Roadrunner Financial knows ATV financing. Explore brands, compare instant loan offers, and secure your ride at a local dealership.

Check My Rate

No commitment. No impact on credit score.

Get a real-time decision with no impact on credit score.

Save time at the dealership. No hassles. No haggling.

Receive competitive rate offers that are valid for 30 days

We welcome all credit scores, from subprime to prime.

*This calculator is a self-help tool and the information provided is for illustrative purposes only. Actual payments and terms may vary. Tax, title, and other fees not included. This is not an offer of credit. All applicants subject to credit approval and not all applicants will qualify.

Use our ATV Loan Calculator to see how a monthly payment fits into your budget. Play around with loan terms, estimate the cost of your ATV financing, and apply to Roadrunner Financial with no impact on your credit score. To estimate your monthly loan payments, select:

This can cover up to the total cost of the vehicle, and sometimes a little extra for parts and accessories. Start with the MSRP of your selected ride.

Interest rates vary based on make, model, applicant, cosigner, and more. Start with our leading rate, 6.99%.

The amount of time to pay off your loan. When you choose a longer term length, your monthly payment is lower. If you choose a shorter term length, your monthly payment will be higher. Start with our most popular term, 60 months.

If you choose a shorter term length, your monthly payment will be higher. Start with our most popular term, 60 months.

The calculator results will show your estimated monthly payment! Click “Get Prequalified Now” to see your monthly rate offers with no credit impact and no commitments.

A new ATV can run between $3,000 – $15,000, with the average price being about $8,000. Prices vary depending on engine size, performance, and additional features or accessories.

Loan term affects both your interest rate and monthly payment – when the term is longer, monthly payment is lower. Plus, certain terms will have certain rates available. The best ATV loan term is the one with the right balance of time, rate, and budget for you! Our most commonly used loan terms are between 36 – 72 months.

We have relationships with over 40 OEM brands to cover buyers across the credit spectrum. Each program is different, but we can offer coverage with a minimum credit score of 550 FICO and coverage for those with little to no credit history. Submit an application to see what’s available to you – with no credit impact!

Each program is different, but we can offer coverage with a minimum credit score of 550 FICO and coverage for those with little to no credit history. Submit an application to see what’s available to you – with no credit impact!

We look at more than your credit score when calculating your rate offer. But, a good rule of thumb is to expect our lowest rates under our prime program, which covers FICO scores of 660 and above. Our non-prime credit builder programs can offer coverage from a 550+ FICO score. The final interest rate is also determined by the vehicle being purchased, the chosen loan terms, and any prime rate promotions we may be running.

Nope! We’re able to pre-qualify you for financing without any credit impact. We’re one of the only ATV lenders with soft credit pulls. That means our application will initiate what’s called a “soft inquiry” on your credit, which does not impact your credit score. The only time we’ll do a hard inquiry is when you are ready to sign your contract.

The only time we’ll do a hard inquiry is when you are ready to sign your contract.

We offer financing on over 25,000 new and used ATVs, side-by-sides, motorcycles, dirt bikes, snowmobiles, zero turn mowers, golf carts and more.

Check My Rate

No commitment. No impact on credit score.

We welcome everyone across the FICO score range to check if they pre-qualify for financing – from subprime to prime. Check your rate online and get an instant decision.

Check My Rate

No commitment. No impact on credit score.

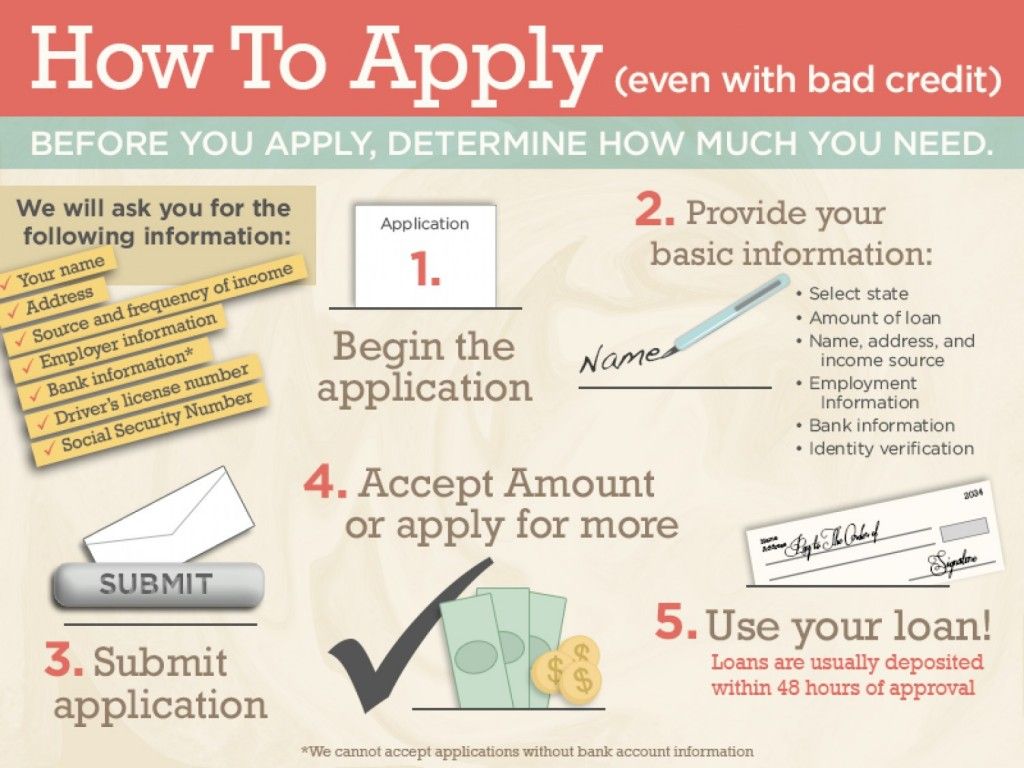

Complete a quick application and get an instant prequalified credit decision. No commitments. No impact on credit score.

You’ll see real terms and monthly payments. Compare your personalized financing offer and choose what’s right for you!

Compare your personalized financing offer and choose what’s right for you!

Take your prequalified credit offer to a local dealership, test-drive the vehicle, complete and sign your paperwork electronically, and they’ll hand over the keys!

Over one-third of Americans and Canadians have a poor credit score. Because poor credit can cause high-interest rates and loan denials, many people think financing options are out of reach.

The same goes for outdoor enthusiasts looking to add to their collection of toys. They think bad credit ATV financing is impossible to obtain, so they never try.

Unfortunately for them, that’s incorrect. However, you can learn from their misunderstandings!

Before discussing your bad credit ATV financing options, let’s determine what constitutes a poor score.

Understanding your credit score is the first step in evaluating your financing situation. The current credit score range is 300 to 850. An excellent credit score falls at 720 or above, while 600 is considered the beginning of the poor score spectrum.

Obviously, the lower your score falls, the more likely you are to suffer hiked interest rates or denial. If you’re applying jointly, both scores will be taken into account.

So what causes bad credit, anyway?

Making late payments or falling far behind can negatively impact your credit score. For many people, the culprit comes in the form of credit card debt, and once credit drops, it can be challenging to rebuild.

In some cases, debts unknown to the individual, such as old phone bills, are reported to collections and can drag down a credit score.

In rare scenarios, credit can be destroyed through cases of identity theft. It’s essential to closely monitor your credit report and dispute any discrepancies as soon as they arise.

Other circumstances that can hurt your score are:

If your score does fall in the poor range or you’ve suffered one or more of the above circumstances, no need to stop reading.

Financing options exist to help you purchase your dream ride. Many of these bad credit ATV financing options can be combined to improve your odds of approval and get you riding sooner.

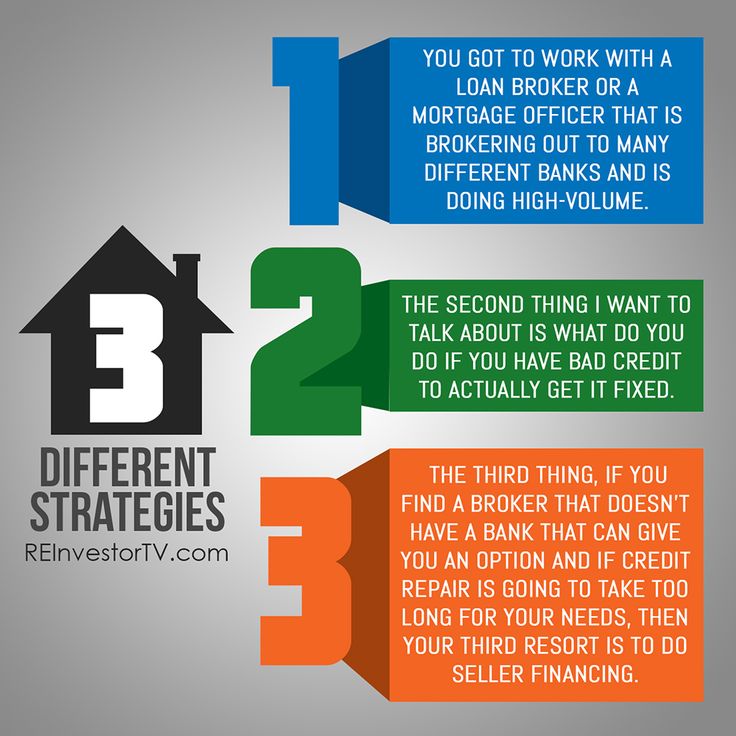

Let’s start with the primary categories of financing options – off-site versus in-house.

In-house financing is an option in which the loan comes directly from the ATV dealer. By eliminating the bank or private lender’s restrictions, the dealer has more flexibility to work with your situation.

In other words, the dealer can lend to individuals with much lower scores than a bank would typically deny.

Further, in-house ATV financing means the dealer can spread your payments over a longer time-frame, increasing your ability to make each payment successfully.

Some may be willing to offer payment plans outside of the traditional monthly schedule. For example, some buyers find it easier to make smaller, weekly payments. Off-site lenders would not have the freedom to negotiate to this extent.

In-house financing can also save you in transactions and other administrative fees related to off-site financing.

Another way to mitigate the effects of bad credit is to get a co-signer on loan. By adding a party with a good credit history, lenders are more likely to approve your loan with a higher assurance they’ll receive payment.

Don’t be surprised, however, if people are not as willing as you expect to help. Because co-signers take on full responsibility for the loan if the primary borrower defaults, many are understandably hesitant to agree.

One step further than a co-signer, a loan from a friend or family member is a bad credit ATV financing option for some. While it’s not advised to beg family for money, there’s potential to work out a personal payment plan.

While it’s not advised to beg family for money, there’s potential to work out a personal payment plan.

Maybe you can do some extra convincing by agreeing to share your new ATV? Just a thought.

While not exactly a bad credit ATV financing option itself, consider a trade-in. By taking some of the principal costs off the top, your loan amount will be less and more likely to be approved.

Additionally, trading in an ATV that you still owe on will eliminate that payment, freeing you up for your new ATV commitment.

Similar to the trade-in concept, providing a larger down payment not only takes a chunk away from the required loan amount, but it proves to lenders you have the saving ability.

In extreme cases, you can consider saving up for the entirety of the purchase and skip financing altogether!

Some dealers offer layaway in place of a true financing option and are a particularly good choice for patient buyers.

In a layaway set-up, you won’t take your ATV home until it’s fully paid for. However, unlike financing, no interest is charged. In certain circumstances, buyers are even allowed to make payments on their own schedule.

This option is best for those who exhaust their options and cannot get a loan or are not yet ready to take the risk of hurting their own credit score. In other words, it could be considered a trial for truly financed payments.

Whether you’re using in-house or off-site financing, the application may ask for references.

Providing a list of reputable individuals who can vouch for your dependability improves your approval odds. However, it likely won’t affect your interest rate.

Additionally, unlike co-signing a loan, serving as a reference carries no financial liability, so people are usually more comfortable participating.

Most lenders like a balance of professional and personal references. Reach out to a supervisor or valued co-worker to vouch for your work dependability, while listing a long-time friend as a character reference.

Reach out to a supervisor or valued co-worker to vouch for your work dependability, while listing a long-time friend as a character reference.

Regardless of whom you choose, references should be able to answer the necessary details about you, including your place of employment and address.

Some dealers, particularly those with in-house financing, are more apt to approve bad credit ATV financing agreements when the buyer can submit to automatic drafts.

By guaranteeing monthly payments on time, the lender is taking on far less risk. Buyers should beware; however, as insufficient funds and other penalties in these situations can be especially harsh.

A less common option, you should remain alert for dealers who host promotions for low credit buyers. These promotions are more likely with in-house financing providers who are willing to take on the additional risk and work with poor scores.

If you’re young or have never opened a line of credit, lenders may be hesitant to approve you or require a co-signer. These same bad credit ATV financing options are also good for you.

However, always be careful when first taking on loans. Because it’s extremely difficult to rebuilt bad credit, you want to make sure you can handle the financial obligation.

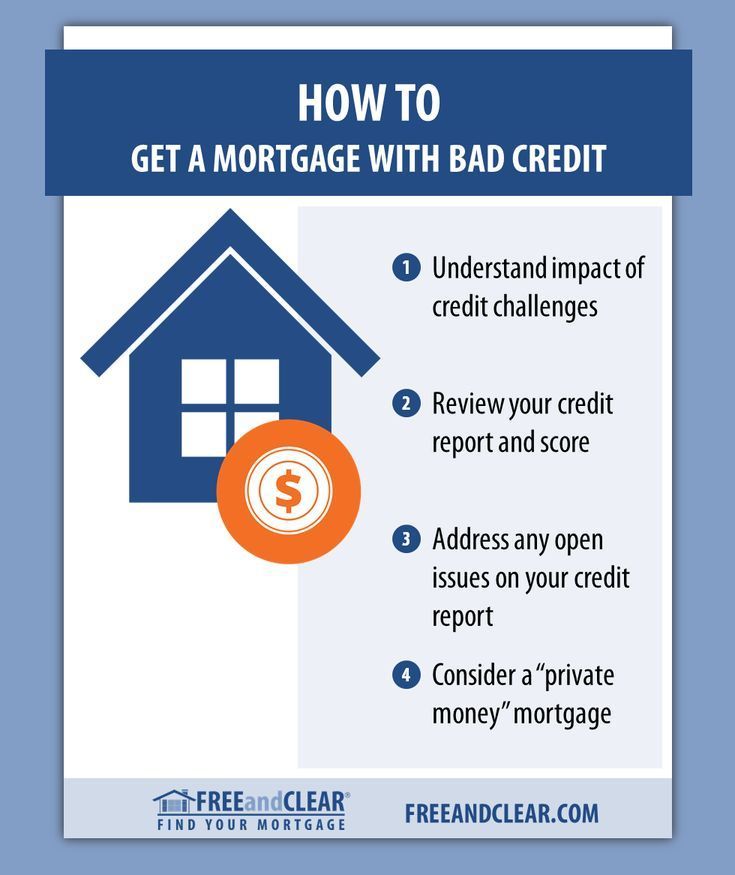

You may choose to take steps to rebuild credit before officially applying for bad credit ATV financing. Just know this will take some time and effort on your part.

For starters, fully pay off any overdue balances as quickly as possible. Then, be sure to make timely payments in the future.

Next, consider a secured credit card designed to assist in credit rebuilding. Most banks offer at least one option. Financial professionals advise against other card types, such as department stores, even if they are easy to obtain.

Finally, any time you can take out a smaller, private loan for any purpose and pay it off appropriately, your credit score will slightly improve.

If you’re convinced that bad credit ATV financing exists, your next step is to explore which of the above options work for you.

As mentioned, you can combine the options for the highest chance of approval. For example, you can save for a large down payment, trade-in and older model ATV, and add a co-signer.

Even if you need some time to save to purchase that ATV for sale you have been eying up, you can begin shopping around for the ATV that you want so you’re prepared for the final cost. Be sure to take into account additional parts and service agreements that may be available for purchase.

Once you’ve established your financing route and accumulated any down payment, it’s time to contact a trusted dealer. Be sure to start with those offering in-house financing!

Of course, do your research to ensure they offer the model and any accessories you fell in love with!

During your conversation with the dealer’s financing representative, there are some important questions to keep in mind:

Once all of your questions have been answered, it’s finally time to apply for financing with the guidance of the representative. Because it’s all done in-house, you should be able to get a quick result.

Because it’s all done in-house, you should be able to get a quick result.

After everything’s been processed, it’s time to hit the trails in your new ATV!

Have experience with other financing options not listed? Leave a comment, so others have full access to bad credit ATV financing advice!

It is often thought that a bad credit history is impossible to either fix or get a loan with it on decent terms. In fact, none of these statements are true if you make some effort.

It happens that a borrower needs to take out a loan, but a credit history (CI) of poor quality interferes. Maybe he did not pay his obligations on time due to inattention, or maybe he became a victim of scammers. In this case, it doesn't matter. The main thing is how to get a loan under these conditions.

There are two options for solving the problem. The first is fast, but quite expensive. It is based on the need for the borrower to prove to the lender their creditworthiness and the absence of risks. It's possible.

It is based on the need for the borrower to prove to the lender their creditworthiness and the absence of risks. It's possible.

The second option is to work on improving the quality of clinical trials and increasing the Personal Credit Rating (PCR). It is longer, but in the end it gives better results, and most importantly, better lending conditions.

Statistics show that the loan approval rate for holders of a low RCC credit rating is only about 15%. That is, approximately every sixth borrower with a bad credit history receives a loan. Why is this happening?

Banks, issuing a loan, are primarily concerned with its return. Evaluating the borrower, they carefully check how conscientiously he previously fulfilled his obligations.

It would seem that if their worst fears are confirmed here, the loan will not be issued. However, the peculiarity of some banking products - including, for example, mortgages or car loans, is that their return is secured not only by the borrower's good faith, but also by collateral. This means that even if the client stops servicing the debt, the bank will return its money by selling the pledged property. And if the rate is high enough, and the collateral exceeds the value of the loan, it will be approved.

This means that even if the client stops servicing the debt, the bank will return its money by selling the pledged property. And if the rate is high enough, and the collateral exceeds the value of the loan, it will be approved.

But this, of course, is not the rule, but rather the exception. Therefore, it is important to know what will help a borrower with a low RCR to convince a bank to approve a loan application.

A large down payment proves that a person is capable of managing money responsibly, and also reduces the risk that in the event of a sharp decline in housing prices, the value of the deposit will no longer cover the amount of debt.

A large down payment proves that a person is capable of managing money responsibly, and also reduces the risk that in the event of a sharp decline in housing prices, the value of the deposit will no longer cover the amount of debt.

Most of the conditions require the borrower to have significant savings or liquid expensive assets. But the owner of a low RCC cannot do without them if he is aimed at obtaining a loan quickly. However, even if all these requirements are met, the borrower must be prepared to refuse. In this case, the only alternative left is to work on improving the quality of the story.

You may also be interested in: What to do if the bank refuses to issue a loan?

This case is not as hopeless as it might seem. Contrary to popular belief, even a very low rating can be raised to the point where most banks will gladly approve a loan. The downside is that it can't be done quickly.

The main thing that the borrower needs to learn is that no matter how much you want to simplify the task, you cannot turn to the help of intermediaries. There are a lot of suggestions on the Internet for improving and even deleting CI records, but the truth is that only those who made them, that is, banks, can change them. Alternative methods advertise, as a rule, scammers to extort money. At best, they will be the hands of the borrower and at his expense try to challenge the credit history - most often unsuccessfully. At worst, you will have to put up with the loss of personal data, money and time. Therefore, it is faster and cheaper to do the increase in anti-ship missiles yourself.

Alternative methods advertise, as a rule, scammers to extort money. At best, they will be the hands of the borrower and at his expense try to challenge the credit history - most often unsuccessfully. At worst, you will have to put up with the loss of personal data, money and time. Therefore, it is faster and cheaper to do the increase in anti-ship missiles yourself.

Getting a card is not difficult: many lenders issue them on the basis of a single application. After receiving a credit card, you must actively use it and do not forget about the need to repay the formed debt before the end of the grace period. This way you can avoid additional costs. The more financial transactions on the card will be made, the faster the RCC will grow.

Getting a card is not difficult: many lenders issue them on the basis of a single application. After receiving a credit card, you must actively use it and do not forget about the need to repay the formed debt before the end of the grace period. This way you can avoid additional costs. The more financial transactions on the card will be made, the faster the RCC will grow. When using any option, it should be remembered that improving the quality of a credit history is possible only if all delinquencies are paid and problem loans are repaid. The main thing here is to enter the payment schedule specified in the contract so that the bank does not have any financial claims. If this is not done, it may not be possible to attract even a small loan, and all efforts will be wasted.

The main thing here is to enter the payment schedule specified in the contract so that the bank does not have any financial claims. If this is not done, it may not be possible to attract even a small loan, and all efforts will be wasted.

After the quality is restored, the borrower can get a loan. However, the question arises: how do you know that loans are already available? To do this, you need to learn how to use the Personal Credit Rating.

RCR is calculated on the basis of credit history records and is essentially its numerical assessment. It is measured in points from 1 to 999 units. The higher the rating, the greater the chance of obtaining a loan on favorable terms. You can get RCC in the same place as history, that is, in the NBKI. The easiest way is to request a rating online in the borrower's personal account on the bureau's official website. You can also use the NBKI-online mobile application. In this case, both the credit history and the RCC will come directly to the smartphone.

It should be noted that for the security of the borrower's personal data, it is necessary to have a confirmed registration on the public services portal. But if it is available, the procedure for requesting and receiving will take no more than one minute.

In addition to assessing the borrower, the RCC has another very useful function: with its help, you can get the most advantageous offers from Russian banks. Usually, special loan products are offered when requesting a rating on the NBKI website. Their advantage is that they exactly match the borrower's scores and therefore are optimal.

As you can see, a bad credit history does not mean that the borrower will not be able to get a loan. The main thing is not to leave your RCC in a deplorable state, take care of the quality of CI and value your financial reputation. Even if a loan is not needed now, this does not mean that it will not be needed in the near future.

Obviously, if you are planning to buy a car on credit, you need to have an impeccable history. After all, it is unlikely that a bank will provide financial assistance to an insolvent or dishonest person. It is this information that is the key parameter for the bank manager, on the basis of which he can refuse or approve the application. However, even if you receive a negative answer, do not despair. As they say, there are no hopeless situations. Almost any issue can be positively resolved if you make certain efforts and confidently go towards the intended goal. Below we will consider how to get a car loan with a bad history, what options are available to improve it, and what needs to be done to buy a new or used car on favorable terms with a minimum of risks and hassle.

Credit history is an indicator of the client's solvency. This is information about every person who has ever taken a loan from a bank. It is stored in the database of credit histories of all borrowers, without exception, and when considering an application, it is a key criterion for making a positive decision or refusal. Depending on how the previous loan was repaid, credit history can be good or bad. In the first case, it is assumed that there are no current delays in mandatory payments. The client is solvent, as he has always paid his bills on time. In this case, the probability of obtaining a car loan on favorable terms is maximum.

It is stored in the database of credit histories of all borrowers, without exception, and when considering an application, it is a key criterion for making a positive decision or refusal. Depending on how the previous loan was repaid, credit history can be good or bad. In the first case, it is assumed that there are no current delays in mandatory payments. The client is solvent, as he has always paid his bills on time. In this case, the probability of obtaining a car loan on favorable terms is maximum.

Bad credit refers to monthly repayments that are irregular or delayed. Delays were both short-term up to 30 days, and long-term - up to several months. In any case, under such conditions, the possibility of obtaining a loan, like any other loan, is minimal. At the same time, the higher the degree of neglect (delays), the lower the likelihood of approval.

There are several ways to improve your credit history. If the delays were due to objective reasons (illness, reduction, pandemic, etc. ), it is necessary to provide the bank manager with documents confirming this or that situation when applying for a car loan. This may be a certificate of illness, temporary non-payment of wages, or something else.

), it is necessary to provide the bank manager with documents confirming this or that situation when applying for a car loan. This may be a certificate of illness, temporary non-payment of wages, or something else.

If you plan to purchase a car in a few months or even next year, you can first take a small loan from the bank where you are going to receive a loan and pay it off quickly. There are many options for "quick money" even with a zero interest rate, if the specified amount is returned within one or two months. Prompt repayment of debt will have a positive impact on credit history.

Another important fact that affects the credit history is the absence of delays in utility and other obligatory payments. Therefore, try to pay off all debts on all accounts before applying. And it is better to do it in advance, and make payments on time for several months.

When there is no desire or time to improve your financial image, there are several legal options for how to get a bad credit car loan. Given that the bank in any case has money back guarantees in the form of collateral, the manager can approve the application if you agree to more stringent conditions:

Given that the bank in any case has money back guarantees in the form of collateral, the manager can approve the application if you agree to more stringent conditions:

Although the first option is not mandatory, double insurance will significantly increase the chances of approval of the application. Otherwise, the probability of acquiring a new car in this way is reduced to zero.

Although the first option is not mandatory, double insurance will significantly increase the chances of approval of the application. Otherwise, the probability of acquiring a new car in this way is reduced to zero. An important point is the fact that, regardless of history, it is better to apply for a car loan at the bank to which your salary or pension is transferred. A good help for making a positive decision can be a deposit that increases the client's solvency.