by Mike

Finding the right tire for your car can be tough, and even tougher to know where it’s coming from. We did the research to help ease that research and decision-making process, finding the tire manufacturers who are making tires right here in the USA. Below are our findings, along with information on how to know where a tire is from, deeper details on each brand, and some information on foreign tire makers that have U.S. facilities. Happy hunting!

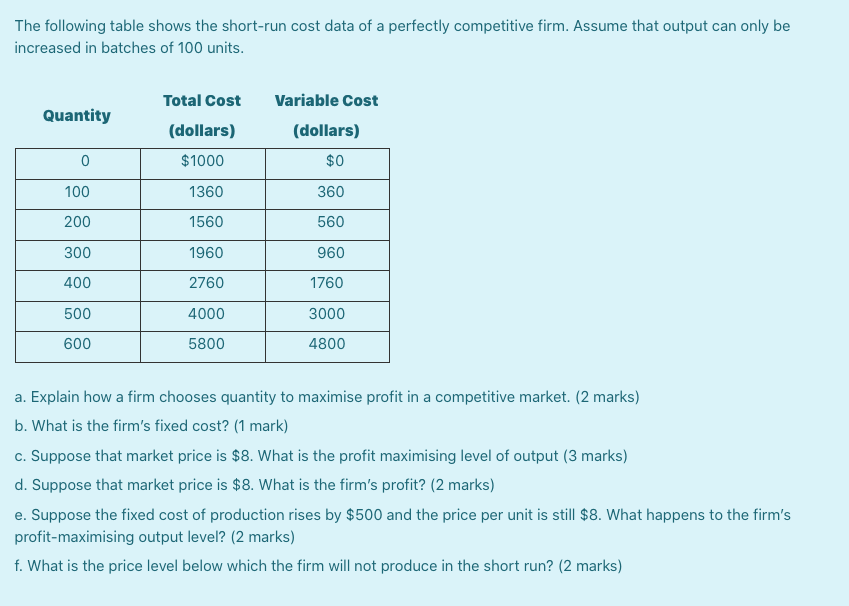

Cooper Tires was founded in Akron, Ohio in 1914 and continues to make many of their tires across a few different plants in the states. They produce tires for a wide variety of (mostly) passenger vehicles, including a series that they call “Discoverer” for SUVs and pickups.

DOT codes for Cooper’s American plants:

3D – Albany, Georgia

U9 – Tupelo, Mississippi

UP – Findlay, Ohio

UT – Texarkana, Arkansas

Mickey Thompson is a subsidiary of Cooper Tires that specializes in high performance tires for street racing and off-road use. They’ve always been about catering their products to automotive enthusiasts, and the quality of their tires and attention to detail really shows it. Their off-road truck tires that they call their “Baja” series are very popular.

Dick Cepek is another subsidiary of Cooper Tires, also specializing in off-road truck tires. They were founded in 1958 by Dick Cepek himself, a huge off-road enthusiast who came up with the idea to make his own tires when he couldn’t find any reliable ones to perform well in extreme environments. Their approach is simple – they only produce three types of tires, but they make them well and have various sizes and adaptations to each style to fit your car or truck.

Their approach is simple – they only produce three types of tires, but they make them well and have various sizes and adaptations to each style to fit your car or truck.

Goodyear is an American staple, founded in 1898 by Franklin Springfield. It’s the official tire of NASCAR and one of the most recognizable brand names in tires. They make tires for a huge variety of passenger, commercial, and competition vehicles. Their Wrangler TrailRunner All-Terrain Tire is a very popular model. It’s extremely versatile and can get you through a variety of conditions, whether you’re in the city or the country.

Here are the DOT codes to identify if your Goodyear tires are made in America:

M6 – Lawton, Oklahoma

MB – Akron, Ohio

MC – Danville, Virginia

MD – Gadsden, Alabama

MJ – Topeka, Kansas

MK – Union City, Tennessee

MM, PJ – Fayetteville, North Carolina

MN – Freeport, Illinois

MP, PL – Tyler, Texas

Carlisle primarily makes tires for the agriculture, farming, and outdoor communities – and they are very good at it. Their trailer tire offers very good protection and durability if you’re hauling something heavy. Carlisle has recently opened up non-US manufacturing facilities, so make sure to check the DOT code on the tire before purchasing.

Their trailer tire offers very good protection and durability if you’re hauling something heavy. Carlisle has recently opened up non-US manufacturing facilities, so make sure to check the DOT code on the tire before purchasing.

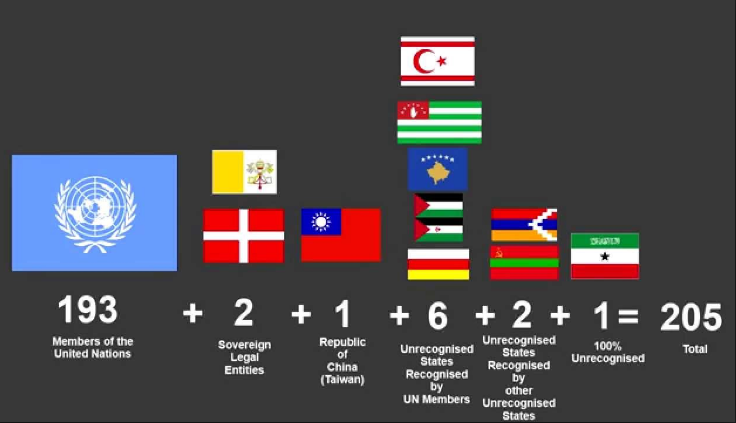

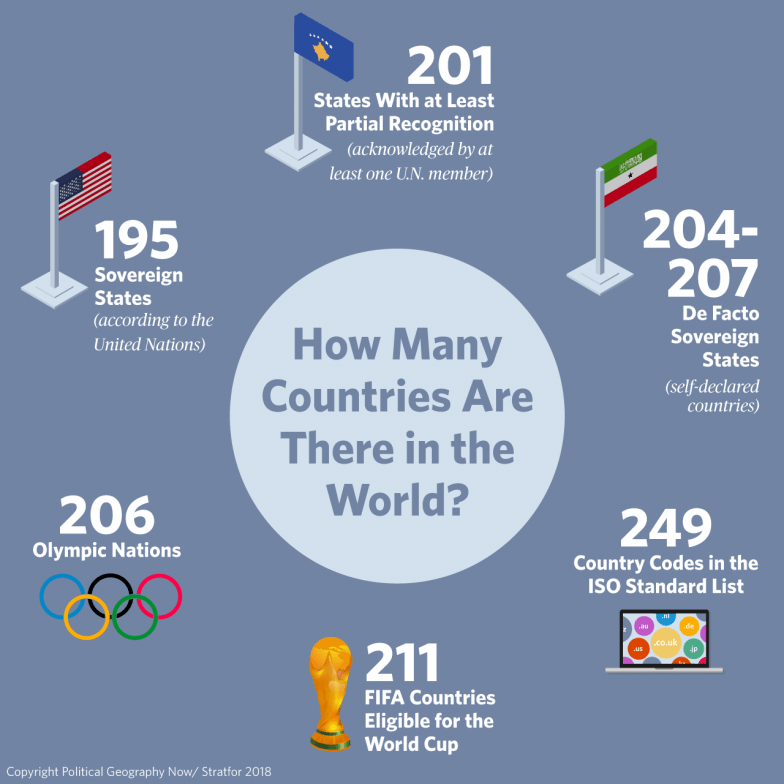

Luckily, identifying whether a tire is made in the USA or not is relatively easy to spot – designating the place of manufacturing on the tire itself is required! You can identify where a tire is manufactured by looking at the DOT (Department of Transportation) code on the side of the tire. After the letters “DOT”, you’ll see the Tire Identification Number (TIN), which has a few components in it (see the graphic). The first ID number after the letters “DOT” identifies the manufacturing plant that the tire came from. We’ve listed those IDs for the American facilities of various tire manufacturers above so you know how to spot American made tires! If you want to look up any other plant codes, Tire Safety Group has a comprehensive list with all codes listed, so you can check that out. The rest of the DOT string identifies tire size, manufacturer, and production date.

The rest of the DOT string identifies tire size, manufacturer, and production date.

Here is some background on the common materials used in tires and whether or not it’s common to find U.S. suppliers for each.

Rubber is the main component of any tire. Most tires are made of a combination of natural and synthetic rubber. So, let’s dive in and learn more about rubber production worldwide and in the United States.

The United States produces around 35 million tons of rubber each year. Although that may seem like a lot, the United States is actually not even one of the top ten rubber producers. Instead, countries like Thailand and Indonesia top the charts – most of the world’s rubber comes from these two countries.

Since, comparatively, the USA doesn’t produce as much rubber as some of these other countries like Thailand, it can be harder to find US-made rubber. However, this doesn’t mean that it’s impossible. There are plenty of rubber-producing companies based in the United States that solely deal with American-made rubber – both natural and synthetic.

Steel is used in tire belts and beads to reinforce the tread and withstand wear.

China is currently the largest steel-producing country, producing just over half of the world’s steel. So, most steel you see on the market will likely come from China. The United States doesn’t fall too far behind in terms of steel production, coming in fourth. Tire companies that care more about the quality of their tires will be more likely to use American steel than Chinese steel, as American steel is three times stronger. So, if you’re looking for a good quality tire, American-made is the way to go. Overall, it shouldn’t be too difficult to find American-made steel as it is superior to Chinese-made steel.

Most tire rubber compounds will include carbon black. Carbon black helps to increase the tire’s lifespan by keeping the heat away from the tread and belts. This material also protects the tire from harmful UV rays.

As with most other materials, carbon black is mostly produced in China. However, the United States is the second-largest producer of this material. So, US-made carbon black is not too difficult to find.

However, the United States is the second-largest producer of this material. So, US-made carbon black is not too difficult to find.

Silica is another compound used in rubber. It is used in tires to help against wet road conditions. Silica also has an incredibly high tear strength.

China produces an estimated 64% of the world’s silica. Other top countries for silica production include Germany and the United States. Although the USA certainly doesn’t produce as much silicon dioxide as China, it is still possible to find American-made silica for tires made in the USA.

Michelin is a French company that is making tires worldwide, and starting doing so in the U. S. in 1950. They have a particularly big production presence in South Carolina.

S. in 1950. They have a particularly big production presence in South Carolina.

Here are their U.S. DOT codes to look out for:

Some of their subsidiaries that they have acquired over the years include companies like: BFGoodrich, Kleber, Kormoran, Riken, Tigar, and Uniroyal.

Continental hails from Germany and got started all the way back in 1871. They didn’t start exploring in the U.S. until more than 100 years later when they bought General Tire & Rubber Company in 1987. Since then, they have put down some roots in the U.S.

Here are the Continental U.S. DOT codes that you can look for:

Pirelli is a double whammy – they are an Italian manufacturer and are owned by a Chinese company called ChemChina. They have a huge footprint across the globe (facilities in 13 countries) and also maintain a few production facilities in the U.S.

They have a huge footprint across the globe (facilities in 13 countries) and also maintain a few production facilities in the U.S.

Here are the Pirelli U.S. DOT codes to look for on their tires:

Dunlop was founded in England in the late 1800’s and is owned by Goodyear. They primarily focus on selling their tires in North America, Australia/New Zealand, and Europe.

Bridgestone comes from Japan, the largest tire manufacturer in that country. They produce all kinds of tires, everything from motorcycles to commercial trucks and passenger vehicles. They expanded into the U.S. in the late 1960’s and have invested heavily in production facilities here.

U.S. DOT codes for Bridgestone tires:

Yokohama is another Japan-based tire manufacturer who is a little less present in the U. S. with only one known manufacturing facility in Salem, Virginia (DOT code is CC). Similar to Bridgestone, they expanded to America in the late 1960’s.

S. with only one known manufacturing facility in Salem, Virginia (DOT code is CC). Similar to Bridgestone, they expanded to America in the late 1960’s.

You’re an American, living in America, and you drive an American car. Naturally, you’d want your car to run on American rubber as well. So, are there still any American tire companies? Why of course, there are still quite a few of them.

We’re going to take a look at these companies. As well as some foreign-owned ones, but of course, they’re still made in the US of A. And we’ll answer some questions you might have about them as well. Here’s the table of contents to make it easier for you to navigate:

Naturally, we’d want to take a look at the “truly” American tire companies. These are the companies that were founded in the USA and don’t have a foreign parent company even to this day:

The Largest Of The American Tire Companies: Goodyear

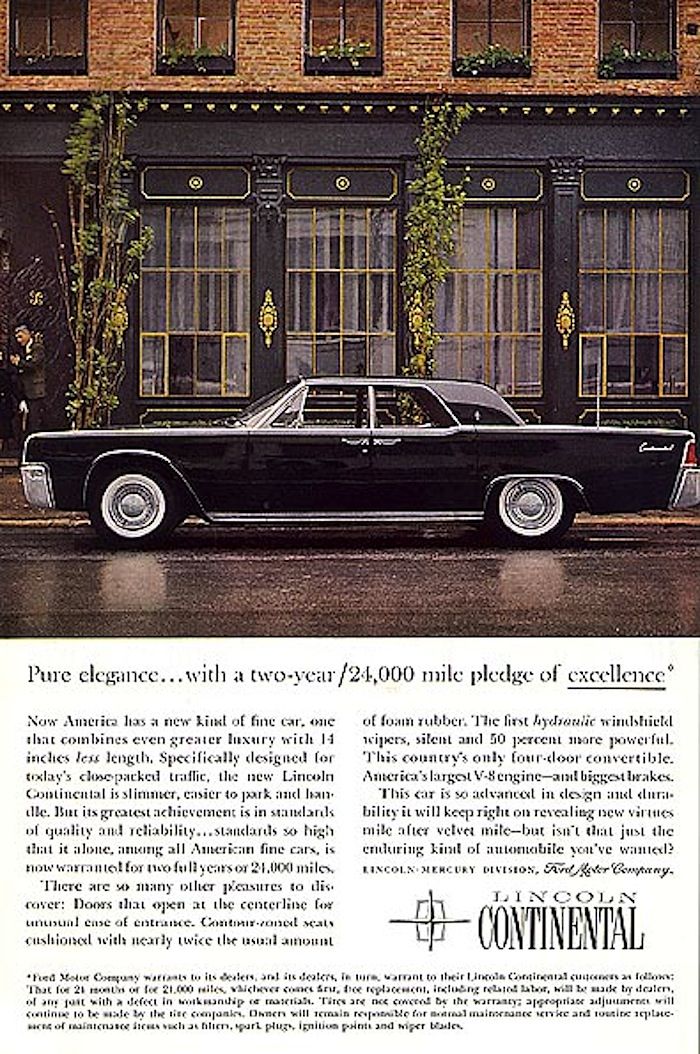

The Largest Of The American Tire Companies: GoodyearOf course, we start with the biggest and most well-known. After all, we’ve all seen the Goodyear blimp, no? Frank Seiberling founded Goodyear Tire & Rubber Company way back in 1898, just a decade after Karl Benz invented the car.

Wait, these early companies are usually named after their founder, no? So, why isn’t it the Seiberling tire & rubber company? Well, the Goodyear name came from Charles Goodyear, the inventor of vulcanized rubber.

Vulcanization is a range of processes for hardening rubbers. To this day it’s still an integral part of modern tire production. So, you can see why they choose this name to honor Charles Goodyear. Anyway, the company has gone global in its 124 years of operation. But its headquarters is still in Akron, Ohio.

Goodyear makes tires for all sorts of different transportation modes. For instance, cars, motorcycles, commercial trucks, farm equipment, airplanes, and even bicycles. Yes, not only you can have Goodyear tires for your cars, you can have them for your bikes as well.

Yes, not only you can have Goodyear tires for your cars, you can have them for your bikes as well.

In addition to road cars, they also make tires for racing cars. They’re currently the sole tire supplier for NASCAR. Certainly quite fitting to have the largest American tire company be the sole supplier of tires for America’s favorite racing series. After 124 years, Goodyear is now the fourth largest tire company in terms of revenue, right after Bridgestone, Michelin, and Continental.

The company owns 55 facilities in 23 countries, including 17 in the USA. They currently have nine manufacturing plants, including in Ohio, Kansas, and Texas just to name a few. Additionally, they own over 1,100 tire and auto service spots and employ over 73,000 people worldwide.

Next on our list is Cooper Tires, which is actually owned by Goodyear. They focus mostly on cars and truck tires. However, the company owns several subsidiaries that specialize in medium trucks, motorcycles, and even racing tires.

The name originates in 1919 when an auto-parts dealer by the name of I. J. Cooper formed The Cooper Corporation in Findlay, Ohio. Interestingly, the company also made pontoons, landing boats, as well as other military devices during World War II. The government bestowed the company with the Army-Navy ‘E’ Award.

While not a household name, Cooper tires have some good products in their lineup. We even recommended one of them in our E-rated tires guide. The Discoverer A/T3, in particular, is a good all-around tire for trucks and SUV owners.

The company currently has four tire plants, which are in Georgia, Mississippi, Ohio, and Arkansas. They have a wide range of tires on offer, but their best ones are the Discoverer range for trucks and SUVs. And the Zeon LTZ is similar to the Discoverer, but with sporty pretensions on the road.

And the Zeon LTZ is similar to the Discoverer, but with sporty pretensions on the road.

Unless you’re in the farming industry, you’re probably not too familiar with Carlisle. They’re part of the larger Carlisle Companies based in Phoenix, Arizona. They dwell in all sorts of industries, from farming to electronics, and even aerospace.

They don’t make car tires, but they have a vast lineup of trailer tires for you to choose from. Additionally, they also have a few rims for your trailers.

Aside from that, they focus mostly on making tires for farming equipment such as tractors. They also have tires for lawnmowers, golf carts, ATVs, and for other heavy-duty applications.

Dick Cepek is an off-road motorsports Hall of Famer. He started the company in 1963 and was one of the first off-road enterprises. As you can imagine, the company focuses on offroad tires.

However, the business was sold off to Mickey Thompson tires in 2000. Mickey Thompson was also an American motorsport figure, he built cars to compete in drag racing and the Indianapolis 500.

Mickey Thompson was also an American motorsport figure, he built cars to compete in drag racing and the Indianapolis 500.

The two companies are currently merging to simply become Mickey Thompson Tires & Wheels, rather than being separate companies. They now focus mainly on performance offroad tires and drag tires. If you go to the strip often, you might want to take a look at their products.

Mickey Thompson is actually a subsidiary of Cooper Tires. Along with other companies such as Mastercraft, Mentor, Roadmaster, and Starfire which are all owned by Cooper, and ultimately, by Goodyear. Avon Tyres and Dean are also under Cooper, operating in Europe and Asia respectively.

Now, there are more American tire companies out there for your car. However, these companies have been bought and are now owned by foreign companies. Whether it’s because of a much-needed investment, or the management just wanted to sell the company.

Still, if you don’t fancy the options above for all-American tire companies, you might like these:

Firestone

FirestoneFounded by Harvey Firestone in 1900, the company is now owned by Bridgestone. While not a global household name, you’re probably familiar with Firestone. You might have seen them on the drag strip in the past. And if you watch Indycar, you’ve no doubt familiar with them.

The sale to Bridgestone was due to the large debt back in the late ’70s. After much restructuring, the company was then sold in 1988. However, its headquarters is still in Tennessee.

The company has gone through its fair share of hardships. From the Firestone 500 tread separation problem in the 1970s. To being part of the Ford Explorer rollover problem in the early 2000s.

However, they’re in a good position now. They make decent tires, and their highway-terrain Transforce HT2 is an excellent choice for trucks and SUVs. If you like to go offroading, then their Destination M/T2 lineup will be more suitable.

They make decent tires, and their highway-terrain Transforce HT2 is an excellent choice for trucks and SUVs. If you like to go offroading, then their Destination M/T2 lineup will be more suitable.

Of course, they still produce their tires in the USA. They currently have eight plants, including in Tennessee, Illinois, and North Carolina.

Fun fact: Harvey Firestone had a personal relationship with Henry Ford himself. Doesn’t really add anything to our list but a fun trivia nonetheless. Perfect for ice-breaking on your next awkward date.

BFGoodrich is another company that you probably know. Originally a part of the industrial conglomerate Goodrich Corporation. However, the company is now owned by Michelin, the French tire maker.

The company makes a wide range of tires for everyday use. But they’re known for making high-quality tires for offroad-oriented vehicles. One of their best product is the BFGoodrich All-Terrain T/A K02. An excellent all-terrain tire for trucks and SUVs, especially in the snow.

Need more first-date ice-breakers? Henry Ford himself chose BFGoodrich tires to be fitted as the factory tires for the Model A Ford in 1903. They have a proud history of tire making, but the Goodrich corporation sold the rights to the tire business to Michelin in 1988.

In addition to the companies above, many foreign tire brands also make their tires in the US. In fact, you can find out where your tires are made simply by reading the tire’s sidewall.

Every tire has a DOT (Department of Transportation) serial number near the wheel’s lips. The “DOT” is followed by an eight to thirteen alphanumeric code that identifies where the tire was made, size, and week and year of production.

As an example, a tire made in Goodyear’s facility in Lawton, Oklahoma will have “DOT M6” since that’s their code. You can take a look at the full list here.

Since the list is quite long, here’s a summary of foreign tire brands with their facilities in the US:

Michelin

MichelinEveryone knows them, the Michelin Man is arguably as famous as the Goodyear blimp. As mentioned, the French tire maker now owns BFGoodrich. It’s also currently the largest tire company in the world by revenue.

Excluding its subsidiaries, the company now owns four tire plants in the US. Here’s the list along with the tire code:

They may be foreign, but they make tires here in the US and employ American people. They have plenty of capable tires, whether it’s for on the road or off the road.

The Michelin Pilot Sport Cup lineup is often regarded as the best performance tires you can buy for sports cars. Although, they aren’t cheap and will cost you as much as $500 each. This depends on your size needs, of course.

If you like Formula 1, you’re undoubtedly familiar with Pirelli. They’re currently the sole tire supplier for F1 and have been since 2011. And their experience on the track translates well into their performance on the road.

They’re currently the sole tire supplier for F1 and have been since 2011. And their experience on the track translates well into their performance on the road.

While reviewers still often pick the Michelin Pilot Cup, the Pirelli P Zero lineup can still go toe to toe with them. However, they often regard the P Zero as the better road tire. Additionally, they often perform better in the wet.

While it’s what they’re known for, they’re not just about performance tires. They also have a wide range of regular tires available for more mundane cars. For example, the Cinturato P7 is an excellent touring tire for passenger cars. They’re not too expensive either, and prices often start at a reasonable $118.

While it’s true Pirelli is an Italian company, they’re now actually owned by a Chinese company by the name of ChemChina. Yet another interesting tire trivia there, and this time it’s not Henry Ford-related. Anyway, they currently have three tire plants in the US:

I wonder if Pirelli picked Rome, Georgia simply because it has the same name as Italy’s capital? Well, regardless, they make good tires. And as F1 fans, you can’t help but feel a little sense of pride when driving on a set of Pirellis.

Since they own Firestone, of course, they also have facilities in the US. Quite a few of them in fact, here’s the list:

Bridgestone makes all sorts of tires, from passenger cars to commercial trucks. I personally had experience with their Dueler highway-terrain (H/T) tire lineup. And I must say, they were excellent performers in the dry.

I personally had experience with their Dueler highway-terrain (H/T) tire lineup. And I must say, they were excellent performers in the dry.

Plenty of grip in the dry and very responsive. With decent performance in the wet, I myself didn’t experience any hydroplaning. As a result, I kept coming back to them for my old Mitsubishi Outlander. Keep in mind that it’s not great in the snow, and tread life isn’t exactly long either.

If you need performance tires, their Potenza lineup is also excellent. It’s even chosen as the factory tires for the Ferrari Portofino. While often not in the talks for the best performance tires, you can’t count them out. You can read our full review here.

Yokohama is another excellent Japanese tire company, albeit less known than Bridgestone. Since their market is smaller and they operate at a smaller scale, they only have one plant in the US. Specifically, in Salem, Virginia. Their DOT code is “CC”.

While many are not familiar, the Japanese tire maker is quite popular in the JDM scene. That’s the Japanese Domestic Market, a broad and loose term for Japanese cars. Organized Japanese car meetups will often have Yokohama as one of the sponsors.

That’s the Japanese Domestic Market, a broad and loose term for Japanese cars. Organized Japanese car meetups will often have Yokohama as one of the sponsors.

Additionally, they sponsor drift championships quite often. And as of last year, they returned to sponsor the NORRA Mexican 1000. A rally event that takes place in Baja California, Mexico.

As for their road tires, the Geolandar A/T tires are probably their most well-known product. It’s an all-terrain tire with stellar dry and wet performance and decent traction in snow. They’re also very comfortable on the road, although tire noise is a bit of an issue with the Geolandar.

Germany gave us the car, so naturally, they also have a large tire industry. As mentioned, they’re one of the top three tire makers just slightly ahead of Goodyear. Fun fact, they bought the Hoosier Racing Tire company back in 2016.

They have quite a strong presence in the US, and currently have six facilities:

They have a wide range of tires on option, mostly for passenger cars and trucks. Some of their best ones include the TerrainContact H/T. This is an excellent choice for truck owners who need all-season tires, especially ones with good snow performance.

If you’re looking for performance tires, the ContiSportContact 5 is worth looking at. They’re excellent tires in the dry, and they’re quite affordable starting at around $127 each for the smaller sizes.

We reviewed this with the Audi R8 and the result was good. But then it comes as no surprise since the tires were developed in conjunction with the R8.

Got more questions about tire brands? The answer you’re looking for might be below:

Dunlop is a tire company founded by John Boyd Dunlop in Dublin, Ireland. The company is in an interesting position, as Goodyear operates the car tire business in North America. If you choose a product from their website, it’ll redirect you to Goodyear’s site. And yes, the tires are made in Goodyear’s facilities.

The company is in an interesting position, as Goodyear operates the car tire business in North America. If you choose a product from their website, it’ll redirect you to Goodyear’s site. And yes, the tires are made in Goodyear’s facilities.

However, Sumitomo Rubber Industries is in control of the motorcycle tire business in North America. Meanwhile, Continental, the German tire company, operates and manufactures Dunlop tires for the Malaysia, Singapore, and Brunei markets. While this is common in other industries, it’s a bit of an anomaly in the tire industry. But we digress.

Bottom line, they’re an Irish company owned by Goodyear and they’re also made in the US. You’ll find their DOT code is “DA” and is produced in Buffalo, New York. However, the production scale is smaller than others.

Falken is also a Japanese company, and the aforementioned Sumitomo Rubber Industries owns it. They used to produce their tires in the US, but they no longer do.

Not a lot of people are familiar with Falken. But much like Yokohama, they often sponsor drift events and other Japanese car culture-related events. The Falken drift team famously won the Formula Drift Championship in 2010 with Vaughn Gittin Jr.

As for their road tires, their Wildpeak A/T3 all-terrain tires have found quite a following. Offroad enthusiasts note that it’s a capable all-terrain tire with stellar snow performance.

Goodyear is our pick. While BFGoodrich and Firestone are also still American companies, Goodyear just seems to offer higher quality products. And of course, you can’t ignore the sheer size and success that Goodyear has found over the years.

Not to mention, most of their tire lineup get a decent tread life warranty. With some models getting up to an 80,000-mile warranty. The only downside is that unfortunately, they’re quite a bit more expensive.

When it comes to tires, it all depends on your needs. The recommendation will vary depending on your car’s make and model, driving conditions, and even the climate in your region. If you’re looking for the best dry performance tires, the Eagle F1 lineup is probably for you.

Meanwhile, if you’re looking for something more winter-friendly, you’ll want the Eagle Exhilarate. But if performance isn’t your thing, the Assurance MaxLife will suit your daily needs.

As for the offroad enthusiasts among you, the Wrangler lineup will surely satisfy your needs. They also have the All-Terrain Adventure with Kevlar, making it even more durable and less prone to puncture.

It’s simple, you’ll need to know your tire size first by reading the tire sidewall. If you’re not changing your rims, then stick to the size you have. Although you may be able to choose a thicker tire for better comfort if you like.

If you’re not changing your rims, then stick to the size you have. Although you may be able to choose a thicker tire for better comfort if you like.

Afterward, pay attention to the speed rating and load range. Make sure the new tires you’re buying have the same specifications. You can upgrade the rating if you’d like, but never buy tires with lower ratings than your factory tires as this can be unsafe.

Afterward, decide whether you need summer, all-season, or winter tires. All-season tires are often the favorite for most people, as it often has good performance in the dry as well as in mild winter conditions.

Finally, read consumer reviews. You’d be surprised how much you can learn about a product from consumer reviews. Be sure to check for fitting costs and tread life warranty as well, although summer tires don’t typically come with a warranty.

If you’re looking for the all-American tire companies, then you can’t go wrong with Goodyear and Cooper Tires. If you’re looking for drag or performance offroad tires, then Mickey Thompson tires have a wide range of options.

If you’re looking for drag or performance offroad tires, then Mickey Thompson tires have a wide range of options.

While those are the “true” American tire companies, there are actually more you can choose from. Both BFGoodrich and Firestone are excellent tire makers from the US although they’re now foreign-owned.

However, even foreign companies have facilities and make their tires in the US. Goodyear and Cooper Tires are excellent choices if you want to show off your patriotism for American tire companies. But there’s nothing wrong with buying foreign either since it often still means your supporting American workers.

These tools have been tried and tested by our team, they are ideal for fixing your car at home.

report this ad

Tags: Ad/best tires/Brands/Bridgestone/buyers guide/Buying Guide/car tires/Firestone/goodyear/Guide/michelin/snow tires/summer tires/tire/tire brands/tire reviews/tires/truck tires/Winter Tires

Industry

00:00, 08/10/2020

The supply of products in the world may fall by 45-50 million units this year

The global economy has suffered significant damage due to the coronavirus pandemic. Many industries have been affected, including the tire industry. More than 120 tire factories around the world have suspended production: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. This year, the supply of tires in the world will fall by 45-50 million units, Nizhnekamskneftekhim, a leading synthetic rubber producer and supplier of tire manufacturers, has calculated. Such a serious reduction in the production of tires will lead to a decrease in demand for rubber, as we wrote about in our review of this market. To support domestic producers of synthetic rubbers, Deputy Prime Minister of Russia Yuri Borisov has already instructed to work out the possibility of purchasing SK from the Federal Reserve. Read more about the situation in the tire industry and the consequences for related industries in the material of Realnoe Vremya.

Many industries have been affected, including the tire industry. More than 120 tire factories around the world have suspended production: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. This year, the supply of tires in the world will fall by 45-50 million units, Nizhnekamskneftekhim, a leading synthetic rubber producer and supplier of tire manufacturers, has calculated. Such a serious reduction in the production of tires will lead to a decrease in demand for rubber, as we wrote about in our review of this market. To support domestic producers of synthetic rubbers, Deputy Prime Minister of Russia Yuri Borisov has already instructed to work out the possibility of purchasing SK from the Federal Reserve. Read more about the situation in the tire industry and the consequences for related industries in the material of Realnoe Vremya.

In the first half of 2020, 24. 4 million tires were produced in Russia, which is 16.5% less than a year earlier. The largest decline in production occurred in April-May due to restrictions on the coronavirus.

4 million tires were produced in Russia, which is 16.5% less than a year earlier. The largest decline in production occurred in April-May due to restrictions on the coronavirus.

In May, the entire automotive industry showed the maximum decline in industrial production in the country, Rosstat reported. The output of vehicles, trailers and semi-trailers fell by 42.2% by May 2020. The ministry cited the suspension of operations at the peak of the epidemic, the lack of imported components and reduced demand as reasons for the ministry.

- Restrictions on the work of enterprises and organizations in a number of industries and segments of the economy, as well as other measures introduced to prevent the spread of coronavirus infection, continued to affect economic activity in the country, the Federal State Statistics Service explained.

According to the Ministry of Industry and Trade of the Russian Federation, car production in 2020 may decrease by 30%. The decline in the automotive industry led to a decrease in production in the tire industry, which is inextricably linked with the automotive industry. Like other enterprises, tire factories suspended work at the peak of the pandemic, which significantly reduced production volumes. In January - May 2020, according to official statistics, 19.9 million tires, or 18% less than the same period last year. In May alone, tire production in the country was 40% lower than in May 2019.

Like other enterprises, tire factories suspended work at the peak of the pandemic, which significantly reduced production volumes. In January - May 2020, according to official statistics, 19.9 million tires, or 18% less than the same period last year. In May alone, tire production in the country was 40% lower than in May 2019.

The Association of Tire Manufacturers noted that the pandemic hit Russian tire manufacturers during the period of active sales - the "summer" season, when tires are replaced with summer ones. As a result, the season is actually lost, the organizations of the wholesale and retail network did not create a financial "cushion" for the off-season. Most likely, in the "winter" season of tire sales, market participants will face a decrease in the purchasing power of consumers. A second wave of the epidemic is not ruled out. “Now it is difficult to make any forecasts, but, according to our preliminary estimates, the fall of the tire market by the end of the year may be at least 24%,” Nadezhda Churmeyeva, executive director of the Tire Manufacturers Association, told Realnoe Vremya.

The decline in tire production in Russia began in 2019 after a five-year growth in the industry. In 2014, domestic tire manufacturers produced 52.4 million tires, in 2015 - 57.6 million, in 2016 - 60.1 million, in 2017 - 65.1 million, in 2018 - 67, 5 million. But already in 2019, tire production decreased by 10%, to 60.5 million units. (the world produces more than 1 billion tires per year). At the same time, the share of imports, according to the Federal Customs Service, on the contrary, increased by 7.5%, to 34.4 million units, or $2 billion in monetary terms. This is not counting those tires that were brought to our country with new cars, trailers, bicycles and any other mechanisms on wheels, which also include spare ones. The share of imports of passenger cars in Russia, according to the Federal Customs Service, also increased by 3.2% last year, to 302.5 thousand, the share of imports of trucks increased by 13.7%, to 29

In addition, 1.66 million more tires were imported into our country (4 wheels on the car + 1 spare): passenger cars - 1. 51 million, trucks - 149.5 thousand.

51 million, trucks - 149.5 thousand.

about 40% is occupied by domestic companies, the rest of the factories produce products under foreign brands. Among the leading enterprises with production facilities in our country are the Finnish concern Nokian Tires (Vsevolozhsk, 17 million tires), PJSC Nizhnekamskshina (Nizhnekamsk, 10 million tires), the Italian holding Pirelli - plants in Kirov (6 million tires) and Voronezh (JV with GC Rostec, 4 million tires), German concern Continental (Kaluga, 4 million tires), Russian holding Cordiant (plants in Yaroslavl (3 million tires) and Omsk (1 million tires)), French Michelin holding (settlement Davydovo, Moscow Region) , 2 million tires), the Japanese concern Yokohama (Gryazinsky district of the Lipetsk region, 1.6 million tires), another Japanese company Bridgestone (Ulyanovsk, 1 million tires) and others. American Goodyear products are also widely represented in Russia, although the company does not have production sites here - only a representative office and a warehouse in Moscow, and tires for the Russian market are produced in Poland and Slovakia.

Tire manufacturers working in Russia have gradually returned to work after the temporary closure of factories. However, the fall in demand for tires, the overstocking of distributors and retailers had an impact on production plans.

In March, the Voronezh Tire Plant, a joint venture between Pirelli and Rostec, suspended production until the end of the month. Closed borders and downtime of European automakers at the peak of the epidemic forced Voronezh tire manufacturers to adjust their production program. In the same period, Pirelli suspended the work of the tire plant in Kirov, but has already restarted production. Other enterprises also took a forced production pause:

- Our plant was closed, but resumed work on April 13, because, according to the decree of the government of the Kaluga region No. 271 of April 6, 2020, Presidential Decree No. 239 of April 2, 2020 does not apply to Continental Kaluga LLC, - said Realnoe Vremya, company communications manager Anna Dundukina.

271 of April 6, 2020, Presidential Decree No. 239 of April 2, 2020 does not apply to Continental Kaluga LLC, - said Realnoe Vremya, company communications manager Anna Dundukina.

- The plant in Ulyanovsk of Bridgestone Thayer Manufacturing CIS LLC resumed production on June 17, 2020. Production was temporarily suspended from May 14 to June 17, 2020 due to the need to optimize the balance of supply and demand. At the same time, the majority of office workers at the plant in Ulyanovsk and all employees of the Moscow office continue to work remotely in order to ensure their safety and minimize health risks. We are closely monitoring the situation and taking the necessary steps as it develops. Bridgestone makes every effort to ensure that there are sufficient stocks of products in stock to meet customer requirements. Shipments across Russia, the CIS, as well as to Europe are made in accordance with the adjusted plans,” said Ludmila Kharcheva, PR manager at Bridgestone Thayer Manufacturing CIS LLC.

According to the interlocutor of the publication, the company continues to "thoroughly analyze the market on a daily basis." Where necessary, additional measures are taken to optimize inventory and operations to ensure the highest possible availability of products.

— According to the data we have, the domestic tire market shrank by 7% over 4 months of the current year, including the car tire market sank by 15% at once. It is not surprising. During the period of self-isolation, the use of personal vehicles has decreased. Incomes of the population also decreased, and with them, demand. Tire production fell by 12% in the country. Again, a decline was registered in the largest segment of tires for passenger cars - by 19%. The remaining segments showed growth: the production of tires for light trucks increased by 26%, truck tires - by 17%, agricultural tires - by 9%, industrial tires - by 39%, - outlined the situation, the head of the sales monitoring and analysis department of the Sales Department of Nizhnekamskneftekhim PJSC Ildar Martyshev.

FINAM Group analyst Alexey Kalachev believes that the tire industry can be attributed to the number of victims of the coronavirus pandemic. Demand for tires depends on sales of new cars, which fell by 70-80% in different countries in some months, depending on the restrictions imposed. The expert noted that Russia was no exception, where in April they recorded a record drop in sales of new cars and commercial vehicles - by 72.4%.

— On a comparable scale, by 79.2% in annual terms, the production of passenger cars in the Russian Federation decreased in April. With the fall in production, naturally, the demand for tires also decreased. But to an even greater extent, the tire market depends on the size of the fleet and the intensity of car traffic. After all, tires need to be replaced with new ones from time to time, which creates the bulk of the demand. Moreover, the decline in sales of new cars is mainly pent-up demand. But, being in the mode of self-isolation and digital passes, people traveled much less, traffic decreased, tire wear does not occur during the downtime of cars, this is not deferred, but lost demand,” Alexey Kalachev emphasized.

Trade enterprises also suffered as a result of the downtime of tire workers. Experts believe that the tire sales market is waiting for the enlargement of players.

— It is clear that the use of cars and their mileage has decreased around the world during the self-isolation regime. The tires didn't wear out. Accordingly, no one was in a hurry to change them. And if everything is rather complicated with the primary market, then the recovery of the secondary market should take place. It is even possible that the effect of pent-up demand will lead to a surge in demand in the retail market. The problem is that tire dealers abroad have accumulated a large amount of unsold tires. And until they sell these excess stocks, we cannot expect a recovery in demand for new tires,” said Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC.

— The biggest concern now is the financial stability of the tire distribution network, primarily retailers. It is highly likely that not everyone will be able to survive this economic crisis,” said Nadezhda Churmeeva, executive director of the Tire Manufacturers Association.

An aggravating factor, according to her, may be the introduction of mandatory marking of tires with identification means planned for this year. However, the Ministry of Economy of the Russian Federation stated that they were ready to discuss with tire manufacturers the issue of postponing this requirement to a later date.

In the first quarter of 2020, with the onset of the coronavirus pandemic, almost all the leading tire companies in the world reduced their revenue. Some manufacturers have lost money.

Sales of the American Cooper fell by 14.1% to $532 million, a net loss of $12 million. For comparison, in January-March 2019, the company exited with a net profit of $7 million. At the peak of the epidemic, Cooper stopped production at factories in USA, China, Serbia, Britain and Mexico. The company's management believes that they will be able to fully assess the consequences following the results of the second quarter, which has become the most difficult.

At the peak of the epidemic, Cooper stopped production at factories in USA, China, Serbia, Britain and Mexico. The company's management believes that they will be able to fully assess the consequences following the results of the second quarter, which has become the most difficult.

Goodyear suffered big losses with a net loss of $619 million in the first three months of 2020. Sales were down 18% to 31.3 million tires. In the original equipment segment, sales fell by 21%, in the replacement market - by 16%. The company is cutting operating and capital costs, marketing and advertising expenses, and has closed its oldest tire plant in Gadsden, Alabama (USA).

Goodyear hit big with net loss of $619 in first three months of 2020Photo: news.drom.ru Another tire company in the United States, Titan International, , showed a loss of $25.5 million in the first three months of 2020. Sales of the manufacturer fell by $68.9 million to $341. 5 mln. According to the association's forecast, in the original equipment segment, the supply of passenger tires will decrease by 24.3%, to 35 million units; light trucks - by 18.4%, up to 4.8 million units; freight — by 30.7%, up to 4.5 million units. In the replacement market, the supply of passenger tires will fall by 17.2% to 184.4 million units; light trucks - by 16%, to 27.3 million units; freight — by 7.3%, up to 17.6 million units.

5 mln. According to the association's forecast, in the original equipment segment, the supply of passenger tires will decrease by 24.3%, to 35 million units; light trucks - by 18.4%, up to 4.8 million units; freight — by 30.7%, up to 4.5 million units. In the replacement market, the supply of passenger tires will fall by 17.2% to 184.4 million units; light trucks - by 16%, to 27.3 million units; freight — by 7.3%, up to 17.6 million units.

Chinese tire company Do ublestar posted a loss of $8.2 million in the first quarter of 2020 from a profit of $2.1 million a year earlier. Revenue fell 28% to $112 million. Overall situation The Chinese tire market has been tense. The export of tires from the Middle Kingdom decreased by 11.3%, to 102 million units. for January-March (data from the General Administration of Customs of the People's Republic of China). In monetary terms, exports fell by 13.2% to $3 billion

The Italian Pirelli . The company's sales in the first quarter, compared to the same period last year, fell by 20% and amounted to just over 1 billion. Net profit fell to 38.5 million (101.4 million a year earlier). Sales of Pirelli tires declined both in the secondary car tire market (-19.3%) due to limited mobility of the population in different countries, and in the original equipment sector (-22.7%) as a result of a decline in car production. The company expects a new deterioration in performance in the current quarter, as demand in the global tire market is forecast to decline by 40%.

The company's sales in the first quarter, compared to the same period last year, fell by 20% and amounted to just over 1 billion. Net profit fell to 38.5 million (101.4 million a year earlier). Sales of Pirelli tires declined both in the secondary car tire market (-19.3%) due to limited mobility of the population in different countries, and in the original equipment sector (-22.7%) as a result of a decline in car production. The company expects a new deterioration in performance in the current quarter, as demand in the global tire market is forecast to decline by 40%.

The German Continental also recorded a deterioration in financial performance. First-quarter sales fell 10.9% to 9.8 billion, adjusted EBIT from 884 million to 432 million, and the margin on this indicator - from 8.1 to 4.4%. In mid-March, the company was shutting down more than 40% of its 249 locations around the world. “This situation was new for all players in the industry,” said Continental CEO Elmar Degenhart.

Another Japanese manufacturer of tires, Yokohama Rubber , also lowered its figures. The company's operating profit in the first quarter fell 90.4% to 1.2 billion yen (10.2 million). Sales decreased by 13.6% to 129.1 billion yen. Losses amounted to 258 million yen, while a year earlier the corporation closed the period with a profit of 9.1 billion yen.

Adjusted operating profit of Nokian in January-March fell by 71%, to 16.3 million, sales - by 17.8%, to 279.8. In Russia and Asia, sales of tires by the Finnish concern decreased by 39. 1%, to 56.5 million. The market of tires for passenger cars and SUVs sank most noticeably - by 24.7%, while 85% of tires in this category were produced in Russia. The reasons for the decline are measures to reduce high stock balances in distributors' warehouses in Russia, a slowdown in economic activity amid COVID-19, and a mild winter.

1%, to 56.5 million. The market of tires for passenger cars and SUVs sank most noticeably - by 24.7%, while 85% of tires in this category were produced in Russia. The reasons for the decline are measures to reduce high stock balances in distributors' warehouses in Russia, a slowdown in economic activity amid COVID-19, and a mild winter.

Like all tire manufacturers, Hankook 's financials have fallen sharply due to falling demand during the pandemic, a downturn in the global economy, a decrease in consumer activity and a halt in production at the company's factories. First-quarter revenue fell 20% to $1.202 billion, while operating income fell 29%.%, up to $88.6 million

Tire manufacturers expect even greater losses in the second quarter of 2020. Goodyear has estimated that tire sales in April-June will fall by about 50% compared to the same period last year, to 25 million units. Similar forecasts are given by Continental A.G. and Pirelli & Co. S.p.A., which said that the supply of consumer-grade tires in Europe and America in the second quarter could fall by 30-40%.

— In our opinion, the world has not faced such threats in recent years. If, for example, to compare with the crisis of 2008-2009year, that crisis was financial. It could be "put out" by the money supply, which was done. But this time we are dealing with a crisis that has affected the real sector of the economy throughout the world. Governments of different countries are trying to follow the same path as before, guided by the well-known saying "If a problem can be solved with money, then this is not a problem." But the injection of money into the economy will serve only as a temporary calm in the securities markets. It won't help much in the current situation. It takes time for the unbalanced market mechanism to return to its previous mode of operation,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC.

After a few weeks of downtime, maybe a month, tire manufacturers have started to get back to work. Not yet in all factories and with limited downloads. Tire enterprises in China were the first to start working, where they had already survived the pandemic. In late April - early May, tire manufacturers in America and Europe are gradually restarting production.

Not yet in all factories and with limited downloads. Tire enterprises in China were the first to start working, where they had already survived the pandemic. In late April - early May, tire manufacturers in America and Europe are gradually restarting production.

In May, Cooper opened factories in the US and Serbia, where they were idle for five weeks. Later, in mid-June, the company's industrial complexes in Britain and Mexico resumed work.

Tire enterprises in China were the first to start working, where they had already survived the pandemic. Photo: news.drom.ruContinental Tire launched a tire plant in Mount Vernon, Illinois (USA) at the beginning of May, and later the manufacturer's other sites started operating. Pirelli was the first to restart a passenger tire plant in the state of Georgia (USA), as well as in Settimo Torinese and Bollate (Italy), then opened the company's industrial sites in the UK.

Kumho in America opened a consumer grade tire manufacturing plant. Bridgestone Americas has resumed production at two truck tire plants in Tennessee, with the remainder of its North American operations open before the end of the month.

Bridgestone Americas has resumed production at two truck tire plants in Tennessee, with the remainder of its North American operations open before the end of the month.

Since the end of April, Yokohama opened a truck tire plant in West Point, Mississippi, USA, and later launched the company's car tire plant in Salem, Virginia, USA. A month after production shutdowns in Hungary and India, Apollo Vredestein began producing tires in limited quantities. Another site in the Netherlands has been producing agricultural tires all this time.

In early May, the Finnish Nokian, after a month of inactivity, launched production at its plant in Dayton (Tennessee, USA). The plant has been closed since March 27. At the end of April, Hankook opened a plant in Tennessee (USA) after a three-week shutdown. All this time the American warehouses of the company continued to work. After a month of downtime, the Giti plant in South Carolina (USA) resumed operation.

By the end of May Japan's Bridgestone had opened tire plants in America, Canada, Brazil, Costa Rica, Mexico and Argentina./cdn0.vox-cdn.com/uploads/chorus_asset/file/3332326/Screen_Shot_2015-01-23_at_9.25.08_AM.0.png) Michelin opened factories in Mexico, Canada and the USA during May-June.

Michelin opened factories in Mexico, Canada and the USA during May-June.

- It's too early to say that production is resuming. If five plants out of 30 are launched, and they work at 20% of their capacity, this gives almost nothing. Of course, NKNK is closely monitoring the situation and is in constant contact with its customers. However, today even they have no certainty about how much raw material they will need in the next month or quarter. Their planning is now going literally by the day. Therefore, the resumption of supplies in one day will not happen. This process will stretch for a period during which their own sales markets will be restored, - said Ildar Martyshev.

By the end of May, Japan's Bridgestone has opened tire plants in America, Canada, Brazil, Costa Rica, Mexico and Argentina. Photo: 4tochki.ru According to him, most factories abroad have not yet resumed production. The exception is Chinese manufacturers, but they have problems with demand. The Chinese tire industry is focused on large volumes of exports, and the share of exports to China has declined. Chinese tire manufacturers have been almost completely cut off from the United States - a major market for Chinese tire manufacturers. Factories that have resumed production operate at very low loads (20-30%). It is possible that due to the second wave of COVID-19There will be new stops.

Chinese tire manufacturers have been almost completely cut off from the United States - a major market for Chinese tire manufacturers. Factories that have resumed production operate at very low loads (20-30%). It is possible that due to the second wave of COVID-19There will be new stops.

As a result of the decline in demand for tires, related industries also suffered. For example, manufacturers of synthetic rubber, for which tire companies are the main consumers, were forced to reduce the load and shift the timing of overhauls.

Tire supplier, leading rubber producer Nizhnekamskneftekhim, in its report for the first quarter of 2020 (the company has not yet published a report for the second quarter), described the situation in the real sector of the global economy as extremely uncertain. Supply chains have been disrupted, with many automotive and tire companies temporarily shutting down production around the world due to falling demand. The manufacturer indicated that in the period from the second half of March until the first week of May 2020, more than 120 tire factories of different companies were idle: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. In April, the Indian authorities introduced a 21-day lockdown, which also affected local tire manufacturers.

The manufacturer indicated that in the period from the second half of March until the first week of May 2020, more than 120 tire factories of different companies were idle: Continental, Goodyear, Bridgestone, Pirelli, Cooper Tire, Hankook, Nokian Tires and others. In April, the Indian authorities introduced a 21-day lockdown, which also affected local tire manufacturers.

- As a result of the above, demand for synthetic rubber has been hit hard. According to our estimates, only taking into account the announced shutdowns of tire factories, the supply of tire products in the world will fall by 45-50 million units this year. This will lead to a reduction in global demand for synthetic rubber in 2020 - at least 2%. While the situation is devoid of any certainty, but, presumably, the largest decline in SK sales will be in the second quarter of 2020 - this is the period that accounts for the largest number of production shutdowns in the global tire and automotive industries, the NKNKH report says.

Despite the deteriorating market conditions, the world's major tire manufacturers have maintained agreements on the purchase of rubber. As Realnoe Vremya already reported in another analytical review, thanks to the high quality of its products, Nizhnekamskneftekhim managed to extend annual contracts with major consumers.

The company has taken all possible measures to adapt to the new conditions. In particular, it moved to an earlier period the overhaul of synthetic rubber plants in order to reduce the supply of the UK as much as possible during a period of low demand.

Nizhnekamskneftekhim took all possible measures to adapt to new conditions. Photo: Nizhnekamskneftekhim PJSC The consequences of the reduction in tire production for rubber producers and related industries will be quite serious, experts warn. Nizhnekamskneftekhim is currently assessing the decline in the global synthetic rubber market at a level of at least 2-2. 5%, or approximately 300-400 thousand tons of rubber. At the same time, NKNKH emphasized that the situation will affect not only the producers of synthetic rubber - a serious decline awaits manufacturers of carbon black, artificial fibers, and chemical additives used in tires. In addition, there is a distinct decline in the global natural rubber (NR) market, where prices have fallen to $1,000-1,100 per ton.

5%, or approximately 300-400 thousand tons of rubber. At the same time, NKNKH emphasized that the situation will affect not only the producers of synthetic rubber - a serious decline awaits manufacturers of carbon black, artificial fibers, and chemical additives used in tires. In addition, there is a distinct decline in the global natural rubber (NR) market, where prices have fallen to $1,000-1,100 per ton.

Tatarstan President Rustam Minnikhanov voiced a common problem for the Russian petrochemical industry related to the export of products to Russian President Vladimir Putin. According to him, it is necessary to create equal competitive conditions for producers of rubbers and plastics with foreign companies importing their products to Russia.

— Our oil refining and petrochemical industries are working, but the promotion of our products for export is difficult because our market is open, and, unfortunately, Western partners are introducing duties and restrictive measures. We are appealing to the Russian government to provide us with some kind of support measures,” the president of Tatarstan called the urgent problem for the industry.

We are appealing to the Russian government to provide us with some kind of support measures,” the president of Tatarstan called the urgent problem for the industry.

Under the current conditions, Russian polymer producers have to pay twice: taxes in Russia and import customs duties in the country of export. Foreign competitors, on the other hand, enjoy the benefits and support of the state in their homeland, and enter the Russian market without hindrance, which is why they lose the budget of the Russian Federation. After listening to Rustam Minnikhanov, Vladimir Putin made a note for himself and asked to report on the situation in more detail in order to study the issue for taking measures at the government level.

Vladimir Putin asked to report on the situation in more detail in order to study the issue for taking measures at the government level. Photo: kremlin.ru In early June, Deputy Prime Minister of Russia Yury Borisov proposed another measure to support petrochemical enterprises. According to him, it is necessary to develop an effective mechanism for updating the products of the Federal Reserve, since during the crisis it turned out to be ineffective - there was no necessary nomenclature in it. According to Borisov, Rosrezerv can be used as a damping mechanism in a crisis situation, temporarily buying out their products from companies when demand for them decreases. As an example, he cited the offer of petrochemists to the authorities to buy synthetic rubber from them for the production of tires for 2 years, the demand for which has now fallen. After two years, companies are ready to buy back their products for 5-6% more.

According to him, it is necessary to develop an effective mechanism for updating the products of the Federal Reserve, since during the crisis it turned out to be ineffective - there was no necessary nomenclature in it. According to Borisov, Rosrezerv can be used as a damping mechanism in a crisis situation, temporarily buying out their products from companies when demand for them decreases. As an example, he cited the offer of petrochemists to the authorities to buy synthetic rubber from them for the production of tires for 2 years, the demand for which has now fallen. After two years, companies are ready to buy back their products for 5-6% more.

- Our petrochemists supply about 80% of synthetic rubber for Western tire manufacturers. And there today the demand has fallen, this raw material is strategic, and we have it in the nomenclature of the Federal Reserve, - Yuri Borisov reported to the President of Russia about the problems of manufacturers in the absence of demand.

- This is undoubtedly a good initiative that can really help SC manufacturers. Moreover, the products purchased by Rosrezerv as part of its activities must be updated in a timely manner. This is, as they say, a "win-win situation". If this initiative is implemented, it will be an effective example of assistance from the state,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC.

Moreover, the products purchased by Rosrezerv as part of its activities must be updated in a timely manner. This is, as they say, a "win-win situation". If this initiative is implemented, it will be an effective example of assistance from the state,” says Ildar Martyshev, Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC.

The Deputy Prime Minister of the Russian Federation instructed to think over the purchase of synthetic rubber in the Federal Reserve. The Ministry of Energy supported the idea and promised to work out the mechanism.

But Russian manufacturers need comprehensive support. In the face of fierce competition, our auto industry buys tires from foreign manufacturers, and not from domestic companies. Government measures to encourage automakers to buy their own tire products would help turn the tide. This applies not only to the production of cars, but also trailers, bicycles and any other equipment on wheels. If auto and other manufacturers buy Russian tires, and tire manufacturers, in turn, buy domestic synthetic rubber, the industry may be able to recover faster, market participants believe.

If auto and other manufacturers buy Russian tires, and tire manufacturers, in turn, buy domestic synthetic rubber, the industry may be able to recover faster, market participants believe.

Nadezhda Churmeeva Executive Director of the Tire Manufacturers Association

Due to the novel coronavirus pandemic, the Russian tire market is facing a very difficult economic situation. Tires were not included in the federally recommended list of essential goods that are allowed to be traded even during the period of established restrictions. This significantly complicates operations for the entire tire distribution chain, from manufacturers and importers to retailers. These difficulties persist in regions where the self-isolation regime has not yet been lifted and where tires have not been classified as essential goods by decision of the regional authorities. However, even in regions where there are no legal barriers, consumers often simply do not buy tires due to lower incomes.

These difficulties persist in regions where the self-isolation regime has not yet been lifted and where tires have not been classified as essential goods by decision of the regional authorities. However, even in regions where there are no legal barriers, consumers often simply do not buy tires due to lower incomes.

Alexey Kalachev analyst at FINAM Group

The tire industry may well be among those affected by the coronavirus pandemic. As the sanitary restrictions are lifted, the demand for tires will begin to recover, and production will catch up with it. So far, the forecast looks optimal that the recovery of the markets will begin in the second half of the year. If the world is not covered by the second wave of the pandemic in the fall, which, unfortunately, cannot be completely ruled out, then production will return to rhythmic work by the middle of next year.

If the world is not covered by the second wave of the pandemic in the fall, which, unfortunately, cannot be completely ruled out, then production will return to rhythmic work by the middle of next year.

Ildar Martyshev Head of the Sales Monitoring and Analysis Department of the Sales Department of Nizhnekamskneftekhim PJSC

Demand for cars was falling back in 2018 and the reason for this was the start of a trade war between the US and China. In 2019, the situation repeated itself, and in 2020 it was aggravated by the coronavirus pandemic. The trade war inevitably led to a slowdown in the world economies, and not only in China, by the way. But in 2018, the trade war was not the only reason for the downturn in auto markets. In September 2018, the World Harmonized Test Method for Passenger Cars (WLTP) began to be implemented in the European Union. WLTP is a new research methodology for determining fuel consumption indicators. Since September 2018, it has become mandatory for all new registered cars in Europe. This technique makes it possible to more accurately determine the amount of fuel consumption and harmful emissions of light vehicles. The introduction of the new procedure caused a decline in the passenger car market in Western Europe. Buyers refrained from buying new cars because they weren't sure if their car would meet the new standards or be taken off the assembly line altogether.

But in 2018, the trade war was not the only reason for the downturn in auto markets. In September 2018, the World Harmonized Test Method for Passenger Cars (WLTP) began to be implemented in the European Union. WLTP is a new research methodology for determining fuel consumption indicators. Since September 2018, it has become mandatory for all new registered cars in Europe. This technique makes it possible to more accurately determine the amount of fuel consumption and harmful emissions of light vehicles. The introduction of the new procedure caused a decline in the passenger car market in Western Europe. Buyers refrained from buying new cars because they weren't sure if their car would meet the new standards or be taken off the assembly line altogether.

There is no other way out for tire manufacturers. They will be helped, on the one hand, by the restoration of car production. This is the so-called primary tire market (complete). On the other hand, retail sales should recover. That is, the population should again begin to change the tires on their cars.

This year we will definitely see a downturn in the global tire and rubber market. One can only argue about the depth of the recession. Now you can hear how some market participants say that it will take up to 3-4 years to fully restore the broken supply chains. Perhaps this is so. We can only hope that this will happen a little sooner.

Ekaterina Faizulina B2C Marketing Director, Michelin Eastern Europe

The current crisis is notable for its global scale: to varying degrees, it has affected almost all industries. The depth of the impact and the speed of recovery will greatly depend on the economy, market conditions and changes in consumer behavior in each country separately. The tire industry is an integral part of the automotive industry and is currently considered one of the most sensitive to the changes that are taking place in the world. Health, concern for the financial condition are now the main priorities for every person in every country. For the tire industry, an additional challenge is a decrease in demand for the purchase of new cars, a temporary restriction of the mobility of the population, which directly affects the frequency of use and the need for tires. However, the potential for fleet development and demand recovery remains.

The tire industry is an integral part of the automotive industry and is currently considered one of the most sensitive to the changes that are taking place in the world. Health, concern for the financial condition are now the main priorities for every person in every country. For the tire industry, an additional challenge is a decrease in demand for the purchase of new cars, a temporary restriction of the mobility of the population, which directly affects the frequency of use and the need for tires. However, the potential for fleet development and demand recovery remains.

The temporary shutdown of production that occurred in many industries in April is a necessary measure, dictated by security considerations, as well as the need for businesses to adapt to changing conditions. At the moment, optimization may force some enterprises to continue reducing production in order to avoid the risks of overproduction, provided that consumer demand continues to decline.

As for the tire industry, in general, despite the decline in production, Michelin does not predict a shortage of tires, since the market was initially provided with a certain level of inventory to respond to the resumption of consumer activity.

At the moment, the Russian Michelin plant, located in Davydovo near Moscow, is operating in standard mode in compliance with all sanitary standards and safety measures.

If we talk about the restoration of demand to the initial level, the situation will directly depend on the development of the epidemiological situation in our region and possible restrictions that may further affect both purchasing power and the decrease in mobility and restrictions on the use of transport and movement. However, it is worth noting that even with the tight restrictions, a certain significant part of the car fleet continues to be active, which will support demand in some categories of tires.

The current situation, of course, has its impact on consumer behavior not only now, but also after the end of the acute period - it is expected that concern for their health and increased attention to sanitary standards may encourage some consumers to prefer the use of personal transport instead of public transport in the future , which could potentially accelerate the recovery of the industry.

Despite a general decline in consumer confidence, in the current environment, the majority of consumers do not change their intention to buy tires. In addition, a significant proportion retains brand preferences and even in these difficult conditions remains true to their choice. Knowing your customer and his expectations is key, which will allow you to match his preferences as much as possible.

Now more than ever, in the search for the best offer, the quality of the product comes to the fore. Great tires that can provide safety and confidence in all conditions throughout their entire life cycle are not only a consumer investment in terms of longer use, but also confidence in their safety and care for loved ones.

As early as May, there is a resumption of consumer activity and a return of demand for summer tires in all regions. Undoubtedly, this is more a result of the resumption of mobility as a shift in demand since April. The overall market will be affected by a decrease in purchasing power both at the end of the summer season and in the coming winter season as a result of a negative forecast for car sales in 2020. However, demand for the premium segment of cars and tires is generally less sensitive to negative market changes.

However, demand for the premium segment of cars and tires is generally less sensitive to negative market changes.

Vasil Shirshova

IndustryPetrochemistry Tatarstan NizhnekamskneftekhimNizhnekamskshina

In the last ten days of December, we are summing up the results of 2018, recalling the events from the world of tires that the Shina.Guide team remembered the most in the past year. Each article of the “results” series is devoted to a separate section: high-profile and resonant events, innovations and tire concepts, news from the life of manufacturing companies, the most interesting tests, and finally, the definition of the best tires of 2018.

Tire manufacturing companies

In the past year, many events have taken place in the life of tire companies, which will further affect both customer loyalty and competition among manufacturers.

For some manufacturers, 2018 was a year of triumphs and victories, for others it flew by in an established work schedule, and for some it brought a lot of reasons for frustration.

In general, this year can hardly be called the most successful for the tire industry. Some companies have experienced a drop in sales and the value of their shares to a 3-5 year low. This trend has especially affected European companies.

Two companies, Michelin and Cooper, have decided to completely or partially close their small production sites in the UK. One of the reasons for this was Brexit - a partial severance by the country of economic and political ties with a united Europe.

Expansion by Chinese companies continued. And if the “head-on attack” stumbled upon anti-dumping duties from the EU and the trade war with the United States, then joint ventures, the opening of production sites outside of China, off-take production and cooperation with European brands have borne fruit.

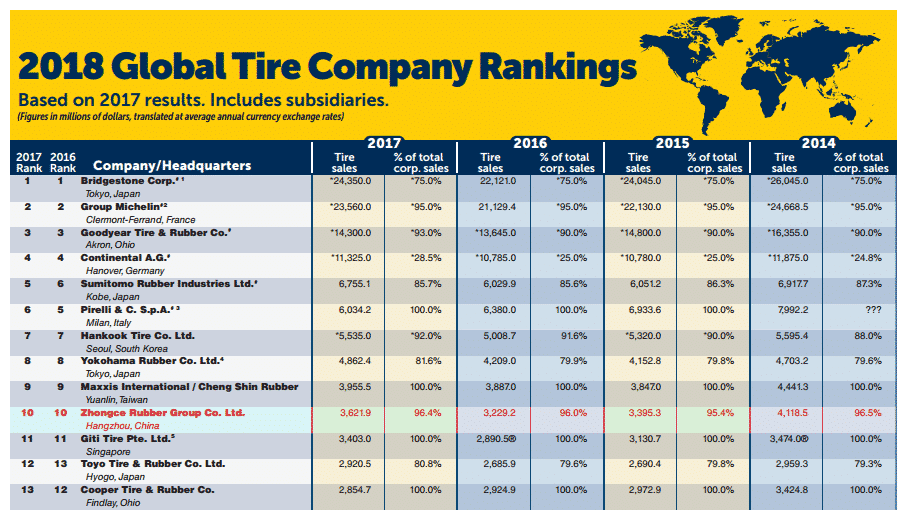

The tire manufacturer ranking compiled by the German publication Neue Reifenzeiting (NRZ) on the basis of 2017 sales volumes has remained relatively stable.

Neue Reifenzeiting ranking of the largest tire manufacturers in 2017The top five tire companies in the world have not changed: Bridgestone, Michelin, Goodyear, Continental and Pirelli have remained in their places. But on the sixth line of the rating was the South Korean manufacturer Hankook, which ousted the Japanese Sumitomo, which owns the Falken brand, from there. But taking into account the events that took place in 2018, rearrangements may again occur on the tire Olympus in the very near future.

Michelin this year, in addition to the travel agency Tablet, acquired the Canadian company Camso, which specializes in the production and distribution of OTR tires. Camso's annual turnover is comparable to a difference of one billion euros, which just separates Michelin from the championship in the top tire manufacturers. And if in 2019 Michelin displays this figure in its financial statements, then it is very possible that the French company will lead the standings.

And if in 2019 Michelin displays this figure in its financial statements, then it is very possible that the French company will lead the standings.

A permutation can occur in third and fourth place. In 2017, Goodyear's sales amounted to 12.8 billion euros, while Continental's volumes reached 11.3 billion euros. According to experts, the German manufacturer shows good growth from year to year, and if the trend continues, then Continental has every chance to reach the third position.

Hankook and Pirelli can also exchange places in the ranking, since the latter recently lost its commercial vehicle tire segment, and the South Korean company was able to improve its position on its own in a year.

Nokian Tires was the most distinguished company in 2018. Distinguished in a bad way. The National Bureau of Investigation of Finland opened a criminal case at the beginning of the year regarding Nokian's actions on the stock market, as well as tire test results in various specialized magazines. This led to a sharp drop in Nokian's share price by 7% and reduced the company's capitalization by 39%.6 million euros.

This led to a sharp drop in Nokian's share price by 7% and reduced the company's capitalization by 39%.6 million euros.

Once again, Nokain Tires shares collapsed in the fall, after the publication of reports for the third quarter of 2018. This crisis was followed by the sale by Bridgestone, the largest shareholder of the Finnish manufacturer, of a third of its shares, as a result of which the ownership decreased from 14.99% to 9.96%.

Meanwhile, the management of the Finnish tire company is building ambitious five-year plans to conquer the markets of Europe and North America, while not pinning much hope on Nokian's home markets - the countries of Scandinavia and Russia.

A long-running play set against the backdrop of 2017 with a 42.01% stake in the South Korean tire company Kumho put up for sale, which had to pay off the manufacturer's accounts payable, ended in drama. In the spring of 2018, the block of shares was bought by the Chinese company Doublestar.

The hands-off policy of the new owner of a large number of shares has led to the fact that Kumho remains unprofitable to this day (seven quarters in a row), although injections to some extent stabilized the financial condition.

To get out of this situation, Kumho has taken a course to more aggressively promote its products not only in the domestic market, but also outside it. In addition, organizational changes and consolidation of the product range began to take place in the company.

The Supervisory Board of the German concern Continental AG approved a reorganization plan that provides for the formation of three business units under the auspices of the new Continental Group.

Continental's reorganization plan foresees a division of business by 2020 into three divisions: Continental Automotive, Continental Rubber and Powertrain.

Let us add that December 2018 was marked by the long-awaited opening of the Taraxagum Lab Anklam research complex. It will become a base for the cultivation of dandelions and the extraction of rubber from them, which in the future may become a worthy alternative to raw materials obtained from the milky juice of the hevea growing in the tropics.

Mitsubishi Corporation approved the purchase of additional shares in Toyo Tire & Rubber Co. in the amount of more than 50 billion yen (390 million euros), which will increase its share by almost 6 times - from 3.05% to 20.00% and make it the largest shareholder of the Japanese tire manufacturer. Mitsubishi representatives will join Toyo's board of directors.

It has also become known that the name of Toyo Tire & Rubber Industry will change to Toyo Tire as of January 1, 2019.

In October 2018, for $75 million, Pirelli bought a 49% stake in Jining Shenzhou Tire, a joint venture with China's Hixih Group that makes passenger tires. Under the terms of the agreement, from January 1, 2021 to December 2025, Pirelli retains the right to increase its shareholding up to 70%.

The joint venture with Hixih will give Pirelli the flexibility it needs in the premium tire segment, given the evolution of the Chinese market, expected changes in the electric vehicle market and the growing share of homologations in China, Japan and Korea.

South Korean Hankook Tire, which already has a production base in Indonesia, is seeking management control of Multistrada Arah Sarana, Southeast Asia's second largest tire manufacturer. According to local media reports, a number of large tire companies, including Michelin, are also interested in buying Multistrada.

Multistrada manufactures tires under the Corsa and Achilles brands, as well as off-take products for Michelin and other companies.

As part of the Baltic Customs’ investigations into the criminal case opened against Bridgestone in November 2018, the company’s Moscow and St. Investigative measures were connected with the delivery of equipment three years ago. Bridgestone is suspected of evading customs duties levied on organizations or individuals on an especially large scale.