Learn more about our 4 key retirement metrics—a yearly savings rate, a savings factor, an income replacement rate, and a potentially sustainable withdrawal rate—and how they work together in the Viewpoints Special Report: Retirement roadmap.

close

View Larger Image

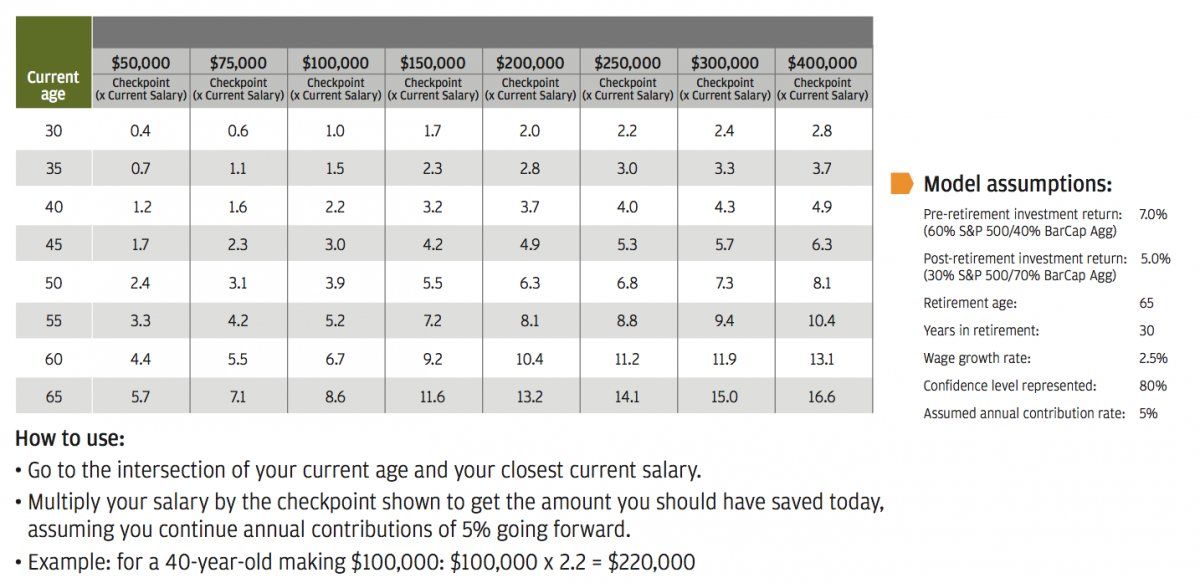

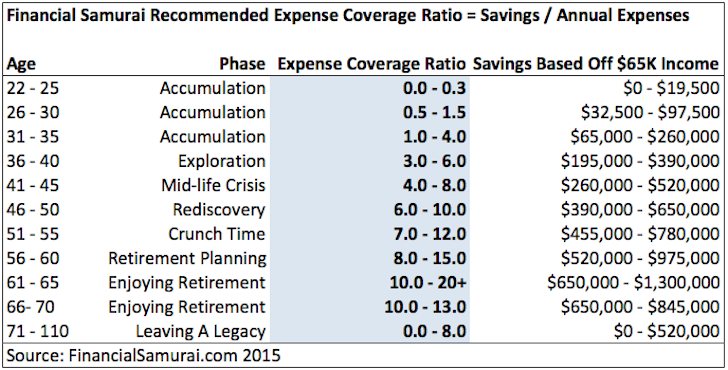

How much do you need to save for retirement? It's one of the most common questions people have. And no wonder. There are so many imponderables: When will you retire? How much will you spend in retirement? And for how long?

That's why we did extensive analysis to come up with age-based retirement savings factors that can help you plan—in spite of those uncertainties. These milestones are aspirational. You likely won't meet all of them. But they can serve as goalposts to help you make a plan to save enough to maintain your lifestyle in retirement.

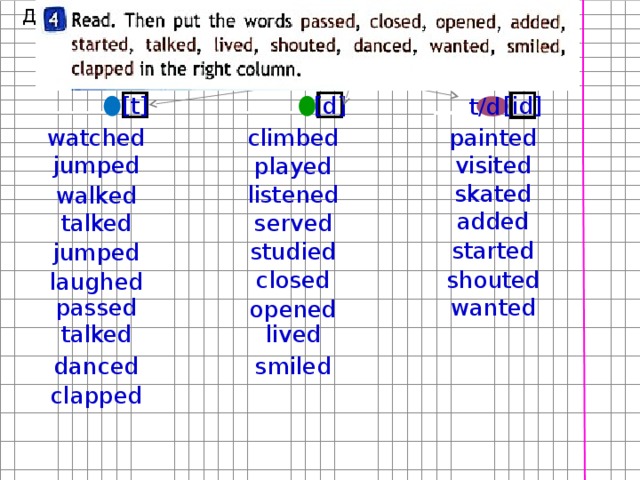

Our savings factors are based on the assumption that a person saves 15% of their income annually beginning at age 25 (which includes any employer match), invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their preretirement lifestyle in retirement (see footnote 1 for more details).

Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should help ensure that you have enough income to maintain your current lifestyle in retirement. That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60. Your personal savings goal may be different based on various factors including 2 key ones described below. But these guidelines can provide a starting point to help your build your savings plan, and assess your progress.

2,3

That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60. Your personal savings goal may be different based on various factors including 2 key ones described below. But these guidelines can provide a starting point to help your build your savings plan, and assess your progress.

2,3

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. That's because delaying gives your savings a longer time to grow, you'll have fewer years in retirement, and your Social Security benefit will be higher.

Consider some hypothetical examples (see graphic). Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you can't always choose when you retire—health and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

See footnote at the end of the article for more information.

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? That's average. If you expect your expenses will be more than they are now, that's above average.

Or will you spend as much as you do now? That's average. If you expect your expenses will be more than they are now, that's above average.

Let's look at some hypothetical investors who are planning to retire at 67. Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Our simple widget lets you see the impact of these 2 variables—when you plan to retire and what kind of lifestyle you want to live in retirement—on how much you need to have saved when you do retire, and on all the intermediate milestones.

What if you're behind? If you're under age 40, the simple answer is to save more and invest for growth through a diversified investment mix. Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks. If you're over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks. If you're over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

No matter what your age, focus on the goals ahead. Don't be discouraged if you aren't at your nearest milestone—there are ways to catch up to future milestones through planning and saving. The key is to take action, and the earlier the better.

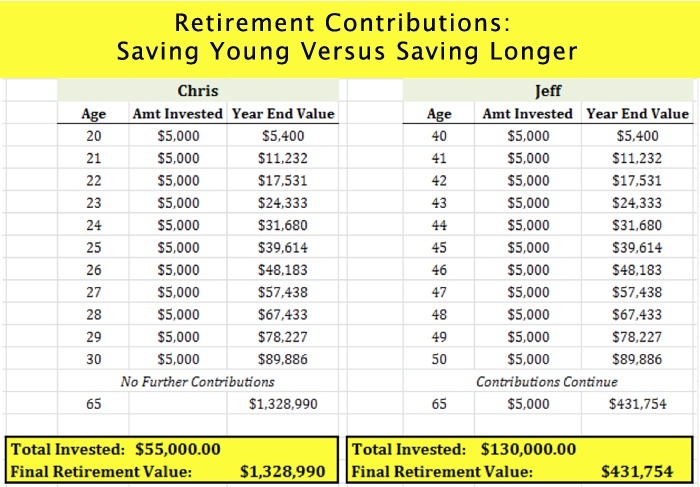

See how small increases in contributions can add up over time.

Amount, account, and asset mix are important when saving for retirement.

Table of Contents

Table of Contents

How Much Do I Need to Save to Retire?

The 4% Rule

Retirement Savings by Age

Retirement Savings Confidence

How to Calculate Retirement Savings

Frequently Asked Questions

How Much Does a Couple Need to Retire?

What Is the 4% Rule?

How Much Should I Save Each Year?

The Bottom Line

Stay on Track for Retirement by Knowing How Much You Need to Save by What Age

By

Jim Probasco

Full Bio

Jim Probasco has 30+ years of experience writing for online, print, radio, and television media, including PBS. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. He has a bachelor's from Ohio University and Master's from Wright State University in music education.

His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. He has a bachelor's from Ohio University and Master's from Wright State University in music education.

Learn about our editorial policies

Updated September 09, 2022

Reviewed by

David Kindness

Reviewed by David Kindness

Full Bio

David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.

Learn about our Financial Review Board

Fact checked by

Suzanne Kvilhaug

Fact checked by Suzanne Kvilhaug

Full Bio

Suzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

Learn about our editorial policies

Investopedia / Sydney Saporito

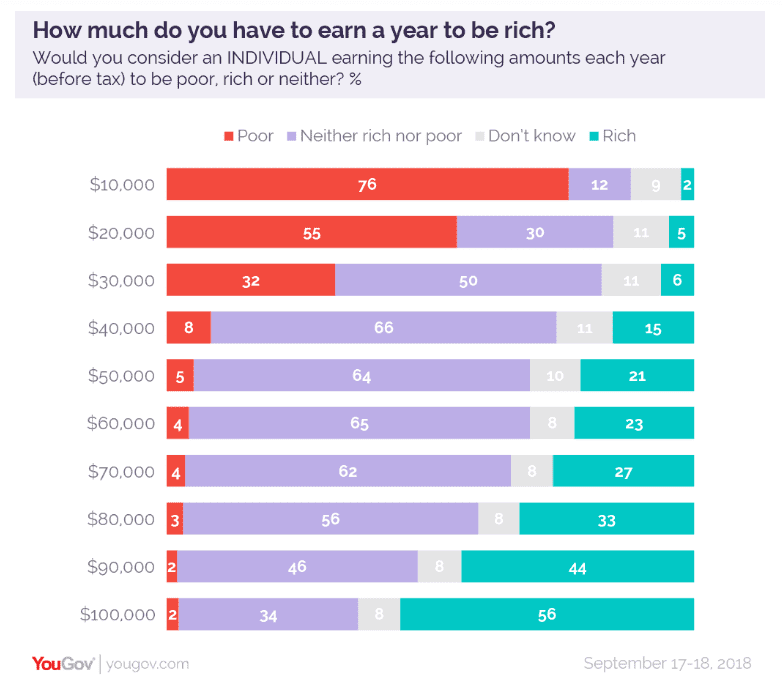

A key part of retirement planning is to answer the question: How much do I need to save to retire? The answer varies by individual, and it depends largely on your income now and the lifestyle you want and can afford in retirement.

Knowing how much you need to save based on how old you are now is just the first step, but it starts you on the path to help you reach your retirement goals. There are a few simple formulas that you can use to come up with the numbers.

Many retirement experts recommend strategies such as saving 10 times your pre-retirement salary and planning on living on 80% of your pre-retirement annual income.

That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.

This amount can be adjusted up or down depending on additional sources of income, such as Social Security, pensions, and part-time employment, as well as factors like your health and desired lifestyle.

Order your copy of the print edition of Investopedia's Retirement Guide for more assistance in building the best plan for your retirement.

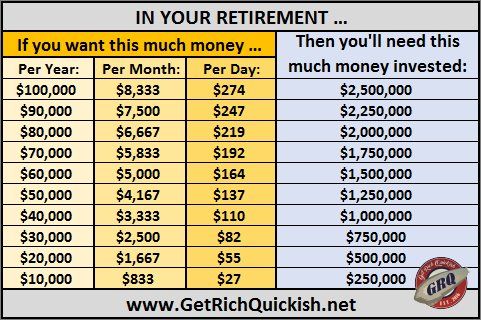

To determine just how much you will need to save to generate the income that you need, one easy-to-use formula is to divide your desired annual retirement income by 4%, which is known as the 4% rule.

For an income of $80,000, you would need a retirement nest egg of about $2 million ($80,000 /0. 04). This strategy assumes a 5% return on investments, after taxes and inflation, no additional retirement income, such as Social Security, and a lifestyle similar to the one you would be living at the time you retire.

04). This strategy assumes a 5% return on investments, after taxes and inflation, no additional retirement income, such as Social Security, and a lifestyle similar to the one you would be living at the time you retire.

In general, the 4% rule assumes that you will live for 30 years in retirement. Retired adults who live longer need their portfolios to last longer, and medical costs and other expenses can increase as you age.

Knowing how much you should save toward retirement at each stage of your life helps you answer that all-important question: “How much do I need to retire?” Here are a few useful formulas that can help you set age-based savings goals on the road to retirement.

To figure out how much you need to accumulate at various stages of your life, it can be useful to think in terms of saving a percentage of your salary.

Fidelity Investments suggests saving 15% of your gross salary starting in your 20s and continuing throughout the course of your working life. This should include savings across various retirement accounts as well as any employer contributions you receive to those accounts, assuming you have access to a 401(k) or another employer-sponsored plan.

This should include savings across various retirement accounts as well as any employer contributions you receive to those accounts, assuming you have access to a 401(k) or another employer-sponsored plan.

Fidelity also recommends the following benchmarks—based on a multiple of your annual earnings—for how much you should have saved for retirement by the time you reach the following ages.

| Target Retirement Savings by Age | |

|---|---|

| Age | Annual Salary |

| 30 | 1x annual salary |

| 40 | 3x annual salary |

| 50 | 6x annual salary |

| 60 | 8x annual salary |

| 67 | 10x annual salary |

Another, more heuristic formula holds that you should save 25% of your gross salary each year, starting in your 20s. The 25% savings figure may sound daunting. But don't forget that it includes not only 401(k) holdings and matching contributions from your employer, but also other types of retirement savings.

The 25% savings figure may sound daunting. But don't forget that it includes not only 401(k) holdings and matching contributions from your employer, but also other types of retirement savings.

If you follow this formula, it should allow you to accumulate your full annual salary by age 30. Continuing at the same average savings rate should yield the following:

Whether or not you try to follow the 15% or the 25% savings guideline, chances are your actual ability to save will be affected by life events such as the job loss many experienced during the COVID-19 pandemic.

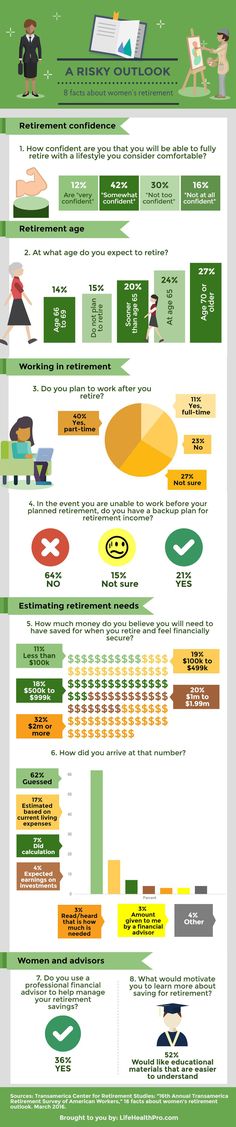

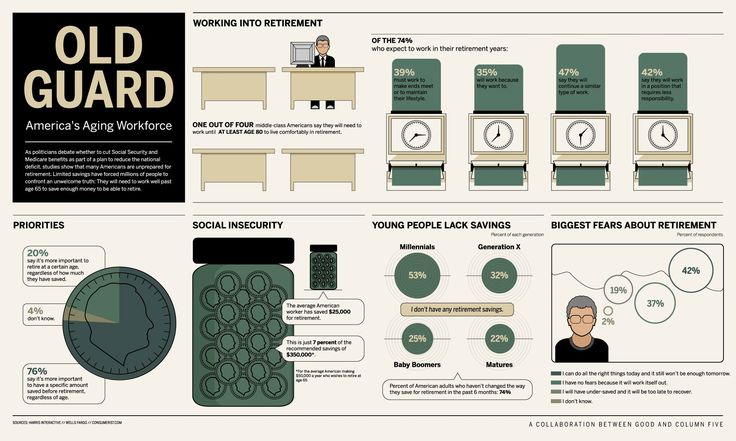

Anxious that you aren't saving enough for retirement? You're not alone. As of 2021, there were roughly 60 million active 401(k) participants, in addition to former employees and retired adults. And while they may be active participants, people’s feelings toward retirement vary widely based on age.

As of 2021, there were roughly 60 million active 401(k) participants, in addition to former employees and retired adults. And while they may be active participants, people’s feelings toward retirement vary widely based on age.

According to the 2022 Investopedia Financial Literacy Study, the majority of adults expect that they will be able to retire. Among those surveyed, 57% of Generation Z and 62% of Millennials expect to retire. Nearly 66% of Generation X have such expectations.

Younger adults, ages 18 to 25, are most optimistic about retiring early—most of Generation Z believe they will retire by age 57.

Those are rosier numbers than what was found in the 2021 data from Natixis Global Retirement Index, which indicated a majority of adults expected to work longer than expected with about 40% saying it would “take a miracle” for them to retire comfortably. It is possible that data was impacted by anxieties around COVID-19 related economic instability.

In Investopedia’s study, not all adults are particularly confident in their understanding of retirement planning. Behind digital currencies and investing, retirement was the third least-understood concept. And retirement was the top personal finance concern for about one-sixth of all those surveyed.

Behind digital currencies and investing, retirement was the third least-understood concept. And retirement was the top personal finance concern for about one-sixth of all those surveyed.

In the early and middle years of your career, you have time to recover from any losses in your retirement accounts. That's a good time to take some of the risks that allow you to earn more with your investments.

In addition to using the above methods to determine what you should have saved and by what age, online calculators can be a useful tool to help you reach your retirement savings goals. For example, they can help you understand how changing savings and withdrawal rates can impact your retirement nest egg.

Although there are many online retirement savings calculators to choose from, some are much better than others. The T. Rowe Price Retirement Income Calculator and MaxiFi ESPlanner are two worth trying.

Much like an individual, how much a couple needs to save to retire comfortably will depend on their current annual income and the lifestyle they want to live when they retire. Many experts maintain that retirement income should be about 80% of a couple’s final pre-retirement annual earnings. Fidelity Investments recommends that you should save 10 times your annual income by age 67.

Many experts maintain that retirement income should be about 80% of a couple’s final pre-retirement annual earnings. Fidelity Investments recommends that you should save 10 times your annual income by age 67.

The 4% rule is a guideline used to determine how much a retiree can withdraw annually from a retirement account. It is intended to make retirement savings last for 30 years.

One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s and last throughout your working years.

Sometimes you'll be able to save more for retirement—and sometimes less. What’s important is to get as close to your savings goal as possible and check your progress at each benchmark to make sure you're staying on track.

A 401(k) might be a good place to start—if you have access to one. If not, consider an IRA. Because the importance of saving for retirement is so great, we've made lists of brokers for Roth IRAs and IRAs so you can find the best places to create these retirement accounts.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Fidelity Investments. "How Much Do I Need to Retire?."

RBC Wealth Management. "Sustainable Withdrawal Rates in Retirement: Utilize as a Guideline to Help Avoid Running Out of Money." Page 1.

Natixis. "2021 Global Retirement Index."

In 2023, not a single person received the right to an old-age pension.

Diana Shigapova

lawyer

From 2024, women will be able to get a pension at 58 years old, and men at 63 years old. In 2028, the pension reform will be completed - from this year onwards, the requirements will become tougher: men will retire at 65, and women at 60, while they will need to accumulate 30 pension points and 15 years of insurance experience. But if you meet a few more conditions, you can start receiving a pension earlier.

In 2028, the pension reform will be completed - from this year onwards, the requirements will become tougher: men will retire at 65, and women at 60, while they will need to accumulate 30 pension points and 15 years of insurance experience. But if you meet a few more conditions, you can start receiving a pension earlier.

/prava-uchebnik/

Course: how to protect your rights at work

According to the length of service , for example, state civil servants, military personnel, citizens from among astronauts and flight test personnel can retire.

Federal civil servants are officials who have entered into a service contract with the Russian Federation through federal authorities.

Art. 10 of the law "On the system of public service of the Russian Federation"

They have a class rank, they wear a uniform, they receive a salary from the federal budget. The positions of federal civil servants are indicated in a special register.

The service pension for civil servants is not an early pension, but an additional one, in addition to the old-age pension.

Clause 1.1, Art. 7 of the Law "On State Pension Provision in the Russian Federation"

As a general rule, it cannot be obtained separately. But there is an exception. In order for federal government civil servants to be able to apply for a superannuation pension, regardless of whether there is an old-age pension, they must meet two conditions:

Both civil servants of the subjects of the Russian Federation and municipal employees can retire according to the length of service. The procedure for calculating the experience of municipal service is established by the regions.

The procedure for calculating the experience of municipal service is established by the regions.

Art. 25 of the law "On municipal service in the Russian Federation"

Military personnel are officers, sergeants, cadets, soldiers who serve in the Armed Forces of the Russian Federation under a contract, the National Guard, the FSB and other law enforcement agencies. For them, the superannuation pension replaces the old-age pension.

Art. 2 of the law "On the status of military personnel"

To receive a military pension, you must serve at least 20 calendar years, including preferential ones.

The procedure for calculating length of service

Grace years are when length of service is counted not one to one, but, for example, a year for two. This is possible not only because of service in harsh climatic conditions, but also in certain positions. For example, in positions of the Airborne Forces, where you need to systematically jump with a parachute, a month is considered one and a half.

Astronaut citizens are:

Early retirement is due to men who have worked for 25 years in any of these positions, and to women who have worked in them for 20 years. At the same time, men must work in a flight test unit for at least 10 years, women - at least 7.5.

Art. 7.1 of the Law "On State Pension Provision in the Russian Federation"

Experience is calculated as two months. And if an astronaut is in space, then a month of stay there is considered as five months of work.

Regulations on the provision of pensions for cosmonauts in the Russian Federation

If the cosmonauts, due to health reasons, can no longer work, then men can retire after 20 years, and women after 15.

If the cosmonaut died, his wife, children and parents of retirement age can receive a survivor's pension.

Citizens from among the employees of the flight test personnel are:

Regulations on the procedure for assigning and paying pensions for years of service to flight test personnel

They are granted a service pension only together with an old-age pension. You won't get it before the time.

Conditions for assigning pensions to citizens from among the employees of the flight test staff

The length of service for each category of employees is calculated differently. For example, for pilots, a year is considered two if they have been conducting flight tests all this time.

But in any case, for the right to a service pension, the total length of service for men must be 25 years, for women - 20 years.

If you had to leave flight work for health reasons, then the right to a service pension will be with at least 20 years of service for men and at least 15 years for women.

By experience. You can get an old-age pension 2 years earlier if you have a long work experience: for men - 42 years, for women - 37 years. At the same time, a man must be at least 60 years old, a woman - 55 years old.

Part 1.2 Art. 8 of the Law "On Insurance Pensions"

When working in hazardous conditions (list No. 1). Men can retire at 50, women at 45 if they have worked in underground jobs, jobs with harmful working conditions and in hot shops from list No. 1.

| Work experience in hazardous conditions | General insurance experience | |

|---|---|---|

| For men | 10 years old | 20 years old |

| For women | 7 years and 5 months | 15 years old |

Work experience in harmful conditions

for men

10 years old

for women

7 years and 5 months

Total experience

for men

20 years 9000 years

for women

15 years

If men and women have worked half or more of the length of service in harmful conditions, then each year of such work reduces the retirement age.

| Length of service for a man | Retirement age of a man | Experience for a woman | Woman's retirement age |

|---|---|---|---|

| 5 years | 55 years old | At least 3 years and 9 months | 52 years old |

| 6 years | 54 years old | 4 years | 51 years |

| 7 years | 53 years old | 5 years | 50 years old |

| 8 years | 52 years old | 6 years old | 49 years old |

| 9 years old | 51 | 7 years old | 48 years old |

| 10 years | 50 years old | 7 years and 6 months | 45 years old |

Retirement age for a man depending on work experience in hazardous conditions:

A woman's retirement age depending on the length of service in hazardous conditions:

When working in difficult conditions (list No. 2) men can retire at 55, women at 50. To do this, they must work in jobs with difficult working conditions from list No. 2.

| Experience in difficult conditions | General insurance experience | |

|---|---|---|

| For men | 12 years and 5 months | 25 years old |

| For women | 10 years old | 20 years old |

Work experience in difficult conditions

for men

12 years and 5 months

for women

10 years

Total experience

For men

25 years

For women

20 years

reduce the retirement age by one year.

| Length of service for a man | Men's retirement age | Length of service for a woman | Woman's retirement age |

|---|---|---|---|

| At least 6 years and 3 months | 58 years old | At least 5 years | 53 years old |

| At least 7 years and 6 months | 57 years old | At least 6 years | 52 years old |

| At least 10 years | 56 years old | At least 8 years | 51 |

| 12 years and 6 months | 55 years old | 10 years old | 50 years old |

The retirement age of a man depending on the length of service in hazardous conditions:

A woman's retirement age depending on the length of service in hazardous conditions:

When working in the Far North , men can retire at 60, women at 55. For this, work experience in the regions of the Far North must be at least 15 years, and in areas equated to them - 20 years. The total experience for men should be 25 years, for women - 20 years.

There are different options for those who have worked in the north.

What to do? 06/24/20

How to pass a medical examination for work in the Far North?

Those who have worked in the regions of the Far North for at least 7 years and 6 months are assigned a pension with a decrease in age by 4 months for each full year of work in these regions.

A woman who has given birth to two or more children and has worked for more than 12 years in the regions of the Far North or at least 17 years in equivalent areas can retire at 50 years old. The total experience must be at least 20 years.

Those who permanently reside in the regions of the Far North and equivalent areas and have worked as reindeer herders, fishermen, and hunters can also retire early. Men - at 50, women - at 45. To do this, men must work for at least 25 years, women - 20 years.

In case of liquidation of an enterprise or reduction of personnel, if you cannot find another job, you can retire two years before retirement age. In 2023 for men - at 62 years old, for women - at 57 years old. The insurance period must be at least 25 years for men and 20 years for women.

Art. 32 of the Law "On Employment in the Russian Federation"

Law No. 153-FZ "On Amendments to Certain Legislative Acts of the Russian Federation"

For the unemployed of pre-retirement age , the right to early retirement will appear if the following conditions are met:

Part 3 35 of the Law "On Insurance Pensions"

Appendix No. 3 to the Law "On Insurance Pensions"

How to get rich

The main materials about everything that affects your money and life are in your mail on Wednesdays and Saturdays. Free of charge

Civil aviation workers can retire earlier.

| Job/occupation | Beneficial work experience | General insurance experience | Retirement age |

|---|---|---|---|

| Flight personnel | 25 years for men, 20 years for women | Not important | Regardless of age |

| When dismissed for health reasons: 20 years for men, 15 years for women | |||

| Aircraft Flight Control | 12 years and 5 months for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Aircraft maintenance engineer | 20 years for men, 15 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

Aircrew

Beneficial work experience

25 years for men, 20 years for women

Upon dismissal for health reasons:

20 years for men; 15 years - for women

Total insurance experience

does not matter

,retirement age

, regardless of the age of

, air vessels

Preferential work experience

12 years and 5 months - for men for men for men , 10 years - for women 9Ol000

Beneficial work experience

20 years for men, 15 years for women

Total insurance experience

25 years for men, 20 years for women

Retirement age for men 9002. 5 years years - for women

5 years years - for women

Secret service workers. Former employees of the Federal Penitentiary Service, the State Fire Service, rescuers of the Ministry of Emergency Situations can retire early.

| Work / profession | Beneficial work experience | General insurance experience | Retirement age |

|---|---|---|---|

| Rescuers in professional emergency rescue services, units of the Ministry of Emergency Situations, participants in emergency response | 15 years old | Not important | 40 or later |

| Workers and employees in places of deprivation of liberty | 15 years for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Fire, fire fighting and emergency services | 25 years old | Not important | 50 years old |

Rescuers in professional emergency rescue services, EMERCOM formations, emergency response participants

Preferential work experience

years

yearsTotal experience

,ATSISE

Pensions

40 years old or later 4000 40 years old or later

Workers and employees in places of deprivation of liberty

Preferential work experience

15 years for men, 10 years for women

Total insurance experience

25 years-for men, 20 years-for women

Pension age

55 years old-for men, 50 years-for women

Fire guard, fire and rescue services

Blessed work experience

25 years

Total insurance experience

Does not matter

Retirement age

50 years

For example, for 2023, the experience of a school teacher is 25 years. He cannot immediately apply for a pension - he will have to wait 5 years. The teacher will need to apply for a pension in 2028.

He cannot immediately apply for a pension - he will have to wait 5 years. The teacher will need to apply for a pension in 2028.

Health care workers must have worked for at least 25 years in rural areas and urban-type settlements, or at least 30 years in cities, or at least 30 years mixed - in cities, rural areas and urban-type settlements. Then they will be able to retire earlier than the generally established age.

The list of positions that are eligible for early retirement includes nurses.

Like teachers, medical workers will be able to apply for a pension not immediately after completing the required length of service, but after 5 years.

Artists of theaters or theater and entertainment organizations can also retire early in the same order as teachers and doctors - 5 years after the required work experience has been completed.

List of professions and positions of employees of theaters and other theatrical and entertainment enterprises who are entitled to a retirement pension

Mothers of many children, who gave birth to three or more children and raised them up to 8 years old, can also count on an early pension. In this case, the woman’s insurance experience should be 15 years, and the pension coefficient should be from 30 points.

In this case, the woman’s insurance experience should be 15 years, and the pension coefficient should be from 30 points.

| Number of children | Retirement age |

|---|---|

| 3 | 57 years old |

| 4 | 56 years old |

| 5 or more | 50 years old |

The number of children

Pension age

3

57 57 years

4,0002 56 years old

5 and more a pension if the father's insurance record is at least 20 years, and the mother's is 15 years. A pension can be issued either by a father at 55, or by a mother at 50.

Disabled people and their caregivers can also retire early.

/socstrah/

What benefits from the state are due to people with disabilities

| Type of disability | General insurance experience | Retirement age |

|---|---|---|

| War trauma | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| By sight, with the first group of disability | 15 years for men, 10 years for women | 50 years for men, 40 years for women |

| Due to pituitary dwarfism and disproportionate dwarfism | 20 years for men, 15 years for women | 45 years for men, 40 years for women |

War trauma

Total insurance experience

25 years - for men, 20 years - for women

Pension age

55 years - for men, 50 years - for women

, with the first disability group

Total insurance record

15 years for men, 10 years for women

Retirement age

50 years for men, 40 years for women

0024

Total length of service

20 years for men, 15 years for women

Retirement age

45 years for men, 40 years for women

children with disabilities. In their case, it happens like this: the retirement age decreases by a year for every 1.5 years of guardianship, but no more than 5 years in total. At the same time, men must have at least 20 years of insurance experience, and women - at least 15 years.

In their case, it happens like this: the retirement age decreases by a year for every 1.5 years of guardianship, but no more than 5 years in total. At the same time, men must have at least 20 years of insurance experience, and women - at least 15 years.

Who else. Early retirement is assigned to many more people - the list of positions and jobs is directly indicated in the law "On Insurance Pensions".

| Job/occupation | Length of service | General insurance experience | Retirement age |

|---|---|---|---|

| Tractor drivers in agriculture, other sectors of the economy, drivers of construction, road and loading and unloading machines | 15 years old | 20 years old | 50 years - for women. This benefit is not available to men |

| Work in the textile industry with increased intensity and severity | 20 years old | Not important | 50 years - for women. This benefit is not available to men This benefit is not available to men |

| Workers of locomotive crews, workers in the organization of transportation and traffic safety in railway transport and the subway, truck drivers in mines, cuts, in mines or ore quarries for the export of coal, shale, ore, rock | 12 years and 5 months for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Work in expeditions, parties, detachments, at sites and in brigades on field geological exploration, prospecting, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work | 12 years and 5 months for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Workers, foremen in logging and rafting | 12 years and 5 months for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Mechanics of complex crews at loading and unloading operations in ports | 20 years for men, 15 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Work as a seafarer on ships of the sea, river fleet and fishing fleet | 12 years 6 months for men, 10 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Drivers of buses, trolleybuses, trams on regular urban passenger routes | 20 years for men, 15 years for women | 25 years for men, 20 years for women | 55 years for men, 50 years for women |

| Work in underground and open pit mining in the extraction of coal, shale, ores and other minerals, in the construction of mines and mines | At least 25 years old | Not important | Regardless of age |

| Longwall miners, drifters, jackhammers, mining machine operators | At least 20 years | Not important | Regardless of age |

| Work on ships of the sea fleet of the fishing industry for the extraction, processing of fish and seafood, acceptance of finished products in the fishery, on certain types of ships of the sea, river fleet and fleet of the fishing industry | 25 years for men, 20 years for women | Not important | Regardless of age |

Tractor drivers in agriculture, other sectors of the economy, drivers of construction, road and loading and unloading machines 9for women This benefit is not available to men

Work in the textile industry with increased intensity and heaviness of

Work experience

20 years

Total experience

does not matter

Pensions

50 years - for women. This benefit is not available to men

This benefit is not available to men

Workers of locomotive crews, employees in the organization of transportation and traffic safety in railway transport and subway, drivers of trucks in mines, open pits, in mines or ore quarries for the export of coal, shale, ore, work, rocks

12 years and 5 months for men, 10 years for women

Total insurance experience

25 years for men, 20 years for women for women

Work in expeditions, parties, detachments, at sites and in teams on field exploration, prospecting, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work

Work experience 502 months and

men, 10 years for womenTotal insurance experience

25 years for men, 20 years for women

Retirement age

55 years for men, 50 years for women

Workers, masters in logging and forestry

Work experience

12 years and 5 months - for men, 10 years - for women

Total experience

25 years - for men, 20 years - for women

End of retirement

55 years-for men, 50 years-for women

Metacuers of integrated brigades for loading and unloading in ports

Work experience

20 years-for men, 15 years-for women 9Ol000 fishing fleet

Length of service

12 years 6 months for men, 10 years for women

Total insurance experience

25 years for men, 20 years for women

Retirement age 000355 years old - for men, 50 years old - for women

Drivers of buses, trolleybuses, trams on regular city passenger routes

Work experience

20 years - for men, 15 years - for women

Total insurance insurance

25 for men, 20 for women

Retirement age

55 for men, 50 for women other minerals, in the construction of mines and mines

Work experience

at least 25 years

Total insurance experience

does not matter

Pension age

, regardless of the age of

Mining of treatment plants, passers for chipped hammering hammers, mining drivers of reinforcing vehicles

Length of service

At least 20 years

Total insurance experience

Does not matter

Retirement age

Regardless of age

Work on the vessels of the Marine Fleet of the fish industry for extraction, processing of fish and seafood, receiving finished products in fishing, on certain types of vessels of the sea, river fleet and fleet of fish industry

Work experience

25 years - for men, 20 years - for men, 20 years years for women

Total length of service

Does not matter

Retirement age

Regardless of age

To retire earlier, you need to earn the length of service necessary for the profession or work. It will include periods when a person worked, was on sick leave or cared for a child, but not more than 6 years.

It will include periods when a person worked, was on sick leave or cared for a child, but not more than 6 years.

Rules for calculating and confirming the insurance period

You should apply to the Social Fund of Russia at the place of residence or to the MFC. You can apply at any time after you have accumulated the required experience.

To apply for a pension, you need to submit an application for its appointment. It is necessary to attach a passport, SNILS and a work book to it.

The SFR has all the information about the length of service, as employers annually submit a corresponding report there. If the SFR suddenly did not have information about the length of service, then they can confirm it:

/npo/

How to get two pensions

All documents that confirm periods of work must have a number and date of issue. They should indicate the full name of the future pensioner, his date of birth, place of work, period of work, profession.

Application form can be downloaded from the FIS website.

May also need:

The application will be considered within 10 business days. The pension will be assigned from the day of applying for it, but not earlier than the day when the right to a pension appeared.

Before the date of application, a pension can be granted if the application was made within 30 days from the date of dismissal. In this case, the pension will be assigned from the day following the day of dismissal from work.

/prava/pensiya/

Rights of pensioners by age

The Social Fund may refuse to pay early pension if there is not enough special experience. Or if the applicant did not submit documents confirming the length of service, and the SFR does not have information that the applicant worked in such and such a place.

The formula for calculating pension payments in the general case is as follows:

Fixed payment + IPC × IPC cost.

The amount of fixed payments and the number of points are different for everyone. For example, in 2023 the generally established fixed payment is 7567.33 R, and for those who have worked in the regions of the Far North for 15 years and have no dependents - 11 350. 99 R.

99 R.

/guide/skolko-pensiya/

How to calculate old age pension

For those who retire on a seniority basis, the formula is different. It depends on the salary while working. For example, astronauts are paid 55% of their salary.