Need help with your NFL retirement plan?

Too much mystery surrounds NFL retirement.

You may find information here and there, but it’s scattered. What’s needed is a resource that puts everything together. A resource that allows you to see the whole picture.

That way, you can begin planning for retirement. Instead of letting retirement plan for you.

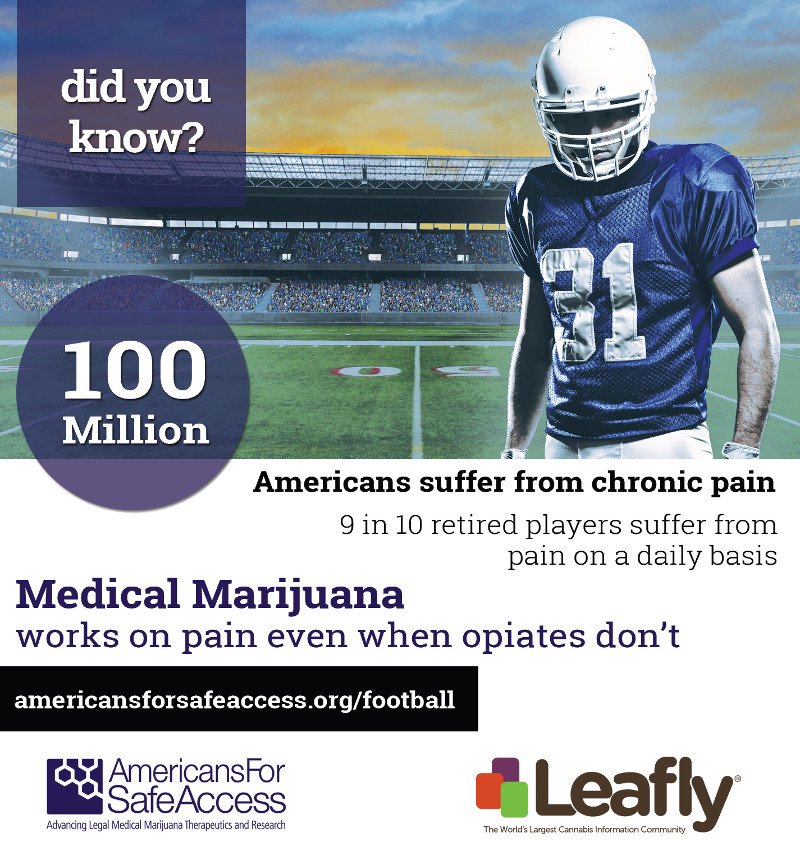

NFL careers are short, and players come into life-changing money at a young age. What do athletes do with all that money? Many retired athletes go broke before they even start receiving a pension. Unfortunately, players aren’t getting the right information to plan for life after pro football.

In this article, you’ll find all that valuable information in one place. It’s carefully laid out so you can capitalize on it to create generational wealth — long before you hang up your jersey.

Let’s begin.

For most U. S. corporations, the habit of handing out pensions is long gone. That’s if they ever had that habit to begin with. On the other hand, the NFL continues to offer pensions for retired players — if they meet certain conditions. More on that later.

The NFL pension is one of the features of the Bert Bell/Pete Rozelle NFL Player Retirement Plan, which was recently updated. I’ll cover some of the critical updates below as well.

In 1960, the American Football League (AFL) had its first season. NFL owners saw this new league as a threat. If NFL players hopped over to the AFL, the NFL owners would threaten to snatch the player’s pension.

Back when the AFL and NFL existed as two separate leagues, NFL players had greater leverage. When NFL owners threatened NFL players, the players would use court actions as their defense. The result? NFL players would gain improved pension coverage and greater benefits.

In 1966, the NFL and AFL merged to become one league. This monumental move crushed all of the leverage NFL players had. Forever.

This monumental move crushed all of the leverage NFL players had. Forever.

On July 3rd, 1968, the National Football League Players Association (NFLPA) voted to have the very first player strike. The goals were to increase compensation, pensions, along with other benefits for all players. NFL owners responded by establishing a seven-day lockout.

On July 14th, 1968, the NFL and NFLPA reached their first collective bargaining agreement. The result? NFL owners would contribute $1.5 million from league revenue to players’ pensions.

In January 1970, the NFLPA and the American Football League Players Association (AFLPA) merged. Both associations wanted to work together so they could get better terms for players, including better pensions.

In Spring 1970, the NFLPA became a certified union. This happened right after NFL owners requested that lawyers be kept out of CBA negotiations. They also requested that players quit asking for increased preseason pay.

In July 1970, NFL players went on a two-day strike. The NFL owners threatened to cancel the season, but the two groups reached a compromise. A new, four-year CBA was established. As a result, pensions increased.

The NFL owners threatened to cancel the season, but the two groups reached a compromise. A new, four-year CBA was established. As a result, pensions increased.

In 1993, NFLPA was re-certified as a union. This was followed by a new CBA. The result from this CBA? Pensions for NFL players nearly doubled. And for the first time, the CBA retroactively enhanced pensions for NFL players already retired.

Since 1993, the NFL and NFLPA extended the CBA five times: 1996, 1998, 2000, 2002, and 2006. Each extension increased the salary and benefits for past, present, and future NFL players. In May 2008, NFL owners opted out of the CBA.

On August 4, 2011, the NFL and NFLPA signed a 10-year CBA. The 2011 CBA, combined with the Legacy Benefit, set it up so that more than $655 million can be set aside, allowing increased pensions for retired players.

The 2020 CBA, which will be valid until the conclusion of the 2030 season, commits nearly $2 billion to NFL player benefits. The latest CBA will result in a huge increase in pensions for NFL players.

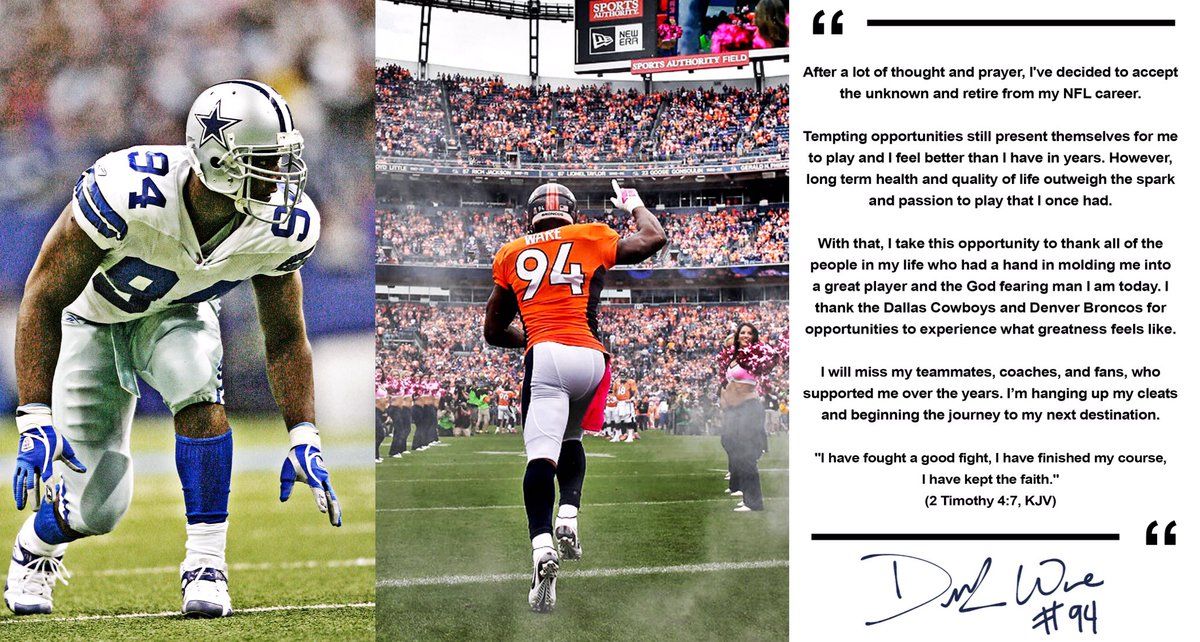

When NFL players retire, they exit a game they’ve based their whole life around. With football out of the picture, they must find a new focus, a new mission.

So, what do some retired pros do during this new phase of their lives?

Some launch broadcasting careers. Some launch businesses. Either way, the players who make NFL retirement plans years in advance often thrive, and you’ll likely have many questions for a wealth manager while planning for your individual retirement.

If you’re wondering: “What age will you retire from the NFL?”

Here’s the short answer:

NFL players don’t have the luxury to choose when they retire. Age, injury, or a cheaper version of you will be the reason you hang the cleats up.

NFL players don’t have to retire at any certain age.

The next section will have more details about that.

Usually, NFL players retire at a young age, often in their 20s. On average, NFL players only play a few seasons. Only the best can retire in their 30s.

On average, NFL players only play a few seasons. Only the best can retire in their 30s.

As some players age, they become more and more protective of their bodies. This can lead to players deciding to leave the game … before they lose their game. They start thinking about their moves off of the field.

Other players find it too difficult to leave the game they fell in love with as a kid.

So, considering all of these factors, it’s clear that there’s no set retirement age. It all depends on the individual.

NFL players must play for three seasons before they can be eligible to receive a pension. That's when he'll be considered vested. Meaning he's eligible to receive benefits negotiated under the CBA.

But what's considered a season? The NFL player must be on a team's roster for at least three games (regular season or postseason).

For each season the player plays, he earns credits. The more credits, the greater his pension amount. So, the amount NFL players make after retirement will vary.

So, the amount NFL players make after retirement will vary.

The amount of income a retired NFL player receives is based on his number of seasons played. Each season represents a credit towards the amount of pension money he can receive.

Also, NFL players must be at least 55 years old to receive their full pension money. If a player wants the money earlier, he can receive a lesser amount plus penalties for taking the pension early. For a player that can wait until 65 to take the pension, the benefit greatly increases.

On average, retired NFL players earn about $43,000 annually from their pension.

Most players also decide to contribute to a 401(k) plan during their careers. The total amount of the 401(k) plan is based on how much the NFL player contributed from his salary. This and the NFL CAP plan are investment accounts and should be coordinated with the rest of your investment accounts.

The NFL Annuity Program can provide another source of income. The amount of income from the annuity depends on how much was contributed each credited season. It also depends on the age the player decided to receive annuity payments and how often he decided to receive them. A retired player can access this stream of income as early as 35.

The amount of income from the annuity depends on how much was contributed each credited season. It also depends on the age the player decided to receive annuity payments and how often he decided to receive them. A retired player can access this stream of income as early as 35.

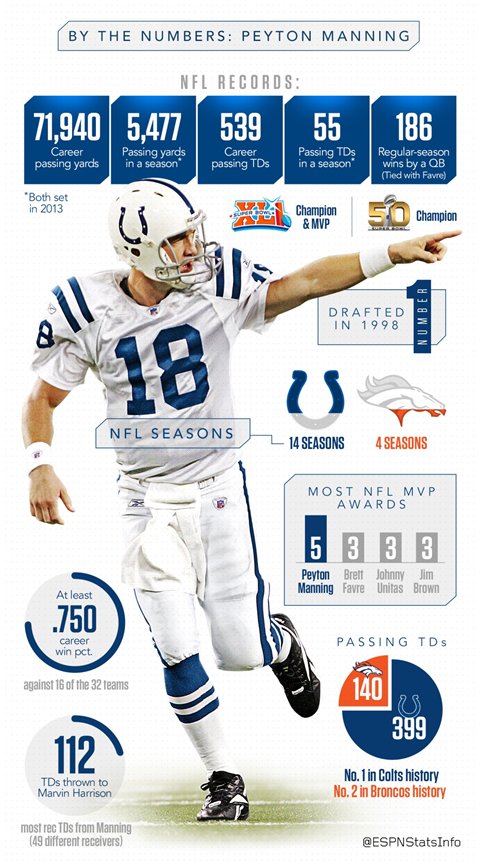

Former NFL players who are in the Hall of Fame do not receive a specific pension outside of what other former NFL players receive. A Hall of Famer’s pension is determined by the number of years he played. Just as with a non-Hall of Famer.

In addition to the pension plan, there are two other benefits NFL players can access.

One of the benefits is the Second Career Savings Plan. That’s a 401(k)-type plan where the employer matches the employee’s input, two-for-one. This plan is available after the NFL player plays two seasons.

There’s also a Player Annuity Program. This is a benefit that’s available for former players after playing four seasons.

But these aren’t the only types of NFL retirement benefits available to former players. There are also health care benefits.

Insurance on the NFL Plan after the 5 years provided post retirement can cost up to $35,000 annually just in premiums. This is a massive cost that should be planned for before a retired player has to start paying the premiums.

The NFL Dedicated Hospital Network Program grants players $25,000 annually for medical care and another $25,000 for mental health services.

This is not a replacement for insurance but an incredible earned benefit that should be utilized when possible.

According to the National Football League Alumni, former NFL players have access to these benefits via the Former Player Life Improvement Plan:

A Joint Replacement Program for former players who need joint work done to their body

Life insurance for former players under the age of 55

A card providing discounts for prescription drugs

A Medicare supplement program that helps with payments for Medicare supplement insurance, for former players 65 or older, covered by Medicare

A neurological care program that covers the expenses for neurological work on the body

Access to assisted-living facilities

A spine treatment program that covers all expenses

NFL Player Engagement provides educational and self-development resources for current and former NFL players:

“From aiding players with building their brands and managing their finances, to supporting their physical, mental and financial well-being, the goal of the Player Engagement department is to provide the best community of care to serve, equip, empower, and support the player and his entire ecosystem during and after his playing days.

”

Another benefit that some retired NFL players can receive is a severance payment. According to NFLPA, former NFL players need at least two credited seasons to access their severance payment.

The severance payment is supplied as a lump sum, via check. Players receive this check one full year after the termination date of their NFL contract. The amount is based on the number of credited seasons the player played and which years he played.

For instance, for the years 2017–2019, players received $22,600 per credited season as part of their severance package.

Now that we’ve covered the pension and benefits available to retired NFL players, it should be clear: The wealth generated during a playing career needs to last.

Former Seattle Seahawk and Super Bowl Champ, Zach Miller, saw a lot of players making expensive mistakes during his time in the NFL.

You can hear everything Zach wished he knew as a rookie in this interview: Owning Your Wealth as an NFL Player. Below are a few of the retirement planning tips he talks about with NFL players now, as a Private Wealth Advisor with AWM.

Below are a few of the retirement planning tips he talks about with NFL players now, as a Private Wealth Advisor with AWM.

As you know, all NFL careers have an expiration date. No one knows its exact date, but you should condition yourself to think years ahead, so you’re not taken by surprise.

“You realize real quick that eventually your career will end. It happens to all athletes. There is a timer on your career. You can’t play forever. And, as soon as you can understand that as a player, as soon as you can understand that the end will eventually come, the better you can start planning for after football.”

As NFL players rack up mileage on their bodies, there are always fresh, young players ready to come up. Even loyal veterans can get cut and replaced for less expensive players.

The earlier you start thinking about making a living without football, the more successful you’ll be in retirement.

You’re the CEO. Your life is your business.

The earlier you realize this in your career, the better your life will be, financially and otherwise.

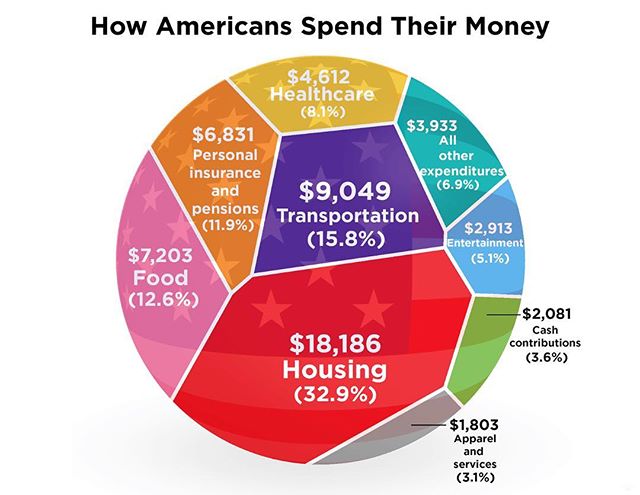

The money you produce from employment is your revenue. With that money, you cover your expenses and support your lifestyle. But also consider surrounding yourself with a team of experts. Experts from fields like investing, accounting, tax law, and so on.

“You’ve put in so much effort and so much time into being an NFL player, to achieving that goal. And to achieving the kind of excellence on the field that you should demand off the field. Whether that’s who you hire as your agent, who you hire for your financial team. And it should be a team. It shouldn’t just be one individual.”

Think of these professionals as your employees, tasked with increasing your wealth. Hold your team to high standards, just as a boss does with employees. More on that in a little bit.

The greatest driver of your wealth is your NFL career. What you need is a financial team that can help you protect and grow that wealth. But not just any financial team.

You need one that specializes in meeting athletes’ needs. One that understands your lifestyle. One that can see things from your perspective.

In short, you want to hire a financial team that gets you.

Think of it like this. You would never hire a physical therapist, trainer, nutritionist, or even a psychologist who doesn’t specialize in treating athletes. Your livelihood depends on their advice.

Still, players often choose a generic brokerage house to manage their investments, thinking only about investment returns.

Zach Miller shared his firsthand experience:

“I wish that I would have known what a Certified Financial Planner was when I was a rookie. Because I would have just hired one immediately and really vetted that professional.

Instead, I hired an advisor from Merill Lynch. And while these people who work there, they can be good people, but the business model is not really set up to help an athlete succeed.”

You need someone qualified to help you make decisions about all the factors that can have a major impact on your wealth and your family’s future -- like disability insurance, buying property, taxes, and estate planning.

What do the wealthiest people in the world do with their money?

How did NFL owners become wealthy enough to buy an NFL team?

These are the types of questions you should ask yourself. When you do, you begin to train yourself to think like an NFL owner, and not one of the “assets” on their team.

Owners make business decisions, detached from emotion.

Most billionaires wouldn’t have become billionaires without the support of a top-notch team, but they don’t trust blindly -- they verify results and demand accountability.

In fact, did you know that some NFL owners establish independent family offices?

That’s how far they go to protect and grow their wealth.

So, think like an NFL owner.

Surround yourself with a team of proven financial experts, and hold them accountable. If they aren’t helping you reach your goals, find someone who can.

“They need to be open to being evaluated by an outside source. They need to be honest with you. They need to prove their value to you because there's too many athletes, too many NFL guys that get taken advantage of. Sometimes it's outright fraud. Sometimes it's recommending bad investments or in other cases, it's just not providing the service that the player deserves.”

This article covered a lot of material, and you can always bookmark it as a resource to reference in the future when you have questions about NFL retirement.

You don’t have to be perfect. You just need to get started and make one decision at a time to start owning your wealth.

If you need more information based on your specific circumstances, it’s always helpful to speak with an experienced wealth advisor.

Contact me if you have any questions about how you can plan for a happy (and lucrative) retirement.

If you’re one of the few Americans that have a pension, then you’re in luck. This is because having a pension affects most of the decisions you make in life, including the spouse you marry.

Included in these pensions is the NFL pension. Like many other professions, the NFL has a pension plan for its players.

It is known as the Bert Bell/Pete Rozelle NFL Player Retirement Plan. All four major league sports in the United States have pension plans for their players.

Find out more about the NFL pension as you read through this article.

Let’s get started with the basics.

READ MORE: PENSION AND INVESTMENT: A Complete Overview In 2023

NFL pension is a pension plan given by the National Football League (NFL). However, the pension plans, like any other corporation in the U.S., are given according to the duration the employee has worked for.

However, the pension plans, like any other corporation in the U.S., are given according to the duration the employee has worked for.

NFL players have been covered by the pension plan since 1962. The current plan considers 55 to be the standard retirement age. Since the career of an NFL player can be very short and is extremely hard on the body, the pension fund is crucial for many players’ futures.

Professional athletes earn high incomes, but often have relatively short careers lasting just a few years in many cases.

After retirement, most professional athletes have a league-sponsored pension plan to which they can look forward. Surprisingly, pension plans vary greatly among different sports, with some leagues providing players with lots of perks, while others offer players the bare minimum.

Many professional athletes live the life that most people can only dream about. They enjoy large paychecks, big endorsement deals, and national publicity.

Throughout their careers, they have been loved and adored by their fans. But what happens when their professional sports careers are over?

But what happens when their professional sports careers are over?

NFL players leave a sport that has been the focus of their entire lives when they retire. They need to find a new direction and purpose now that football is no longer an option.

So what do some professionals who have retired do in this new stage of their lives?

Some begin careers in broadcasting. A few start enterprises. In either case, NFL players who prepare retirement plans years in advance frequently prosper, and while making individual retirement plans, you’ll probably have a lot of questions for a wealth manager.

If you’re wondering when you’ll leave the NFL, your age is.

Here is a succinct response:

NFL players are not given the privilege of picking their retirement date. You’ll hang up the cleats due to old age, injury, or a less expensive version of you.

NFL players are not required to stop playing at a specific age.

More information on that is provided in the section after this.

READ MORE: PENSION AND INVESTMENT: Best 2023 Guide

NBA players have one of the most generous pension plans out of all professional sports. They are vested into their pension plans after playing at least three seasons in the league.

The average benefit in 2016 for a player who retires at the age of 50 is $38,000 per year – not a bad retirement for a three-year career. A 10-year veteran can gross $102,000.

But that is not all. NBA players are also eligible to participate in a league-sponsored 401(K). Do you think your 401(k) plan is good with a 50% matching policy? The NBA matches a player’s contributions up to 140%.

READ MORE: 401k: Easy Guide for Beginners and Pros(+Best 15 Plans in 2023)

NFL players typically leave the sport at an early age—often in their 20s. NFL players often only participate in a few seasons. In their 30s, only the best may retire.

Some athletes get more and more cautious of their bodies as they get older. This may cause players to decide to quit the game before they lose. They begin to consider their actions off the field.

This may cause players to decide to quit the game before they lose. They begin to consider their actions off the field.

Others find it too challenging to stop playing the game they once fell in love with.

It is evident that there is no predetermined retirement age when all of these criteria are taken into account. Everything is dependent on the person.

Before becoming eligible for a pension, NFL players must compete for three seasons. He will thereafter be regarded as vested. Consequently, he qualifies for the benefits agreed upon in the CBA.

But what qualifies as a season? For at least three games, the NFL player must be listed on a team’s roster (regular season or postseason).

The player receives credits for each season he participates in. His pension is increased in proportion to his credit balance. Therefore, the money NFL players earn when they retire will differ.

A retired NFL player’s income is determined by the number of seasons he played. Each season counts as a dollar credit toward the maximum pension he is eligible to earn.

Each season counts as a dollar credit toward the maximum pension he is eligible to earn.

Additionally, NFL players cannot get their full pension benefits until they are 55 years old. A player can earn a smaller sum of money along with early retirement penalties if he wants the money sooner. The benefit significantly rises for a player who can hold off on taking their pension till they are 65.

NFL players who have retired typically receive $43,000 a year in pension payments.

The majority of athletes choose to make 401(k) contributions at some point in their careers. Based on how much the NFL player contributed from his salary, the entire amount of the 401(k) plan is determined. As investment accounts, both this and the NFL CAP plan should be synchronized with your other investment accounts.

Another source of income is available through the NFL Annuity Program. The amount contributed throughout each credited season determines the annuity’s income level. It also depends on the player’s choice of annuity payment frequency and the age at which he made that decision. A retired athlete can start using this source of income at age 35.

A retired athlete can start using this source of income at age 35.

The NFL could stand for “Not For Long,” with the average career lasting only three years. But that’s just enough time to qualify for the league’s pension plan.

The league’s plan is based on years of service in the league. A player with a minimum of three years of play reportedly receives an annual pension check of $21,360 at retirement. On average, retired players receive an annual pension check of about $43,000 in 2014.

Players who retired in the 1980s and 1990s reportedly receive anywhere from $3,000 to $5,640 per month for every season played in the NFL.

Newly retired players since 1998 receive $5,640 each month for every year of service. Players with 3 years of service receive an additional retirement bonus in the form of an annuity.

Players are eligible to receive their full benefits at the age of 55.5 While the pension plan is much worse than other sports, the NFL does offer a generous 401(k) plan. The league matches every player’s contribution by as much as 200%.

The league matches every player’s contribution by as much as 200%.

Players are eligible to receive their full benefits at the age of 55.5 While the pension plan is much worse than other sports, the NFL does offer a generous 401(k) plan. The league matches every player’s contribution by as much as 200%.

More so, your future financial success rests heavily on the decisions you make now — spending, saving, and investing your NFL earnings.

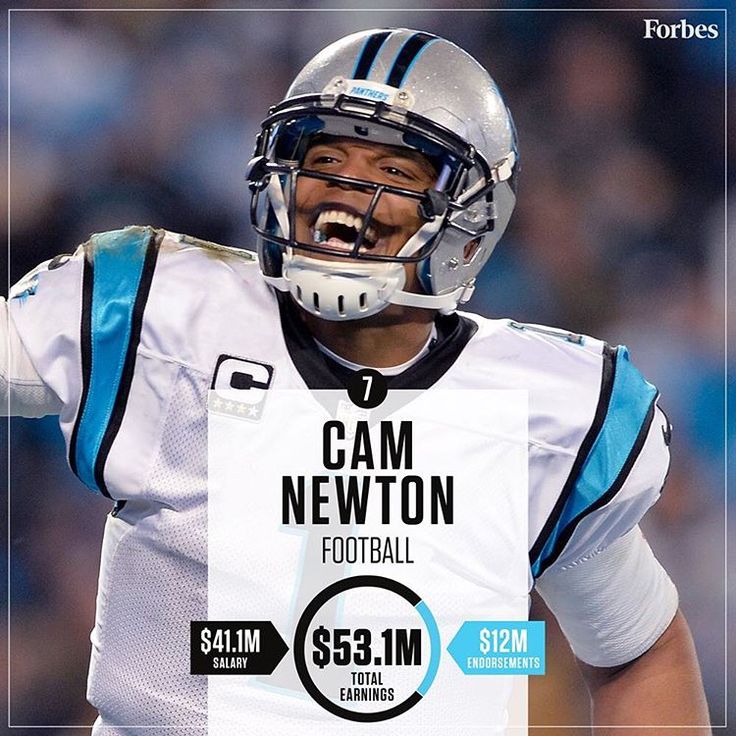

The average NFL career is 3.5 years long with total earnings of $6.7 million. It is important to make the most of it!

READ MORE: Personal Finance: Basics, Importance, Types, Management ( + Free Softwares)

OJ Simpson played in the NFL from 1969 to 1979. NFL players who played before 1982 get a monthly pension credit of $250 for every season played. Since Simpson played 11 seasons, that adds up to $2,750 a month.

As part of a settlement in 2011, former players were given an extra monthly payment of $124 per season played before 1975, and $108 per season played in subsequent years.

Simpson played six seasons before 1975 (a monthly total of $744) and five seasons after ($540). That’s an additional $1,284.

That adds up to $4,034 a month.

That’s what Simpson would have made if he elected to start taking out his NFL pension at the age of 55. Getting paid that for 108 months in jail would mean O.J. made $435,672.

But if he waited until 65 (he turned 70 in July), he would have collected 2.619 times that, according to the formula. That would make his pension approximately $10,565 a month, and based on 60 months in jail after his 65th birthday, that’s $633,900.

Though Simpson’s pension looks great compared to other NFL retirees, he’s in some serious debt. Despite his acquittal during his infamous 1995 murder trial, a civil court ordered him in 1997 to pay a sizable fee to the families of his late ex-wife, Nicole Brown Simpson, and Ronald L. Goldman, in compensatory and punitive damages.

With accrued interest, he owes them $52 million. But, fortunately for Simpson, according to the law, he’s not legally obliged to use his pension to pay that off.

But, fortunately for Simpson, according to the law, he’s not legally obliged to use his pension to pay that off.

READ MORE: Secondary Mortgage Market: Step By Step Guide On How It Works

According to the Mount Laurel-based NFL Alumni group, the NFL’s more than 10,000 retired players or alumni will all receive dramatically increased benefits as part of the new CBA between the owners and players.

After a week of voting, the CBA proposal was approved by the current players by a very close vote of 1,019 to 959, the NFLPA announced Sunday. A simple majority is needed to approve the proposal.

The collective bargaining agreement, negotiated by the NFL Players Association and the owners’ management council, governs all aspects of NFL operations and runs for 10 years.

According to the NFL Alumni, average pensions for players will go from $30,000 per year to $46,000 per year, and more than 10,000 former players will realize that benefit.

The change from four years of credited seasons to three to become vested for a pension provides a $19,800 annual pension for life for former players with three years of NFL service but not four.

That figure is expected to increase to $22,000 in 2025 based on expected annual NFL revenue growth. That affects an estimated 3,000 retired players.

More so, retired players 65 or older will see a 25 percent increase in their Medicare supplement benefit.

Also, according to the release from the NFL Player Alumni’s website, the new CBA calls for “all retired players to receive free or low-cost screenings, preventive care, mental health services and orthopedic care at a new national network of top hospitals created by the owners and the union.”

In order to get the $43,560 per year, tax-free, after the age of 55, the player in question would have to have played in the NFL for ten years after 1993.

Pension benefits can generally be started at age 55, however, if you had a Credited Season prior to 1993, you may be able to start receiving them at age 45. Prior to 2012, former players with a minimum of three creditable seasons will receive $550 for each season.

Prior to 2012, former players with a minimum of three creditable seasons will receive $550 for each season.

A lump sum post-retirement check is given as severance pay. After a full year without engaging in any NFL contract action, you will be paid on the quarter’s end date. The amount you will receive is determined by the years you participated and the number of credited seasons you have.

Brady’s annual salary as Fox’s top game analyst after retirement may reach $25 million. At ESPN and CBS, Brady will easily defeat Tony Romo and Troy Aikman.

READ MORE: EQUITY FINANCING: Types, Sources, Advantages & Disadvantages

The amount of pension money an NFL player receives depends on the time they retire. For example, according to Investopedia, if a player retired in the 1980s or 90s they could receive between $3000 to $5640 per month. NFL players who retire after 1998 receive $5,640 each month.

NFL players who retire after 1998 receive $5,640 each month.

The amount is also based on the number of credited seasons played. Under the 2020 CBA agreement, player retirement funding was increased.

NFL pension value increases periodically and is the same for all players regardless of salary.

Currently, a player with a minimum of three years of play would receive an annual pension check of $21,360 at retirement. On average, retired players receive about $43,000 annually from their pension.

Players who take advantage of the 401(k) plan would also be able to make withdrawals from that account when eligible. The amount of this benefit would depend on how much he chose to contribute to the plan while he was still earning money.

Similarly, players with an annuity could be receiving payments from that as well. Again, the amount would depend on the total amount of the annuity; it would also depend on how the player chose to receive payments (including the age to start and the frequency of payments).

READ MORE: 401k: Easy Guide for Beginners and Pros(+Best 15 Plans in 2021)

Players can qualify for two other benefits in addition to the pension plan. One is a 401(k)-type plan (the Second Career Savings Plan) that includes two-for-one employer matching, and it is available to players once they play for two seasons.

The other benefit is a Player Annuity Program, which is available after they play for four seasons.

Former NFL players are also eligible for several types of health care benefits.

The National Football League Players Association (NFLPA) describes the following benefits available to former players.

There is no special pension for former NFL players who are in the Hall of Fame, except for what other former NFL players receive. The number of seasons a Hall of Famer play affects his pension. similarly to a non-Hall of Famer.

The number of seasons a Hall of Famer play affects his pension. similarly to a non-Hall of Famer.

NFL players have access to two more advantages in addition to the pension plan.

The Second Career Savings Plan has only one perk. That is a 401(k)-style plan where the employer doubles the amount contributed by the employee. The NFL player has two more seasons to use this plan after that.

A player annuity program is also available. After four seasons of play, former athletes are eligible for this incentive.

However, there are additional NFL retirement benefits that former players can take advantage of. Additionally, there are health advantages.

After the initial five years granted after retirement, insurance under the NFL Plan can cost up to $35,000 per year in premiums alone. This is a significant expense that needs to be budgeted for before a retired player is required to begin making premium payments.

Players receive $25,000 per year for medical care and an additional $25,000 per year for mental health services through the NFL Dedicated Hospital Network Program.

This is a fantastic earned benefit that should be used whenever possible, not as a substitute for insurance.

The Former Player Life Improvement Plan, according to the National Football League Alumni, gives former NFL players access to the following benefits:

Furthermore, a severance payment is another perk that certain retired NFL players may be eligible to receive. For access to their severance payment, former NFL players must have at least two credited seasons, according to NFLPA.

For access to their severance payment, former NFL players must have at least two credited seasons, according to NFLPA.

The lump sum severance payment is given in the form of a cheque. After their NFL contract expires, players get this payment a full year later. The sum is determined by the player’s seasons of service and the years in which those seasons occurred. For instance, as part of their severance settlement, players received $22,600 every credited season from 2017 to 2019.

The league’s uniformed pension for coaches, which had previously been required, was made voluntary by a club decision in March 2009.

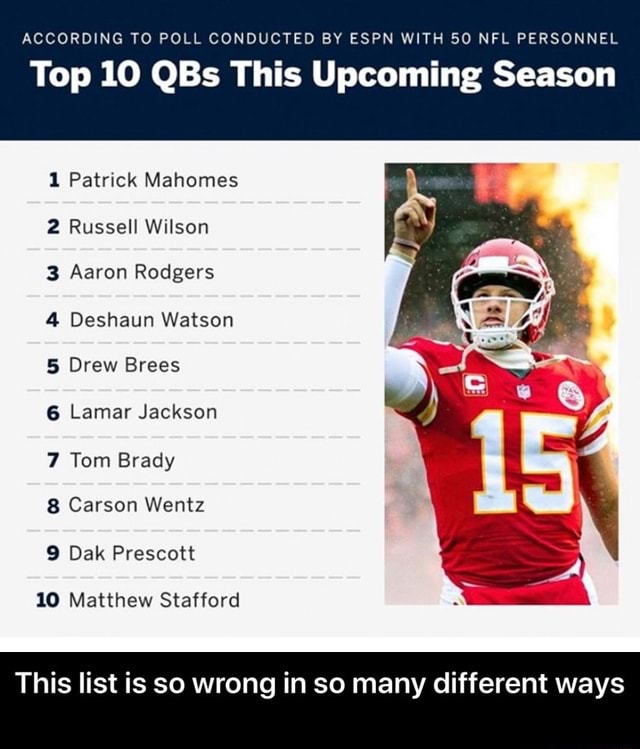

Four quarterbacks, including Aaron Rodgers, Russell Wilson, Kyler Murray, and Deshaun Watson, have subsequently surpassed Patrick Mahomes of the Chiefs, who had the highest average compensation at the start of the 2023 offseason at $45 million annually.

Waterboys also receive benefits outside of their regular pay. In particular, players may give them a variety of gifts and free mementos, such as toys or jerseys. Additionally, they may easily access the squad that the majority of fans fantasize about.

In particular, players may give them a variety of gifts and free mementos, such as toys or jerseys. Additionally, they may easily access the squad that the majority of fans fantasize about.

In 2023, an NFL mascot will have an average yearly income of roughly $60,000.

In a TikTok video, former NFL player Jake Thieneman asserted that the average salary for an NFL water boy is $53,000, adding that the exact amount is dependent on the team’s standing and the applicant’s level of expertise.

I hope this article explains everything there is about the NFL pension as well as its benefits. If you have any questions, let me know in the comments section.

All the best!

NFL pension is a plan given by the National Football League to its players.

The duration of the NFL pension is dependent on the length of time the employee worked for.

If you are one of the few Americans with a pension, then you are in luck. This is because having a pension affects most of the decisions you make in life, including the spouse you marry.

These pensions include the NFL pension. Like many other professions, the NFL has a retirement plan for players.

Known as the Bert Bell/Pete Rozelle retirement plan for NFL players. All four major league sports in the US have retirement plans for their players.

Learn more about NFL retirement by reading this article.

Let's start with the basics.

READ MORE: PENSION SECURITY AND INVESTMENT: Full Review in 2023

NFL Pension is a retirement plan provided by the National Football League (NFL). However, pension plans, like in any other corporation in the US, are provided based on the employee's length of service.

However, pension plans, like in any other corporation in the US, are provided based on the employee's length of service.

NFL players covered by pension plan since 1962 years old. The current plan considers 55 as the standard retirement age. Because an NFL player's career can be very short and extremely hard on the body, a retirement fund is critical to the future of many players.

Professional athletes earn high incomes but in many cases have relatively short careers of only a few years.

After retirement, most professional athletes have a league-sponsored retirement plan that they can count on. Surprisingly, retirement plans vary greatly by sport, with some leagues giving players a lot of perks, while others offer players the bare minimum.

Many professional athletes live lives that most people can only dream of. They enjoy big salaries, big advertising deals and national fame.

Throughout their career they have been loved and adored by their fans. But what will happen when their professional sports career is over?

But what will happen when their professional sports career is over?

NFL players leave the sport they have been playing all their lives when they retire. They need to find a new direction and purpose now that football is no longer an option.

So what are some retired professionals doing in this new phase of their lives?

Some start careers in broadcasting. Several start-up businesses. Either way, NFL players who prepare retirement plans years in advance often do well, and you're likely to have a lot of questions for your wealth manager when putting together individual retirement plans.

If you're wondering when you'll leave the NFL, this is your age.

Here is the short answer:

NFL players are not allowed to choose their retirement date. You hang up your boots due to old age, injury, or a less expensive version of yourself.

NFL players are not required to stop playing at a certain age.

See the next section for more information on this.

READ MORE: RETIRE AND INVESTMENT: 2023 Best Guide

NBA players have one of the most generous retirement plans of any professional sport. They enter their retirement plans after they have played at least three seasons in the league.

Average earnings in 2016 for a player who retires at age 50 is $38,000 per year - not a bad retirement for a three-year career. A veteran with 102,000 years of service can earn $102,000.

But that's not all. NBA players are also eligible to compete in league-sponsored tournaments. 401(K). Do you think your 401(k) plan is good with a 50% compliance policy? The NBA matches the player's contribution up to 140%.

READ MORE: 401k: The Easy Guide for Beginners and Pros (+ Top 15 Plans in 2023)

NFL players typically retire at an early age—often in their 20s. NFL players often only play a few seasons. In their 30s, only the best can retire.

Some athletes become more and more careful with their bodies as they age. This can lead to players deciding to exit the game before they lose. They begin to consider their actions off the field.

It is too difficult for others to stop playing the game they once fell in love with.

Obviously, when all these criteria are taken into account, there is no predetermined retirement age. It all depends on the person.

NFL players must play three seasons before they qualify for retirement. After that, it will be considered secured. Therefore, he is eligible for benefits agreed to by the CBA.

But what can be considered a season? For at least three games, the NFL player must be listed on the team's roster (regular season or postseason).

The player receives credits for each season in which he participates. His pension increases in proportion to the balance of his loans. Therefore, the money that NFL players make after retirement will be different.

A retired NFL player's income is determined by the number of seasons they have played. Each season counts as a dollar credit towards the maximum pension he is entitled to earn.

In addition, NFL players cannot receive their full retirement benefits until they are 55 years old. The player can earn a smaller amount of money along with early retirement penalties if they wish to receive the money sooner. The benefit increases significantly for a player who can defer retirement until age 65.

Retired NFL players typically receive $43,000 per annum in retirement benefits.

Most athletes make 401(k) contributions at some point in their careers. Depending on how much an NFL player has contributed from their paycheck, the entire amount of the 401(k) plan is determined. As investment accounts, both this account and the NFL CAP plan must be synced with your other investment accounts.

Another source of income available through the NFL Annuity Program. The amount contributed during each credited season determines the annuity's income level. It also depends on the choice of the annuity payment frequency by the player and the age at which he made this decision. A retired athlete can start using this source of income at age 35.

The amount contributed during each credited season determines the annuity's income level. It also depends on the choice of the annuity payment frequency by the player and the age at which he made this decision. A retired athlete can start using this source of income at age 35.

NFL can stand for "Not for long" when an average career lasts only three years. But that's just enough time to qualify for the league's retirement plan.

The league plan is based on the number of years in the league. A player who plays for at least three years is reported to receive an annual retirement check of $21,360 upon retirement. On average in 2014, retired players receive an annual pension of around $10,000.

Players who retired in the 1980s and 1990s are reported to have received between $3,000 and $5,640 a month for each season played in the NFL.

Newly retired players over 1998 year olds receive $5,640 per month for each year of service. Players with XNUMX years of experience receive an additional retirement bonus in the form of an annuity.

Players with XNUMX years of experience receive an additional retirement bonus in the form of an annuity.

Players are eligible for their full benefits at age 55.5. Although the retirement plan is much worse than other sports, the NFL offers a generous 401(k) plan. The league corresponds to the contribution of each player by as much as 200%.

Players are eligible for their full benefits at age 55.5. Although the retirement plan is much worse than other sports, the NFL offers a generous 401(k) plan. The league corresponds to the contribution of each player by as much as 200%.

What's more, your future financial success depends a lot on the decisions you make now—spending, saving, and investing your NFL earnings.

The average NFL career is 3.5 years and the total income is $6.7 million. It's important to get the most out of it!

READ MORE: Personal Finance: Fundamentals, Importance, Types, Management (+ Freeware)

OJ Simpson has been in the NFL since he was 1969 to 1979. NFL players who played before 1982 receive a monthly pension of $250 for each season played. Since Simpson played 11 seasons, that works out to $2,750 per month.

NFL players who played before 1982 receive a monthly pension of $250 for each season played. Since Simpson played 11 seasons, that works out to $2,750 per month.

As part of the settlement in 2011, former players were paid an additional monthly allowance of $124 for the season played before 1975 and $108 for the season played in subsequent years.

Simpson played six seasons until 1975 (only $744 per month) and five seasons after ($540). That's an additional $1,284.

This works out to $4,034 per month.

This is what Simpson would have earned if he decided to start collecting his NFL pension at age 55. Getting that amount in 108 months in jail would mean OJ made $435,672.

But if he had waited until the age of 65 (he turned 70 in July), then according to the formula he would have collected 2.619 times more. This would make his pension approximately $10,565 per month, and with 65 months in prison after his 60th birthday, that's $633,900.

While Simpson's retirement looks great compared to other NFL retirees, he's heavily in debt. Despite his acquittal during a notorious 1995 murder trial, a civil court ordered him in 1997 to pay a substantial sum to the families of his late ex-wife Nicole Brown Simpson and Ronald L. Goldman in compensation and punitive damages.

Despite his acquittal during a notorious 1995 murder trial, a civil court ordered him in 1997 to pay a substantial sum to the families of his late ex-wife Nicole Brown Simpson and Ronald L. Goldman in compensation and punitive damages.

With accrued interest, he owes them $52 million. But fortunately for Simpson, he is not legally required to use his pension to pay this amount.

READ MORE: Secondary Mortgage Market: A Step-by-Step Guide to How It Works

According to the Mount Laurel NFL Alumni Group, over 10,000 retired NFL players or alumni will receive significantly increased benefits under the new CBA between owners and players.

After a week of voting, the CBA's proposal was approved by current players in a very close vote of 1,019 to 959, the NFLPA announced Sunday. A simple majority is required to approve a proposal.

The collective bargaining agreement between the NFL Players Association and the Board of Managing Owners governs all aspects of the NFL's operations and lasts for 10 years.

The average player pension will rise from $30,000 to $46,000 a year, according to NFL alumni, and over 46,000 former players are realizing the benefit.

The transition from four years of countable seasons to three to qualify for a pension provides an annual lifetime pension of 19$.800 for former players with three years in the NFL, but not four years.

This figure is expected to increase to $22,000 in 2025 based on expected annual NFL revenue growth. This will affect approximately XNUMX retired players.

What's more, retired players aged 65 and over will see a 25 percent increase in their Medicare Supplement.

In addition, according to a posting on the NFL alumni website, the new CBA encourages "all retired players to receive free or low-cost screening, preventive care, mental health and orthopedic care at a new national network of top hospitals created by the owners and the union."

To receive $43,560 a year without taxes after 1993, the player in question must have played in the NFL for ten years after 55.

Retirement benefits can usually start at age 55, but if you had a qualifying season prior to 1993, you can start receiving them at age 45. Until 2012, former players who have played at least three qualifying seasons will receive $550. for every season.

A lump sum after retirement is provided as a severance pay. After a full year without participating in any NFL contract activities, you will receive payment on the end date of the quarter. The amount you receive is determined by the number of years you have entered and the number of credited seasons you have.

Brady's annual salary as chief game analyst at Fox could be $25 million after his retirement. On ESPN and CBS, Brady would easily defeat Tony Romo and Troy Aikman.

READ MORE: EQUITY FINANCING: Types, Sources, Advantages & Disadvantages

The amount of retirement money an NFL player receives depends on when they retire. For example, according to Investopedia, if a player retired in the 1980s or 90s, they could earn between $3,000 and $5,640 a month. NFL players who retired after 1998 receive $5,640 per month.

For example, according to Investopedia, if a player retired in the 1980s or 90s, they could earn between $3,000 and $5,640 a month. NFL players who retired after 1998 receive $5,640 per month.

The amount also depends on the number of seasons played. Under the 2020 CBA agreement, player retirement funding has been increased.

NFL Retirement increases periodically and is the same for all players, regardless of salary.

Currently, a player who has played for at least three years will receive an annual retirement check of $21,360 upon retirement. On average, retired players receive about $5,000 a year from their pension.

Players who use the 401(k) plan will also be able to withdraw funds from this account when they are eligible. The amount of this benefit will depend on how much he decides to contribute to the plan while he is still earning money.

Similarly, players with an annuity can also receive payments from him. Again, the amount will depend on the total amount of the rent; this will also depend on how the player chooses to receive payments (including age to start and frequency of payments).

Again, the amount will depend on the total amount of the rent; this will also depend on how the player chooses to receive payments (including age to start and frequency of payments).

READ MORE: 401k: The Easy Guide for Beginners and Pros (+ Top 15 Plans in 2021)

Players may qualify for two other benefits in addition to the retirement plan. One of them is a 401(k) plan (Second Career Savings Plan), which includes matching two employers for the price of one, and is available to players after they play two seasons.

Another benefit is the player annuity program, which is available after they have played four seasons.

Former NFL players are also eligible for several types of medical benefits.

The National Football League Players Association (NFLPA) describes the following benefits available to former players.

There is no special pension for former NFL players in the Hall of Fame, except for that received by other former NFL players. The number of seasons a Hall of Famer has played affects his retirement. as well as not a member of the Hall of Fame.

NFL players have access to two more benefits in addition to the retirement plan.

The second career savings plan has only one bonus. This is a 401(k) style plan where the employer doubles the amount the employee contributed. After that, the NFL player has two more seasons to use this plan.

After that, the NFL player has two more seasons to use this plan.

A player annuity program is also available. After four seasons of play, former athletes are eligible for this promotion.

However, there are additional NFL retirement benefits available to former players. Plus, there are health benefits.

After the first five years of retirement, NFL insurance can cost up to $35,000 per year in premiums alone. These are significant expenses that need to be budgeted for before a retired player has to start making bonus payments.

Players receive $25,000/year for medical care and an additional $25,000/year for mental health services through the NFL Specialty Hospital Network program.

This is a fantastic earned benefit that should be used where possible and not in lieu of insurance.

Former Player Improvement Plan gives former NFL players access to the following benefits, according to National Football League alumni:

In addition, severance pay is another benefit that some retired NFL players may be eligible for. Former NFL players must have at least two credited seasons to qualify for severance pay, according to the NFLPA.

Lump sum severance pay is issued in the form of a check. After the expiration of their contract with the NFL, players receive this payment one year later. The amount is determined by the player's seasons of service and the years in which those seasons fell. For example, as part of the severance pay, players received $22,600 for each credited season from 2019 to 2019.

For example, as part of the severance pay, players received $22,600 for each credited season from 2019 to 2019.

The coaches' flat league pension, previously required, became voluntary by club decision in March 2009of the year.

Four quarterbacks, including Aaron Rodgers, Russell Wilson, Kyler Murray and Deshawn Watson, subsequently surpassed the Chiefs' Patrick Mahomes, who had the highest average salary at the start of the 2023 offseason of $45 million a year.

Waterboys also receive benefits on top of their regular wages. In particular, players can give them various gifts and free souvenirs, such as toys or T-shirts. Plus, they can easily access the team that most fans dream of.

In 2023, the NFL mascot will have an average annual income of approximately $60,000.

In a TikTok video, former NFL player Jake Tineman claimed that the average NFL water boy salary is $53,000, adding that the exact amount depends on the position of the team and the level of expertise of the applicant.

I hope this article explains everything there is to know about NFL retirement and its benefits. If you have any questions let me know in the comments section.

All the best!

NFL Pension is a plan provided by the National Football League to its players.

The duration of the NFL pension depends on the length of service of the employee.

To figure out whether income tax is charged on pensions in 2023, you need to know what types of pensions are. Today we will tell you whether pensions and other payments are taxed for citizens who have taken a well-deserved rest.

Today we will tell you whether pensions and other payments are taxed for citizens who have taken a well-deserved rest.

Disability and old-age pensions, allowances, stipends and other similar benefits are considered income and, logically, should be subject to income tax. However, there is an article in the Tax Code that states that most state benefits are payments that are not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation).

This begs the question - are pension accruals taxed?

In Russia, there are two types of pension benefits - state pension and non-state.

The first is paid to those citizens who have worked diligently all their lives and retired on a well-deserved rest upon reaching a certain age or length of service. But the size of government payments is small.

Example

Petrov receives state compensation and does not pay income tax (personal income tax) on this income, since this payment is not subject to personal income tax by law.

Those who think about the future begin to pay voluntary pension contributions in advance from their income from non-state pension provision.

In order not to pay personal income tax from a non-state pension, an agreement with the NPF must be concluded for you, and you must pay such contributions yourself.

Example

Smirnova made voluntary contributions for a future pension for several years, having entered into an agreement with one of the NPFs in Russia. Smirnova does not pay income from these deductions, since she entered into an agreement with the fund on herself.

There are cases when, for example, an employer enters into an agreement with an NPF and makes contributions in favor of an employee. In this option, the employee actually has income that should be subject to personal income tax, since the contributions were not made by the employee himself.

Example

Zhukov receives a non-state payment, and it is taxed at 13%, since his employer paid the contributions. Personal income tax is kept by a tax agent, that is, a fund, because it pays non-state contributions to Zhukov.

Personal income tax is kept by a tax agent, that is, a fund, because it pays non-state contributions to Zhukov.

Before making contributions, you need to conclude an agreement with a non-state pension fund (NPF), which will subsequently transfer non-state reimbursements.

To avoid paying 13% on pension contributions to the NPF, use your own funds as contributions. Otherwise, you will have to pay income tax. Contact our experts on all tax issues: we will fill out the 3-NDFL declaration for you and send it to you in pdf and xml format.

Fill out the 3-NDFL declaration for you

Standard

Fill out the 3-NDFL declaration yourself for a tax deduction intuitive constructor

More details

Maximum

Our expert will check your documents, fill out the 3-personal income tax declaration for you for a tax deduction and independently send it to the IFTS

3 490 ₽

More details

Optimal

Our expert will check your documents, calculate the maximum tax deduction and fill out a 3-NDFL declaration for you

1,690 ₽

More

We came up with another important question - do working pensioners pay income tax on pensions in Russia?

The conditions described above also apply to those pensioners who continue to work. That is, the current salary and pension are different items of income, to which their own rules apply.

That is, the current salary and pension are different items of income, to which their own rules apply.

Personal income tax from the salary of a working pensioner is withheld and transferred to the budget by his employer, and the pension payment of 13% is not taxed, unless this is the exception that we mentioned above.

Read also Pension tax deduction

Some categories of citizens receive additional payments to pension accruals. For example, a low-income pensioner can apply for additional social assistance. No income tax is levied on such a one-time surcharge (clause 8, article 217 of the Tax Code of the Russian Federation).

Another example of an additional payment is financial incentives in some organizations if the employee continues to work. Since this money is considered the pensioner's income, it is subject to income tax (13%), as well as salary.

Sample Application

Types of tax deductions

Download

In 2022, a pensioner bought an apartment. For what years can I get a deduction?

+

Retirees can roll over the deduction to previous years and receive a refund for periods where they were not yet eligible for the deduction. In 2023, you can return 13 percent for 2022, 2021, 2020 and 2019 if there were taxable incomes.

I have not worked for three years. Can I get a deduction for last year's treatment?

+

Unfortunately no. The deduction is provided only to taxpayers, and taxes are not paid on state pension accruals. But your adult children or your working spouse may receive a deduction for your treatment.

Do they take income tax from my pension if I continue to work?

+

No, state pension payments are not taxed at 13%.