You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you and your family.

Each year, we review the records of all Social Security beneficiaries who have wages reported for the previous year. If your latest year of earnings is one of your highest years, we recalculate your benefit and pay you any increase you are due. The increase is retroactive to January of the year after you earned the money.

If you receive survivors benefits, the additional earnings could help make your retirement benefit higher than your current survivors benefit.

When you begin receiving Social Security retirement benefits, you are considered retired for our purposes. You can get Social Security retirement or survivors benefits and work at the same time.

However, there is a limit to how much you can earn and still receive full benefits.

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount.

If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. In 2022, this limit on your earnings is $51,960. We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year.

If your earnings will be over the limit for the year and you will receive retirement benefits for part of the year, we have a special rule that applies to earnings for one year. The special rule lets us pay a full Social Security benefit for any whole month we consider you retired, regardless of your yearly earnings.

If you receive survivors benefits, we use your full retirement age, for retirement benefits when applying the annual earnings test (AET) for retirement or survivors benefits. Although the full retirement age for survivors benefits may be earlier, for AET purposes, we use your full retirement age for retirement benefits. This rule applies even if the beneficiary is not entitled to retirement benefits.

Read our publication, “How Work Affects Your Benefits,” for more information.

When you reach full retirement age:

In 2022, if you’re under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Let's look at a few examples. You are receiving Social Security retirement benefits every month in 2022 and you:

Are under full retirement age all year. You are entitled to $800 a month in benefits. ($9,600 for the year)

You work and earn $29,560 ($10,000 over the $19,560 limit) during the year. Your Social Security benefits would be reduced by $5,000 ($1 for every $2 you earned over the limit). You would receive $4,600 of your $9,600 in benefits for the year. ($9,600 - $5,000 = $4,600)

Reach full retirement age in August 2022. You are entitled to $800 per month in benefits. ($9,600 for the year)

($9,600 for the year)

You work and earn $63,000 during the year, with $52,638 of it in the 7 months from January through July. ($678.00 over the $51,960 limit)

When we figure out how much to deduct from your benefits, we count only the wages you make from your job or your net profit if you're self-employed. We include bonuses, commissions, and vacation pay. We don't count pensions, annuities, investment income, interest, veterans benefits, or other government or military retirement benefits.

If you are eligible for retirement benefits this year and are still working, you can use our earnings test calculator to see how your earnings could affect your benefit payments.

How old are you?Step 1 of 11

Select an answer181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465

Select an answer181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465

< backforward >

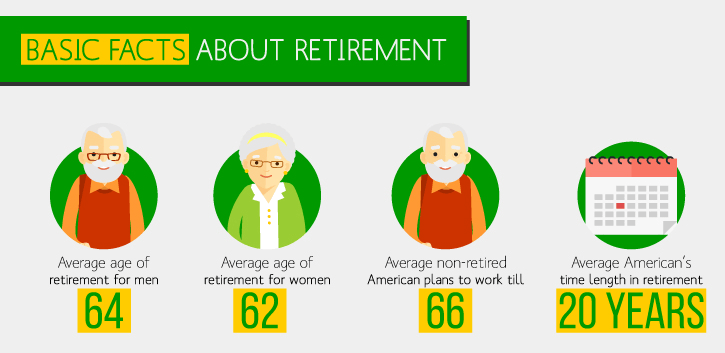

Because Social Security retirement benefits plus savings and other investments are often not enough to live on comfortably, many people keep working for at least a few years after they claim Social Security early retirement benefits. Other people keep their jobs or take new ones to stay active and involved in the world of work. If you keep working at a high enough salary, you may increase your lifetime earnings average, thereby slightly increasing your retirement benefits for the years to come.

Other people keep their jobs or take new ones to stay active and involved in the world of work. If you keep working at a high enough salary, you may increase your lifetime earnings average, thereby slightly increasing your retirement benefits for the years to come.

Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each year may reduce your Social Security retirement benefits (until you reach full retirement age). This reduction in benefits applies only to the years you're working. It doesn't have a permanent effect on the amount of benefits you'll receive in future years (and you can even make back some of the reduction in future years—more on this below). So you can earn any amount at age 62, but it might cause a reduction in your benefits.

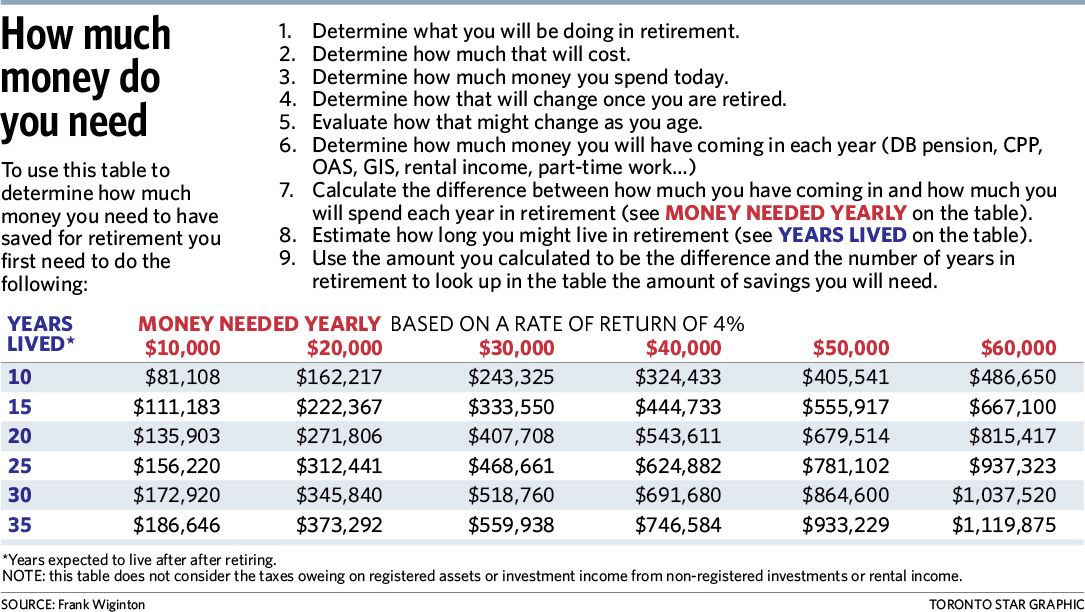

How much you can earn when you retire depends on your age. Social Security has different rules for:

Until you reach full retirement age, the Social Security Administration (SSA) will subtract money from your retirement check if you exceed a certain amount of earned income for the year. This penalty limits the amount you can earn when you retire (and still have it be worthwhile to work). For the year 2022, the maximum income you can earn after retirement is $19,560 ($1,630 per month), without having your benefits reduced. The amount goes up each year. The maximum income limit doesn't change depending on your age; in other words, it's the same whether you're 62, 63, or 64.

If you're collecting Social Security retirement benefits before full retirement age and you make more than this amount, Social Security will reduce your benefits by $1 for every $2 you earn over the limit. Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit.

Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit.

Note that if you're working and you lose your job, you may collect unemployment benefits (assuming you otherwise qualify for them) even though you are also collecting your Social Security retirement benefits.

If you are already receiving your retirement benefits, a special higher earnings limit applies in the calendar year you turn your full retirement age (67 for folks born in 1960 or later). If you will reach full retirement age in 2022, you can earn up to $4,330 per month without losing any of your benefits, up until the month you turn 67. But for every $3 you earn over that amount in any month, you will lose $1 in Social Security benefits. Beginning in the month you reach full retirement age, you become eligible to earn any amount without penalty.

If you're self-employed, you may receive full benefits if, during the year you turn your full retirement age, there are any months in which you didn't perform what Social Security considers "substantial services. " The usual test for whether you worked substantial services is whether you worked in your business more than 45 hours during the month (or between 15 and 45 hours in a highly skilled occupation). In other words, if you work in your business more than 45 hours in a month before you reach full retirement age, Social Security may reduce your benefit.

" The usual test for whether you worked substantial services is whether you worked in your business more than 45 hours during the month (or between 15 and 45 hours in a highly skilled occupation). In other words, if you work in your business more than 45 hours in a month before you reach full retirement age, Social Security may reduce your benefit.

The SSA bases its retirement benefit calculations on earnings reported on W-2 forms and on self-employment tax payments. Most individuals are not required to send in an estimate of earnings.

But Social Security does request earnings estimates from some recipients: those with substantial self-employment income or those whose reported earnings have varied widely from month to month, including people who work on commission. Toward the end of each year, Social Security sends these people a form asking for an earnings estimate for the following year. The agency uses the information to calculate benefits for the first months of the following year. The SSA will then adjust the amounts, if necessary, after it receives actual W-2 or self-employment tax information in the current year.

The SSA will then adjust the amounts, if necessary, after it receives actual W-2 or self-employment tax information in the current year.

Once retirees reach full retirement age, Social Security will no longer check their income. Because there is no Social Security limit on how much a person can earn after reaching full retirement age, there is nothing to report.

The amounts of early retirement benefits you lose as a setoff against your earnings due to work are not necessarily gone forever. When you reach full retirement age, Social Security will recalculate your benefits to make up for the reduction. Using a complicated calculation, the agency will actually adjust upward the amount of your benefits to take into account the amounts you lost because of the earned income rule. The lost amounts will be made up gradually, a little bit each year. It will take up to 15 years to completely recoup your lost benefits. Unfortunately, the readjustment will not change the permanent percentage reduction in your benefits that was calculated when you claimed early retirement benefits (the early retirement penalty).

If you claim Social Security retirement benefits before your full retirement age, which is 67 for those born in 1960 or later, the SSA will permanently lower your benefits. Social Security does this to try to make the amount you receive over your life expectancy equal whether you claim at age 62 and get a reduced amount, 67 and get the standard amount, or 70 and get an increased amount.

The SSA will reduce your benefits by 5/9 of one percent per month for each month you receive benefits before your normal retirement age. This reduction is roughly equal to roughly .556% per month. For example, if you start claiming benefits 27 months before you turn 67, your monthly benefit will be reduced by 15% (27 x .556%). The reduction is permanent.

If you claim retirement benefits more than 36 months early, the per-month reduction is not quite as harsh. The SSA has a different calculation for the months over 36. For example, if you start claiming benefits 60 months before you turn 67, your benefit will be reduced by 30% (36 x . 556% plus 24 x .417%). The earliest you can claim retirement benefits is 60 months before your retirement age.

556% plus 24 x .417%). The earliest you can claim retirement benefits is 60 months before your retirement age.

To learn more about collecting Social Security benefits, you may want to consider reading Nolo's book, Social Security, Medicare, & Government Pensions: Get the Most Out of Your Retirement & Medical Benefits.

Updated May 16, 2022

According to official data, the average retirement pension in Russia is 13,323 R. Someone gets more, someone less, and many are looking for additional income.

Maria Svetlakova

will not advise bad

If you have already retired by age, but feel the strength in yourself to earn extra money and increase income, read what options are available: we have compiled a list of vacancies for pensioners.

These professions do not involve physical work and do not require special education. Many vacancies are available to those who do not have work experience.

Many vacancies are available to those who do not have work experience.

Librarian. Libraries often employ older people. The work is not dusty: treat books with care, keep order and help visitors with their choice.

Applicants will be provided with a stable salary, constant access to all literature and hot tea. In Moscow, librarians can earn up to 25,000.

Baker. If you succeed in baking, you can make money on it: find a pastry shop or bakery closer to home, get a comfortable schedule and continue doing what you love. You can earn 30 thousand and more.

/selected/part-time/

Where and how to earn extra money

Dispatcher. If you lack communication, you can try to get a job as a dispatcher: you will need to call customers or answer incoming calls. The work is not tiring, you don’t have to stand on your feet all day and night. You can get in the region of 20-30 thousand.

Tutor. Teachers of the "old school", who maintain the status of educational institutions, are gradually leaving for a well-deserved rest. But knowledge is needed: if you are one of those who taught at school, offer the services of a tutor to your friends or place an ad on the site. Earnings depend on the number of students. On average, one academic hour in Moscow costs from 1500 RUR.

Watchman. The work of a watchman is often quieter than it seems: you can sit in an armchair and watch TV, or you can read books, devote time to hobbies and even take online courses. The average salary is from 12 to 20 thousand, but you can find higher.

Nanny. When families are looking for a nanny, they need someone with teaching experience who can take care of the children. It often happens that preference is given to older people. But such work has health limitations: it is worth asking the family if they expect active games with the child from the nanny. Working as a nanny, you can get from 20 to 40 thousand and more.

Working as a nanny, you can get from 20 to 40 thousand and more.

/nanny/

How to find a nanny

Seamstress. If you know how to sew and cut, and vision problems have bypassed you, you can get a job in an atelier. You can receive from 17 to 30 thousand.

You can also earn money from hobbies. The main thing is to know exactly how.

Knitting and embroidery. Handmade is wildly popular right now: if you like to knit hats, scarves, socks and are ready to make it to order, you can make money on it. Start with acquaintances, and word of mouth will spread everything by itself. Advanced level - start a page on a social network and post work there.

Rag toys. Fabric toys are not inferior to knitted things, they are also in high demand. Rag dolls are especially popular. If you can handle fabrics, sewing machine and paint, you can make good money on it.

Grow vegetables and fruits. If you live outside the city and you have your own garden for which you have the strength, time and enthusiasm, you can grow something for sale. Not all rural residents are ready to devote time to working on a land plot. It is just such people that you can offer your services: fresh vegetables and fruits are always in demand.

Custom cakes and pastries. With a love of cooking and experience, baking cakes to order is not that difficult. Gain a client base either through friends or using the Internet.

/instagram-business/

How to do business safely on Instagram*

Home studio. Buying the same thing in the mass market is boring, and therefore the seamstress will always have work. The order search scheme is the same as in the previous version: word of mouth or the Internet.

Making furniture at home. This is one of the most interesting jobs for men. If there is a love for crafting from wood and hands that grow from the right place, then there is no price for you. Demand will be especially high when customers start talking about you to their friends.

If there is a love for crafting from wood and hands that grow from the right place, then there is no price for you. Demand will be especially high when customers start talking about you to their friends.

The computer is not a source of headaches and other problems. When used correctly, it will help you earn. If you have not yet thought about freelancing - remote work on your own schedule - it's time to reconsider your views. Here's what you can do online.

/online-jobs/

How to understand that you have poor earnings on the Internet

Take surveys. You can get a little money for passing tests and opinion polls. The results of these questionnaires are important for a particular firm, and the more answers, the more accurate the statistics. For one passed test, you can get from 15 to 150 R.

Write reviews. If you complain to your neighbor about the rudeness of the doctor, the inaction of the management company and the useless face cream, this will not improve the situation. But if you leave a review, it can become resonant, and even bring money. The sites "Otzovik", "Kak-prosto", "I-recommend" pay for such reviews: money is charged for the number of views.

But if you leave a review, it can become resonant, and even bring money. The sites "Otzovik", "Kak-prosto", "I-recommend" pay for such reviews: money is charged for the number of views.

/fake-review/

How to recognize fake reviews on the Internet

Write articles to order. If you love to write, but have worked as an accountant all your life, you have the opportunity to make your dream come true: you won’t be able to become a journalist, but it’s quite possible to earn money by writing. Try your hand at copywriting.

Edit articles. This is the next step after the copywriter. You can immediately come to this position if you have experience working with texts, or wait for a promotion after your own successful articles. Just remember that the job of an editor comes with a lot of responsibility.

Process photos and videos. Running with a camera in retirement is already difficult, but processing already taken pictures to order is much easier. It's good if you've done this before. But even if there is no experience, you can learn on your own: there are enough video tutorials on this topic.

It's good if you've done this before. But even if there is no experience, you can learn on your own: there are enough video tutorials on this topic.

Even though the pension is just around the corner, and yet: how do you plan to earn money when the well-deserved rest begins? Vote in our poll in Odnoklassniki.

If part-time work is not your option, read what you can save on without harming your life:

Instructions for a comfortable life in Moscow

What additional payments are due to Moscow pensioners.