Search

Three-quarters of Americans agree that the country is facing a retirement crisis, making research around the topic more relevant than ever. We dug into the data on every angle of retirement and compiled the most important statistics below. Read on to learn about what today’s retirees face, from financial challenges to lifestyle decisions and more.

Key Takeaways:

Advertisement

Expand

| Country | Average Retirement Age | Official Retirement Age |

|---|---|---|

| United States | 66. 85 85 | 67 |

| United Kingdom | 64.5 | 65 |

| Canada | 64.75 | 65 |

| France | 60.55 | 62 |

| Greece | 60.7 | 67 |

| Italy | 61.7 | 66.58 (men)/65.58 (women) |

| Netherlands | 63.25 | 66 |

| China | 64 | 60 (men)/50 (women) |

| Israel | 67.8 | 67 (men)/62 (women) |

| New Zealand | 68.4 | 65 |

| Mexico | 69 | 65 |

| Japan | 69.95 | 62 |

Source: OECD

8 percent). Seventeen percent of Hispanic seniors and 9.3 percent of Asian seniors live below the poverty line.

8 percent). Seventeen percent of Hispanic seniors and 9.3 percent of Asian seniors live below the poverty line.Expand

Expand

Expand

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: July 22, 2022

Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

gov/sites/default/files/Aging%20and%20Disability%20in%20America/2020ProfileOlderAmericans.Final_.pdf

gov/sites/default/files/Aging%20and%20Disability%20in%20America/2020ProfileOlderAmericans.Final_.pdf S. Households (SHED). Retrieved from https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

S. Households (SHED). Retrieved from https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm fidelity.com/bin-public/06_PSW_Website/documents/Building_Financial_Futures.pdf

fidelity.com/bin-public/06_PSW_Website/documents/Building_Financial_Futures.pdf aspx

aspx Statista. Retrieved from https://www.statista.com/statistics/194295/number-of-us-retired-workers-who-receive-social-security/

Statista. Retrieved from https://www.statista.com/statistics/194295/number-of-us-retired-workers-who-receive-social-security/ pdf

pdfOn This Page

Who Am I Calling?

Calling this number connects you to Senior Market Sales (SMS), a trusted partner of Annuity. org.

org.

If you're interested in buying an annuity, a representative will provide you with a free, no-obligation quote.

SMS is committed to excellent customer service. The company can help you find the right insurance agent for your unique financial objectives.

877-918-7024

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you are interested in learning more about buying or selling annuities, call us at 877-918-7024

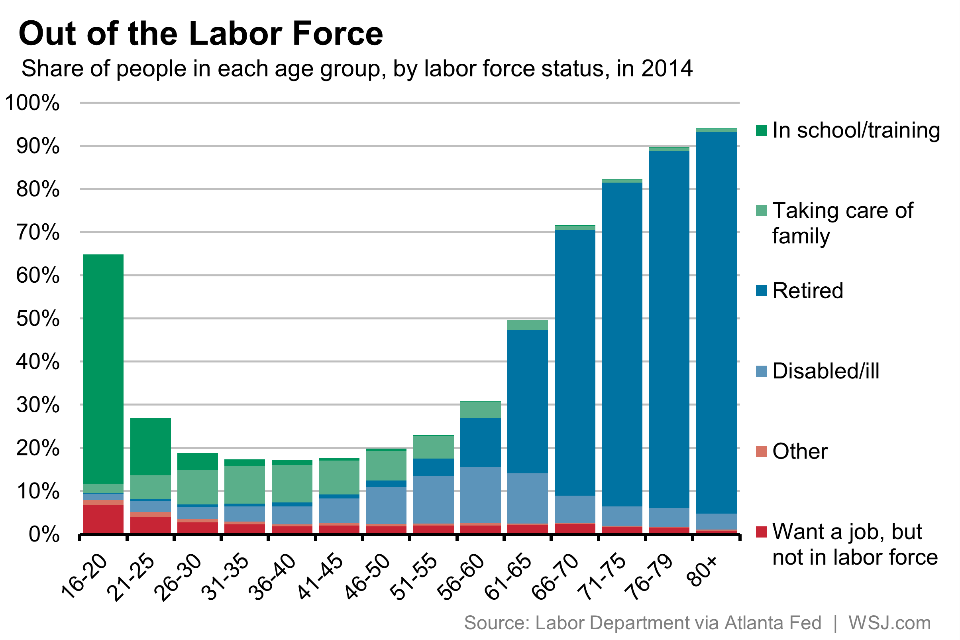

As employers contend with growing numbers of younger employees quitting in the great resignation, the COVID-19 recession and gradual labor market recovery has also been accompanied by an increase in retirement among adults ages 55 and older.

As of the third quarter of 2021, 50. 3% of U.S. adults 55 and older said they were out of the labor force due to retirement, according to a Pew Research Center analysis of the most recent official labor force data. In the third quarter of 2019, before the onset of the pandemic, 48.1% of those adults were retired. In regard to specific age groups, in the third quarter of 2021 66.9% of 65- to 74-year-olds were retired, compared with 64.0% in the same quarter of 2019.

3% of U.S. adults 55 and older said they were out of the labor force due to retirement, according to a Pew Research Center analysis of the most recent official labor force data. In the third quarter of 2019, before the onset of the pandemic, 48.1% of those adults were retired. In regard to specific age groups, in the third quarter of 2021 66.9% of 65- to 74-year-olds were retired, compared with 64.0% in the same quarter of 2019.

The leading edge of the Baby Boomer generation reached age 62 (the age at which workers can claim Social Security) in 2008. Between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million.

How we did this

The COVID-19 recession caused millions of Americans to leave the labor force, including many older workers. The recovery began in April 2020, and labor markets have tightened. Retirement is not necessarily permanent, as some retired adults may subsequently reenter the labor market. The track of the retirement rate sheds some light on how durable or long-lasting the employment disruptions are proving to be among older adults.

The track of the retirement rate sheds some light on how durable or long-lasting the employment disruptions are proving to be among older adults.

The share of retired U.S. adults is derived from the monthly Current Population Survey (CPS), conducted by the U.S. Census Bureau for the Bureau of Labor Statistics. The CPS is the nation’s premier labor force survey and is the basis for the monthly national unemployment rate released on the first Friday of each month. The CPS is based on a sample survey of about 70,000 households. The estimates are not seasonally adjusted.

“Retired” in this analysis is based on labor force status. Those who cite “retired” as the reason for not being in the labor force (neither employed nor seeking work) constitute the retired population. This is a moment-in-time measure, and increases reflect the net change of adults moving both into and out of “retirement” due to changes in labor force participation.

The CPS microdata files analyzed were provided by the IPUMS at the University of Minnesota.

The COVID-19 outbreak has affected data collection efforts by the U.S. government in its surveys, especially limiting in-person data collection. This resulted in about an 8 percentage point decrease in the response rate for the CPS in September 2021. It is possible that some measures of retirement and labor market activity and its demographic composition are affected by these changes in data collection.

The large impact of the COVID-19 recession – February 2020 to April 2020 – on retirement differs from recent recessions and marks a significant change in a long-standing historical trend toward declining or steady retirement rates among older adults.

During the Great Recession and its aftermath, retirement rates declined. By the third quarter of 2010, 48% of adults ages 55 and older were retired, down from 50% in the same quarter of 2007. The prior recessions did not disrupt the longer-running trend of rising labor force participation and declining retirement among older Americans that began around 1997. Gradually declining retirement reflected in part rising education levels among older Americans as well as gains in their health. In addition, there were policy changes in Social Security that may have impacted retirement decisions. (For example, in 2000 the earnings test on benefit claimants was no longer applied to those who had reached full retirement age.)

Gradually declining retirement reflected in part rising education levels among older Americans as well as gains in their health. In addition, there were policy changes in Social Security that may have impacted retirement decisions. (For example, in 2000 the earnings test on benefit claimants was no longer applied to those who had reached full retirement age.)

The financial context in which older adults are making retirement decisions during the pandemic is markedly different from the Great Recession. During that period – December 2007 to June 2009 – there was a steep decline in the value of financial assets as well as home prices. The resulting loss of wealth induced some older workers to remain in the labor force and postpone retirement. In contrast, household wealth has been rising since the onset of the pandemic. House prices have been rising in most markets. The stock market did have a sharp sell-off in March 2020 but reached new record highs by August 2020.

The retirement uptick among older Americans is important because, until the pandemic arrived, adults ages 55 and older were the only working age population since 2000 to increase their labor force participation. Labor force participation for the entire working age population declined from an annual average of 67% in 2000 to 63% in 2019. This partly reflects a steep drop in participation among 16- to 24-year-olds (66% to 56%) as young people increasingly pursued schooling rather than employment. Participation has also been declining this century among the “prime working age” population, those ages 25 to 54. The overall decline in labor force participation would have been larger if adults 55 and older had not increased their labor force participation (from 32% in 2000 to 40% in 2019).

Labor force participation for the entire working age population declined from an annual average of 67% in 2000 to 63% in 2019. This partly reflects a steep drop in participation among 16- to 24-year-olds (66% to 56%) as young people increasingly pursued schooling rather than employment. Participation has also been declining this century among the “prime working age” population, those ages 25 to 54. The overall decline in labor force participation would have been larger if adults 55 and older had not increased their labor force participation (from 32% in 2000 to 40% in 2019).

It is unclear whether the pandemic-induced increase in retirement among older adults will be temporary or longer lasting. Newly published labor force projections from the Bureau of Labor Statistics suggest it will be temporary. BLS projects large increases in labor force participation among older adults from 2020 to 2030, with nearly 40% of 65- to 69-year-olds being in the labor force by 2030, up from 33% in 2020.

The recent retirement spike has not been uniform across demographic groups. The share of older White adults who are retired increased 3 percentage points from Q3 of 2019 to Q3 of 2021. The retirement rate of older Black adults did not significantly increase. The retirement rate of U.S.-born adults ages 55 and older rose 3 points from 2019 to 2021, while the rate for their foreign-born peers was unchanged.

Retirement among those 55 and older who have completed at least a bachelor’s degree rose 3 percentage points over this period. Among older adults who have a high school diploma or less the rate increased 1 point. The retirement rate increased for older adults living in metropolitan areas (2 points) and also increased for older adults in rural areas (1 point).

Richard Fry is a senior researcher focusing on economics and education at Pew Research Center.

POSTS BIO TWITTER EMAIL

The number of pensioners registered with the Pension Fund for 2021 decreased by almost a million. This is the largest decline since the early 1990s. As of January 1, 2022, the number of pensioners registered with the Pension Fund amounted to 42 million people.

According to RBC with reference to the data of the Fund, the number of Russian pensioners has been declining since 2019 against the backdrop of an increase in the retirement age. Then, at the end of the year, their number decreased by 319 thousand people. In 2020, the decline continued against the backdrop of the coronavirus pandemic, with a decline of 569,000 people over the year.

The publication, citing experts, notes that the reduction in the number of pensioners led to budget savings, but it was offset by the cost of supporting vulnerable segments of the population.

You can read more about the pension reform in IRK.ru's article “What awaits Russians when they reach retirement age?” .

Don't forget to confirm the address

(letter in your mail)

The reasons for the "disappearance" of older citizens will be included in the reference table

The number of pensioners in the country is decreasing at an accelerated pace. According to the Accounts Chamber (AC), which analyzed the draft budget of the Pension Fund of Russia (PFR), the forecast for a decrease in the number of recipients of insurance pensions has been worsened by 200 thousand people for 2021, by 500 thousand for 2022 and by 600 thousand for 2023- go. On Tuesday, at the plenary session of the State Duma, the head of the Pension Fund, Andrei Kigim, said: “Today, the number of new pensioners has decreased by 700,000.” But despite the fact that the urgency of this problem has been growing throughout the past year, the FIU still cannot give a clear answer to the question of the causes and contribution of the pandemic. Only after the conflict with the deputies on this issue reached a higher level, the FIU promised to prepare a reference table.

According to the Accounts Chamber (AC), which analyzed the draft budget of the Pension Fund of Russia (PFR), the forecast for a decrease in the number of recipients of insurance pensions has been worsened by 200 thousand people for 2021, by 500 thousand for 2022 and by 600 thousand for 2023- go. On Tuesday, at the plenary session of the State Duma, the head of the Pension Fund, Andrei Kigim, said: “Today, the number of new pensioners has decreased by 700,000.” But despite the fact that the urgency of this problem has been growing throughout the past year, the FIU still cannot give a clear answer to the question of the causes and contribution of the pandemic. Only after the conflict with the deputies on this issue reached a higher level, the FIU promised to prepare a reference table.

The forecast for the number of pensioners has worsened in the country. This can be judged by the conclusion of the joint venture on the draft PFR budget for 2022–2024. As indicated in the materials, it is expected that the average annual number of recipients of insurance pensions will be less than 39 million people in 2021, and it will decrease to about 37. 8 million in 2024.

8 million in 2024.

A year ago, in its opinion on the draft PFR budget for the period 2021-2023, the joint venture reported that in 2020 the number of recipients of insurance pensions was estimated at 39.8 million people, and it was expected to decrease to 38.5 million people in 2023.

Within these three-year periods, it is possible to compare old and new forecast data for several years. So, in last year's materials, the expected number of recipients of insurance pensions in 2021 was estimated at 39.2 million people, and now the forecast figure for this year has become about 230 thousand people less.

In last year’s projections, in 2022, the expected number of recipients of insurance pensions was also about 39.2 million people, now this figure has decreased by almost 500 thousand people. Finally, in last year's projections, the benchmark for 2023 was the number of recipients of insurance pensions at the level of 38.5 million people, now this forecast figure has become almost 600 thousand people less.

“The calculation of forecast indicators for the number of recipients of insurance pensions is carried out by the PFR. The Accounts Chamber, when checking the validity of the indicators of the draft budget, agreed with these calculations, ”the press service of Alexei Kudrin’s department explained to NG.

“The budget for the next financial year and for the planning period is calculated from the average annual number of recipients of insurance pensions and is forecast based on the actual number of recipients of insurance pensions as of the last reporting date before the formation of the draft budget. In fact, the number as of July 1, 2021 amounted to 38.51 million people,” the press service of the joint venture also noted.

It turned out to be extremely difficult to get an answer from the FIU to the question of what contribution the pandemic (and not just the pension reform) made to accelerating the decline in the number of pensioners, it turned out to be extremely difficult, as can be judged by the attempts of non-factional deputy Oksana Dmitrieva.

As the deputy said at the end of last week on her Facebook page, “at the very first meeting of the budget committee, the first friction with the new chairman of the Pension Fund.” Dmitrieva, according to her, failed to get an answer to any of the questions that concerned the amount of funds needed to index the pensions of working pensioners, savings in 2020 by raising the retirement age, the reasons for reducing the number of pensioners in 2020 (raising the retirement age or excess mortality from covid?).

* In thousand people. Source: materials of the Accounts Chamber

To clarify, according to the joint venture, which is contained in the conclusion on the draft budget of the PFR, as of the beginning of 2021, there were almost 621 thousand recipients of insurance pensions in the country less than it was at the beginning of 2020. And the number of old-age pensioners has decreased by about 600 thousand people.

“In 2019, the number of newly assigned pensions decreased by 874 thousand, this is due to the start of the pension reform and the increase in the retirement age. At the same time, the number of pensioners decreased by only about 342 thousand in terms of insurance pensions. And in the pandemic 2020, the number of recipients of insurance pensions decreased by about 620,000, while the number of newly assigned pensions decreased by 76,000,” Oksana Dmitrieva said in an interview with NG.

At the same time, the number of pensioners decreased by only about 342 thousand in terms of insurance pensions. And in the pandemic 2020, the number of recipients of insurance pensions decreased by about 620,000, while the number of newly assigned pensions decreased by 76,000,” Oksana Dmitrieva said in an interview with NG.

So far, we can only assume that this is due to mortality due to the pandemic. But this is a significant value, which now requires adjustments to the budget parameters, especially considering that the trends are the same in 2021.

The problem of "disappearance" of pensioners has been growing throughout the previous year. As NG has already written, in Russia, against the backdrop of the pandemic, the annual growth in the number of citizens aged 60 and over is slowing down, although it accelerated over the past three years before the pandemic (see issue dated 19.09.21). At the same time, the number of Russians who died from coronavirus is several times higher than last year, and among them, about 85% are still elderly.

This week, after discussions at a budget committee meeting, Dmitrieva again reported unsuccessful attempts to get answers from the FIU: “The pension fund aggressively does not want to answer questions about savings due to the increase in the retirement age. In 2020, the number of pensioners decreased by 620 thousand people. There is no answer to the question of what is the reason: a reduction in the number of newly assigned pensions or excess mortality.

And only after this "scandal" reached a higher level, the FIU promised to prepare a reference table.

So, on Tuesday, at a plenary meeting of the State Duma, Dmitrieva turned to the head of the Pension Fund Andrei Kigim with the same question about the reasons. After all, as can be preliminarily judged, now the effect of the pension reform seems to be less tangible than the factor of the loss of older citizens associated with mortality during the pandemic.

“We are preparing a table, this is by no means an easy question,” Kigim replied. - We have a preliminary form, according to which we saw: in previous years, the balance of pensioners arriving and leaving life was as follows: approximately 1 million 700 thousand new pensioners appeared each time, and 1 million 400, 1 million 300 left , 1 million 450. Since 2019years, we really changed the balance. We are now preparing a certificate, and in order for it to be objective, we want to say that today we have reduced the number of new pensioners by 700,000.” This, according to him, is a preliminary result.

- We have a preliminary form, according to which we saw: in previous years, the balance of pensioners arriving and leaving life was as follows: approximately 1 million 700 thousand new pensioners appeared each time, and 1 million 400, 1 million 300 left , 1 million 450. Since 2019years, we really changed the balance. We are now preparing a certificate, and in order for it to be objective, we want to say that today we have reduced the number of new pensioners by 700,000.” This, according to him, is a preliminary result.

Meanwhile, Yevgeny Yakushev, head of the pension system development laboratory at the Institute for Social Policy at the Higher School of Economics, told NG that the change in the retirement age is “a key driver of a temporary reduction in the number of pensioners who receive insurance pensions, which will end at the end of the transition period in 2028.”

“We should not forget about the new requirements for the insurance period and the number of pension points, these factors increase the minimum criteria for assigning an insurance pension. Those who do not meet these criteria are assigned a social pension, and their number is growing,” the expert says.

Those who do not meet these criteria are assigned a social pension, and their number is growing,” the expert says.

The pandemic factor has led to an increase in mortality in older ages, Yakushev noted. “However, its impact on the number of pensioners is significantly less compared to the reduction in new appointments of insurance pensions,” he said.

Speaking about changes in the forecast number of pensioners in the PFR budget projections, Yakushev noted that updating short-term financial forecasts is a normal phenomenon. “Procedurally, this is an internal affair of the Pension Fund of Russia, and it “orders” as much funds as it thinks is necessary to fulfill all obligations, and the target is to balance the budgets of all levels,” the expert explained.

Although Yakushev clarified: “If the methodology of actuarial valuation were used to build forecasts of the financial flows of the pension system, then disclosures of initial data and methodology would be mandatory - this is a standard world practice for national pension systems.