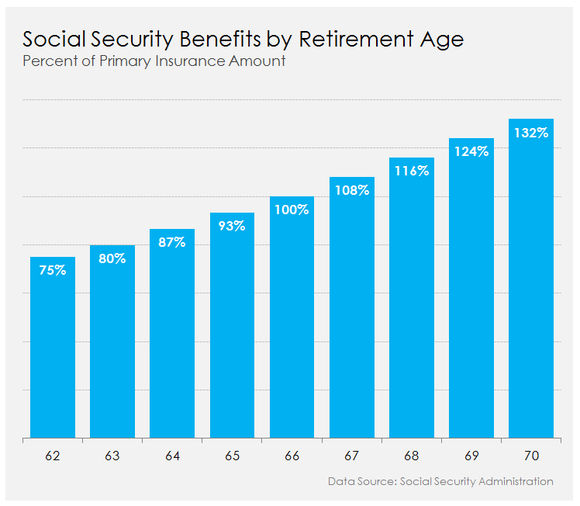

| When To Start Receiving Retirement Benefits Benefit calculators How we calculate benefits | Workers planning for their retirement should be aware that retirement benefits depend on age at retirement. If a worker begins receiving benefits before his/her normal (or full) retirement age, the worker will receive a reduced benefit. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70. | Early retirement reduces benefits | In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. For example, if the number of reduction months is 60 (the maximum number for retirement at 62 when normal retirement age is 67), then the benefit is reduced by 30 percent. This maximum reduction is calculated as 36 months times 5/9 of 1 percent plus 24 months times 5/12 of 1 percent. | Delayed retirement increases benefits | Delayed retirement credit is generally given for retirement after the normal retirement age. To receive full credit, you must be insured at your normal retirement age. No credit is given after age 69. If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start benefits. The calculator below gives you the amount with all credits applied for comparison purposes. Delayed retirement credits increase a retiree's benefits. The table below shows the delayed retirement credit by year of birth. | Compute the effect of early or delayed retirement | If you enter your date of birth and the effective month for beginning your benefits, we will tell you the effect of early or delayed retirement as a percentage of your primary insurance amount. Please note that benefits are generally paid in the month following the effective month.

The month you will reach your normal retirement age is . |

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

If you start receiving benefits early, your benefits are reduced a small percent for each month before your full retirement age.

To find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. This example is based on an estimated monthly benefit of $1000 at full retirement age.

| Year of Birth 1. | Full (normal) Retirement Age | Months between age 62 and full retirement age 2. | At Age 62 3. | |||

|---|---|---|---|---|---|---|

| A $1000 retirement benefit would be reduced to | The retirement benefit is reduced by 4. | A $500 spouse's benefit would be reduced to | The spouse's benefit is reduced by 5. | |||

| 1943-1954 | 66 | 48 | $750 | 25.00% | $350 | 30.00% |

| 1955 | 66 and 2 months | 50 | $741 | 25. 83% 83% | $345 | 30.83% |

| 1956 | 66 and 4 months | 52 | $733 | 26.67% | $341 | 31.67% |

| 1957 | 66 and 6 months | 54 | $725 | 27.50% | $337 | 32.50% |

| 1958 | 66 and 8 months | 56 | $716 | 28. 33%

33% | $333 | 33.33% |

| 1959 | 66 and 10 months | 58 | $708 | 29.17% | $329 | 34.17% |

| 1960 and later | 67 | 60 | $700 | 30.00% | $325 | 35.00% |

| ||||||

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different. It is important to remember:

It is important to remember:

If you decide to delay your benefits until after age 65, you should still apply for Medicare benefits within three months of your 65th birthday. If you wait longer, your Medicare medical insurance (Part B) and prescription drug coverage (Part D) may cost you more money.

If you qualify for benefits as a Survivor, your full retirement age may be different.

Cherkessk, November 8, 2021. On January 1, 2019, Federal Law No. 350-FZ “On Amendments to Certain Legislative Acts of the Russian Federation on the Assignment and Payment of Pensions” came into force, aimed at ensuring a balance and long-term financial stability of the pension system.

Changes approved in accordance with the law fix the generally established retirement age at 65 for men and 60 for women. The increase in the retirement age is gradual and will last until 2028.

At the same time, changes in the retirement age will not affect people who have early retirement benefits. For example, miners, miners, rescuers, as well as other workers employed in difficult, dangerous and harmful working conditions, for which employers pay additional contributions to pension insurance. For the majority of such workers, as before, the right to retire comes upon reaching the age of 45 (list 1) and 50 years (list 2) for women, 50 years (list 1) and 55 years (list 2) for men.

The right to early retirement is also retained by teachers, doctors and representatives of other professions, who receive payments after acquiring the required length of service. At the same time, from 2019, the appointment of a pension for this category of workers is postponed, taking into account the transition period from the moment of acquiring the required length of service by profession.

The right to early retirement is also reserved for persons whose pensions are awarded for social reasons. So, for example, for women with five children, the visually impaired, parents and guardians of the disabled and other citizens, early exit remains completely unchanged.

But there were also norms in the law concerning women who gave birth and raised three and four children, which cause a large number of appeals.

For clarifications, we turned to Irina Tambiyeva, Deputy Head of the GU-OPFR for the KChR.

As Irina Viktorovna explained, according to the amendments and additions made to Article 32 of the Federal Law of December 28, 2013 N 400-FZ "On Insurance Pensions", a mother of three children will be able to retire early at the age of 57, and a mother of four children - at age 56, subject to transitional provisions. The main requirements are 15 years of insurance experience, the required number of pension points and raising a child up to 8 years old.

The main requirements are 15 years of insurance experience, the required number of pension points and raising a child up to 8 years old.

Also in the law there was a norm giving the right to retire 2 years earlier than the generally established retirement age for a long insurance period: for women - 37 years of experience, for men - 42 years of experience.

As before the amendments to the legislation, in order to receive a pension in 2021, the minimum requirements for the length of the insurance period and the number of pension points must be met. The right to a pension this year will be given to people with 12 years of service and 21 pension coefficients.

*For women born in the indicated years, it is advantageous to take out an old-age insurance pension on a general basis.

Please note that the changes in the law do not affect the social disability and survivor's pensions, which are assigned regardless of the generally established retirement age. Citizens who have lost their ability to work retain the right to apply for a pension, regardless of age when establishing a disability group.

If you have any questions, please contact the specialists of the Pension Fund of the KCHR by calling the "Hot Line": 8-800-600-02-91.

Share news

Pension provision of northerners - the Pension Fund of the Russian Federation old age pensions;

Who is entitled to an early appointment of an old-age labor pension for work in the Far North?

This right is granted to:

For citizens who worked in the regions of the Far North and equivalent areas, a labor pension is established for 15 calendar years of work in the Far North. At the same time, each calendar year of work in areas equivalent to the regions of the Far North is considered nine months of work in the regions of the Far North.

Citizens who have worked in the regions of the Far North for at least 7 years 6 months, a labor pension is assigned with a reduction in the generally established retirement age (60 years for men and 55 years for women) by four months for each full calendar year of work in these regions;

Citizens who have worked for at least 15 calendar years in the regions of the Far North or less than 20 calendar years in areas equivalent to them and who have the insurance experience necessary for the early assignment of an old-age pension and the length of service in the relevant types of work, the age established for the early appointment of the specified pension is reduced by five years.

How does the fixed basic labor pension of "northerners" increase?

The FBI old-age labor pension, the FBI labor disability pension and the FBI labor pension in case of loss of the breadwinner "northerners" are increased by the corresponding district coefficient, which is established by the Government of the Russian Federation depending on the district (locality) of residence, for the entire period of residence in these areas (areas) of residence.

If a retiree moves from the Far North to an area with normal climatic conditions, the FBI labor pension, FBI labor disability pension, and FBI labor survivor's pension are subject to revision and are determined without applying the district coefficient.

If a pensioner comes from a region of the Far North to another northern region, where a higher or lower regional coefficient is set for wages, the FBI old-age pension, disability labor song and survivor's pension are subject to change either upwards or downwards decrease depending on the area of the new place of residence.

Citizens who have worked for at least 15 calendar years in the regions of the Far North or at least 20 calendar years in areas equivalent to them, and have an insurance record of at least 25 years for men and at least 20 years for women, the FBI of the insurance part of the labor pension for old age and labor disability pension is set at an increased rate, regardless of the place of residence.

At the same time, they are given the right to choose: an increase by the FBI of the insurance part of the old-age labor pension and the FBI of the labor disability pension using the appropriate district coefficient or the establishment of an increased fixed basic amount of the labor pension.

How is the "northern" length of service taken into account when assigning a pension?

When determining the right to an early old-age retirement pension, the “northern” length of service is calculated in a calendar order, that is, without the use of preferential calculation. The same procedure for calculating the "northern" experience was applied in accordance with the previous legislation, including the pension legislation of the USSR.

In the case of an assessment of pension rights as of 01/01/2002 using paragraph 3 of Article 30 of Federal Law No. 173-FZ dated 12/17/2001, periods of work in the Far North are included in the total length of service in a calendar order.

If the assessment of pension rights as of 01/01/2002 at the choice of the insured person is carried out using paragraph 4 of Article 30 of the Federal Law of 12/17/2001 No. 173-FZ, then the periods of work in the regions of the Far North and areas equated to the regions of the Far North, are included in the total length of service in one and a half size. At the same time, the restrictions provided for in this paragraph are applied to the estimated amount of the labor pension.

In all cases, the assessment of pension rights is carried out taking into account the provisions of the citizen according to the most favorable option for him.

Regional coefficients to the wages of workers in non-productive industries in the regions of the Far North and areas equivalent to them, used in the assessment of pension rights

| Far North regions | District coefficient | |

| 1 | Islands of the Arctic Ocean and its seas Republic of Sakha (Yakutia):

| 2. |

| 2 | Krasnoyarsk Territory:

Murmansk region:

| 1.8 |

| 3 | Republic of Sakha (Yakutia):

| 1.7 |

| 4 | Republic of Komi:

Republic of Sakha (Yakutia):

Krasnoyarsk Territory:

Khabarovsk Territory:

Sakhalin Region:

| 1. |

| 5 |

Republic of Sakha (Yakutia):

Tyva Republic:

Nenets Autonomous Okrug Tyumen Region:

Khanty-Mansiysk Autonomous Okrug Yamalo-Nenets Autonomous Okrug

1 Tomsk Oblast :

| 1. |

| 6 | Republic of Altai:

Republic of Karelia:

Republic of Sakha (Yakutia) Primorsky Krai:

Khabarovsk Territory:

Arkhangelsk region:

Murmansk region Sakhalin Region | 1.4 |

| 7 | Republic of Buryatia:

Republic of Karelia:

Republic of Komi:

Krasnoyarsk Territory:

Amur region:

Irkutsk region:

Trans-Baikal Territory:

Khanty-Mansi Autonomous Okrug: Tomsk region:

| 1. |

| 8 | Republic of Buryatia:

Republic of Komi Primorsky Krai:

Khabarovsk Territory:

Arkhangelsk region Perm region:

| 1. |

| 9 | Republic of Karelia | 1.15 |

Compensation for travel to and from the place of rest

rest on the territory of the Russian Federation and back. Payment of the cost of travel to a place of rest outside the Russian Federation, including to the border of the Russian Federation, is not made.

For compensation, a pensioner can apply once every two years to the Pension Fund of the Russian Federation at the place of residence.

Compensation can be made in the form of: