Retirement can mean many things for people. Some look forward to the free time in hand. Some worry about how they will manage to meet ends. Others wonder how they will pass their time. If planned properly, retirement can be a great phase in a person’s life. Here are 5 steps to take before retirement and what to do after retirement in India that can help you have a healthy happy retirement phase.

Image courtesy of debspoons at FreeDigitalPhotos.net

Read – Is Rs 1 Cr enough for your retirement?

5 Steps for Happy Retirement – Before you Retire1) Plan for your income post-retirement –Once you retire, you will not have your regular source of income. You need to plan beforehand on how to take care of your expenses

post-retirement. Decide on investments that will give you regular returns. Your wealth and returns should be such that they take care of living expenses taking inflation into account.

You could start a side business before retirement or make the arrangements for the same so that you can work post-retirement. Else you can equip yourself with some skills or brush up on your existing knowledge and skills that can be used post-retirement for earning income.

If you have your income post-retirement sorted, you will be less stressed. You know you can take care of your expenses and fund your lifestyle and also take care of emergencies.

Your investment portfolio should be such that it is diversified and protected from risks in different markets. It should be a mix of debt and equity-related investments, commodities, and real estate.

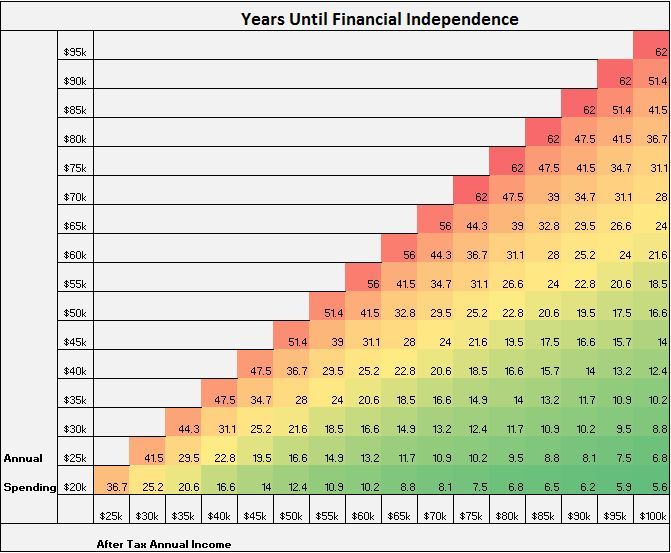

2) Decide when to retire and take appropriate steps –When you are earning, have a plan as to when to retire and what to do after retirement.

Many people will not be able to choose when to retire. But if you do get a choice as to when to retire, you will be happier as you will feel you are in charge.

When you are working, you have a sense of purpose. You have many things to do, places to go, and people to interact with. This will not be the case during retirement. Some might get depressed that they are being unproductive or not sought by people. You have to prepare yourself for a less hectic life. Make sure you have something to do during retirement. You should also have a social life. Looking forward to doing something that you like and engaging with people will keep you enthusiastic.

Set up your retirement goals. They cannot be vague like ‘I will enjoy life’ or ‘I will provide for my children.’ They have to be concrete. Some examples –

– Buy a house for retirement in my hometown

– Spend Rs. 1,00,000 per year on vacation.

You can set short-term, medium-term, and long-term goals. Short-term goals could be to pay off the car loan. Medium Term goals could be to do with children’s education depending on their age. Long Term goals could be building a house or having an appropriate sum in the retirement fund.

It is good to do Estate planning. You should plan on how your wealth has to be distributed. You have to plan for debts to be paid off and how they are to be managed if you are not around.

Check- Retirement Planning Vs Child Future Planning

3) Plan for Appropriate Medical Coverage –Health is Wealth. It is important to be healthy to have an enjoyable retired life. You should take care of your health and also buy health insurance. Buy health insurance when you are young. Your premium will be below and you will get benefits like health regular health check-ups and medical consultation. Apart from health insurance, you should have an emergency fund to cover sudden medical emergencies.

4) Plan for the Unexpected –There can be unfortunate emergencies. There can be a major repair in the house or you need a car for mobility. You or your spouse might have an accident or an illness. Such events can take a toll on you physically, mentally, and financially. It is important to keep some money separately as an emergency fund to take care of such exigencies so that financially you are protected.

It is important to keep some money separately as an emergency fund to take care of such exigencies so that financially you are protected.

Must Read – How do you benefit from long-term orientation in Life and in Investing?

5) Communicate with near and dear ones –If you have a spouse, talk about retirement frankly. You both have to be in it together. You both have to be aware of

If you do not have a spouse, talk about these topics to any other person close to you.

Must Read – 5 Reasons you should not retire

What to do After Retirement In India 1) Be physically and mentally active –You have worked hard all your life. It is time to enjoy the rewards during retirement. Be ready to what to do in retirement. You have time for learning the musical instrument you always wanted or spend time volunteering for a cause close to your heart. You can do all that now.

Be ready to what to do in retirement. You have time for learning the musical instrument you always wanted or spend time volunteering for a cause close to your heart. You can do all that now.

Do not spend all the time idling. Fill your time with hobbies and doing things that interest you. Meet like-minded people. Make sure you keep yourself physically active and mentally alert.

Must Read – When you are not ready for your retirement

2) Have a Schedule –Even if you are retired, it is good to have a schedule. It will help you look forward to something. The schedule can involve work and leisure activities. You should maintain a positive frame of mind and not get bogged down by thoughts that destroy your self-image.

You can make a daily routine and stick to it so that you do not waste away your time. It need not account for every minute of the day but be such that you have some activities to fill your day. If you have a kind of schedule, there are lesser chances of getting bored or depressed.

Check –The 3 Stages Of Retirement

3) Financially Active –You should stick to your budget, Keep a track of your income and expenses. Review your financial plan once in a while. If you have a financial advisor, get help on how to improve returns (beating inflation). You should educate yourself in financial aspects and investment aspects. You may not have had time to educate yourself about finances when you were young. Retirement is a good time to learn and implement what you have learned after discussing with your advisor.

4) Take a part-time job or an income stream –If you are healthy and have an inclination to keep yourself busy, you can take up a job. It can be a consulting role or a part-time job. You can tutor children if you are interested. If you are from the field of finance, you can take up auditing and taxation-related assignments. It will add to your income and keep you active. But no need to take unnecessary pressure if you are financially free.

But no need to take unnecessary pressure if you are financially free.

Check –Are you ready for your Retirement?

5) Make Retirement a Positive Phase of Life –Retirement is a great time to enrich your life. You can travel to different places and understand more about our country and the world. If you are fit, you can try out new experiences. You can start reading and get various perspectives on life. It will improve your vocabulary and keep your mind fresh.

If you have grandchildren, spend time with them. You can otherwise spend some time with younger people around. It will give you a fresh perspective on life. You can learn a lot of things about today’s world.

You can reduce bad habits like smoking and follow good practices such as daily exercise, follow current affairs for time pass, etc.

A healthy mind-fit body and a proper retirement plan will help you look forward to a happy retirement phase. You can be in charge of your retired life and add value to it instead of just allowing life to drift by. Must share your plans or thoughts on happy retirement or if you are already retired “what to do after retirement” in the comment section.

Must share your plans or thoughts on happy retirement or if you are already retired “what to do after retirement” in the comment section.

Previous articleImportance of Financial Planning in Your Life

Next articleWhat is Gratuity & Calculation of gratuity in India?

Hemant Beniwal

Hemant Beniwal is a CERTIFIED FINANCIAL PLANNER and his Company Ark Primary Advisors Pvt Ltd is registered as an Investment Adviser with SEBI. Hemant is also a member of the Financial Planning Association, U.S.A and registered as a life planner with Kinder Institute of Life Planning, U.S.A. He started his Financial Planning Practice & TFL Guide Blog in 2009. "The Financial Literates" is a dream & mission to make Indians Financial Literate.

com

comToday, being safe is being happy. Your retired life, too, can be H.A.P.P.Y. Here’s how.

H: Have A Plan

Your retired life may be longer than you think. According to data from the World Bank, life expectancy for India in 2019 was 69.7 years; almost 15 years more than what it was in 1980. A longer lifespan is great news, but it also means a longer retired life, and that much more planning is now required during your earning years to sustain post-retirement living expenses.

Clearly, the data point indicates the need for one to plan for retirement. So start planning. No plan is perfect, but having a plan is non-negotiable. And the discipline to keep revisiting the plan, and adapt it to one’s changing realities is non-negotiable as well.

A famous quote attributed to the former US President Dwight Eisenhower is, “A plan is nothing, but planning is everything”. This is particularly true when it comes to planning for your retirement. A plan that you draw up today may not be particularly relevant 10 years later due to either increased affluence or inflation or maybe drastically different professional aspirations. What is required is a constant, ongoing process of reviewing what you have saved vis-à-vis what you need and that on-going process is what retirement planning is all about.

This is particularly true when it comes to planning for your retirement. A plan that you draw up today may not be particularly relevant 10 years later due to either increased affluence or inflation or maybe drastically different professional aspirations. What is required is a constant, ongoing process of reviewing what you have saved vis-à-vis what you need and that on-going process is what retirement planning is all about.

A: Assess Your Post-Retirement Lifestyle

The first step in retirement planning is to try and visualise what your retired life will look like. Some broad level questions could be which city one plans to settle in and will it be an owned house or rented accommodation. These might seem like questions that are too “far off” for you to be able to answer with precision. And that is a valid point. However, remember the earlier point about planning being an on-going process. So, start with some “best estimates” and as you keep moving closer to retirement, you can fine tune these estimates to get better precision.

However, the first step has to be about visualising because only then will you be able to set a “how-much-will-it-cost-me” figure to it. Broad expense heads that you should think of are accommodation, food, regular medical spends, and other lifestyle related expenses. The sharper your visualisation, the more granular will be your estimation of expenses of life after retirement. Needless to say, ensure that you factor in inflation when working on this step.

At the end of this step, you should have a rough idea of the monthly expenses that your life after retirement will entail at that time.

P: Project Growth In Savings

Once you have arrived at the monthly expense number, the next step is to arrive at how much your current savings will grow to till the time you retire.

The 5-Step H.A.P.P.Y Way To Plan For A Secure Retired LifeMost of us would have saved up some amount. This could be in deposits, Public Provident Fund (PPF), mutual funds, real estate or the myriad other avenues that are available. Clearly, not all of them will go towards retirement planning. For example, some of these savings may have been made for your children’s education. This step forces us to identify which of our savings will actually go towards funding our life after retirement. Like in the earlier step, there will be an element of estimation involved, but that is exactly the point. The more we think of our investments through the lens of which goal they serve, the greater the chance of our plan meeting its designated goal.

Clearly, not all of them will go towards retirement planning. For example, some of these savings may have been made for your children’s education. This step forces us to identify which of our savings will actually go towards funding our life after retirement. Like in the earlier step, there will be an element of estimation involved, but that is exactly the point. The more we think of our investments through the lens of which goal they serve, the greater the chance of our plan meeting its designated goal.

Having identified that part of your savings that are meant for retirement, you will now need to project how much this will grow. In the earlier step, you assumed your expenses to grow at the rate of inflation. In this step, you will assume that your savings will grow at a certain rate.

P: Perfect Plans For Retirement

By now you have a fairly clear idea of what your life after retirement is going to cost you. You also have a fair idea of how much your current savings will grow to and thus address a part of your post-retirement expenses. What remains is the step of bridging the gap.

What remains is the step of bridging the gap.

For example, if your estimation tells you that life after retirement is going to cost you Rs 50,000 per month and that that your current savings will provide for Rs 30,000 per month, the ask is to plan for the balance Rs 20,000 per month.

Once you have a clear understanding of the deficit, the next step is to identify the right plan to help you bridge that gap. There are many investment routes you can take to secure a retirement plan. Which plan you choose to take depends on investment outlook, risk appetite and the amount that you can start setting aside.

One of the types of plans to secure retirement income is an annuity plan. An annuity plan ensures a guaranteed regular flow of income throughout your retirement years.

An immediate annuity plan is where you begin receiving a pension almost immediately after you have invested in the said annuity product. This is relevant for people who are on the verge of retirement or have already retired. A deferred annuity plan allows you to invest today to start getting a retirement income in future. Typically, you can choose to start the income after a period of up to 10 years.

A deferred annuity plan allows you to invest today to start getting a retirement income in future. Typically, you can choose to start the income after a period of up to 10 years.

The key feature of annuity plans is that the guaranteed income will continue for your entire life.

Y: “Your Time”

Last but not the least, it is important to remember that retirement time is “Your time”. All the things you have sacrificed during your working years-- passions, hobbies, friendships and relationships--retirement is the time to reclaim all of those.

Financial planning is an important part but definitely not the only part to be planned for. Planning holistically for your retirement and what you want to do in that chapter of life will ensure that you approach it with a sense of joy and anticipation which is exactly how it should be.

Disclaimer: The views are that of the individual and do not necessarily reflect the views of the organisation. Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)

Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)

The author is Head of Products, ICICI Prudential Life Insurance.

India is an unusual country that attracts with contradictions. There are unimaginable contrasts and an eclectic mix of cultures. There is a beach holiday, but you can also go to the mountains or surfing, clubs and discos. You can see the slums and luxurious palaces. People here don't seem to be in a hurry. The rhythm of life is very measured - especially for those who come from noisy cities.

Surprisingly paradoxical past of the state and its incredibly mysterious spirit attract many tourists. But compatriots come here not only to relax. Some set out to settle here for a long time. There are many reasons for this - someone is interested in low prices, someone likes the climate.

It is noteworthy that the Indians are a very simple people. They are smiling, friendly and ready to help. But is it worth moving? How do ordinary people live in India?

They are smiling, friendly and ready to help. But is it worth moving? How do ordinary people live in India?

First impressions are often misleading. This definitely applies to living in another state. After all, if you are a tourist, you can see one side of life in India. Guests receive quality service that meets European standards. However, only moving to permanent residence allows you to understand what the living conditions really are here.

The climate in the country is not at all the same as in Russia. The weather is also determined by the location of the region - it is different in different places. In the center, for example, it is never cold. Almost all trees retain foliage throughout the year. The average temperature in the southern part of the state is +30°C degrees. And not everyone can withstand such heat.

Almost all trees retain foliage throughout the year. The average temperature in the southern part of the state is +30°C degrees. And not everyone can withstand such heat.

But climate is not the only criterion that determines how ordinary people live in India. The “land of contrasts” is literally “entangled” with stereotypes, conjectures, various beliefs. And many of them are very persistent. But a number of myths are important to debunk. These include, for example, such performances:

Everything is very relative and depends on the specific area. In some regions there is no devastation and dirt - people take care of the adjacent territories. This is especially true for those involved in the hotel business. There are, of course, places where even an urn is hard to find. But it's not so far everywhere. And in Goa, in general, all the streets are washed and cleaned - so that tourists feel as comfortable as possible.

It is possible to meet men in kurtas and turbans on the street. You can see beautiful saris on women. But then again, not everyone is like that. If you take young people, they are more comfortable in jeans, comfortable shoes such as sneakers. And yes, they wear whatever they want. There are shops with clothes from Europe. As for traditional costumes, they are more appropriate for various festivities, and not in everyday life.

Send request

All fields are required

Dudhsagar Falls is the largest waterfall in India. Located in a natural park - the largest in Goa. The road runs through the tropical forests, in the real jungle, which is home to many animals and birds. You can get to it only by special transport (jeeps). The jets fall from a height of 300 meters and are white in color. There is a romantic legend explaining this feature.

The jets fall from a height of 300 meters and are white in color. There is a romantic legend explaining this feature.

In fact, you can easily taste a chop or a steak here. Beef is not illegal, but it is illegal to kill cows, and then only in some northern and western states. But if we talk specifically about vegetarian dishes, they are incredibly tasty in India. Many tourists note that they practically did not eat meat during their holidays. And this did not worsen their well-being.

Do not think that every resident regularly practices yoga or knows all the subtleties of Ayurvedic teachings. Here you can meet professional yoga instructors, but often they are monks of Hindu temples or even foreigners who want to earn extra money.

Of course, this state is more religious than any European. But there is as much spirituality in their culture as in the cultures of other countries. Usually, locals are very careful about their rituals, religious traditions - but there is no question of any fanaticism.

It may be so, but for the local population. By the standards of Indians, truly beautiful women are slightly overweight. They do not have any dietary restrictions. To those "ideals" to which the Russians are accustomed, Indian film actresses are as close as possible.

Emigration to India is a frequent occurrence - after all, the Russian diaspora here is more than 2,000,000 people. Most often they move to cities such as Bangladesh and Delhi. But before you decide to take this step, you should soberly assess your capabilities. This applies to many things - for example, language. Many migrants talk about how important it is to know English in order to emigrate here. However, even excellent possession of it is not a guarantee that everything will turn out exactly the way the moving person wants. The official languages in India are English and Hindi, but it should be remembered that 477 languages are spoken here. And the number of dialects exceeds 2000!

In addition, you will have to collect the documents that you will need for the move. And there are several schemes that allow you to legally settle in Indian territory:

These options allow you to go to India and stay there for several years, and you do not need to make a residence permit or permanent residence. Although some citizens live on a tourist visa for 5 years. But the standard tourism pass, if issued for the first time, allows you to stay in the country for six months. 1-2 times a year you can travel to a neighboring state, but you must definitely go back, otherwise the rules of presence in the country on a visa pass will be violated. During these six months, you can definitely decide whether to stay here. And during this time, you can take short courses or, for example, a yoga program.

To use the rights that are available to residents of the state, you can make the main documents:

Benefits of issued Adhar card and PAN card to foreigners:

Indian migration legislation regulates the possibility of obtaining 2 types of residence permit:

If a temporary residence permit is obtained for the first time, it is valid for 1 year. But there is no limit on the number of renewals of this document. To extend the residence permit, representatives of the migration authorities bring a petition. It takes up to 10 days to make a decision.

Pikola Lake Palace - the palace of the local ruler was built right in the center of the reservoir. On the surface of the water is a white-stone eastern castle, richly decorated with carvings. Currently, it is rented to tourists and there are about a hundred luxurious rooms inside. One of the James Bond films, Octopussy, was filmed here.

Send an application

All fields are required

Usually, the submission of documentation for opening a residence permit is carried out after crossing the Indian border. The following papers will be required:

When it comes to coming to the country for employment or conducting religious activities, it is not necessary to substantiate financial solvency.

All papers must be translated into Hindi or English. They must also be notarized.

But there is an important point - due to the overpopulation of the country, the local government is not very willing to accept foreign citizens for permanent residence. However, visas for long-term residence are opened without any problems - after all, they do not give an immigrant the right to stay in the state permanently. Therefore, the best option is to first go here on vacation. This is a good way to get acquainted with the culture and other features of the country, evaluate your capabilities and understand whether you really want to stay here for a longer period. In addition, it is possible to issue a tourist permit in a short time - even 4 days before a trip abroad.

This visa is called the Indian e-visa. She is electronic. The purpose of the trip abroad when applying for this particular permit is tourism, business visit or treatment. The application must be submitted a maximum of 4 months and a minimum of 4 days before the date of arrival. Such a visa is valid for 2 months - it involves 2 visits to the state, but if this is a trip for medical purposes, then there may be 3 visits. The entry corridor is 120 days. The pass begins to be valid from the moment you cross the border, which distinguishes the Indian e-visa from standard permits - their validity begins when the document is issued. This means that a traveler who received a permit by e-mail on September 1 has the right to cross the border on any of the days from September 1 to January 1. And after entering, you can stay in the country for as many days as it is written in the visa.

To open an electronic document, fill out a questionnaire on the website of the Embassy of India. You will also need to pay a consular fee - it is 35 USD. The answer comes, as a rule, in 4-5 working days. The permit you receive can simply be printed out and taken with you on your trip. Upon arrival, it is shown to border control officers, but you will also have to be fingerprinted.

It is important to remember that the passport must be valid for at least another six months from the start of the trip. It must contain at least 2 blank sheets. If they are not there, the issue of obtaining a new foreign identity card should be resolved in advance so as not to get into an unpleasant situation at the border. These sheets are stamped on the basis of the received electronic permit.

Citizens of the Russian Federation can also open a regular tourist visa in advance - it is allowed to stay continuously in Indian territory for six months. This option is often used by those who do not want to stay in Russia in winter. However, it is more difficult to make it. To do this, you will have to visit the consular section of the Indian Embassy. But it is also allowed to apply to an accredited visa center, for example, to the "EVC".

If we look at the statistics, officially there are about 1,000 Russian immigrants living on the territory of the state. These include those people who have received permanent residence or resident status. However, according to other sources, many more Russians live there - almost 2,000,000 people.

Mehrangarh Fortress is a huge fortress-palace on top of a mountain. Located in the state of Rajasthan, right above the city of Jodhpur. Construction began in the middle of the 15th century, along with the construction of the city. The walls and gates were erected for several centuries and became simply monumental. Until the middle of the 20th century, local rulers lived in the fortress. Inside there is a museum, palaces and viewing platforms on the city.

Russians settle down, as a rule, in Delhi. It is in the Indian capital that the largest Russian community is located. For more than 10 years, DARS, the Delhi Association of Russian Compatriots, has been working here. Its employees organize Russian holidays, and also teach children the Russian language in schools.

Prices here are characterized by affordability. For example, in terms of rubles, bread costs a maximum of 25 ₽, milk - about 40 ₽, cheese - a little more than 250 ₽, plain drinking water costs up to 30 ₽. In general, food is inexpensive.

The vast majority live on $2 a day. But at the same time, some residents of the country manage to manage even 50 cents a day. But at the same time, the state is in 5th place in the world in terms of the number of billionaires. This only confirms the presence of strong contrasts - given the fact that poverty often reigns on the streets of cities.

Other peculiarities of the Indian way of life should also be kept in mind. For example, there is a very low literacy rate. Local residents usually have neither the money nor the desire to get an education. They have no desire to improve their lives. In mixed families, communication takes place only in Hindi or English - there are no other options. A Hindu is unlikely to learn the language of his foreign wife. These points must be taken into account by an immigrant before moving to a new place.

Apply for a visa

Submit an application

All fields are required

In India, the life of ordinary people cannot be imagined without transport. Only here it is very peculiar - guests have to get used to it. Especially strange at first seems to be a huge amount of motor vehicles and cycle rickshaws on the roads. But there is nothing surprising in this - there are a lot of people here, the climate is quite hot, the streets are narrow, and a liter of fuel costs about 1 USD.

Usually Indians prefer auto rickshaws, but small ones to save money. Pedicabs, like bicycles, are not very popular, because riding them in the heat is a dubious pleasure. Motorcycles are rarely seen - they still belong to luxury items here.

Among the most popular cars are brands of local manufacturers – Mahindra and Tata. A little less often you can see Korean and Japanese cars, for example, Suzuki, Hyundai. Cars of European brands are rare.

In general, the life of the common people in India does not imply owning a car, because it is expensive. In addition, accidents happen here very often, and repairs also entail considerable costs. Therefore, Indians do not really care how their cars look - they can be with crumpled doors, cracked bumpers. And even after an accident, locals can simply leave without sorting things out with each other. The population cannot be called rich, so in most cases there is nothing to take from the culprit of a traffic accident.

If you need to go to another city or state, buses are great for this purpose. Prices for trips, by the way, are very affordable. Since the fleets are the property of the authorities, there is usually nothing to complain about the shuttle buses - they are in very good condition.

If we consider railways and air communication, they are developed at a decent level. By train, you can reach almost any settlement. These trips are inexpensive. But it is better to buy tickets at the tourist ticket offices - there are no long queues there, moreover, it is more likely to get a ticket to a comfortable carriage.

However, if we talk about suburban traffic, then everything is much worse with it. The level of service here is low, guests are not advised to travel in such trains.

Many are interested in how Indians live in their age - do they receive a pension, can they count on any benefits. Pension payments are due only to those citizens who have worked for more than 40 years in the public sector or in military service. However, even in this case, people receive minimal benefits. To live in the country on only one pension is, in fact, to be a beggar. In addition, the bulk of the population simply does not receive it.

This naturally raises another question - how then do people live in India now if they do not work in the civil service or in the army? They either work in international firms, corporations, or have sources of passive income.

It is noteworthy that in 2004 the state began to carry out social reform, designed to divide the pension into 2 parts: mandatory taxes for employers and voluntary contributions. There are no results from these actions at the moment. This reform affected only 1% of local workers.

Do you have any questions or do you need competent help in preparing the documentation? Experienced specialists of the United Visa Application Center are ready to start working on your request today!

Red Fort in Agra is a grandiose fortress built of red sandstone. Located in Agra, it is one of the two most significant attractions in the region. It was built by several generations of the Great Mughals, the beginning of construction is attributed to the middle of the 16th century. Inside the impregnable walls is a whole complex of buildings, palaces and parks. Included in the UNESCO World Heritage List.

one / 3

Hampi

Hawa Mahal

Qutub Minar

Article rating:

Head of production department for the city of Krasnodar, traveler and visa expert with 4 years of experience in the company.

How to apply for a visa for Russians to travel to Portugal in 2022

visa -free countries for Russians in 2022: TOP 5

Rules for entry into the UAE

Visa registration in Latvia in 2022

Getting a visa to the UK

Which countries are open for Russians now

Send

By clicking "Submit", you agree to the terms of the Privacy Policy0023

#SchoolTAS

04/26/2019

796

“The land of dreams and romance, unprecedented wealth and unprecedented poverty, luxury and poverty, palaces and shacks, famine and plague, lamps of Alladin, giants cobras and jungle; a country of hundreds of peoples and languages, a thousand religions and two million gods »

— this is how the writer Mark Twain saw India at the end of the of the 19th century . And this is how it appears to the world today...

The first mention of Indian insurance appeared in the works of ancient Indian philosophers, who talked about the redistribution of resources during disasters - fires, floods, epidemics. In this country, one of the first in Asia, the insurance business arose in connection with the development of navigation and trade.

The development of insurance in its modern forms began in the second half of the 19th century. The insurance market of this country developed along with trade and, of course, under the influence of the protectorate of Great Britain, of which India was a colony until 1947. The first colonial insurance company Oriental Life Insurance was established in 1818 . In Calcutta.

The history of Indian insurance has not been without a state monopoly. In 1956 the Government of India issued an Ordinance nationalizing the life insurance sector and established in the same year Life Insurance Corporation (LIC), took over 154 Indian and 16 non-Indian insurers. The period of state monopoly continued until 1999 when the insurance market was reopened to the private sector and foreign investors.

But this happens mainly due to the total number of inhabitants of this country, since only 2.76% of them have life insurance policies.

And the average insurance premium per capita is 55 US dollars .

However, it is expected that in the next five years the compound annual growth rate of this market will be 12-15%.

It can be said that the insurance market in India is mainly focused on life insurance, but other types of insurance related to general insurance have also developed rapidly recently: medical, auto and health insurance.

Representatives of the Indian insurance market attribute the rise in popularity of life insurance to the fact that private companies that entered the country's market at the time of liberalization brought products such as policies with a strong investment component and risk protection. This step eliminated the last lag in competition with banking products - low yields on long-term savings policies.

Cumulative life insurance is one of the main ways to ensure a decent old age in the face of a weak social policy. And here we smoothly move on to the topic of Indian pensions, the situation with which is even more acute than in Ukraine.

In 2018, pensioners in India received from Rs 1000 to 2000 ($15-30 ) per month. The average pension is about $22 and the minimum is $15.

Currently, India does not have a comprehensive welfare system that would protect the country's senior citizens from poverty. All potential pensioners here are divided into three groups - civil servants who are included in the mandatory pension program, the military and all others whose pensions depend on the employer.

There are now about 90 million retirees in India, that is, people who have reached 60 years (the retirement age is the same for men and women). According to some estimates, by 2050 their number will already reach 315 million .

Civil servants and employees of companies with more than 20 employees are required to participate in the pension accumulation system. Only 12% 9 can expect to receive a pension0288 of the entire working population of the country, since 433 million Indians work in the so-called "unorganized sector", which includes small companies and all those who receive a daily salary for the amount of work performed.

Pension in India is accumulated in an individual account, which receives a small deduction from each salary of a working person and a similar deduction from the employer's funds. This money is then invested in pension products sold by three public financial institutions elected as the regulator of pension funds. The investment is carried out by one of eight authorized companies, which the employee chooses (but civil servants do not have the right to choose). Since the profitability of products is regulated by the market, a person cannot know exactly how much she will save for her retirement. Also, in case of improper investment or bankruptcy of the company, the future pensioner loses all his savings.

Therefore, most older people try to work until old age. Then the burden of feeding the old falls on their children. And so on in a circle for many years.

It is easier for peasants to survive on their natural economy. But no less significant part works in factories and plants, it is, of course, more difficult for them. The state has special social programs for these segments of the population. This statistic shows India's life insurance market share in FY 2018 broken down by sector and premium type. The state-owned Indian Life Insurance Corporation (LIC) occupies approximately 69.36% market share in total premiums, while the private sector is about 30.64%.

In India, pension accumulation occurs through various instruments: from savings funds to direct contributions. The country also has a National Pension Insurance System, in which all citizens aged from 18 to 55 years old can participate. Each participant undertakes to transfer a certain amount (about 100 dollars per year minimum). The national system links employers, banks and post offices, thereby speeding up the transfer of funds. If a participant fails to pay the minimum amount, they will be charged a penalty and their account will be frozen.

It's simple. When no one in your environment has received this pension for many years, it is hard to believe that someday you yourself will receive it.

Various pension programs in India cover a total of 58 million people, and 88% working citizens do not participate in the pension system.

The situation will break down no earlier than those citizens who start to retire and receive real money who worked before retirement age in the public sector and in those rare industries where white wages are paid, as well as those who saved money during their working age to savings funds.

Only when at least every third pensioner begins to receive something, the population will have faith in the pension.

The future for the life insurance industry in India looks promising, but subject to changes in the regulatory framework, will lead to further shifts in how the industry conducts its business and interacts with its customers.

India's insured population is expected to reach 750 million in 2020 . In addition, life insurance is projected to account for 35% of total savings by the end of this decade.

Demographic factors such as a growing middle class, a young insurance population and awareness of the need for protection and retirement planning are driving the growth of life insurance in India.

Since the film industry in India is one of the largest in the world and one of the most specific, we could not ignore the Indian life insurance videos.