the share is mainly shared between Visa and Mastercard. In addition to Russia, Mir cards are accepted by some terminals in ten more countries: mainly the CIS countries, as well as Turkey and Vietnam.

Canadians do not keep cash in their pockets. Almost everything can be bought with credit cards. Cards are not accepted only by small Chinese shops (they will have to pay in cash) and some types of Russian car repair shops and dry cleaners.

In order to obtain an immigrant visa, you need to prove your financial solvency and, as a guarantee that you will not sit on the neck of the state in the first days of your arrival, transfer to your account opened with a Canadian bank, a certain amount, depending on the number of family members . After your arrival, you come to the bank and unfreeze your account. This means a visit to the manager of the branch of the bank that best suits you geographically. You show your documents: visa, passport and rental agreement. The manager turns on the computer and transfers your money from the central office, where an account is opened while the person is not in the country, to the branch you need. You sign a lot of papers. At home, you can take a dictionary and try to translate them, but it will be quite difficult, since banking terminology is not a simple thing. Any bank, after opening an account, without fail issues you a debit card, a checkbook, and a customer's book. Two accounts are opened in your name at once: checking and saving. A checking account is a working account that is accessed by a debit card when paying by card, from which money is withdrawn when paying by check. In general, this is your live account.

After your arrival, you come to the bank and unfreeze your account. This means a visit to the manager of the branch of the bank that best suits you geographically. You show your documents: visa, passport and rental agreement. The manager turns on the computer and transfers your money from the central office, where an account is opened while the person is not in the country, to the branch you need. You sign a lot of papers. At home, you can take a dictionary and try to translate them, but it will be quite difficult, since banking terminology is not a simple thing. Any bank, after opening an account, without fail issues you a debit card, a checkbook, and a customer's book. Two accounts are opened in your name at once: checking and saving. A checking account is a working account that is accessed by a debit card when paying by card, from which money is withdrawn when paying by check. In general, this is your live account.

Saving - an account for storing cash surpluses. To activate it, you will need to conclude an agreement with the bank. This is done in the event that you decide to deposit money at interest. They will be stored on this account.

This is done in the event that you decide to deposit money at interest. They will be stored on this account.

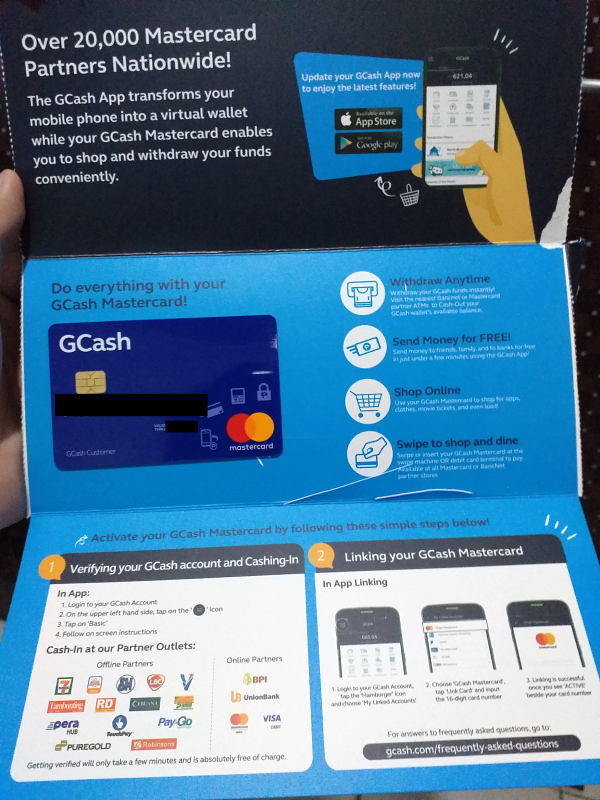

Debit card - a plastic card that you can use to the extent of the funds in your account. All plastic cards are 55*85 mm in size. At the top of the card is the logo of the organization that issued the card. Next, the card number, the date until which the card is valid, your first and last name.

At the top of the reverse side there is a magnetic strip, a place for your painting, information about the rules for using the card in English and French, round-the-clock telephone numbers of operators.

When giving you a card, the manager will ask you to dial a combination of several digits on a special device - this is your code. In the future, the card will only work after you enter your code.

With a debit card you can pay in all areas of life.

Debit card - a pass to an ATM both for withdrawing cash and for obtaining information about your account and receiving other services.

Checkbook - a notebook containing 25-50-100 checks (your choice). The check you signed is a payment document. Checks are not accepted everywhere. You can pay by check for housing and all mail-order payments, but you can't pay with a check at a store or doctor's office. The check is also used to pay the monthly contractual payments.

Payment for your car insurance, payment of a loan for housing, payment of a loan for a car, is withdrawn from your account without acceptance, every day of the month specified in the agreement. To confirm your payments, a check issued and filled out by you, crossed out with the inscription VOID (corrupted), is used. By filling out a check, you cross it out with this word, and it automatically allows its holder to withdraw a certain amount from your account on a certain day.

Client book - similar to our passbook, which reflects all your financial transactions. Served by a clerk in your bank branch, you hand him a book, and he prints out all the transactions on your account in it. You can see the date, time, location, and amount you have spent or charged.

You can see the date, time, location, and amount you have spent or charged.

Using an ATM, you can insert your customer book into a special hole, and the machine will print out all your expenses and receipts since the last update.

ATM is a device through which you can fully manage your account at any time of the day. ATMs are located at the entrance to any branch of the bank. Access to them around the clock. For your first acquaintance with this machine, if you will do it yourself, I advise you to choose as late as possible. This will make it easier for you, as you will be alone, and no one will loom behind your back, waiting for their turn.

1. To start working with an ATM, you must insert your debit card into a special slot as shown in the figure. The ATM will then swallow your card and ask for a code.

2. Type the code on the keyboard and press ENTER. After checking and confirming the code, a menu will appear on the screen from which you can select the operation you need.

You can withdraw cash from your account. It is worth knowing that people who have recently opened an account are only allowed to withdraw $100 per day from an ATM. If you need a large amount, you will have to contact the clerk in your branch. Questions like, why do you need money, are not asked here. Need means need. There are practically no cases when there is no money in the bank. The amount of more than 10,000 dollars in cash must be ordered in 1-2 days. The same applies to your USD account (if you have one)

Cash withdrawal. In the menu, using the cursor, you must select the operation "withdrawal of money" and press ENTER. The machine will then ask you to enter the amount you need. Enter the amount using the number keys, press ENTER and ...... the money will fall into your hands. After you remove the money from the receiver, the machine will ask you: "Is there anything else you would like, my dear?" In case of your refusal (keys Yes No) you will be asked: "Do you need to print this operation?" In case of your positive answer, you will need to insert an open customer book into a special hole, and the ATM will print all your transactions, starting with the last one. When finished, confirm with the Enter key and take your card back. After you pull out the card, the ATM will give you a check with the balance in your account.

When finished, confirm with the Enter key and take your card back. After you pull out the card, the ATM will give you a check with the balance in your account.

Using the card as an access to your account, you can do the following operations:

Print your customer book.

Pay bills.

To pay the bill, you can choose the one you need from the list of accounts stored in the memory of the ATM (the largest companies in Canada - communications, light, large stores)

If the company you need is not in the list of the car, you will have to send a check in an envelope to pay for its services by mail.

Checks received at work or elsewhere can also be deposited into your account through an ATM.

I recommend that you explore and use all the features of the ATM. On the one hand, of course, it's easier to go to your bank branch, and everything you need to do with the help of a clerk (every bank in the Russian region has Russian-speaking clerks). But, firstly, this is a waste of time, and secondly, each operation carried out through a clerk will cost you from 1 to 3 dollars. While through an ATM the same will be almost free. I say almost, since all money transactions in Canada are paid. They are inexpensive (10-40 cents). But, when everything is done with the help of a clerk, this little thing can add up to $30 a month, which is $360 a year!

While through an ATM the same will be almost free. I say almost, since all money transactions in Canada are paid. They are inexpensive (10-40 cents). But, when everything is done with the help of a clerk, this little thing can add up to $30 a month, which is $360 a year!

It is very important from the first days to find out for what and how much your bank charges. If each cash withdrawal costs $1, then it doesn't make sense to withdraw $10 every day. It is better to rent once a month as much as you need for the entire period.

If your bank charges 40 cents for every grocery store payment with a debit card, it's best to pay in cash.

IMPORTANT! You should withdraw cash from the card at ATMs of the bank that issued the card. Otherwise, you will pay from 3 to 5 dollars for receiving money, regardless of the amount

That is, if you have a Royal Bank card, then you should not use it at a Canada Trust ATM.

There are many such nuances and you need to delve into them from the very beginning.

Many companies use point cards to incentivize customers. At any ESSO gas station you can pick up an information form and a point card. To activate it, you need to fill out a form and send it by mail. In a few days your card will be activated. Refueling in this network of gas stations, in addition to paying for gasoline, you give the operator your card, and he removes the slip from it. For each use of the ESSO gas station, you are awarded points. The number of points you have earned can be viewed on the company's website www.esso.com by entering your card number. In a year, it can click on a tank of gasoline. A trifle, but nice!

Air miles point card works in the same way. To receive a card, you need to take a questionnaire in any store, on the doors of which there is a logo of this company, and, having filled it out, send it by mail. You will receive your card in a week. Instead of points, Air Miles awards air miles. For several years of using the card, you can fly on an airplane of this company for free. The company has contracts with many stores. Wherever there is an Air Miles badge at the checkout, when you pay for an item, you can get points on your card. I advise you not to neglect these little things.

The company has contracts with many stores. Wherever there is an Air Miles badge at the checkout, when you pay for an item, you can get points on your card. I advise you not to neglect these little things.

In Canada, between people and organizations, the following types of payments are accepted:

Cash - no explanation needed and welcome everywhere.

Settlement by check - you fill out one of the sheets of your checkbook indicating the date, amount, to whom and for what.

Money order settlement - this document can be obtained from a bank clerk. The cost of one Money order is 3 dollars, regardless of the amount for which it is filled. It indicates the addressee and, after filling it out, the amount issued is blocked on your account until it is received by the addressee or you make a refund.

Draft calculation - the same as Money order, but valid starting from three thousand dollars.

Certified Check calculation - exactly the same as the two previous payment methods, only a different name.

Credit Card Check - each credit card comes with a check book. If you wish, you can use these checks in the same way as checks from your debit account.

Now it's time to talk about credit cards and credit history.

In Toronto, as well as in any American-Canadian city, there is a credit bureau. This is the most powerful organization, one might say centralized throughout the American continent.

After you arrive in the country, on the day you receive your Social Security Card (SIN) in your name, a file is opened at the credit bureau, which will be closed only after your death. This file will display your entire credit life. In Canada, there is a huge system of selling goods, services, money on credit. How you borrow and how you repay is recorded in the computer. Even if you asked for something on credit, but they didn’t give it to you, this will also be reflected in the computer as a refusal, which is not good. The next potential lender to a large number of refusals may react with a refusal on their part.

Let's start with goods on credit. In many stores you can see advertising posters urging you to take the item now and pay in a year. If you are interested in this kind of purchase, the store will give you a questionnaire. After you fill it out, the clerk will fax it, and after 20 minutes, you will receive an answer whether you are allowed to use the loan and for how much. There are also situations when the address to which it needs to be sent is written on the questionnaire. In this case, you will receive a response to your loan request by mail within 10 days.

IMPORTANT ! Regardless of whether your appeal was approved or not, a response is sent to you without fail.

Standard Form

Date Amount Mercant No

Invoice No Credit limit

Tell us about yourself

Last name__________First name_____________SIN_____________

Date of birth_____________

Spouse name____________________date of birth____________________SIN__________

No of dependents0037 Tell us about your employment

Employer's name__________phone__________how long___________

The same about spouse employer______________________________

Tell us where you live

Full address_______________________________________________

Own_______rent_________parents__________relatives____________

Rent/mrgh per month______________how long____________________ 900 us37 about=yourell name address phone________________________________

alignTjustify" income

Gross monthly income____________________________________________

Spouse income_______________________________________________

Other income_______________________________________________

TOTAL__________________________________________________________

Credit references

Name address phone ______________________________________________

Name address phone______________________________________________

Name address phone______________________________________________

Visa N________________Master card N___________Other__________

Your Bank branch address___________phone_____________________

Chequing account N___________saving_________________________

Driver's license N____________________________________________

Nearest relative not living with you address______________________________

SIGNITURE________________________________________________

If you don't have any Canadian bank credit cards, you don't have to try to borrow anything. The fact that the store gives you a loan does not mean that you will pay the store. The credit will be provided by one of the several credit companies in Canada with which the store has an agreement. This scheme applies to all retail loans except Canadian Tire (they have their own lending reserves) and a few other large chain stores.

The fact that the store gives you a loan does not mean that you will pay the store. The credit will be provided by one of the several credit companies in Canada with which the store has an agreement. This scheme applies to all retail loans except Canadian Tire (they have their own lending reserves) and a few other large chain stores.

If you ask for a car loan, the car center will send requests to all banks in Canada asking if someone can give you a loan in a certain amount to buy a car. If agreed, the bank will transfer the money to the auto center and you will pick up the car, and the money withdrawn from your account on a monthly basis will go to the bank.

The situation is the same when buying real estate. After you choose a house or apartment for yourself, the real estate office through which your choice was made will begin to look for a bank that will lend you money and take over your property if you cannot pay for it.

It is very difficult to imagine life in Canada without loans. The entire system of the country is built on loans, and this should be used.

The entire system of the country is built on loans, and this should be used.

The first brick of life in debt will be your first credit card. In fact, this is your third account, to which the bank credits its money and allows you to spend it.

If you order adaptation services through our company, we will receive a credit card for you in the first days.

Otherwise, depending on the state of your account, you can write an application for a credit card within a period of 3 months to 1 year.

Credit cards are Visa, Master card, American express, and others. Everyone has the same idea - to pay for goods and services with money that you do not have.

In fact, with a credit card, you can do all the same operations as with a debit card, communicating with your finances both through a clerk and through an ATM.

IMPORTANT! Credit cards are not accepted for payment in grocery stores.

IMPORTANT ! if you receive a credit card from the same bank where you have a permanent debit account, then the PIN code for opening access to the card will by default be the same as on the debit card.

IMPORTANT! - any card requires activation. After receiving the card by mail, call the number indicated on the back of the card and answer the questions that the operator will ask you. This is necessary to identify you as the true owner of the card. You will be asked questions, the answers to which are only in your banking agreement. It could be your birthday, your mother's maiden name, or a special password word you choose for yourself when you unfreeze your master account. Store credit cards are activated in the same way.

What happens as you spend money on your credit card. If you spend a certain amount on your credit card, you will receive an invoice in the mail for the return of this amount to the bank. The invoice will indicate the date by which you must return the money and the minimum payout amount. As a rule, this is 5-10 percent of the amount you actually spent. That is, if you spent $300 from the card, then in a couple of weeks you will receive an invoice in which you will be asked to pay $300 within two weeks. The minimum payment amount is $30.

The minimum payment amount is $30.

Thus, you actually have an interest-free loan for a period of one month. You can pay the full amount by the due date, or you can only pay the minimum amount shown on the invoice. This will not be considered a violation of the credit history, since you have fulfilled one of the requirements of the bank. If you paid only the minimum, then the rest of the amount will be charged to you with bank interest for the days that you owe. Typically, the average interest on credit cards is 25 percent per annum. This is the point of the bank to lend you money.

Tip: Even if you are able to pay the full amount, sometimes it is better not to. Pay the rest of the debt in a few days. Let the bank take a few cents from you. The hen pecks at the grain. Moreover, if at the time of payment there was money on your main account, the bank will understand that you are simply giving it the opportunity to earn money and will thank you in due time.

Store credit cards work in exactly the same way, with the only difference being that goods are offered instead of money.

Tip: If you are unable to pay even the minimum amount to prevent your credit from being recorded, call the company and let them know that you are behind on your payment. Name the date by which you will pay off the debt, and spell the name of the employee who received this information. As a rule, in this case, most companies make concessions and do not charge you fines.

In addition to purely material benefits, a credit card in Canada also has a moral connotation. A credit card tells about the honesty of a person and his income. The owner of a credit card with a large limit, proudly shows his card. Visa Gold, means that the bank trusts this person so much that it allows him to spend 5,000 dollars, and Visa Platinum allows you to dispose of as much as 25,000 dollars.

The longer and more actively you use your credit card, the more benefits you get from the bank.

Your cash limit increases, payment terms increase, bank interest decreases, the amount that you can withdraw in cash at once through an ATM or through a clerk increases.

In Canada, every person has a bank account, and sometimes more than one. There are many banks in Canada, but only a few large and convenient for the client.

1. Royal Bank of Canada

2. CIBC bank

3. Canada Trust

4. Bank of Montreal

5. Scotia Bank

What is the difference between Canadian banks? In general - nothing. You can store money anywhere. The American continent does not know situations like August 1998 in Russia. Everything is very stable and reliable. The American banking system is eternal. For at least the last 300 years, it has only failed once.

The listed five banks are quite worthy and reliable. Your account may well be opened in one of them. Branches of these banks are located at every major street intersection. Wherever you live, your bank will be close to you.

All of the above banks provide, in addition to the basic package of services, additional services, one of which is Internet Banking.

This service allows you to use your account, receive information, make payments, pay bills without leaving your home. By subscribing to this service (the first three months are free, then $2-4 per month) you have the ability to work with your money over the world wide web from your home computer. The program for working with your account via the Internet at Royal Bank is one of the most convenient. For the convenience of the user, it can be configured in such a way that it itself reminds you of your debts or transfers money itself within the time specified by you. This is especially convenient for long trips. Although, using your debit card number and your pin code, you can go to your account regardless of where you are.

By subscribing to this service (the first three months are free, then $2-4 per month) you have the ability to work with your money over the world wide web from your home computer. The program for working with your account via the Internet at Royal Bank is one of the most convenient. For the convenience of the user, it can be configured in such a way that it itself reminds you of your debts or transfers money itself within the time specified by you. This is especially convenient for long trips. Although, using your debit card number and your pin code, you can go to your account regardless of where you are.

So, summing up all of the above, a bank in Canada is your friend and life partner, regardless of your desire. You can choose it many times, but you need to - once and for all. If you have a good relationship with him, he can open the doors to the financial world for you. Quarrel with him - and he will cut off your oxygen at all stages of your life path. Therefore, regardless of which bank your account will be opened with, even before arriving in the country, study the structure of the work of all banks, applying it to yourself and your plans for life, work, business. Choose the one that suits you more than others, and build your relationship with him on the basis of fruitful cooperation and complete mutual understanding.

Choose the one that suits you more than others, and build your relationship with him on the basis of fruitful cooperation and complete mutual understanding.

Now I would like to touch upon the credit system and the credit policy of Canadian banks. After reading Russian newspapers, you will see a large number of advertisements convincing you that at any time of the day or night they are ready to provide you with a cash loan for any need, without a credit history and even with a damaged credit history, regardless of the length of stay in the country. In short, you only have to wish and any amount is almost in your pocket.

First, what is a cash loan in Canada.

As soon as you receive confirmation from any bank about the readiness to provide you with a loan, you come to the bank's office, sign the necessary documents and, within 3 days, the agreed amount appears on your credit account.

This means that a separate account is opened for you, to which the entire amount of your loan is credited.

Credit in Canada has no term.

You may never take a penny from this amount in your life, and yet it will always be in your account, without obliging you to anything.

You can withdraw all the money in one day and, returning it the next day, you will pay the bank interest for one day of using the money.

You can take them all and never return them, paying only a monthly interest.

There are two types of money loans:

Line of credit

Business credit

In the first case, this is an amount up to 30,000 dollars, issued for personal needs and has no restrictions on use.

In the second case, this is an amount up to 50,000 dollars issued for a newly registered and no history business. It is unlikely that anyone will check the intended use of the loan with the timely payment of interest, but this possibility cannot be ruled out. In the case of verification, you will need to prove that every cent spent was used for the purposes of your business.

These amounts, so to speak, are starting ones, a person who has recently arrived in the country, who does not have a long credit history, an expensive car and a large bank account, can count on them. Accordingly, if you have property, real estate, jewelry, the loan amount that you can get increases proportionally. The scheme for allocating money is as follows:

If you do not have anything on your account or in property, then they will not give you anything.

If you are worth about 30,000 dollars, then they will give you another 20,000 in money

If you started paying your own housing - you can count on 50,000 thousand

If your business, no matter what, even if it is selling ice cream from a cart, has successfully existed for a year, showed a good income, you have paid all taxes and submitted a detailed business to the bank - a plan to expand your business, then the loan amount increases proportionally.

A small business in Canada is defined as an enterprise with three or more employees.

Small business loans allowed up to $1,000,000.

This means that theoretically, if you, your wife and your child bake bread in a small bakery, then you have a chance to get a loan of $1,000,000.

These are extremes, but nothing is impossible.

In fact, the situation with loans is as follows:

Cash loans are given, but very tight. Since, due to the large influx of immigrants and the inadequate value of the dollar in various underdeveloped countries, cases of non-return have become more frequent in recent years.

Let's imagine a situation when a certain citizen from Mozambique was lucky enough to get to Canada, and even with a status. Not being seven spans in his forehead, he realized that he would never learn the language, his profession as a swineherd is unacceptable for Canada, and the maximum that he can count on, after 10 years of living in this country - for a good pension, after another 30 years - a square of land in a cemetery and $7 an hour in hard labor.

The 20,000 dollars that he can borrow from the bank will allow him not only to buy a return ticket to his homeland, but also to buy a big house and 20 hectares of land in his native country.

Of course, this is an exaggerated situation. But on the whole, this is how it works. There are no actual mechanisms guaranteeing the bank to repay the loan. Of course, every loan is insured. It is noteworthy that the same citizen from Mozambique, having failed to dispose of the stolen money in his country, can return back to Canada. On arrival, surrender to the authorities and explain that he wanted, they say, to do business, but he foolishly lost in a casino and there is no more money. Forgive me, unlucky one. Forgive me, but what to do. The insurance company has already covered the damage to the bank. They will record the fool in the credit history, declare him bankrupt, and within 9years, no one will give him anything.

Having understood what you read, you can understand that it is not so easy to get real money in Canada.

Speaking of loans, it should be clarified that these are cash loans: that is, real money gets into your account, which you can dispose of as you please.

Loans are also property and targeted.

Further we will talk about them.

Anything that cannot be taken and taken away from Canada is classified as non-monetary loans. You want to buy a restaurant, for example. They came to the bank and asked for a loan of 500 thousand. Will they? Quite possible. Only not in money to your account, but directly to the account of the seller of this very restaurant. You can enter a restaurant as an owner, you can start working and promote your business, but you will become the owner, owner, of this institution only when you have fully settled with the bank. In the same way, targeted loans for business development are issued. In accordance with the business plan submitted by you to the credit commission, all invoices provided by you will be paid to supplier companies.

If you want to buy equipment and start the production of spare parts for machines - please. Agree on the purchase, conclude an agreement, issue an invoice and bring it to your bank. The bank will pay your bill, but will become the owner of the equipment until your full payment.

Agree on the purchase, conclude an agreement, issue an invoice and bring it to your bank. The bank will pay your bill, but will become the owner of the equipment until your full payment.

This seems to be enough for you to understand how great it is to do business in Canada. The main thing is your head, hands and desire. The state will help you. It's in his best interest. 70 percent of Canada's economy is made up of small and medium businesses. Most of the business started with credit money.

Banks have money, but money should not be kept in safes, it should be profitable. This is the main motto of the Canadian financial system. If your ideas can find application in Canada, you will find an opportunity to finance them.

In conclusion, I would like to return to those advertisements for granting loans that are full of Russian newspapers.

After a thorough examination, it turns out that at the moment, five intermediaries are working in Toronto to help get a loan from a bank. Their service is that they fill out a loan application for you, give it to their familiar manager, member or chairman of the credit commission, and in case of a successful solution to your issue, they receive 10 percent of the loan issued to you from you. If your situation allows you to get a loan, they will give it to you anyway. In a situation of runaway surpluses, bank branches have monthly amounts that must be distributed. Either in the form of loans, or in the form of investments, but this money should start working. Of course, first of all, the money will be given to those people who are represented by intermediaries. Of the 10 percent you paid for services, the lion's share will end up in the manager's pocket. This is not a bribe. This is quite the official payment for financial advice. The manager will pay taxes on this money, and he will sleep peacefully. It is up to you to choose whether or not to use the services of intermediaries.

Their service is that they fill out a loan application for you, give it to their familiar manager, member or chairman of the credit commission, and in case of a successful solution to your issue, they receive 10 percent of the loan issued to you from you. If your situation allows you to get a loan, they will give it to you anyway. In a situation of runaway surpluses, bank branches have monthly amounts that must be distributed. Either in the form of loans, or in the form of investments, but this money should start working. Of course, first of all, the money will be given to those people who are represented by intermediaries. Of the 10 percent you paid for services, the lion's share will end up in the manager's pocket. This is not a bribe. This is quite the official payment for financial advice. The manager will pay taxes on this money, and he will sleep peacefully. It is up to you to choose whether or not to use the services of intermediaries.

But this should be done only in difficult cases. Such as ignorance of the language, a short stay in the country, lack of money in the account, a long stay on welfare.

Such as ignorance of the language, a short stay in the country, lack of money in the account, a long stay on welfare.

In all other situations, you can go to your bank yourself, state your request, and in most cases you will not be refused.

In the case of using an intermediary, it is very important to choose the right one. The selection criteria are the evaluation of the following points: whether the person who advertises the possibility of obtaining a loan really has personal contact with the credit structure of the bank. Is he a financial professional? You can determine his professionalism by the way he fills out a loan application form for you. A knowledgeable mediator will skillfully expose the positive aspects of your story and hide the negative ones. Finding personal contacts is more difficult. Know that if you are denied in one bank, then the refusal will be entered into the computer, and the other bank will think hard before deciding to help you. Therefore, you do not need to immediately fill out the questionnaire. Agree with the mediator that he will receive verbal information. Describe your situation and find out your chances of successfully completing the case. Only in the case of a positive oral decision, fill out the questionnaire.

Agree with the mediator that he will receive verbal information. Describe your situation and find out your chances of successfully completing the case. Only in the case of a positive oral decision, fill out the questionnaire.

Speaking of finances, one cannot fail to mention the tax system. Taxes in Canada are quite high and you have to pay them. Fortunately, there are many ways to get your money out of your tax base. This issue also needs to be dealt with from the very first days of your stay in the country. In a new life, the outlook on finance should be new. From now on, you can not get a salary, put it in your pocket and think only about how to stretch it until the beginning of the next month. When you come to Canada, you must learn how to use your income in the way that is customary in this country.

So that the return from it is maximum, and taxes are minimal. Fortunately, the legislative framework allows you to save and increase your capital.

Let's take a look at how different types of income are taxed.

| Type of income | Up to $29.590 | From $29.590 to $59.180 | Above 59.180$ |

|---|---|---|---|

| Salary and interest | 19% | 45.5% | 52% |

| Capital growth | 10.8% | 34.2% | 39% |

| Dividends | * | 29.3% | 36.5% |

* If you have no other income, you can earn up to $27,500 in dividends and you will not have to pay any taxes.

In addition to income taxes, Canadians must pay all sorts of other taxes. For example:

). All sorts of other taxes, both visible and hidden.

). All sorts of other taxes, both visible and hidden. Canadians now pay more taxes than residents of France, Japan, Germany, Italy and the UK.

Most of the above taxes are included in the prices we pay or are a percentage of the value of something. Therefore, we can only control some of the taxes that we have to pay.

The biggest taxes we have to pay are income tax and wealth tax.

The taxes we pay can go up or down significantly depending on the state of our financial affairs.

What can we do to reduce the amount of taxes we have to pay?

First of all, let's look at the difference between tax write-offs and tax credits.

Tax write-offs reduce taxable income by deducting expenses that are allowed to be used for that purpose.

Tax credits, on the other hand, reduce the taxes we have to pay.

First:

Make the Most of Your Retirement Plan (RRSP) is Canada's most popular form of tax haven.

You can contribute up to 18% of your annual income (but not more than $13,500) per year to your pension plan. Thus, your annual income will decrease by this amount and you will pay less taxes.

In addition, you can use a few more "tricks".

Invest in your retirement plan at the beginning of the year so that any income they bring in is tax-hidden.

Currently, up to 20% of your pension plan can be invested in foreign deposits. Today it is possible to legally have 100% of your plan in all kinds of foreign deposits. Consult with your financial adviser and he will help you with this. This will not reduce your taxes, but it will probably increase your income.

Please note that if your spouse is not the beneficiary of your plan, more than 50% of your savings will be taken by the government if you die. This can be avoided by using insurance. To do this, you will need the help of a specialist in this field.

Second:

Change the type of your income.

1. Earn dividends instead of interest. To do this, you need to invest in securities that bring dividends, not interest. Such contributions would be, for example, contributions to Preferred Shares (Proferred Shags) or Trust Funds that pay dividends.

Dividends are the paid portion of a corporation's income, since the corporation has already paid taxes prior to paying dividends, you will pay less tax on that income.

For those paying taxes on the highest scale, the tax on dividends will be about 37%, while the tax on interest will be 52%. In the case of dividends, you save 15%, which is 15% more in your pocket.

2. Taxes on capital gains are also taxed at a privileged rate.

25% of capital gains are tax free. For example, if you made $1,000.00 by buying something for $9,000.00 and selling it for $10,000.00, you would only pay tax on $750.00 of income. On $1,000 of interest income on the highest scale, you will pay approximately $520 in taxes. For $1,000 in Capital Gains, You Will Pay $39$0 or $130 less.

Third:

You can tax your mortgage payment. It doesn't require complex planning.

"My home is my castle" is an English proverb. In Canada, your home is also one of the last tax havens. Earnings from the sale of your home are not taxed.

If you have a mortgage and other investments, you can sell your investments and pay off your mortgage. You can then borrow money from the bank (at a relatively low interest rate) using your house as collateral and invest that money. You can deduct the interest on this bank loan from your taxes, since you took it for investment. Mortgage is not included in this category. Please note that this must be done in such a way that there are no problems.

Make it so that you can prove that your house was supposed to serve as collateral in a bank (to pay lower interest on a loan). Make other deposits than you had before you paid off your mortgage.

Fourth:

"Children are the flowers of our life. "

"

If you receive a child tax bonus, you can invest this money in the name of your children. In this case, you do not have to pay tax on income from this bonus.

If your children earn money (for example, by working in the summer), then you can lend them money without interest in the amount of their earnings. This will enable your children to invest their earnings. In this case, what they earn by making such an investment will be taxed on their tax scale and not on yours.

Educational Plans (RESPs) allow you to save money to pay for your children's education. Contributions to such plans cannot be deducted from your taxes, but the income from this money will be taxed on your children's tax scale, which is usually much less. You can contribute up to $4,000 per year, up to a maximum of $42,000 (total per child.)

Effective January 1, 1998, the government will pay 20 percent of your first $2,000 in contributions, up to a maximum of $400 per year. This free loan is paid until the child reaches the age of 17.