April 13, 2016

Leslie Kan

Interested in data on the average teacher pension in your state? See the chart below for data on the average teacher pension in your state. But before you do, here are some caveats to what you're looking at:

1. Not all teachers qualify for a pension. States can and do set relatively high minimum service requirements, ranging from five to 10 years, and over half of incoming teachers won’t qualify for retirement benefits in their state. Leaving these teachers out of the overall pool obscures who gets counted in the “average pension.”

2. Of the teachers who do qualify for a pension, their benefits will vary widely.

The statistical average, or mean, hides the fact that only a small percentage of incoming teachers will receive a full career pension at retirement, while many, many more get only a small amount. Also, teachers in 15 states aren't covered by Social Security; pensions in these states tend to be larger to make up for this fact.

3. These amounts only tell us what a teacher earns at retirement—not what she contributed to her state or local system. The averages include many teachers who qualify for some pension, but those pensions may be worth less than the value of the teacher's own contributions.

Now onto the data. The first column shows the “average pension” for newly retired teachers from the past ten years in each state. The next column shows, amongst all newly retired teachers, what the median retiree earns. The last column show the estimated percentage of new teachers who will actually receive a pension. The data come from each state's annual comprehensive financial report.

In Maryland, for example, the “average pension” for new teachers is $35,000. But the median pension for new retirees is just $20,544, meaning half of all new retirees earn less than that amount. Moreover, 57 percent of new Maryland teachers are expected to leave the system before qualifying for any benefits at retirement. They're not included in the pension data at all.

Moreover, 57 percent of new Maryland teachers are expected to leave the system before qualifying for any benefits at retirement. They're not included in the pension data at all.

Knowing what your state’s “average pension” can be interesting. But this amount doesn’t necessarily reflect the amount that many teachers actually earn. With those caveats in mind, here are the data:

State | Average Benefit for New Retirees | Median Benefit for New Retirees | Percentage of New Teachers Who QUALIFY FOR a Pension |

|---|---|---|---|

Alabama | $ 20,721.89 | $ 19,728.00 | 39 |

Alaska (DB plan) | $33,845 | $39,372 | 37 |

Arizona | $ 20,508. | $ 20,328.00 | 100 |

Arkansas | $ 21,067.00 | $ 17,784.00 | 57 |

California | $ 43,308.00 | $ 40,008.00 | 69 |

Colorado | $ 37,452.00 | $ 29,376.00 | 36 |

Connecticut | $47,386 |

| 55 |

Delaware | $ 20,485.00 | $ 25,440.00 | 36 |

Distrct of Columbia | $ 63,468. | $ 48,420.00 | 29 |

Florida | $ 19,765.00 | $ 18,198.00 | 28 |

Georgia | $ 34,946.00 | $ 22,835.16 | 33 |

Hawaii | $ 14,964.00 | $ 30,252.00 | 25 |

Idaho | $ 17,043.00 | $ 13,992.00 | 70 |

Illinois | $ 46,513 | $ 52,188.00 | 50 |

Indiana (Pre1996 Fund) | $ 17,436. | $ 21,516.00 |

|

Indiana (1996 Fund) | $ 16,392.00 | $ 12,492.00 | 31 |

Iowa | $ 19,704.00 | $ 15,180.00 | 42 |

Kansas* | $ 12,929.00 | $15,924.12 | 44 |

Kentucky | $ 34,685.00 | $ 36,330.00 | 67 |

Lousiana | $ 23,828.00 | $ 25,836.00 | 56 |

Maine* | $ 20,333. | $ 24,312.00 | 14 |

Maryland | $ 34,956.00 | $ 20,544.00 | 43 |

Massachusetts | $ 38,637.00 |

| 12 |

Michigan | $ 21,348.00 | $ 4,680.00 | 43 |

Minnesota (All retirees) |

| $ 20,283.00 | 50 |

Mississippi* | $ 18,764.25 | $ 17,064.00 | 24 |

Missouri | $ 41,344. | $ 47,460.00 | 58 |

Montana | $ 21,153.00 | $ 27,708.00 | 35 |

Nebraska | $ 22,590.15 | $ 20,288.39 | 32 |

Nevada | $ 30,468.00 | $ 27,036.00 | 57 |

New Hampshire | $ 21,355.00 | $ 7,020.00 | 31 |

New Jersey | $ 40,104.00 |

| 56 |

New Mexico | $ 21,165. | $ 19,765.68 | 33 |

New York | $ 44,383.40 | $ 46,920.00 | 40 |

North Carolina | $ 18,443.00 |

| 35 |

North Dakota | $ 31,596.00 | $ 57,413.00 | 56 |

Ohio | $ 46,620.00 | $ 57,696.00 | 34 |

Oklahoma | $ 19,846.00 |

| 44 |

Oregon | $ 28,320. | $ 28,296.00 | 46 |

Pennsylvania | $ 24,603.00 | $ 23,664.00 | 36 |

Rhode Island | $ 44,953.00 |

| 51 |

South Carolina | $ 19,630.00 | $ 26,287.80 | 37 |

South Dakota | $ 18,717.00 | $ 18,120.00 | 53 |

Tennessee | $ 18,612.00 | $ 10,668.00 | 56 |

Texas | $ 44,556. |

| 59 |

Utah (noncontributory)* | $ 21,063.00 | $ 19,512.00 |

|

Utah (contributory)* | $ 15,996.00 | $ 25,020.00 | 52 |

Vermont | $ 18,230.18 | $ 27,245.00 | 33 |

Virginia | $ 21,962.50 | $ 18,708.48 | 50 |

Washington (PERS 1) | $ 28,203.65 | $ 26,529.84 |

|

Washington (PERS 2) | $ 20,775. | $ 18,311.28 | 55 |

West Virginia | $ 19,165.69 | $ 23,364.00 | 39 |

Wisconsin* | $ 22,911.00 | $ 13,392.00 | 64 |

Wyoming | $ 17,556.00 |

| 42 |

Source: Data collected from state comprehensive annual financial reports. Teacher state plans were used unless otherwise noted.

**Out of all retirees.

*Average for all participants plan; includes teachers and other state employees.

Last updated 4/13/16. For more updated data, see here.

Taxonomy:

State Pension Plans

Degree CompletedHigh School Diploma/GEDSome CollegeAssociate DegreeBachelor's DegreeMaster's DegreeDoctorate Degree

Desired DegreeDiploma/CertificateAssociate DegreeBachelor's DegreeMaster's DegreeDoctorate

Program of InterestAll Education ProgramsAdministration & LeadershipBusiness EdEarly Childhood EdElementary EdEnglishESL & Foreign LanguageFine Arts EdGifted EdHistoryMathPhysical EdPost Secondary EdSchool CounselingSecondary EdSpecial EdSTEM Ed

Sponsored Content

If you’re entering the teaching world, your primary focus has likely been on how to effectively educate young minds. You’ve spent years studying strategies for thinking and planning ahead, preparing your students for future academic success, but have you stopped to think of yourself?

Being prepared in your personal life is just as important as being prepared in the classroom. Obtaining the health care you need and planning for your retirement later in life ensures the wellbeing of you and your family.

As a teacher in the state of Texas, you qualify for an all-inclusive benefits package that includes both retirement and health insurance planning, allowing you to make these preparations confidently.

Alvernia University

Featured Program: Special Education Certification

Request Info

Campbellsville University

Featured Program: MA in Special Education - Initial Certification; Supervisor of Instruction Certification; Superintendent Certification

Request Info

Grand Canyon University

Featured Program: Bachelor of Arts & Science in ECE, Elem. & Sec. Education, Master of Education in ECE, Elem. & Sec. Education, and Ed. Doctorate

Request Info

University of Southern California

Featured Program: Master of Arts in Teaching, Master of Arts in Teaching – Teaching English to Speakers of Other Languages, Doctor of Education in Organizational Change and Leadership

Request Info

Liberty University

Featured Program: Undergraduate Certificate in Preschool, Bachelor of Education (B. Ed.), Master of Arts in Teaching (MAT), Doctor of Education

Ed.), Master of Arts in Teaching (MAT), Doctor of Education

Request Info

Regis University

Featured Program: Build up our next generation—and yourself—at Regis University. Masters-level education programs to help you nurture, lead and succeed. Designed to support educators at all career stages—from initial licensure to advanced professional development

Request Info

Learn more about becoming a teacher. Contact schools offering teacher education/certification programs in Texas.

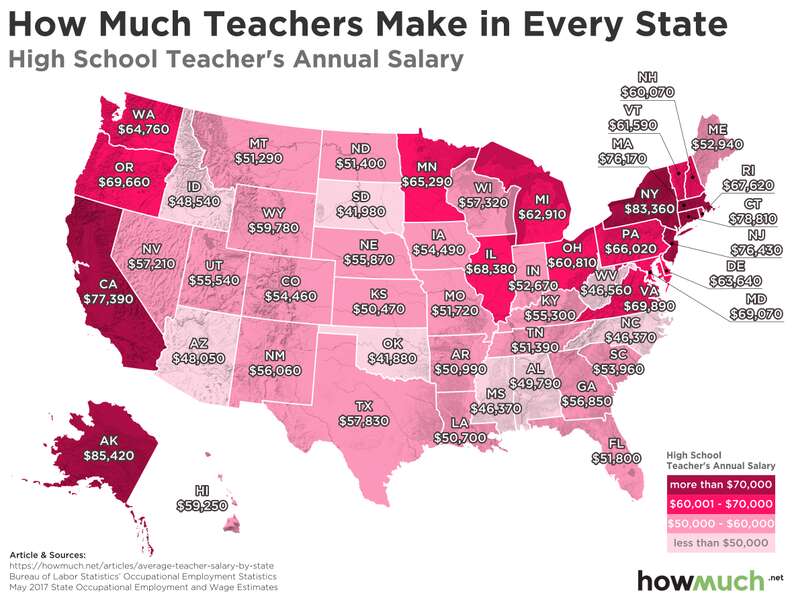

As teachers further their educations and gain experience in the field, they receive pay increases that reflect their dedication and hard work. Salaries vary between school districts, but the following are some examples of the salaries you can expect in Texas:

| Experience | Bachelor’s | Master’s |

|---|---|---|

| At 3 years | $36,400 | $37,400 |

| At 6 years | $38,250 | $39,250 |

| At 9 years | $40,050 | $41,050 |

| At 12 years | $42,350 | $43,350 |

Source: Vernon Independent School District

When you begin work as public school teacher in Texas, you are automatically enrolled in a retirement plan through the Teacher Retirement System of Texas (TRS). It is the largest public retirement system in Texas, serving more than 1.3 million participants.

It is the largest public retirement system in Texas, serving more than 1.3 million participants.

The TRS retirement plan is a defined benefit plan. Once you qualify for normal retirement, you are eligible to receive a monthly pension for life.

As a TRS member, you contribute 6.4% of your compensation toward future retirement benefits. The amount contributed by employing school districts differs from district to district.

Your eligibility for service retirement is determined by your age and years of service. To retire with full benefits, you must meet the following qualifications:

Once you reach normal retirement age and terminate your employment, you can begin to receive your monthly benefits. Monthly benefits are based on a formula that is subject to change. However, you can use the following formula to calculate your normal retirement annuity based on current law:

Average of five highest salaries

multiplied by

Total years of service credit

multiplied by

2. 3%

3%

For example, if your average final salary was $45,000 and you worked for 25 years, your final pension would be $25,875 per year, or $2,156.25 per month.

To learn more about the retirement options available to you as a teacher in Texas, visit the Teacher Retirement System of Texas .

To guarantee the wellbeing of teachers and their families, TRS has also implemented a voluntary health care program that provides health insurance. This statewide health coverage program includes almost 500,000 members and their dependents.

The program offers four PPO (preferred provider organization) plans and three health maintenance organization (HMO) plans. Teachers are able to choose coverage under any plan that is available to them. Because some plans are only available in certain counties, you should check with your local county for information about health plans in the area.

You can tailor your health insurance to meet your specific needs. For example, if you want a low deductible with low out-of-pocket expenses, you can pay a little more each month for that benefit.

For example, if you want a low deductible with low out-of-pocket expenses, you can pay a little more each month for that benefit.

No matter what plan you choose, each covers a multitude of medical expenses including:

In addition to medical care, TRS offers teachers additional benefits such as dental, vision, and long-term disability insurance. Explore the TRS website for more information about the health benefits available to teachers.

Published:

At the beginning of this year, it was announced that teachers' salaries would increase by 25-30% in the near future. How the remuneration of workers in the field of education has actually changed, in the material Nurfin.

How the remuneration of workers in the field of education has actually changed, in the material Nurfin.

According to the results of the first quarter of 2020, employees of all segments of education, from preschool to higher education, earned on average 154 600 tenge , reports the monitoring agency Ranking.kz.

There is indeed an increase in wages, it amounted to 40.6% compared to the previous year, when the average salary in the education system was less than 110 thousand tenge. Real growth adjusted for inflation was 32.6%.

The average salary among all workers in Kazakhstan is about 200,000 tenge.

The lowest wages have always been observed in preschool education - on average 90 300 tenge per month. Growth compared to last year was 21.5%. By the way, this sector has some of the lowest salaries in the country. Nannies and other junior employees of kindergartens sometimes receive the lowest possible salary.

Nannies and other junior employees of kindergartens sometimes receive the lowest possible salary.

The average salary of teachers and other professionals working in schools is 137 740 tenge. The real growth of wages - 36.1%.

The largest increase in salaries is observed in the field of secondary vocational education - in real terms it amounted to 40.2%, and the average salary - 171 800 tenge.

And the highest salaries are among employees of the higher education sector - on average 190 900 tenge. But growth here is the lowest - 12.3% in real terms.

Employees in the field of additional educational services have an average salary of 157 800 tenge. Growth adjusted for inflation - 10.7%.

In other segments of education, the average salary for the first quarter of 2020 amounted to 133 750 tenge and increased by 21.3% compared to the same period last year, taking into account inflation.

By the way, salaries in this segment began to grow since last year, in 2018 and 2017 in real terms, that is, taking into account inflation, it only went down, and before that it grew, but only slightly.

Infographic: ranking.kz: UGCNote that the salary of teachers in state institutions depends on bonuses for qualifications, length of service, additional duties and characteristics. And employees of private educational institutions, as a rule, have a higher salary, which often depends on the prestige of the institution.

The highest salary in education is observed in Nur-Sultan. Metropolitan specialists earn on average 260 300 tenge. This gap can be explained by the fact that the Ministry of Education and a large number of paid schools are located in the capital.

Almaty is next with an average salary of 181 300 tenge. For metropolitan specialists, it grew the least - by 27. 5%. A year ago it was 142,200 tenge.

5%. A year ago it was 142,200 tenge.

In third place is the Almaty region - 158 500 tenge. Here wages grew the most - by almost 50%. A year ago it was just over 100,000.

Educational workers from the Mangistau region also receive above average wages in the country - 156 600 tenge. Slightly below the average in the Atyrau region - 153 200 tenge. In other regions, earnings are even less.

The lowest salary in the field of education in the West Kazakhstan region is on average 134 600 tenge, which is two times less than in the capital. A year earlier, specialists in this region were also paid the least - an average of 94 000 tenge.

The top three anti-rating also included Aktobe region - 137 100 tenge, and the city of Shymkent - 142 400 tenge.

Infographics: ranking.kz: UGC This area has 1,100,000 employees, which is almost two percent more than last year.

It is noteworthy that only a third of the male representatives here, and about 74% of the workers are women.

Most representatives of the educational sector work in the Turkestan region - 139 thousand people. By the way, this region has one of the lowest salaries - 142 700 tenge, but it has grown by almost 48%. Even last year, this figure was equal to 96,500 tenge.

Slightly fewer specialists in the Almaty region - 129 thousand and in Almaty - 97 thousand specialists.

For several years, the total number of employees in the education sector in the country has hardly changed and remains at the level of one million.

Infographic: ranking.kz: UGCOriginal article: https://www.nur.kz/nurfin/economy/1859727-skolko-zarabatyvaut-ucitela-v-kazahstane/

Social supplement up to the subsistence minimum

If the pension of a non-working pensioner is below the subsistence minimum, then it will be increased due to additional payments. The federal cost of living is established every year by the budget law, this year for pensioners it is 10,022 rubles. Each region also sets its own living wage, it can be higher or lower than the federal one.

The federal cost of living is established every year by the budget law, this year for pensioners it is 10,022 rubles. Each region also sets its own living wage, it can be higher or lower than the federal one.

If the federal PM is higher than the regional one, then the pensioner will receive a federal surcharge, and if the PM in the region is higher, the regional one. You can get a surcharge upon application.

Monthly cash payment

This payment is due to veterans, disabled people, Chernobyl victims and other persons affected by radiation, former minor prisoners of fascism, Heroes of Russia and the Soviet Union, Heroes of Socialist Labor. It is assigned automatically.

In addition to it, they are provided with monthly compensation for a set of social services (drugs, sanatorium treatment, travel to and from the sanatorium, train trips). A pensioner can refuse a set of social services and take the cash equivalent.

Additional payment for a dependent's pension

A pensioner can count on state support if he/she supports disabled persons, for example, minor children, full-time students, elderly relatives (parents, spouses, grandparents), disabled people.

The supplement can be received for a maximum of three disabled family members, the total amount of the supplement in 2021 is 6044.48 rubles. One third of the fixed payment to the old-age insurance pension is paid for one family member.

"Rural" allowances

An increased pension is paid to citizens who have worked in rural areas for 30 years. The supplement to the pension is 25% of the fixed payment as part of the insurance pension, in 2021 its amount is 6044.48 rubles.

Starting January 1, 2022, "rural" supplements to pensions will be paid regardless of the pensioner's place of residence. At present, when a pensioner moves from a rural area to a city, the allowance is removed.

Pension recalculation after 80 years

Pensioners who have reached the age of 80 are entitled to an increased fixed payment to the old-age insurance pension, it increases by 100%.

A pensioner does not need to submit any applications to the FIU. The increase in the month of execution of 80 years is assigned automatically from the date of birth, and is paid from the next month.

The increase in the month of execution of 80 years is assigned automatically from the date of birth, and is paid from the next month.

Supplement to the pension for the "northern" experience

Citizens who worked in the regions of the Far North and areas equivalent to them, regardless of the place of current residence, can receive an increased pension. The conditions for the additional payment are an insurance period of at least 25 years for men and at least 20 years for women. You also need to work for at least 15 years in the regions of the Far North or at least 20 years in areas equivalent to them.

If the length of service is worked out in the regions of the Far North, the fixed payment to the insurance pension is increased by 50%, if in areas equated to them - by 30%.

Additional financial support for outstanding achievements and special merits

Additional payment in an increased amount due to a special additional payment can be received by: Heroes of Russia and the Soviet Union, Heroes of Socialist Labor and Heroes of Labor of Russia, awarded orders, laureates of state prizes, Champions of the Olympic, Paralympic and Deaflympics.