Ten years ago, you could buy a decent steer tire for $300. Not anymore. But, then again, you're not buying the same tire anymore either.

Long-term pricing trends show that the cost of raw materials used in tire manufacturing has gone up over the past decade, along with the shelf prices for tires, but consumers haven't seen the price swings for tires that manufacturers have seen for materials over the same period of time.

And raw materials are only part of the tire's cost structure.

“In a normal year, raw materials make up about 50% of the cost of the commercial tire,” says Rick Phillips, director of commercial sales at Yokohama Tire Corp. “That includes natural rubber, synthetic rubber, carbon black, steel and a host of other organic chemicals, including petroleum.”

Phillips says natural rubber was selling for 56 cents a pound in 2009. Today it's around $1.50 per pound.

Accord to price charts posted on a government of India website, www. rubberboard.org, prices for various grades of natural rubber have increased from $135 per 100 kg in 2004, to a current price in March 2013 ofabout$290.

Steel prices, while essentially stagnant over the past year at $700 to $800 per metric ton, have seen significant swings over the past 10 years. Most types of steel saw price peaks of $1,000 and higher per ton in 2008, which was up dramatically from pre-recession pricing of $500 to $600 per ton for most products.

And don't forget oil prices.

Oil prices in 2003 averaged $27.69 per barrel in 2003 dollars. Today, prices hover in the $90s, another significant increase. This hit tire manufacturers two ways, first as a raw material in tire production, and again in shipping costs, especially for those bringing tires here from overseas.

Less tangible but omnipresent are the research and development costs. Phillips says tire makers were making very good tires 10 years ago, but they can hardly compare to today's tires.

Tires are so much more efficient today than in previous generations that while acquisition costs have increased, life-cycle costs and cost per mile have actually come down. You're getting way more bang for your buck, Phillips says. But at the same time, it's getting harder and harder to make significant strides in technology.

“Now, tires are so efficient and so well-built that we have to spend millions and millions of dollars to get just a small gain,” he says. “The development curve isn't as steep as it was. You have to go a long way to even move the needle today.”

Supply and demand

Global demand for tires has increased, with countries like India and China putting more and more trucks on the road every year. Demand in North America and in Europe is down somewhat.

That reduces the pressure on supply, although Phillips says much of the need for tires in emerging markets is filled domestically.

“We've got a bit more supply here than demand at the present,” he says, “But by the end of the year and through 2014, I expect that will change. When global demand picks up again, we'll have problems here because there's not enough North American capacity to meet demand. And when the commodity brokers see that, we'll probably see more price manipulation like we did in 2011.”

When global demand picks up again, we'll have problems here because there's not enough North American capacity to meet demand. And when the commodity brokers see that, we'll probably see more price manipulation like we did in 2011.”

In the short term, Phillips expects prices to stay relatively flat, but when global demand starts to rise, tires and their raw materials costs will start going up right alongside.

“Steel is more stable than rubber, and rubber is more stable than oil, but each is subject to its own pressures,” he notes.

The good news, according to Goodyear, is that raw materials pric ing has been stable over the past few months. That doesn't mean we'll see discounts on tire prices, but they may not be jumping as frequently as they have over the past few years. Enjoy it while you can.

Natural rubber is havested from the hevea trea as a liquid, much like maple syrup is harvested from a maple tree.

Alternatives to natural rubberAlthough we're in no danger of running short of our primary source of natural rubber, prices have risen dramatically over the past 10 years and some companies are now looking for alternatives.

The primary producers of natural rubber are in South and Southeast Asia, with some production in tropical West Africa.

All those are places subject to damaging seasonal monsoons and other extreme weather conditions.That makes supply a little unpredictable.

Rubber has also recently become a traded commodity, leading to speculative investment, which has driven up prices.

“It's not unlike petroleum markets,” says Bill Niaura, Bridgestone Americas'director of new business development. “There are price points where it begins to make economic sense to explore and drill for oil in non-traditional areas. We're now at the point in the rubber industry where it makes sense to look for alternatives.”

There are about 2,000 plant species producing natural rubber, but the Hevea tree is the most productive. In the history of the rubber business only one other species, guayule, has been used in actual rubber production.

Unlike the hevea tree, which grows in tropical climates, guayule grows in the arid climates of the U. S. Southwest.

S. Southwest.

Active research and development programs are under way to domesticate and commercialize guayule, with two led by tire manufacturers.

Guayule blooms againA consortium consisting of Cooper Tire & Rubber Co., Yulex Corp., Arizona State University and the U.S. Department of Agriculture are working under a $6.9 million grant from the USDA and the U.S. Department of Energy.

The goal is to harness biopolymers extracted from guayule as a replacement for petroleum-based synthetics and tropical-based natural rubber used in the manufacture of tires.

Meanwhile, Bridgestone has its own plans for a guayule research farm near Eloy, Ariz., and a research center in nearby Mesa,Ariz.A 281 -acre agricultural site in Eloy will serve as the base of its agricultural research operation, and will supply guayule for the company's process research center in nearby Mesa.

“Material-wise, guayule is the same polymer as hevea rubber, but it diversifies our supply,” Niaura says. “In terms of plant biology and regionality, it's domestic to the Americas, but there are still challenges ahead.”

“In terms of plant biology and regionality, it's domestic to the Americas, but there are still challenges ahead.”

The facility is expected to be fully operational in 2014, with trial rubber production starting in 2015.

Regular pressure checks are the best way to ensure a long and prosperous relationship with your tires.

Tires are worth looking afterIt's easy to dismiss tires as low-tech commodities requiring more time and effort to maintain than they are worth.The truth is you get out of your tire program what you put into it.

Fleets with strong tire programs treat tires as assets.According to Continental's Clif Armstrong, fleets that are ahead of the curve on tires treat them as investments.

“Thirty years ago, when your $150 tire wore out at 40,000 miles, you just disposed of it and bought another one,” he says. “With tires at $350 or $400 and even up to $700 for wide-single tires, you have to treat them as assets.The tread has wearability value, and the casing can be retreaded or sold. ”

”

The more retreads you get from a casing,the better the value, Armstrong says. “It's conceivable today to run a tire/casing out to a million miles with excellent maintenance and several retreads.”

The key factor in maintaining the value in your tire and casing investment is proper maintenance and management-and maintaining tire inflation pressure.

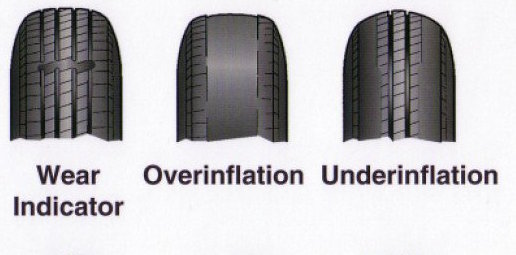

“Improper inflation reduces tire life,” says Bob Montgomery, vice president of intelligent transportation systems for Stemco."Low tire pressure also leads directly to irregular wear and premature failures, which the Technology & Maintenance Council of the American Trucking Associations says are 90% attributable to under-inflation.”

Automatic tire inflation systems, such as Aeris from Stemco, can keep tires at their optimum pressures while providing real-time data to detect leaks, analyze tire performance, calculate fuel economy and even identify mismatched dual tires.

On the pressure monitoring side, several available technologies can alert drivers or fleet management of an impending tire failure through telematics.

Continental's ContiPressureCheck, for example, also uses temperature compensation to tell if a hot tire is underinflated. Without some form of temperature compensation, a hot tire that is underinflated might appear to be fine, because the contained air pressure is at or above its cold inflation pressure.

Aeris, PressureCheck and similar inexpensive and reliable technologies really can extend tire life. Perhaps not to 1 million miles every time, but considerably further than if you do nothing buy kick them a couple of times a week.

Published Date 6/23/17 9:58 AM

The global market for tire manufacturing stands at $180 billion. Michelin anticipates the long-term demand to rise at the rate of 5 to 10% a year in developing markets and 1 to 2% a year in mature markets. Moreover, in terms of volume, sales are expected to reach 2. 5 billion units by 2020, this will be propelled by an increase in automobile manufacturing. The automobile market, in turn, is expected to strengthen due to growing urbanisation and rising personal disposable incomes.

5 billion units by 2020, this will be propelled by an increase in automobile manufacturing. The automobile market, in turn, is expected to strengthen due to growing urbanisation and rising personal disposable incomes.

Bridgestone is the largest player in the market with revenues close to $27.1 billion, followed by Michelin (revenues of $22 billion) and Goodyear (revenues $16 billion). Bridgestone, Michelin and Goodyear together hold approx. 40% of the global market share as shown in the below chart. Merger and acquisitions, entry barriers such as huge capital investments and brand loyalty are the major reasons for concentration in the industry.

The sales of tires can be classified into demand from original equipment manufacturers (OEM) and replacement market (RC) also known as aftermarket sales. Sales in OEM segment are dependent on the sale patterns of new vehicles, whereas RC sales depend on the usage patterns of consumers.

Televisory analysed the data of Good Year, JK Tyre and Michelin and observed that on an average RC accounts for 68% of the sales, while OEM constitutes 32% of the total sales (displayed through the below pie charts), which is also an average for the industry as a whole. The demand from RC market is expected to stay strong due to a large number of vehicles on-road. Furthermore, any sale in OEM segment leads to an assured RC segment demand in the next 4-5 years.

The demand from RC market is expected to stay strong due to a large number of vehicles on-road. Furthermore, any sale in OEM segment leads to an assured RC segment demand in the next 4-5 years.

In addition, raw materials account for almost 75% of the production costs with natural and synthetic rubber being the key raw materials. A reduction in the raw material cost is passed on to consumers as an advantage or vice versa. Crude oil has a direct influence on the price of synthetic rubber. Additionally, any movement in the price of synthetic rubber subsequently affects the natural rubber prices. The rubber prices were at an all-time high in 2012 and thereafter maintained low levels as can be seen from the below data. The fall in crude oil prices along with the excessive production of natural rubber in Asian nations such as China and Thailand kept the rubber prices in economic range. However, rubber prices bounced back in 2016 as the major rubber producing companies in Thailand, Indonesia and Malaysia agreed to cut down the supply by 0. 6 million tonnes (Source: Business Standard). The impact got transferred to the final prices of tires. Goodyear raised its prices by 8% (February 2017) and other companies such as Copper Tire & Rubber, Carlstar and Nexen Tire are expected to follow the suit.

6 million tonnes (Source: Business Standard). The impact got transferred to the final prices of tires. Goodyear raised its prices by 8% (February 2017) and other companies such as Copper Tire & Rubber, Carlstar and Nexen Tire are expected to follow the suit.

The production expenses have the greatest bearing on cost in the tire industry, at around 70% of revenues whilst other operating costs constitutes 20% of revenues. An analysis of the financial statement of Michelin, Goodyear and JK Tyre revealed that the production costs of Goodyear were higher than its peers, this was due to high production and general overheads. However, its operating expenses were comparatively lower due to limited selling and advertising expenses.

The net sales of Michelin rose by 8.4% in FY 2015 primarily due to the acquisition of Sascar (€256 million additional), currency effects (€1.5 billion) and rise in sales volume (€624 million). On the contrary, Goodyear and JK Tyre faced a decline in their revenues in the same year. The principle reason for the fall in Goodyear’s revenue was currency translation, especially in the EMEA region. The revenue for JK Tyre contracted due to an 8.7% fall in demand from SCV segment coupled with rising imports of truck radial tyres from China.

The principle reason for the fall in Goodyear’s revenue was currency translation, especially in the EMEA region. The revenue for JK Tyre contracted due to an 8.7% fall in demand from SCV segment coupled with rising imports of truck radial tyres from China.

Although Indian manufacturers are accelerating the production of radial tyres, the radialisation volume of truck/bus segment stands at only 44%. The scope of expansion in the truck/bus radial segment has led to a heightened competition both from domestic and international players.

On an analysis of the profit margins of the companies (stated in the below graphs), Televisory found that Goodyear had the lowest net margin owing to loss of deconsolidation of Goodyear de Venezuela amounting to $646 million. Goodyear’s net margin was unusually high in 2014 due to $1.8 billion net income tax benefits. This was owing to release of the valuation allowance on deferred tax assets in the US. All the major players capitalised on the cost advantage due to fall in rubber prices and thus, their production costs kept declining. JK Tyre being an Asian firm benefitted most from cheap imports of rubber through Asian countries with its production cost plummeting 6.3%. Michelin being a global player with a larger asset base had depreciation expenses equivalent to 6.7% of its revenues, while JK Tyre with its manufacturing restricted to India and Mexico had depreciation expenses of 3.7%. Therefore, Michelin’s drop from EBITDA to EBIT margin was more than that of JK Tyre. However, JK Tyre’s dependence on debt was more as indicated by its higher interest expenses amounting to 3.3% of its revenue, thus lowering its net margin. These interest expenses, however, provide for a significant tax shields, this can often be a complimentary part of the capital structure.

JK Tyre being an Asian firm benefitted most from cheap imports of rubber through Asian countries with its production cost plummeting 6.3%. Michelin being a global player with a larger asset base had depreciation expenses equivalent to 6.7% of its revenues, while JK Tyre with its manufacturing restricted to India and Mexico had depreciation expenses of 3.7%. Therefore, Michelin’s drop from EBITDA to EBIT margin was more than that of JK Tyre. However, JK Tyre’s dependence on debt was more as indicated by its higher interest expenses amounting to 3.3% of its revenue, thus lowering its net margin. These interest expenses, however, provide for a significant tax shields, this can often be a complimentary part of the capital structure.

Thus, Michelin has been consistent in maintaining its net margin at around 5.5%, while JK Tyre has exhibited an increasing trend in its net margin. Goodyear and Michelin began offering tires online directly to customers in 2016, this is expected to contribute positively to their sales volumes. JK Tyre adopted a low-cost automation plan at its manufacturing plants and has been judiciously investing in R&D in order to sustain technologically. However, in terms of global expansion JK Tyre has a long way to go and its manufacturing and distribution costs might therefore increase accordingly. In an industry, where material costs cannot be directly controlled by the manufacturers, optimising manufacturing and distribution capacities are the key to success.

JK Tyre adopted a low-cost automation plan at its manufacturing plants and has been judiciously investing in R&D in order to sustain technologically. However, in terms of global expansion JK Tyre has a long way to go and its manufacturing and distribution costs might therefore increase accordingly. In an industry, where material costs cannot be directly controlled by the manufacturers, optimising manufacturing and distribution capacities are the key to success.

Also Read:- Impact of volatility in natural rubber and crude oil prices on tire manufacturing industry

Cars | ||||||||||||||

| Service name | RI2-RI3 | R14 | R15 | R16 | R17 | R18 | R19 | R20-R23 | to R 26 | |||||

| Removal and installation of 1 wheel | 80 | 80 | 95 | 115 | 140 | 160 | 185 | 205 | 230 | |||||

| Mounting/removing 1 wheel | 45/90 | 70/140 | 85/170 | 115 /230 | 140/280 | 150/300 | 165/330 | 185/370 | 200/400 | |||||

| Fitting/removing 1 RunFlat wheel | 105/210 | 140/280 | 170/340 | 200/400 | 275/550 | 300/600 | 320/640 | 360/720 | 400/800 | |||||

Fitting/removing 1 low profile wheel (45, 40. ..) ..) | 60/120 | 90/180 | 115/230 | 150/300 | 185/370 | 200/400 | 220/440 | 240/480 | 265/530 | |||||

| Fitting/removing 1 low profile wheel (45, 40...) RunFlat | 125/250 | 170/340 | 210/420 | 250/500 | 335/670 | 355/710 | 390/780 | 440/880 | 450/900 | |||||

| Balancing 1 wheel (including load) | 115 | 125 | 160 | 215 | 265 | 275 | 275 | 285 | 345 | |||||

| Total (4 pieces) | 1150 | 1380 | 1700 | 2240 | 2710 | 2940 | 3130 | 3450 | 3910 | |||||

| Total (4 pcs) RunFlat | 1610 | 1930 | 2380 | 2900 | 3790 | 4120 | 4380 | 4830 | 5470 | |||||

Sum (4 pcs) low profile (45, 40. ..) ..) | 1270 | 1560 | 1910 | 2520 | 3100 | 3340 | 3600 | 3880 | 4420 | |||||

| Sum (4 pcs) low profile (45, 40...) RunFlat | 1780 | 2180 | 2670 | 3290 | 4280 | 4580 | 4930 | 5470 | 5900 | |||||

| Imbalance optimization 1 wheel | 200 | 250 | 300 | 350 | 400 | 400 | 450 | 450 | 600 | |||||

| Vulcanization 1 wheel | 800 | 800 | 850 | 1100 | 1200 | 1200 | 1400 | 1400 | 1800 | |||||

Vans and SUVs | ||||||||||||||

| Service name | R15 | R16 | R17 | R18 | R19 | R20 - R22 | up to R 26 | |||||||

| Removal and installation of 1 wheel | 105 | 120 | 150 | 185 | 210 | 235 | 265 | |||||||

| Mounting/removing 1 wheel | 95/190 | 135/270 | 150/300 | 175/350 | 185/370 | 210/420 | 230/460 | |||||||

| Mounting/removing 1 wheel RunFlat | 190/380 | 230/460 | 305/610 | 345/690 | 365/730 | 415/830 | 455/910 | |||||||

Fitting/removing 1 low profile wheel (45, 40. ..) ..) | 120/240 | 160/320 | 200/400 | 220/ 440 | 240/480 | 275/550 | 300/600 | |||||||

| Fitting/removing 1 low profile wheel (45, 40...) RunFlat | 225/450 | 285/570 | 365/730 | 410/820 | 445/890 | 505/1010 | 555/1110 | |||||||

| Balancing 1 wheel (including load) | 180 | 220 | 295 | 315 | 325 | 335 | 400 | |||||||

| Total (4 pieces) | 1890 | 2440 | 2990 | 3380 | 3590 | 3980 | 4490 | |||||||

| Total (4 pcs) RunFlat | 2650 | 3190 | 4190 | 4730 | 5030 | 5570 | 6290 | |||||||

Sum (4 pcs) low profile (45, 40. ..) ..) | 2090 | 2640 | 3360 | 3750 | 4050 | 4490 | 5060 | |||||||

| Sum (4 pcs) low profile (45, 40...) RunFlat | 2930 | 3610 | 4700 | 5250 | 5670 | 6290 | 7080 | |||||||

| Imbalance optimization 1 wheel | 330 | 385 | 440 | 440 | 460 | 495 | 800 | |||||||

| Vulcanization 1 wheel | 950 | 1200 | 1300 | 1300 | 1500 | 1500 | 1900 | |||||||

Other work | |

| Single wheel wash/cleaning | 60 |

| Replacement spool | 35 |

| Wheel geometry test | 60 |

| Wheel leak test | 60 |

| Camera repair (1 damage) | 60 |

| Sealing | 120 |

| Tire recycling | 120 |

| Tire pack | 25 |

| Tire storage (per day per wheel) | 120 |

Repair of one wheel (puncture) | |

| Harness | 130 |

| Fungus | 230 |

| Patch | 300 |

| Valve installation | 55 |

| Camera removal/installation | 60 |

Consumables | ||

| Regular valve | 35 | |

| Chrome valve | 72 | |

| Cap | 12 | |

CAR TIRE STORAGE (6 months) | ||

| The most favorable conditions for our customers! | ||

| Radius | Without discs | With discs |

| 13-15R | 2300 | 2800 |

| 16-18R | 2500 | 3000 |

| With 19R and up | 3000 | 3500 |

The cost of tires for tires

Removal of the wheel puncture

300 rub

R-13 4 pcs

1300 RUB

SHOP

1600 RUB 900 RUBSITA 1600 rub

Hinomontazh R-16 4 pcs

1800 rub

Shinomontazh R-17 4 pcs

1800 rub

R-18 4pcs

3400 rub

10012821283

2300/2800

Radius 16-18

without discs/s discs

2500/3000

Radius from 1

without discs/s

3000/3500

33 This section contains and updated all prices for tire services in 2020, our price list contains all the relevant information necessary to clarify the cost of work.

Tire fitting is a fairly simple procedure, but a lot depends on the quality of its implementation: how the car will behave on the road, how long the tires will last. Fuel consumption even indirectly depends on the quality of work. Therefore, it is important to ensure that all stages of work are carried out competently and professionally.

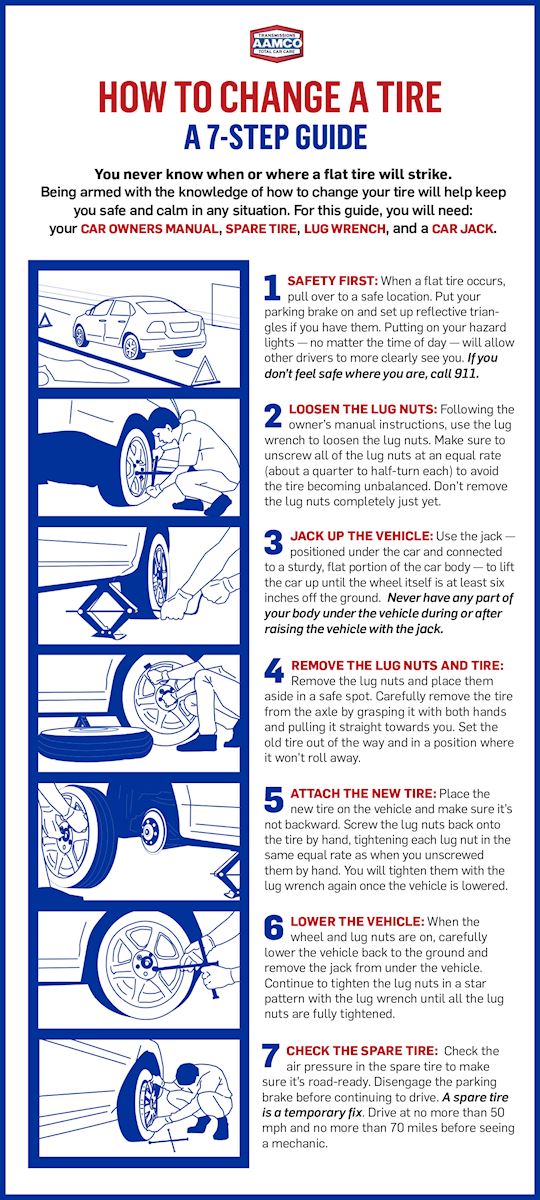

removing wheels from a car

removing tires from rims;

installing new tires on rims;

inflation;

balancing;

installation on a car.

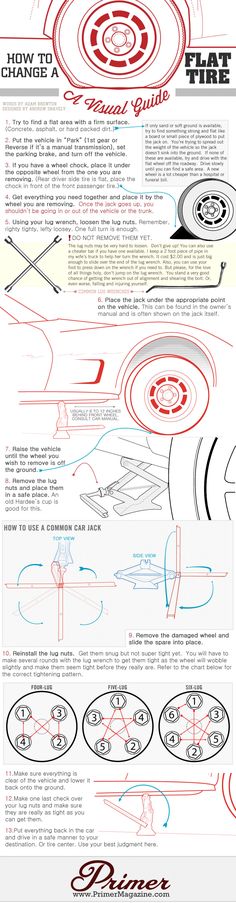

The machine must be raised to remove the wheels. The easiest way to install a tire is to raise the car on a platform, lift or jacks. If you work with a jack, you will need to ensure that the car is level. And on a platform or lift, the masters have access to all wheels at the right height at once.

The wheel is removed and then washed or cleaned. Working with a dirty wheel can interfere with the normal process, so it needs to be cleaned of dirt. Nord uses a washing machine for this, thanks to which the wheel can be completely cleaned in seconds.

Nord uses a washing machine for this, thanks to which the wheel can be completely cleaned in seconds.

To remove a tire, you must first deflate it by unscrewing the valve. After that, the tire is squeezed out with special tools in a circle. If you squeeze it in one place and try to remove it, you can damage the sides or the valve. A phased spin allows you to remove the tire as accurately as possible.

Then we start mounting the new tire on a special machine. It is put on carefully, pressing in the same way in a circle until it snaps into place. All work starts from the inside. The tire is lubricated with mounting grease so that the beading is successful. Our master examines it, determining the degree of wear and the presence of possible damage.

The tire must then be inflated. This is done in several stages. Having pumped up the tire slightly, master Nord makes sure that it fits exactly into its seat. Then it pumps up to the desired state and balances.

Before installing the wheel, the technician inspects the brake discs and cleans the mating surface and studs with a brush if necessary. Then, copper grease is applied to the place where the disc contacts the rim, the wheel is installed and bolted. The bolts are twisted crosswise in a few steps so that they stand up straight.

Then, copper grease is applied to the place where the disc contacts the rim, the wheel is installed and bolted. The bolts are twisted crosswise in a few steps so that they stand up straight.

When working with tires, the master must check how tight they are. He should also inspect for significant tire damage. The disk is also carefully inspected - it must be cleaned of any kind of contaminants, checked for axial or end runout.

Modern equipment allows Nord Service to easily and quickly perform tire fitting in 2020 without compromising the quality of work.

In one of the previous materials, we talked about how to properly dispose of car tires. This is indeed a very serious problem, because the number of discarded but not properly disposed of tires in Russia is measured in millions of tons. Another opportunity to reduce environmental damage is the retreading of used tires.

This is indeed a very serious problem, because the number of discarded but not properly disposed of tires in Russia is measured in millions of tons. Another opportunity to reduce environmental damage is the retreading of used tires.

The idea of extending the life of car tires dates back to the last century. Always and at all times, zealous car owners wanted more resource from tires. The most widespread are two technologies - the replacement of the tread tape and the so-called recutting of the tread (regruving). Those who remember the times of the USSR are probably familiar with the latest technology - during the years of total shortage it was a popular way to extend the life of tires, including cars. Of course, this happened with varying success - for example, retreaded tires could explode while driving due to the destruction of the cord.

The second technology is the so-called welding, that is, the replacement of the tread tape with a new one, using a cold or hot method. Currently, this is the most popular method of tire retreading, which, however, has a number of limitations. Let's look at each technology in turn.

Currently, this is the most popular method of tire retreading, which, however, has a number of limitations. Let's look at each technology in turn.

For starters, the most important thing. Car tire carcasses are not designed to be reused, so they cannot be restored in any way! Everything that will be said about retreading applies only to "commercial" tires for trucks, construction equipment and buses. These tires have a strong all-metal carcass that can withstand much more than the tread, as well as a special design designed for two to three times recovery.

First, let's talk about regrooving the tread, or, as it is also called, regrowing. This is a procedure for deepening the tread with a hand-held cutting tool. Of course, this can not be done with any tires, but only with those that have the Regroovable marking.

Image: Yokohama

In such cases, the design of the tire implies an additional layer of rubber at the base of the tread, which allows you to deepen the pattern by about 3 millimeters, thereby “winning” another 35-40 thousand mileage. The optimal moment for recovery is tread wear up to 3 mm.

The optimal moment for recovery is tread wear up to 3 mm.

This retreading method is considered the most inexpensive - spending only 3-5% of the cost of a new tire on regrooving, you can get another 20-30% of the original resource.

Regrowing also has disadvantages. The success of the operation depends entirely on the quality of the framework and the skill of the specialist performing the recutting. Some tire brands allow multiple regrooving for certain models, but after that, the tread must still be replaced. In addition, in a number of countries, the installation of "undercut" tires on the front axles of buses is prohibited at the legislative level.

Retreading, or changing the tread band, is the most common way to retread truck tires, allowing them to recover at least 50-60% of their original life. Retreaded tires are widely used in all world markets, for example, in Europe they account for more than half of total sales.

Given the high quality of the tire carcass, welding can be performed repeatedly, increasing the tire life up to 450-500 thousand kilometers. Hardfacing can be cold or hot. Let's analyze the differences between these technologies.

When retreading car tires in small industries, the cold method is most often used.

Image: GoodYear

It looks like this. The worn tire is placed in a special machine, where the tread layer is removed from it with a cutter. The breaker layer is carefully inspected for defects, which are repaired using pneumatic tools. The next stage is extrusion, in which the breaker is covered with a layer of raw rubber covering all defects. After that - another layer of raw rubber.

Images: Nokian Tires

The tread tape is then applied to the tire. As a rule, all major tire manufacturers produce such tapes, for example, Nokian Tires calls such treads Noktop and E-Tread. An interesting feature of the Noktop tread is the two-layer structure. A softer top layer provides improved traction in winter. By spring, it wears off, revealing a more rigid tread, optimal for use at positive temperatures.

A softer top layer provides improved traction in winter. By spring, it wears off, revealing a more rigid tread, optimal for use at positive temperatures.

The assembled tire is placed in a so-called envelope, from which the air is evacuated. Next, the tires are placed in an autoclave, where, at a pressure of about 4 atmospheres at a temperature of 110 degrees Celsius, the vulcanization process takes place. As a result, the tread is tightly connected to the tire carcass.

The second technology - hot vulcanization - is characterized by the highest quality of recovery, but due to its high cost and energy consumption, it is used only in large-scale industries.

Image: GoodYear

Hot welding is performed at 180 degrees Celsius, and its main difference from the cold process is that a large layer of raw rubber (including sidewalls) is applied to the prepared carcass, and then, when vulcanized with a press -shape on the tire is formed tread pattern - just like when creating a new tire.