256 watching

DON'T BUY

specialty stores

Create a FREE account to see the latest opinions & get alerts about when to buy, sell or hold stocks

Unlock opinion & get signals

BUY

specialty stores

BUY

specialty stores

TRADE

specialty stores

DON'T BUY

specialty stores

DON'T BUY

specialty stores

BUY

specialty stores

DON'T BUY

specialty stores

BUY

specialty stores

WEAK BUY

specialty stores

DON'T BUY

specialty stores

DON'T BUY

specialty stores

BUY

specialty stores

HOLD

specialty stores

WAIT

specialty stores

Showing 1 to 15 of 335 entries

Next Page

Ranking : 4 out of 5

Bullish - Buy Signals / Votes : 4

Neutral - Hold Signals / Votes : 0

Bearish - Sell Signals / Votes : 4

Total Signals / Votes : 8

Stockchase rating for Canadian Tire Corporation Ltd. (A) is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

Canadian Tire Corporation Ltd. (A) is a Canadian stock, trading under the symbol CTC.A-T on the Toronto Stock Exchange (CTC.A-CT). It is usually referred to as TSX:CTC.A or CTC.A-T

In the last year, 8 stock analysts published opinions about CTC. A-T. 4 analysts recommended to BUY the stock. 4 analysts recommended to SELL the stock. The latest stock analyst recommendation is . Read the latest stock experts' ratings for Canadian Tire Corporation Ltd. (A).

A-T. 4 analysts recommended to BUY the stock. 4 analysts recommended to SELL the stock. The latest stock analyst recommendation is . Read the latest stock experts' ratings for Canadian Tire Corporation Ltd. (A).

Canadian Tire Corporation Ltd. (A) was recommended as a Top Pick by on . Read the latest stock experts ratings for Canadian Tire Corporation Ltd. (A).

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should buy, sell or hold the stock.

8 stock analysts on Stockchase covered Canadian Tire Corporation Ltd. (A) In the last year. It is a trending stock that is worth watching.

On 2022-12-19, Canadian Tire Corporation Ltd. (A) (CTC.A-T) stock closed at a price of $141.7.

Canadian Tire Corporation, Limited provides a range of retail goods and services in Canada. The company operates through three segments: Retail, CT REIT, and Financial Services. The Retail segment retails general merchandise, apparel, footwear, sporting equipment, gasoline, sporting goods and active wear, and workwear under the Canadian Tire, SportChek, Sports Experts, National Sports, Pro Hockey Life, Atmosphere, Mark's, PartSource, Gas+, and Helly Hansen banners. This segment also participates in loyalty programs, as well as sells its products online. The CT REIT segment operates as a closed-end real estate investment trust that holds a portfolio of properties comprising Canadian Tire stores, Canadian Tire anchored retail developments, mixed-use commercial property, and distribution centers. The Financial Services segment provides financial and other ancillary products and services, including credit cards, in-store financing, insurance products, and retail and broker deposits; and savings accounts and guaranteed investment certificates. The company was founded in 1922 and is headquartered in Toronto, Canada.

This segment also participates in loyalty programs, as well as sells its products online. The CT REIT segment operates as a closed-end real estate investment trust that holds a portfolio of properties comprising Canadian Tire stores, Canadian Tire anchored retail developments, mixed-use commercial property, and distribution centers. The Financial Services segment provides financial and other ancillary products and services, including credit cards, in-store financing, insurance products, and retail and broker deposits; and savings accounts and guaranteed investment certificates. The company was founded in 1922 and is headquartered in Toronto, Canada.

Read More

Receive CTC.A Stock News and Ratings via Email

Sign-up to receive the latest news and ratings for Canadian Tire and its competitors with MarketBeat's FREE daily newsletter.

Email Address

See More Headlines

View Price History Chart DataSkip Price History Chart

30 days | 90 days | 365 days | Advanced Chart

Receive CTC. A Stock News and Ratings via Email

A Stock News and Ratings via Email

Sign-up to receive the latest news and ratings for Canadian Tire and its competitors with MarketBeat's FREE daily newsletter.

Email Address

Get Stock Alerts

56

56 50

50 Dean Charles McCann (Age 60)

Dean Charles McCann (Age 60)View All Competitors

Should I buy or sell Canadian Tire stock right now?

6 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Canadian Tire in the last year. There are currently 6 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" CTC.A shares.

There are currently 6 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" CTC.A shares.

View CTC.A analyst ratings or view top-rated stocks.

What is Canadian Tire's stock price forecast for 2023?

6 Wall Street analysts have issued 12 month price objectives for Canadian Tire's shares. Their CTC.A share price forecasts range from C$160.00 to C$244.00. On average, they predict the company's share price to reach C$195.56 in the next year. This suggests a possible upside of 37.1% from the stock's current price.

View analysts price targets for CTC.A or view top-rated stocks among Wall Street analysts.

How have CTC.A shares performed in 2022?

Canadian Tire's stock was trading at C$181.44 on January 1st, 2022. Since then, CTC.A stock has decreased by 21.4% and is now trading at C$142.61.

View the best growth stocks for 2022 here.

When is Canadian Tire's next earnings date?

The company is scheduled to release its next quarterly earnings announcement on Wednesday, February 15th 2023.

View our CTC.A earnings forecast.

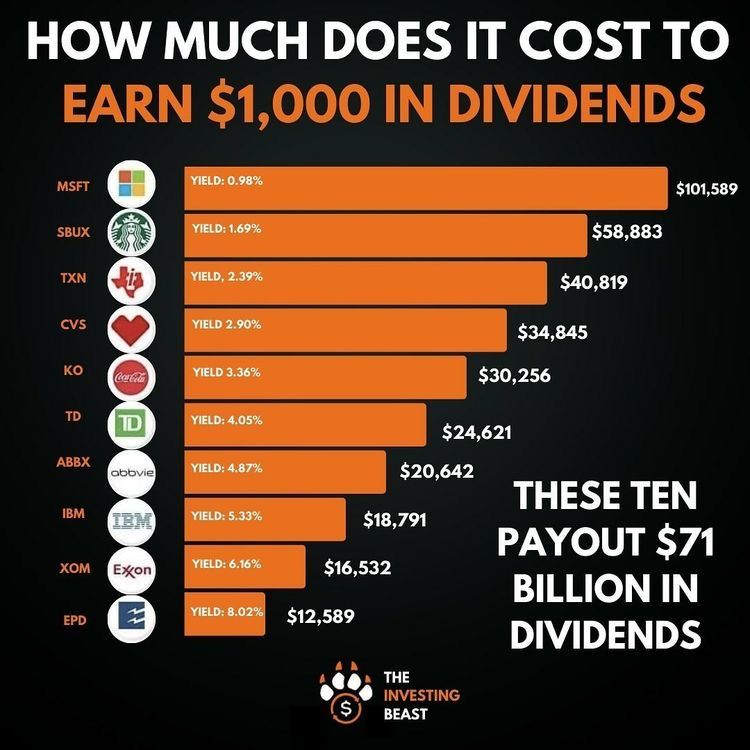

Is Canadian Tire a good dividend stock?

Canadian Tire (TSE:CTC.A) pays an annual dividend of C$5.40 per share and currently has a dividend yield of 4.82%. CTC.A has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. The dividend payout ratio is 31.97%. This payout ratio is at a healthy, sustainable level, below 75%.

Read our dividend analysis for CTC.A.

What is Canadian Tire's stock symbol?

Canadian Tire trades on the Toronto Stock Exchange (TSX) under the ticker symbol "CTC.A."

How do I buy shares of Canadian Tire?

Shares of CTC.A stock and other Canadian stocks can be purchased through an online brokerage account. Popular online brokerages with access to the Canadian stock market include BMO InvestorLine, CIBC Investor's Edge, Desjardins Online Brokerage, HSBC InvestDirect, Laurentian Bank Discount Brokerage, National Bank Direct Brokerage, Qtrade Investor, Questrade, RBC Direct Investing, Scotia iTrade, TD Direct Investing, and Virtual Brokers.

Popular online brokerages with access to the Canadian stock market include BMO InvestorLine, CIBC Investor's Edge, Desjardins Online Brokerage, HSBC InvestDirect, Laurentian Bank Discount Brokerage, National Bank Direct Brokerage, Qtrade Investor, Questrade, RBC Direct Investing, Scotia iTrade, TD Direct Investing, and Virtual Brokers.

Compare Top Brokerages Here.

What is Canadian Tire's stock price today?

One share of CTC.A stock can currently be purchased for approximately C$142.61.

How much money does Canadian Tire make?

Canadian Tire (TSE:CTC.A) has a market capitalization of C$8.35 billion and generates C$17.61 billion in revenue each year.

How many employees does Canadian Tire have?

The company employs 13,735 workers across the globe.

How can I contact Canadian Tire?

Canadian Tire's mailing address is 2180 Yonge Street, Stn K PO Box 770, TORONTO, ON M4P 2V8, Canada. The official website for the company is www.canadiantire.ca. The company can be reached via phone at +1-416-4808725.

The official website for the company is www.canadiantire.ca. The company can be reached via phone at +1-416-4808725.

Nearly 76% of tires in the US have been recycled into products such as rubber-modified asphalt, automotive products, and landscaping. mulching, according to the U.S. Tire Management Association 2019 Report. This is below 96% in 2013.

Approximately 56 million scrap tires remain in US warehouses, especially in states such as Arizona, Colorado, Michigan, New Jersey, New Mexico, Texas, Virginia and Washington. New Jersey, New Mexico, Texas, and Virginia do not have active stockpile cleanup programs. nine0007

In contrast, the Canadian Tire Recycling Association reported a leakage rate of 111% in 2018 and an eight-year average of 104% as the industry operates with available inventory.

Canada 2019 totals are scheduled to be released in the coming weeks.

“Three decades after we successfully eliminated 94% of the more than 1 billion scrap tires stockpiled in the (USA), this report shows that efforts to find and develop new uses for scrap tires have stalled,” said Ann Forristall Luke, President and CEO of the United States Tire Management Association (USTMA). nine0007

Canadian jurisdictions collected 439,509 tons of tires in 2018 and recycled 461,434 tons in total.

“Canada has been approaching 100% for several years now,” says Glenn Maidment, President and CEO of the Canadian Tire and Rubber Association, referring to the country's recycling efforts.

"Every province has an organization that is ultimately responsible for ensuring that their scrap tires are collected and used." nine0007

Canada's primary markets for recycled rubber are sports flooring, molded goods and rubberized asphalt. But most of the crumb rubber he says used for rubberized asphalt is exported to the US.

"If I had one wish, it would be for the Canadian provinces to take a closer look at this, using it as material, because it's really a virtuous circle in terms of creating a circular economy."

Meanwhile, USTMA encourages states to focus tire recycling funds on reuse, recycling and cleaning programs; national portal for interstate data exchange; and increased use of rubber-modified asphalt and stormwater infiltration galleries. nine0007

Massive tire fire in Hagersville, Ontario. 30 years ago there was an increased focus on used tires in Canada.

“Millions of tires burned out within 17 days, evacuating nearby residents and polluting the environment,” writes CATA Chairman Brett Eckstein in the organization's 2019 annual report.

"With numerous large stocks of end-of-life tires across the country, provincial governments have recognized the growing public demand for a more sustainable use of tires in the environment. " nine0007

" nine0007

Original URL: https://www.trucknews.com/transportation/canadian-tire-recycling-programs-outpace-u-s/1003145568/

Industry

00:00, 08/10/2020

The supply of products in the world may fall by 45-50 million units this year

The global economy has suffered significant damage due to the coronavirus pandemic. Many industries have been affected, including the tire industry. More than 120 tire factories around the world have suspended production: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. This year, the supply of tires in the world will fall by 45-50 million units, Nizhnekamskneftekhim, a leading synthetic rubber producer and supplier of tire manufacturers, has calculated. Such a serious reduction in the production of tires will lead to a decrease in demand for rubber, as we wrote about in our review of this market. To support domestic producers of synthetic rubbers, Deputy Prime Minister of Russia Yuri Borisov has already instructed to work out the possibility of purchasing SK from the Federal Reserve. Read more about the situation in the tire industry and the consequences for related industries in the material of Realnoe Vremya. nine0007

To support domestic producers of synthetic rubbers, Deputy Prime Minister of Russia Yuri Borisov has already instructed to work out the possibility of purchasing SK from the Federal Reserve. Read more about the situation in the tire industry and the consequences for related industries in the material of Realnoe Vremya. nine0007

In the first half of 2020, 24.4 million tires were produced in Russia, which is 16.5% less than a year earlier. The largest decline in production occurred in April-May due to restrictions on the coronavirus.

In May, the entire automotive industry showed the maximum decline in industrial production in the country, Rosstat reported. The output of vehicles, trailers and semi-trailers fell by 42.2% by May 2020. The ministry cited the suspension of operations at the peak of the epidemic, the lack of imported components and reduced demand as reasons for the ministry. nine0071

nine0071

— Restrictions on the work of enterprises and organizations in a number of industries and segments of the economy, as well as other measures introduced to prevent the spread of coronavirus infection, continued to affect economic activity in the country, the Federal State Statistics Service explained.

According to the Ministry of Industry and Trade of the Russian Federation, car production in 2020 may decrease by 30%. The decline in the automotive industry led to a decrease in production in the tire industry, which is inextricably linked with the automotive industry. Like other enterprises, tire factories suspended work at the peak of the pandemic, which significantly reduced production volumes. In January - May 2020, according to official statistics, 19.9 million tires, or 18% less than the same period last year. In May alone, tire production in the country was 40% lower than in May 2019.

In May, tire production in the country was 40% lower than in May 2019. Photo: portalvoronezh.ru

Photo: portalvoronezh.ru The Association of Tire Manufacturers noted that the pandemic hit Russian tire manufacturers during the period of active sales - the “summer” season, when tires are replaced with summer ones. As a result, the season is actually lost, the organizations of the wholesale and retail network did not create a financial "cushion" for the off-season. Most likely, in the "winter" season of tire sales, market participants will face a decrease in the purchasing power of consumers. A second wave of the epidemic is not ruled out. “Now it is difficult to make any forecasts, but, according to our preliminary estimates, the fall of the tire market by the end of the year may be at least 24%,” Nadezhda Churmeyeva, executive director of the Tire Manufacturers Association, told Realnoe Vremya. nine0007

The decline in tire production in Russia began in 2019 after a five-year growth in the industry. In 2014, domestic tire manufacturers produced 52.4 million tires, in 2015 - 57. 6 million, in 2016 - 60.1 million, in 2017 - 65.1 million, in 2018 - 67, 5 million. But already in 2019, tire production decreased by 10%, to 60.5 million units. (the world produces more than 1 billion tires per year). At the same time, the share of imports, according to the Federal Customs Service, on the contrary, increased by 7.5%, to 34.4 million units, or $2 billion in monetary terms. This is not counting those tires that were brought to our country with new cars, trailers, bicycles and any other mechanisms on wheels, which also include spare ones. The share of imports of passenger cars in Russia, according to the Federal Customs Service, also increased by 3.2% last year, to 302.5 thousand, the share of imports of trucks increased by 13.7%, to 29

6 million, in 2016 - 60.1 million, in 2017 - 65.1 million, in 2018 - 67, 5 million. But already in 2019, tire production decreased by 10%, to 60.5 million units. (the world produces more than 1 billion tires per year). At the same time, the share of imports, according to the Federal Customs Service, on the contrary, increased by 7.5%, to 34.4 million units, or $2 billion in monetary terms. This is not counting those tires that were brought to our country with new cars, trailers, bicycles and any other mechanisms on wheels, which also include spare ones. The share of imports of passenger cars in Russia, according to the Federal Customs Service, also increased by 3.2% last year, to 302.5 thousand, the share of imports of trucks increased by 13.7%, to 29

An additional 1.66 million tires were imported into our country (4 wheels on the car + 1 spare): passenger cars - 1.51 million, trucks - 149.5 thousand.

about 40% is occupied by domestic companies, the rest of the factories produce products under foreign brands. Among the leading enterprises with production facilities in our country are the Finnish concern Nokian Tires (Vsevolozhsk, 17 million tires), PJSC Nizhnekamskshina (Nizhnekamsk, 10 million tires), the Italian holding Pirelli - plants in Kirov (6 million tires) and Voronezh (JV with GC Rostec, 4 million tires), German concern Continental (Kaluga, 4 million tires), Russian holding Cordiant (plants in Yaroslavl (3 million tires) and Omsk (1 million tires)), French Michelin holding (settlement Davydovo, Moscow Region) , 2 million tires), the Japanese concern Yokohama (Gryazinsky district of the Lipetsk region, 1.6 million tires), another Japanese company Bridgestone (Ulyanovsk, 1 million tires) and others. American Goodyear products are also widely represented in Russia, although the company does not have production sites here - only a representative office and a warehouse in Moscow, and tires for the Russian market are produced in Poland and Slovakia. nine0007 In the Russian tire market, about 40% share is occupied by domestic companies, the rest of the plants produce products under foreign brands.

Photo: radius-tires.ru

Photo: radius-tires.ru

Tire manufacturers working in Russia have gradually returned to work after the temporary closure of factories. However, the fall in demand for tires, the overstocking of distributors and retailers had an impact on production plans.

In March, the Voronezh Tire Plant, a joint venture between Pirelli and Rostec, suspended production until the end of the month. Closed borders and downtime of European automakers at the peak of the epidemic forced Voronezh tire manufacturers to adjust their production program. In the same period, Pirelli suspended the work of the tire plant in Kirov, but has already restarted production. Other enterprises also took a forced production pause:

- Our plant was closed, but resumed work on April 13, because, according to the decree of the government of the Kaluga region No. 271 of April 6, 2020, Presidential Decree No. 239 of April 2, 2020 does not apply to Continental Kaluga LLC, - said Realnoe Vremya, company communications manager Anna Dundukina.

- The plant in Ulyanovsk of Bridgestone Thayer Manufacturing CIS LLC resumed production on June 17, 2020. Production was temporarily suspended from May 14 to June 17, 2020 due to the need to optimize the balance of supply and demand. At the same time, the majority of office workers at the plant in Ulyanovsk and all employees of the Moscow office continue to work remotely in order to ensure their safety and minimize health risks. We are closely monitoring the situation and taking the necessary steps as it develops. Bridgestone makes every effort to ensure that there are sufficient stocks of products in stock to meet customer requirements. Shipments across Russia, the CIS, as well as to Europe are made in accordance with the adjusted plans,” said Ludmila Kharcheva, PR manager at Bridgestone Thayer Manufacturing CIS LLC. nine0007 In March, a joint venture between Pirelli and Rostec, the Voronezh Tire Plant, suspended production until the end of the month. Photo: gorcom36.ru

According to the interlocutor of the publication, the company continues to "thoroughly analyze the market on a daily basis. " Where necessary, additional measures are taken to optimize inventory and operations to ensure the highest possible availability of products.

" Where necessary, additional measures are taken to optimize inventory and operations to ensure the highest possible availability of products.

— According to the data we have, the domestic tire market shrank by 7% over 4 months of this year, including the car tire market sank by 15% at once. It is not surprising. During the period of self-isolation, the use of personal vehicles has decreased. Incomes of the population also decreased, and with them, demand. Tire production fell by 12% in the country. Again, a decline was registered in the largest segment of tires for passenger cars - by 19%. The remaining segments showed growth: the production of tires for light trucks increased by 26%, truck tires - by 17%, agricultural tires - by 9%, industrial tires - by 39%, - outlined the situation, the head of the sales monitoring and analysis department of the Sales Department of Nizhnekamskneftekhim PJSC Ildar Martyshev.

FINAM Group analyst Alexey Kalachev believes that the tire industry can be attributed to the number of victims of the coronavirus pandemic. Demand for tires depends on sales of new cars, which fell by 70-80% in different countries in some months, depending on the restrictions imposed. The expert noted that Russia was no exception, where in April they recorded a record drop in sales of new cars and commercial vehicles - by 72.4%. nine0007

Demand for tires depends on sales of new cars, which fell by 70-80% in different countries in some months, depending on the restrictions imposed. The expert noted that Russia was no exception, where in April they recorded a record drop in sales of new cars and commercial vehicles - by 72.4%. nine0007

— On a comparable scale, by 79.2% in annual terms, the production of passenger cars in the Russian Federation decreased in April. With the fall in production, naturally, the demand for tires also decreased. But to an even greater extent, the tire market depends on the size of the fleet and the intensity of car traffic. After all, tires need to be replaced with new ones from time to time, which creates the bulk of the demand. Moreover, the decline in sales of new cars is mainly pent-up demand. But, being in the mode of self-isolation and digital passes, people traveled much less, traffic decreased, tire wear does not occur during the downtime of cars, this is not deferred, but lost demand,” Alexey Kalachev emphasized. nine0007 In April, Russia recorded a record drop in sales of new cars and commercial vehicles - by 72.4%. Photo 32cars.ru

nine0007 In April, Russia recorded a record drop in sales of new cars and commercial vehicles - by 72.4%. Photo 32cars.ru

Trade enterprises also suffered as a result of the downtime of tire workers. Experts believe that the tire sales market is waiting for the enlargement of players.

– It is clear that the use of cars and their mileage has decreased around the world during the self-isolation regime. The tires didn't wear out. Accordingly, no one was in a hurry to change them. And if everything is rather complicated with the primary market, then the recovery of the secondary market should take place. It is even possible that the effect of pent-up demand will lead to a surge in demand in the retail market. The problem is that tire dealers abroad have accumulated a large amount of unsold tires. And until they sell these excess stocks, we cannot expect a recovery in demand for new tires,” said Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC. nine0007

nine0007

— The biggest concern now is the financial stability of the tire distribution network, primarily retailers. It is highly likely that not everyone will be able to survive this economic crisis,” said Nadezhda Churmeeva, executive director of the Tire Manufacturers Association.

An aggravating factor, according to her, may be the introduction of mandatory marking of tires with identification means planned for this year. However, the Ministry of Economy of the Russian Federation stated that they were ready to discuss with tire manufacturers the issue of postponing this requirement to a later date. nine0007

In the first quarter of 2020, with the onset of the coronavirus pandemic, almost all the leading tire companies in the world reduced their revenue. Some manufacturers have lost money.

Sales of the American Cooper fell by 14.1% to $532 million, a net loss of $12 million. For comparison, in January-March 2019, the company exited with a net profit of $7 million. At the peak of the epidemic, Cooper stopped production at factories in USA, China, Serbia, Britain and Mexico. The company's management believes that they will be able to fully assess the consequences following the results of the second quarter, which has become the most difficult. nine0007

At the peak of the epidemic, Cooper stopped production at factories in USA, China, Serbia, Britain and Mexico. The company's management believes that they will be able to fully assess the consequences following the results of the second quarter, which has become the most difficult. nine0007

Goodyear suffered the biggest loss with a net loss of $619 million in the first three months of 2020. Sales were down 18% to 31.3 million tires. In the original equipment segment, sales fell by 21%, in the replacement market - by 16%. The company is cutting operating and capital costs, marketing and advertising expenses, and has closed its oldest tire plant in Gadsden, Alabama (USA).

Goodyear hit hard with net loss of $619 in the first three months of 2020Photo: news.drom.ru Another tire company in the United States, Titan International, showed a loss of $25.5 million in the first three months of 2020. Sales of the manufacturer fell by $68. 9 million to $341.5 mln. According to the association's forecast, in the original equipment segment, the supply of passenger tires will decrease by 24.3%, to 35 million units; light trucks - by 18.4%, up to 4.8 million units; freight — by 30.7%, up to 4.5 million units. In the replacement market, the supply of passenger tires will fall by 17.2% to 184.4 million units; light trucks - by 16%, to 27.3 million units; freight — by 7.3%, up to 17.6 million units. nine0007

9 million to $341.5 mln. According to the association's forecast, in the original equipment segment, the supply of passenger tires will decrease by 24.3%, to 35 million units; light trucks - by 18.4%, up to 4.8 million units; freight — by 30.7%, up to 4.5 million units. In the replacement market, the supply of passenger tires will fall by 17.2% to 184.4 million units; light trucks - by 16%, to 27.3 million units; freight — by 7.3%, up to 17.6 million units. nine0007

Chinese tire company Do ublestar posted a loss of $8.2 million in the first quarter of 2020, compared with a profit of $2.1 million a year earlier. Revenue fell 28% to $112 million. Overall situation The Chinese tire market has been tense. The export of tires from the Middle Kingdom decreased by 11.3%, to 102 million units. for January-March (data from the General Administration of Customs of the People's Republic of China). In monetary terms, exports fell by 13.2%, to $3 billion

The Italian Pirelli . The company's sales in the first quarter, compared to the same period last year, fell by 20% and amounted to just over 1 billion. Net profit fell to 38.5 million (101.4 million a year earlier). Sales of Pirelli tires declined both in the secondary car tire market (-19.3%) due to limited mobility of the population in different countries, and in the original equipment sector (-22.7%) as a result of a decline in car production. The company expects a new deterioration in performance in the current quarter, as demand in the global tire market is forecast to decline by 40%. nine0007

The company's sales in the first quarter, compared to the same period last year, fell by 20% and amounted to just over 1 billion. Net profit fell to 38.5 million (101.4 million a year earlier). Sales of Pirelli tires declined both in the secondary car tire market (-19.3%) due to limited mobility of the population in different countries, and in the original equipment sector (-22.7%) as a result of a decline in car production. The company expects a new deterioration in performance in the current quarter, as demand in the global tire market is forecast to decline by 40%. nine0007

The German Continental also recorded a deterioration in financial performance. First-quarter sales fell 10.9% to 9.8 billion, adjusted EBIT from 884 million to 432 million, and the margin on this indicator - from 8.1 to 4.4%. In mid-March, the company was shutting down more than 40% of its 249 locations around the world. “This situation was new for all players in the industry,” said Continental CEO Elmar Degenhart.

Yokohama Rubber , another Japanese manufacturer of tires, also lowered its figures. The company's operating profit in the first quarter fell 90.4% to 1.2 billion yen (10.2 million). Sales decreased by 13.6% to 129.1 billion yen. Losses amounted to 258 million yen, while a year earlier the corporation closed the period with a profit of 9.1 billion yen.

Adjusted operating profit of Nokian in January-March fell by 71%, to 16.3 million, sales - by 17.8%, to 279.8. In Russia and Asia, sales of tires by the Finnish concern decreased by 39. 1%, to 56.5 million. The market of tires for passenger cars and SUVs sank most noticeably - by 24.7%, while 85% of tires in this category were produced in Russia. The reasons for the decline are measures to reduce high stock balances in distributors' warehouses in Russia, a slowdown in economic activity amid COVID-19, and a mild winter.

1%, to 56.5 million. The market of tires for passenger cars and SUVs sank most noticeably - by 24.7%, while 85% of tires in this category were produced in Russia. The reasons for the decline are measures to reduce high stock balances in distributors' warehouses in Russia, a slowdown in economic activity amid COVID-19, and a mild winter.

As with all tire manufacturers, Hankook 's financials have fallen sharply due to falling demand during the pandemic, a downturn in the global economy, a decrease in consumer activity and a halt in production at the company's factories. First-quarter revenue fell 20% to $1.202 billion, while operating income fell 29%.%, to $88.6 million.

Tire manufacturers expect even bigger losses in the second quarter of 2020. Goodyear has estimated that tire sales in April-June will fall by about 50% compared to the same period last year, to 25 million units. Similar forecasts are given by Continental A.G. and Pirelli & Co. S.p.A., which said that the supply of consumer-grade tires in Europe and America in the second quarter could fall by 30-40%.

- In our opinion, the world has not faced such threats in recent years. If, for example, to compare with the crisis of 2008-2009year, that crisis was financial. It could be "put out" by the money supply, which was done. But this time we are dealing with a crisis that has affected the real sector of the economy throughout the world. Governments of different countries are trying to follow the same path as before, guided by the well-known saying "If a problem can be solved with money, then this is not a problem." But the injection of money into the economy will serve only as a temporary calm in the securities markets. It won't help much in the current situation. It takes time for the unbalanced market mechanism to return to its previous mode of operation,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC. nine0007

After weeks of downtime, maybe even a month, tire manufacturers have started to get back to work. Not yet in all factories and with limited downloads. Tire enterprises in China were the first to start working, where they had already survived the pandemic. In late April - early May, tire manufacturers in America and Europe are gradually restarting production.

Not yet in all factories and with limited downloads. Tire enterprises in China were the first to start working, where they had already survived the pandemic. In late April - early May, tire manufacturers in America and Europe are gradually restarting production.

In May, Cooper opened factories in the US and Serbia, where they were idle for five weeks. Later, in mid-June, the company's industrial complexes in Britain and Mexico resumed work. nine0007 Tire enterprises in China were the first to start working, where they had already survived the pandemic. Photo: news.drom.ru

Continental Tire launched a tire plant in Mount Vernon, Illinois (USA) at the beginning of May, and other sites of the manufacturer later started operating. Pirelli was the first to restart a passenger tire plant in the state of Georgia (USA), as well as in Settimo Torinese and Bollate (Italy), then opened the company's industrial sites in the UK.

Kumho in America opened a consumer grade tire manufacturing plant. Bridgestone Americas has resumed production at two truck tire plants in Tennessee, with the remainder of its North American operations open before the end of the month. nine0007

Bridgestone Americas has resumed production at two truck tire plants in Tennessee, with the remainder of its North American operations open before the end of the month. nine0007

From the end of April, Yokohama opened a truck tire plant in West Point, Mississippi, USA, and later launched the company's car tire plant in Salem, Virginia, USA. A month after production shutdowns in Hungary and India, Apollo Vredestein began producing tires in limited quantities. Another site in the Netherlands has been producing agricultural tires all this time.

In early May, the Finnish Nokian, after a month of inactivity, launched production at its plant in Dayton (Tennessee, USA). The plant has been closed since March 27. At the end of April, Hankook opened a plant in Tennessee (USA) after a three-week shutdown. All this time the American warehouses of the company continued to work. After a month of downtime, the Giti plant in South Carolina (USA) resumed operation. nine0007

By the end of May Japan's Bridgestone had opened tire plants in America, Canada, Brazil, Costa Rica, Mexico and Argentina. Michelin opened factories in Mexico, Canada and the USA during May-June.

Michelin opened factories in Mexico, Canada and the USA during May-June.

- It is too early to say that production is resumed. If five plants out of 30 are launched, and they work at 20% of their capacity, this gives almost nothing. Of course, NKNK is closely monitoring the situation and is in constant contact with its customers. However, today even they have no certainty about how much raw material they will need in the next month or quarter. Their planning is now going literally by the day. Therefore, the resumption of supplies in one day will not happen. This process will stretch for a period during which their own sales markets will be restored, - said Ildar Martyshev. nine0007 By the end of May, Japan's Bridgestone has opened tire plants in America, Canada, Brazil, Costa Rica, Mexico and Argentina. Photo: 4tochki.ru

According to him, most factories abroad have not yet resumed production. The exception is Chinese manufacturers, but they have problems with demand. The Chinese tire industry is focused on large volumes of exports, and the share of exports to China has declined. Chinese tire manufacturers have been almost completely cut off from the United States - a major market for Chinese tire manufacturers. Factories that have resumed production operate at very low loads (20-30%). It is possible that due to the second wave of COVID-19There will be new stops.

Chinese tire manufacturers have been almost completely cut off from the United States - a major market for Chinese tire manufacturers. Factories that have resumed production operate at very low loads (20-30%). It is possible that due to the second wave of COVID-19There will be new stops.

As a result of the decline in demand for tires, related industries also suffered. For example, manufacturers of synthetic rubber, for which tire companies are the main consumers, were forced to reduce the load and shift the timing of overhauls.

Tire supplier, leading rubber producer Nizhnekamskneftekhim, in its report for the first quarter of 2020 (the company has not yet published a report for the second quarter), described the situation in the real sector of the global economy as extremely uncertain. Supply chains have been disrupted, with many automotive and tire companies temporarily shutting down production around the world due to falling demand. The manufacturer indicated that in the period from the second half of March until the first week of May 2020, more than 120 tire factories of different companies were idle: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. In April, the Indian authorities introduced a 21-day lockdown, which also affected local tire manufacturers. nine0007

The manufacturer indicated that in the period from the second half of March until the first week of May 2020, more than 120 tire factories of different companies were idle: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. In April, the Indian authorities introduced a 21-day lockdown, which also affected local tire manufacturers. nine0007

- As a result of the above, demand for synthetic rubber has been hit hard. According to our estimates, only taking into account the announced shutdowns of tire factories, the supply of tire products in the world will fall by 45-50 million units this year. This will lead to a reduction in global demand for synthetic rubber in 2020 - at least 2%. While the situation is devoid of any certainty, but, presumably, the largest decline in SK sales will be in the second quarter of 2020 - this is the period that accounts for the largest number of production shutdowns in the global tire and automotive industries, the NKNKH report says. nine0007

nine0007

Despite the deteriorating market conditions, the world's major tire manufacturers have maintained agreements on the purchase of rubber. As Realnoe Vremya already reported in another analytical review, thanks to the high quality of its products, Nizhnekamskneftekhim managed to extend annual contracts with major consumers.

The company has taken all possible measures to adapt to the new conditions. In particular, it moved to an earlier period the overhaul of synthetic rubber plants in order to reduce the supply of the UK as much as possible during a period of low demand. nine0007 Nizhnekamskneftekhim took all possible measures to adapt to new conditions. Photo: Nizhnekamskneftekhim PJSC

The consequences of the reduction in tire output for rubber producers and related industries will be quite serious, experts warn. Nizhnekamskneftekhim is currently assessing the decline in the global synthetic rubber market at a level of at least 2-2. 5%, or approximately 300-400 thousand tons of rubber. At the same time, NKNKH emphasized that the situation will affect not only the producers of synthetic rubber - a serious decline awaits manufacturers of carbon black, artificial fibers, and chemical additives used in tires. In addition, there is a distinct decline in the global natural rubber (NR) market, where prices have fallen to $1,000-1,100 per ton. nine0007

5%, or approximately 300-400 thousand tons of rubber. At the same time, NKNKH emphasized that the situation will affect not only the producers of synthetic rubber - a serious decline awaits manufacturers of carbon black, artificial fibers, and chemical additives used in tires. In addition, there is a distinct decline in the global natural rubber (NR) market, where prices have fallen to $1,000-1,100 per ton. nine0007

Tatarstan President Rustam Minnikhanov voiced a common problem for the Russian petrochemical industry related to the export of products to Russian President Vladimir Putin. According to him, it is necessary to create equal competitive conditions for producers of rubbers and plastics with foreign companies importing their products to Russia.

— Our oil refining and petrochemistry are working, but it is difficult to promote our products for export, because our market is open, and, unfortunately, Western partners are introducing duties and restrictive measures. We are appealing to the Russian government to provide us with some kind of support measures,” the president of Tatarstan called the urgent problem for the industry. nine0007

nine0007

Under the current conditions, Russian polymer producers have to pay twice: taxes in Russia and import customs duties in the country of export. Foreign competitors, on the other hand, enjoy the benefits and support of the state in their homeland, and enter the Russian market without hindrance, which is why they lose the budget of the Russian Federation. After listening to Rustam Minnikhanov, Vladimir Putin made a note for himself and asked to report on the situation in more detail in order to study the issue for taking measures at the government level.

Vladimir Putin asked to report on the situation in more detail in order to study the issue for taking measures at the government level. Photo: kremlin.ru In early June, Deputy Prime Minister of Russia Yury Borisov proposed another measure to support petrochemical enterprises. According to him, it is necessary to develop an effective mechanism for updating the products of the Federal Reserve, since during the crisis it turned out to be ineffective - there was no necessary nomenclature in it. According to Borisov, Rosrezerv can be used as a damping mechanism in a crisis situation, temporarily buying out their products from companies when demand for them decreases. As an example, he cited the offer of petrochemists to the authorities to buy synthetic rubber from them for the production of tires for 2 years, the demand for which has now fallen. After two years, companies are ready to buy back their products for 5-6% more. nine0007

According to Borisov, Rosrezerv can be used as a damping mechanism in a crisis situation, temporarily buying out their products from companies when demand for them decreases. As an example, he cited the offer of petrochemists to the authorities to buy synthetic rubber from them for the production of tires for 2 years, the demand for which has now fallen. After two years, companies are ready to buy back their products for 5-6% more. nine0007

- Our petrochemists supply about 80% of synthetic rubber for Western tire manufacturers. And there today the demand has fallen, this raw material is strategic, and we have it in the nomenclature of the Federal Reserve, - Yuri Borisov reported to the President of Russia about the problems of producers in the absence of demand.

— This is undoubtedly a good initiative that can really help SC manufacturers. Moreover, the products purchased by Rosrezerv as part of its activities must be updated in a timely manner. This is, as they say, a "win-win situation". If this initiative is implemented, it will be an effective example of assistance from the state,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC. nine0007

If this initiative is implemented, it will be an effective example of assistance from the state,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC. nine0007

The Deputy Prime Minister of the Russian Federation instructed to think over the purchase of synthetic rubber in the Federal Reserve. The Ministry of Energy supported the idea and promised to work out the mechanism.

But Russian manufacturers need comprehensive support. In the face of fierce competition, our auto industry buys tires from foreign manufacturers, and not from domestic companies. Government measures to encourage automakers to buy their own tire products would help turn the tide. This applies not only to the production of cars, but also trailers, bicycles and any other equipment on wheels. If auto and other manufacturers buy Russian tires, and tire manufacturers, in turn, buy domestic synthetic rubber, the industry may be able to recover faster, market participants believe. nine0071

nine0071

Nadezhda Churmeeva Executive Director of the Tire Manufacturers Association

Due to the novel coronavirus pandemic, the Russian tire market is facing a very difficult economic situation. Tires were not included in the federally recommended list of essential goods that are allowed to be traded even during the period of established restrictions. This significantly complicates operations for the entire tire distribution chain, from manufacturers and importers to retailers. These difficulties persist in regions where the self-isolation regime has not yet been lifted and where tires have not been classified as essential goods by decision of the regional authorities. However, even in regions where there are no legal barriers, consumers often simply do not buy tires due to lower incomes. nine0007

However, even in regions where there are no legal barriers, consumers often simply do not buy tires due to lower incomes. nine0007

Alexey Kalachev analyst at FINAM Group

The tire industry is one of the hardest hit by the coronavirus pandemic. As the sanitary restrictions are lifted, the demand for tires will begin to recover, and production will catch up with it. So far, the forecast looks optimal that the recovery of the markets will begin in the second half of the year. If the world is not covered by the second wave of the pandemic in the fall, which, unfortunately, cannot be completely ruled out, then production will return to rhythmic work by the middle of next year. nine0007

nine0007

Ildar Martyshev Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC

WLTP is a new research methodology for determining fuel consumption indicators. Since September 2018, it has become mandatory for all new registered cars in Europe. This technique makes it possible to more accurately determine the amount of fuel consumption and harmful emissions of light vehicles. The introduction of the new procedure caused a decline in the passenger car market in Western Europe. Buyers refrained from buying new cars because they weren't sure if their car would meet the new standards or be taken off the assembly line altogether. nine0007

WLTP is a new research methodology for determining fuel consumption indicators. Since September 2018, it has become mandatory for all new registered cars in Europe. This technique makes it possible to more accurately determine the amount of fuel consumption and harmful emissions of light vehicles. The introduction of the new procedure caused a decline in the passenger car market in Western Europe. Buyers refrained from buying new cars because they weren't sure if their car would meet the new standards or be taken off the assembly line altogether. nine0007 There is no other way out for tire manufacturers. They will be helped, on the one hand, by the restoration of car production. This is the so-called primary tire market (complete). On the other hand, retail sales should recover. That is, the population should again begin to change the tires on their cars.

This year we will definitely see a downturn in the global tire and rubber market. One can only argue about the depth of the recession. Now you can hear how some market participants say that it will take up to 3-4 years to fully restore the broken supply chains. Perhaps this is so. We can only hope that this will happen a little sooner. nine0007

Now you can hear how some market participants say that it will take up to 3-4 years to fully restore the broken supply chains. Perhaps this is so. We can only hope that this will happen a little sooner. nine0007

Ekaterina Faizulina B2C Marketing Director, Michelin Eastern Europe

Health, concern for the financial condition are now the main priorities for every person in every country. For the tire industry, an additional challenge is a decrease in demand for the purchase of new cars, a temporary restriction of the mobility of the population, which directly affects the frequency of use and the need for tires. However, the potential for fleet development and demand recovery remains. nine0007

Health, concern for the financial condition are now the main priorities for every person in every country. For the tire industry, an additional challenge is a decrease in demand for the purchase of new cars, a temporary restriction of the mobility of the population, which directly affects the frequency of use and the need for tires. However, the potential for fleet development and demand recovery remains. nine0007 The temporary shutdown of production that occurred in many industries in April is a necessary measure, dictated by security considerations, as well as the need for businesses to adapt to changing conditions. At the moment, optimization may force some enterprises to continue reducing production in order to avoid the risks of overproduction, provided that consumer demand continues to decline.

As for the tire industry, in general, despite the decline in production, Michelin does not predict a shortage of tires, since the market was initially provided with a certain level of inventory, which will allow to respond to the resumption of consumer activity. nine0007

nine0007

At the moment, the Russian Michelin plant, located in Davydovo, Moscow Region, operates in a standard mode in compliance with all sanitary standards and safety measures.

If we talk about the restoration of demand to the initial level, the situation will directly depend on the development of the epidemiological situation in our region and possible restrictions that may further affect both purchasing power and the decrease in mobility and restrictions on the use of transport and movement. However, it is worth noting that even with the tight restrictions, a certain significant part of the car fleet continues to be active, which will support demand in some categories of tires. nine0007

The current situation, of course, has its impact on consumer behavior not only now, but also after the end of the acute period - it is expected that concern for their health and increased attention to sanitary standards may encourage some consumers to prefer the use of personal transport instead of public transport in the future , which could potentially accelerate the recovery of the industry.

Despite a general decline in consumer confidence, in the current environment, the majority of consumers do not change their intention to buy tires. In addition, a significant proportion retains brand preferences and even in these difficult conditions remains true to their choice. Knowing your customer and his expectations is key, which will allow you to match his preferences as much as possible. nine0007

Now more than ever, in the search for the best offer, the quality of the product comes to the fore. Great tires that can provide safety and confidence in all conditions throughout their entire life cycle are not only a consumer investment in terms of longer use, but also confidence in their safety and care for loved ones.

As early as May, there is a resumption of consumer activity and a return of demand for summer tires in all regions. Undoubtedly, this is more a result of the resumption of mobility as a shift in demand since April. The overall market will be affected by a decrease in purchasing power both at the end of the summer season and in the coming winter season as a result of a negative forecast for car sales in 2020.