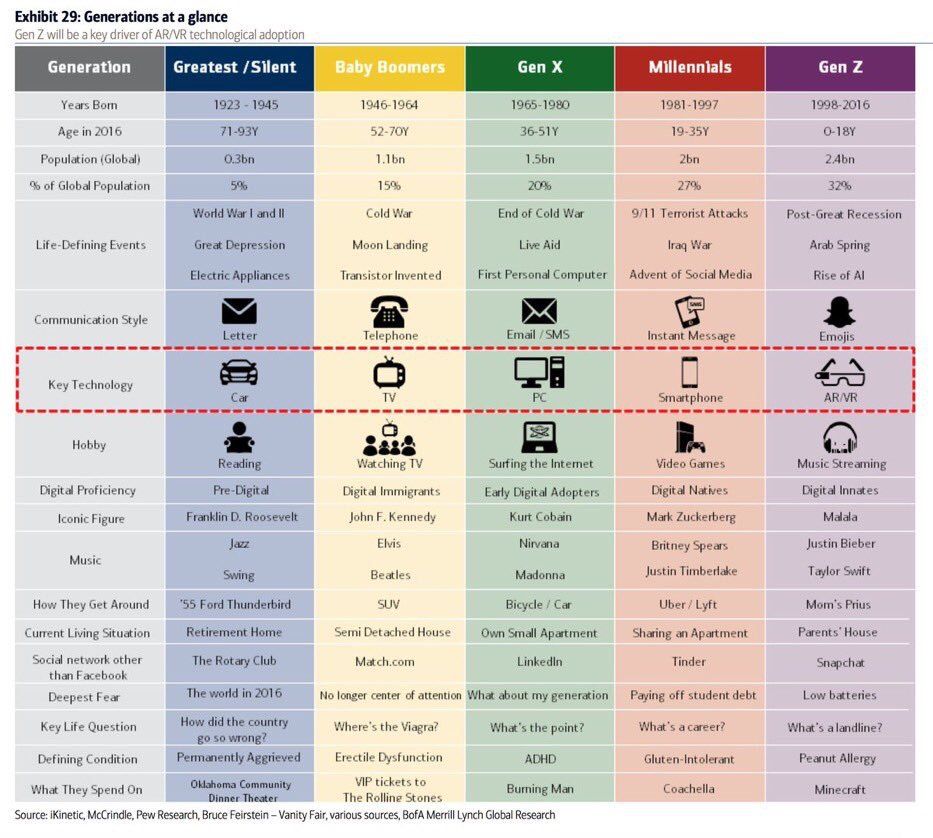

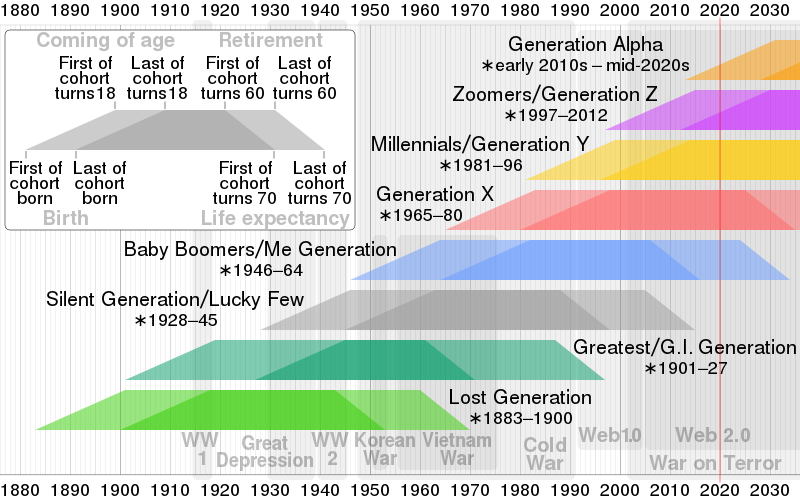

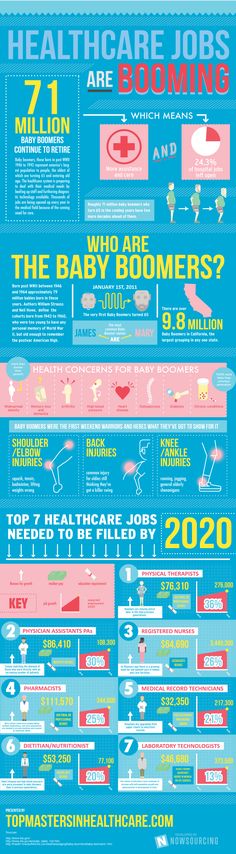

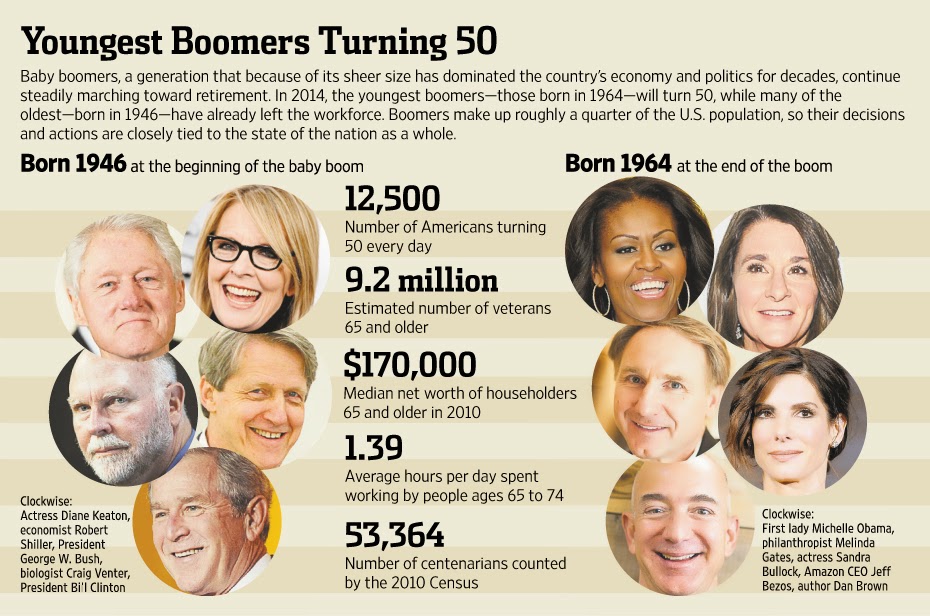

Baby Boomers, born between 1946 and 1964, make up 28% of the United States population, making them one of the largest living adult generations, second to millennials. 10,000 Baby Boomers reach retirement age every day, meaning radical changes to the job market have already begun.

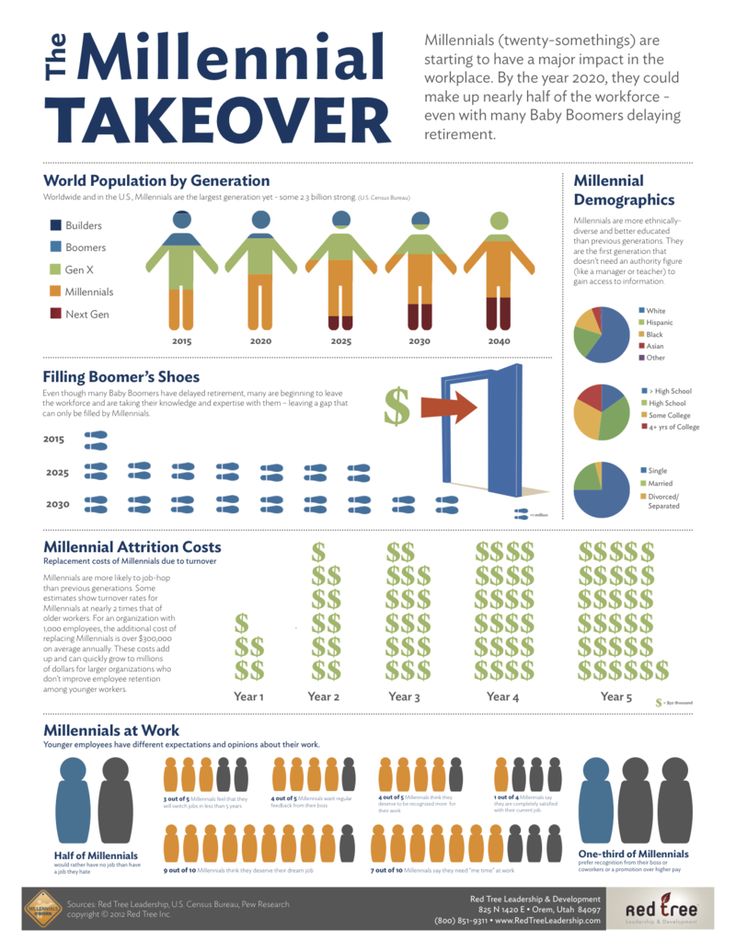

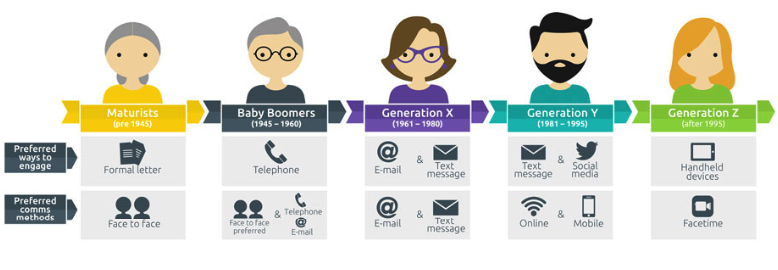

How will this affect the job market? Baby Boomers' retirement will affect many industries, particularly the IT and technology industries. This demographic has become less interested and obligated to work long hours, partially due to their high corporate rankings and because they are less defined by their career than younger generations who are newer to the workforce.

The following information describes Boomer retirement trends, why boomers are not retiring, commonly held positions by this generation, likely economic changes, and Boomer statistics.

According to Pew Research Center, the rate of retirement for Boomers has accelerated since COVID-19 began. Nearly 29 million Boomers retired in 2020, three million more than in 2019. Seventy-five million Boomers are expected to retire by 2030, paving the way for what is now called "The Great Retirement," which may surpass The Great Resignation as the most significant hiring trend for 2022.

“The Great Retirement” is an unprecedented flood of retirees exiting the workforce earlier than planned. This event was triggered by the pandemic and heavily involved Boomers. Whether it is to enjoy life, health concerns, or a changing work environment, the workforce in recent years has seen an uptick in retirement. By the fall of 2020, according to the PEW Research Center, almost 30 million Boomers had retired, an increase of 213% from the previous year.

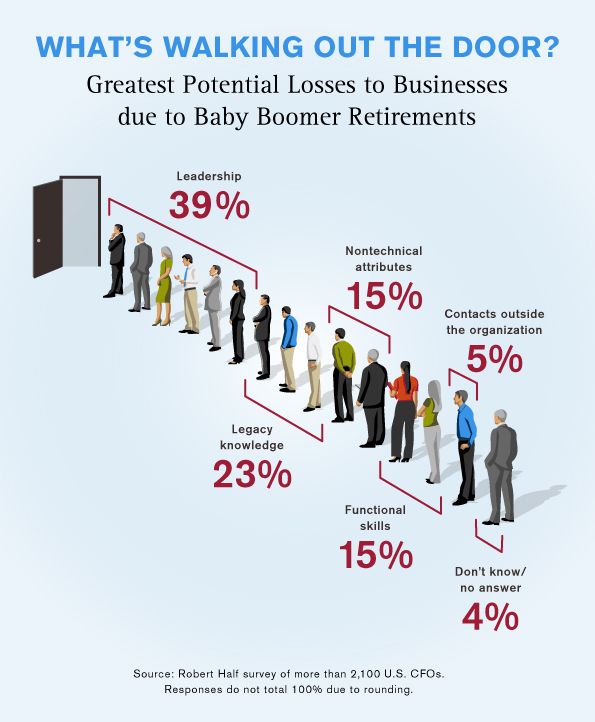

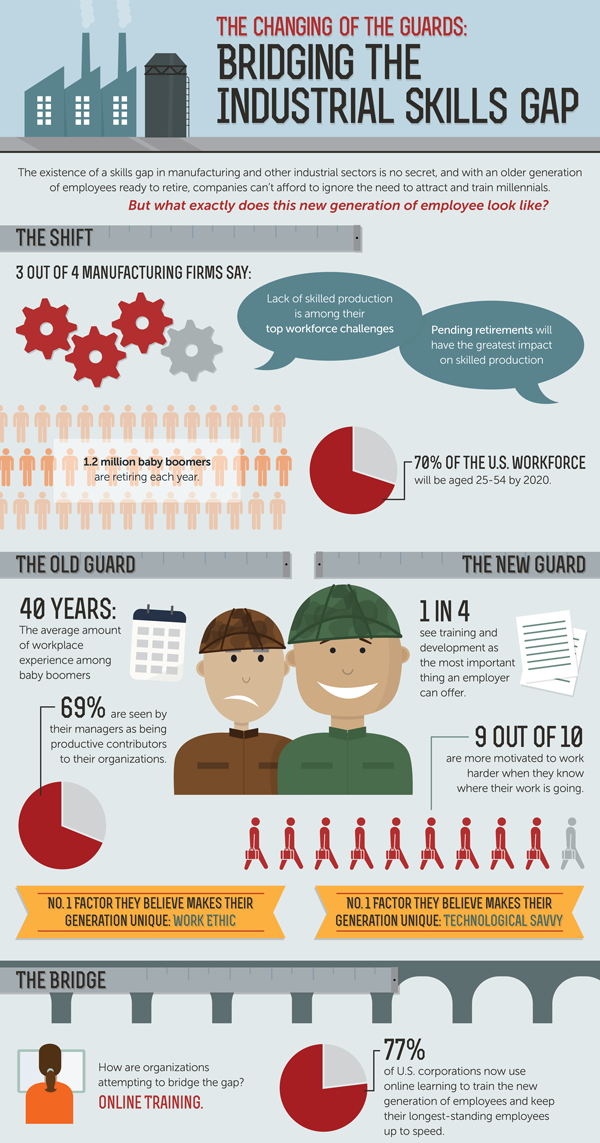

One in four workers in the United States is a Boomer, amounting to 41 million in total. The mass retirement likely will lead to an even wider workforce gap as companies will need to fill positions made available after the Boomers' retirement. As mentioned above, these workers generally hold higher positions, making the need for recruiters even more critical. Working with a recruitment agency can help ensure that jobs are filled by qualified candidates, facilitating an easy transition. Click here to learn more about how working with a recruiter will revolutionize your hiring process.

As mentioned above, these workers generally hold higher positions, making the need for recruiters even more critical. Working with a recruitment agency can help ensure that jobs are filled by qualified candidates, facilitating an easy transition. Click here to learn more about how working with a recruiter will revolutionize your hiring process.

To avoid the workforce gap, employers can take steps involving new talent.

Rather than discounting younger talent for lack of knowledge, train them on the skills needed to perform well in your company. If your company does not have a formal training program, they can enroll in online courses that provide training at no cost.

Rather than discounting younger talent for lack of knowledge, train them on the skills needed to perform well in your company. If your company does not have a formal training program, they can enroll in online courses that provide training at no cost. There are several reasons why a portion of Boomers has not yet retired.

As more boomers approach retirement, there are fewer skilled workers to take their place. This is creating what is known as a "knowledge gap," as highly demanded workers and their skills are exiting the workforce quicker than new employees can receive the necessary training and experience to replace them.

This is creating what is known as a "knowledge gap," as highly demanded workers and their skills are exiting the workforce quicker than new employees can receive the necessary training and experience to replace them.

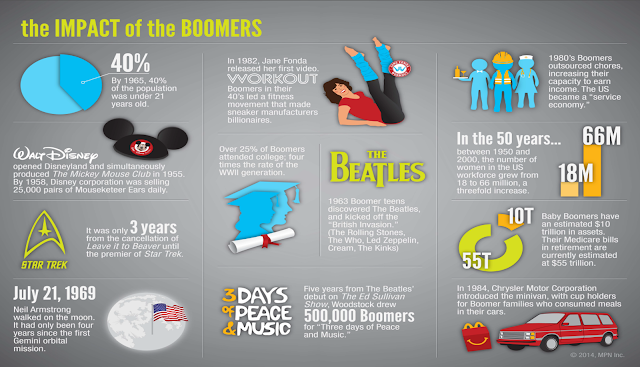

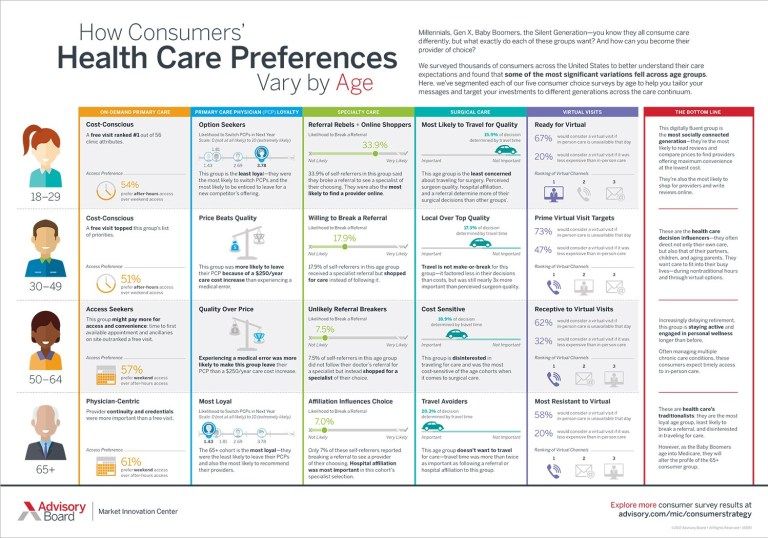

Boomers have improved health and wellness compared to previous generations. With innovation and progress in the health industry and a movement toward greater fitness and overall health, Boomers are living a healthier lifestyle than before. This has encouraged the generation to continue working and find more ways to stay productive.

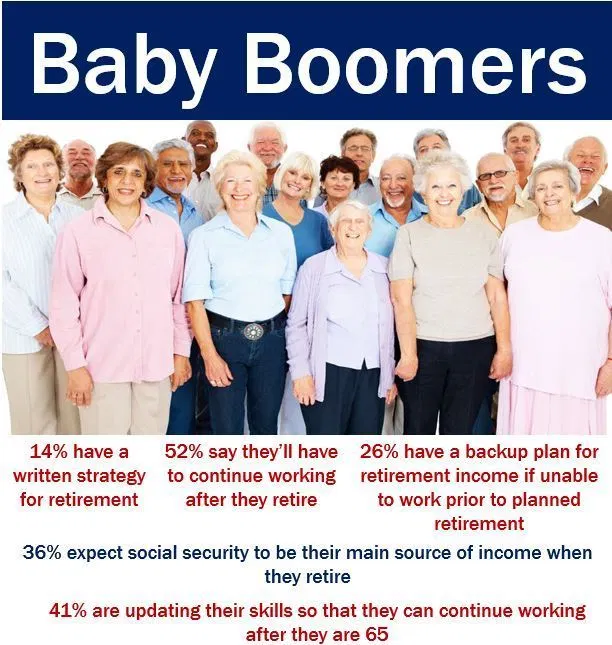

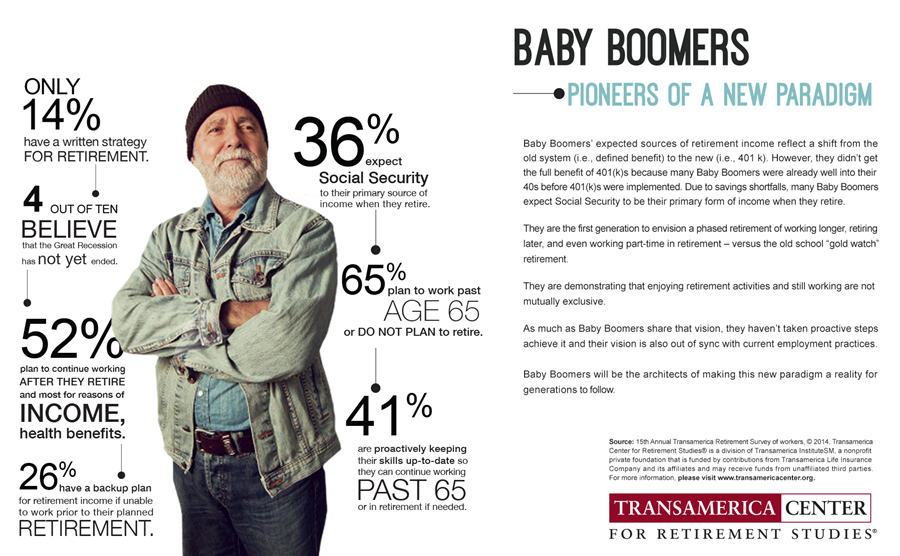

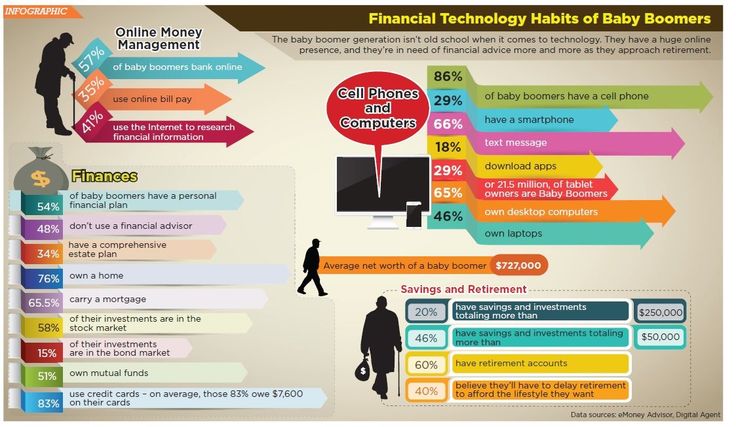

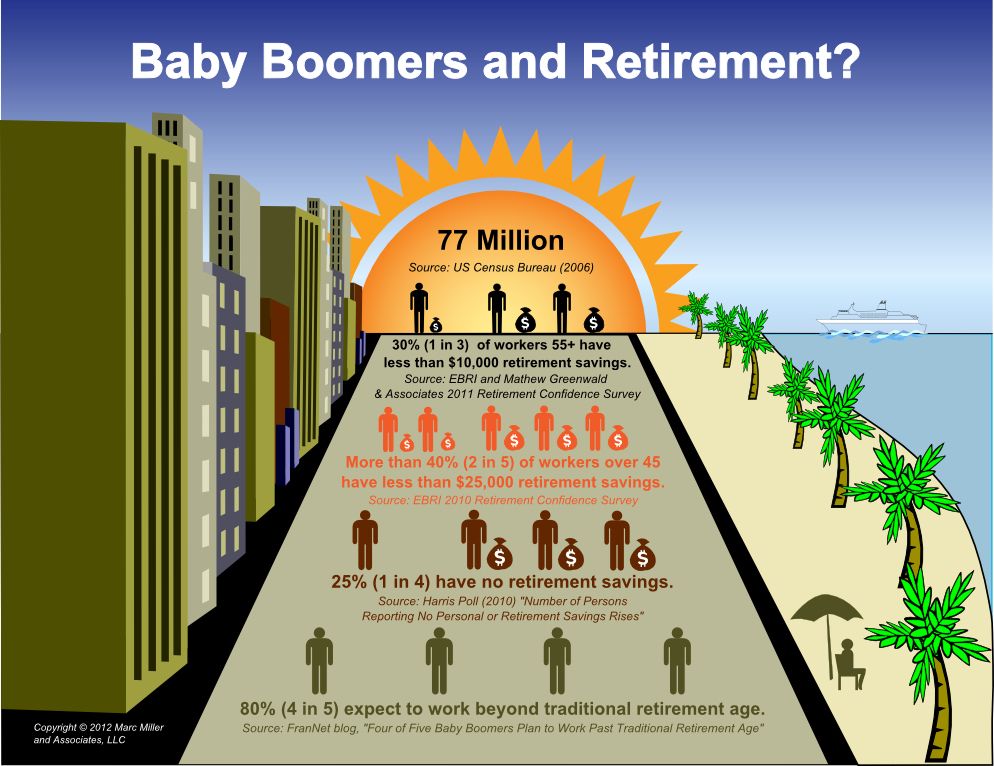

Social security will not be available until age 67, meaning many Boomers will need to continue working to support themselves and their dependents. This, coupled with a lack of retirement savings, means Boomers will continue to work past retirement age. The median 401(k) balance of those aged 55-64 is $177,805, according to a report from Vanguard. According to the "4% rule" of retirement, this translates to $7,112 per year for retirement. Despite the additional income from social security, this is not nearly enough income for most retirees to sustain their lives. 45% of Boomers report having no savings for retirement at all.

Despite the additional income from social security, this is not nearly enough income for most retirees to sustain their lives. 45% of Boomers report having no savings for retirement at all.

Some Boomers take the generational motto, "Live to work," to an extreme. A 2013 Gallup poll on consumer and workplace behavior of Boomers asked at what age the generation planned to retire. 10% of respondents chose "Never" as their response.

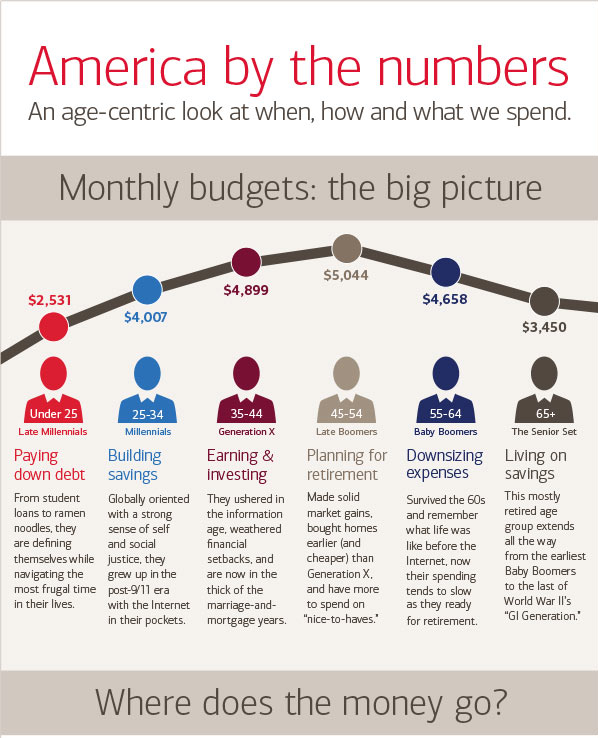

After more Boomers retire, several changes to the economy are expected. Consumer spending will be affected, as retirees both produce less and consume/spend less money. The unemployment rate is historically low, but many people are still looking for jobs, specifically young talent. When Boomers retire, it will free up jobs for younger employees.

Boomers also spend more on their adult children than previous generations, as a substantial percentage of parents provide some financial support for their adult children. In February 2020, 47% of adults aged 18-29 resided with one or both of their parents. As of July 2020, that number increased to 52%, even surpassing the previous peak seen during the Great Depression. The most common area of assistance is student loans, and although this may be a debt of the past, the financial support provided by Boomers will likely slow down after retirement.

In February 2020, 47% of adults aged 18-29 resided with one or both of their parents. As of July 2020, that number increased to 52%, even surpassing the previous peak seen during the Great Depression. The most common area of assistance is student loans, and although this may be a debt of the past, the financial support provided by Boomers will likely slow down after retirement.

Boomers thrive in the installation, transportation, and engineering industries. The generation is used to working with their hands and grew up before the internet. By analyzing which positions Boomers hold, we can better identify likely job openings in the next several years. Some of these common positions include:

This is a typical job for Boomers, some even taking the career up post-retirement.

This is a typical job for Boomers, some even taking the career up post-retirement. They are also in charge of approving budgets and other organizational plans. The median salary for these positions is $183,200

They are also in charge of approving budgets and other organizational plans. The median salary for these positions is $183,200

The above information highlights the key aspects and future trends of one of the most demanding working generations. Although "The Great Retirement" may be a daunting event continuing to approach the horizon, young talent is ready to be trained and fully integrated into the workforce. This transition can be better facilitated through workplace flexibility, reskilling, upskilling, and mentorship provided by those who may soon head toward retirement.

Written by Lauren Kemp

Lauren Kemp, Communications and Marketing Specialist at J2T, earned a Bachelor of Science in Business Management with a minor in Latin American studies and a Master of Science in Innovation and Management from Montana State University. Lauren hails from Montana and enjoys reading about the history of her home state. Her bucket-list items include touring the Biltmore Estate in Asheville, North Carolina, and taking an immersion trip to Chile to experience Latin American culture first-hand.

J2T is a recruiting and staffing firm that solely focuses on accounting and finance roles. J2T Flex facilitates all operational accounting needs, both direct hire and contract or contract-to-hire needs. On the direct hire side, J2T Recruiting specializes in senior positions starting at Sr. Accountant up through CFO in both direct hire and contract or contract-to-hire needs encompassing everything in the corporate accounting and finance organizational chart. J2T is a women-owned business exclusively serving the Colorado and Montana markets with the overarching goal to serve you in all areas of the hiring experience.

J2T is a women-owned business exclusively serving the Colorado and Montana markets with the overarching goal to serve you in all areas of the hiring experience.

Millions of Baby Boomers retire each year from the U.S. labor force. But in the past year the number of retired Boomers increased more than in prior years, according to a Pew Research Center analysis of monthly labor force data. The recent increase in the share of Boomers who are retired is more pronounced among Hispanic and Asian American Boomers and those residing in the Northeast.

In the third quarter of 2020, about 28.6 million Baby Boomers – those born between 1946 and 1964 – reported that they were out of the labor force due to retirement.

This is 3.2 million more Boomers than the 25.4 million who were retired in the same quarter of 2019. Until this year, the overall number of retired Boomers had been growing annually by about 2 million on average since 2011 (the year the oldest Boomer reached age 65), and the largest increase was 2. 5 million between the third quarter of 2014 and 2015.

5 million between the third quarter of 2014 and 2015.

How we did this

More than 70 million Baby Boomers reside in the U.S. Since the time that the oldest Boomers reached age 65, there has been public interest in their impact on the nation’s labor force, public social insurance programs and asset values. The COVID-19 recession resulted in a large and sharp employment contraction across generations. This analysis looked at whether retirements had accelerated among Boomers during the pandemic.

The overall number of retired Baby Boomers is derived from the monthly Current Population Survey (CPS), conducted by the U.S. Census Bureau for the Bureau of Labor Statistics. The CPS is the nation’s premier labor force survey and is the basis for the monthly national unemployment rate released on the first Friday of each month. The CPS is based on a sample survey of about 60,000 households. The estimates are not seasonally adjusted.

“Retired” in this analysis is based on labor force status. Those who cite “retired” as the reason for not being in the labor force (neither employed nor seeking work) constitute the retired Boomer population. This is a moment-in-time measure, and increases reflect the net change of Boomers moving both into and out of “retirement” due to changes in labor force participation.

Those who cite “retired” as the reason for not being in the labor force (neither employed nor seeking work) constitute the retired Boomer population. This is a moment-in-time measure, and increases reflect the net change of Boomers moving both into and out of “retirement” due to changes in labor force participation.

The CPS microdata files analyzed were provided by the IPUMS at the University of Minnesota.

The COVID-19 outbreak has affected data collection efforts by the U.S. government in its surveys, especially limiting in-person data collection. This resulted in about a 4 percentage point decrease in the response rate for the CPS in September 2020. It is possible that some measures of retirement and labor market activity and its demographic composition are affected by these changes in data collection.

The job losses associated with the COVID-19 recession may be contributing to the jump in Boomer retirements. Since February 2020, the number of retired Boomers has increased by about 1. 1 million. Some of this increase could reflect seasonal change in employment activity. But during the February to September period last year, the population of retired Boomers rose by only about 250,000.

1 million. Some of this increase could reflect seasonal change in employment activity. But during the February to September period last year, the population of retired Boomers rose by only about 250,000.

In September, 40% of Boomers were retired, up from 39% in February. The recent increase in the share of those who have retired has been greater for some demographic groups. Among Boomers 65 and older, the share retired has increased 2 percentage points since February, whereas the retirement rate has remained unchanged among Boomers younger than 65 (18%).

The share of Boomers who have retired differs by educational attainment. Among those with no education beyond high school, the share is up 2 percentage points since February. There has been no change among those with some college education, and for those with a four-year college degree, the share is up 1 point.

The share of Hispanic Boomers reporting they are retired has increased 4 percentage points since February (30% to 34%). And the retirement rate among Asian Boomers has increased 3 points, from 36% to 39%. Retirement is up more modestly among White and Black Boomers (1 point for each).

And the retirement rate among Asian Boomers has increased 3 points, from 36% to 39%. Retirement is up more modestly among White and Black Boomers (1 point for each).

Looking regionally, the movement into retirement appears most prevalent among Boomers residing in the Northeast (35% in February and 38% in September).

Richard Fry is a senior researcher focusing on economics and education at Pew Research Center.

POSTS BIO TWITTER EMAIL

The Baby Boomer generation is reaching retirement age in record numbers. With more baby boomers retiring every day, it's important to understand how ready they are to leave their jobs for good. In this article, we discuss the average Baby Boomer retirement savings and provide tips on how to increase your retirement income. No matter what generation you are, a financial advisor can help you prepare for your retirement.

Average Baby Boomer Retirement Savings

According to the Transamerica Retirement Research Center, Baby Boomers have a median retirement savings of $202,000. Based on the 4% rule, this gives an annual retirement income of $8,000 per year. Depending on your point of view, this portfolio size may be larger or smaller than you expected. Transamerica also found that about 45% of baby boomers have saved $250,000 or more. In addition, 40% of baby boomers agree with the statement that they have not done enough to save for retirement.

Based on the 4% rule, this gives an annual retirement income of $8,000 per year. Depending on your point of view, this portfolio size may be larger or smaller than you expected. Transamerica also found that about 45% of baby boomers have saved $250,000 or more. In addition, 40% of baby boomers agree with the statement that they have not done enough to save for retirement.

A Stanford Longevity Center study found that people born in 1948-1953 had a median balance in tax-favored plans of $290,000, while people born in 1954-1959 had a median balance in tax-favored plans of $209,246.

One argument for this is that the boomer generation was the last to have wide access to workplace pensions. Expecting retirement income from pensions, many boomers didn't feel the need to save as much as later generations.

Also, for the boomers who are still active, this number should continue to rise as they make additional annual contributions and their investments grow. Using the Rule of 72, the youngest boomers can look forward to the last “doubling” of their retirement nest with an average return of 8% to 10% before they reach 67 years of age.

How Baby Boomers Can Increase Their Retirement Income

Retirement income is an important topic for people approaching retirement age. These steps are easy ways to increase the average retirement savings for baby boomers. Every strategy you can implement will increase your potential retirement income.

Maximize pension plans

.

By making the maximum annual contribution to pension plans, you will create a larger nest from which you can withdraw funds for retirement. Also, if you make contributions to pre-tax retirement plans (such as a 401(k), 403(b) or 457 Plan), you will reduce your tax bills each year by providing additional money for investment. In 2022, you can contribute up to $20,500 to these plans.

Conversely, by making contributions to an after-tax retirement plan, such as a Roth IRA, you create tax-free retirement income. These plans have no mandatory minimum deductions starting at age 72, so the tax-free money can continue to grow for many years to come. You can contribute up to $6,000 per year to a Roth IRA (2022 annual limit), depending on your income.

Catch-up contributions for contributors over 50

When you turn 50, you are eligible to make catch-up contributions to your retirement accounts. This means you can add another $6,500 to your company's retirement plans and another $1,000 to your IRA (traditional or Roth). These additional contributions will help you increase your retirement savings in the final years leading up to retirement. The more you can save, the more your retirement egg will grow and generate monthly retirement income.

Use a brokerage account

When you have maximized your retirement savings, it is a good idea to invest through a brokerage account. There are no deposit limits or withdrawal rules to worry about. While most retirement plans have limited choices, you have infinitely more investment options in a brokerage account.

Brokerage accounts can also help with tax planning strategies, as you can choose which assets to sell. For example, you can take advantage of capital losses that offset unlimited capital gains and up to $3,000 of regular income each year. And when you sell a winning investment after holding it for more than one year, the profits are taxed at lower capital gains rates.

For example, you can take advantage of capital losses that offset unlimited capital gains and up to $3,000 of regular income each year. And when you sell a winning investment after holding it for more than one year, the profits are taxed at lower capital gains rates.

Use the Medical Savings Account

The Medical Savings Account provides triple tax benefits. Your contributions are taxed annually if you are in a high deductible health plan. Money grows with tax deferral as long as it is in the account. And withdrawals are tax-free if they are used to cover eligible medical expenses, including Medicare premiums. In addition, there is no minimum distribution requirement, so the money can continue to grow and cover future medical expenses in retirement.

Purchase an annuity

.

Annuities are another investment option that provides tax-deferred growth for your investments. These insurance products provide returns that mimic various assets, including fixed income and the stock market. Equity index annuities offer the best of both worlds. They offer guarantees similar to fixed income, but the potential to earn more through participation in the stock market.

When you need retirement income, you can withdraw money as needed or annuitate your balance for a guaranteed income, just like with a pension. Monthly annuity payments are a combination of principal and interest. The principal amount is refunded tax-free. However, you must report all interest on your tax return.

Life insurance in cash

Purchasing a life insurance policy with a cash value allows you to purchase death insurance indemnity to protect your loved ones with the opportunity to invest additional cash. As your cash balance increases, you can increase your beneficiary's death insurance coverage. In addition, you can withdraw cash without paying taxes if you take it on credit. When you pass away, the unpaid balance will be deducted from your death benefit.

Postpone Social Security

Full retirement age for people born between 1943 and 1954 is 66. For everyone who was born after that - 67 years. For every year you delay receiving Social Security, your monthly benefit increases by 8%. While it may be tempting to get guaranteed money today by getting Social Security early, waiting can be very rewarding.

For everyone who was born after that - 67 years. For every year you delay receiving Social Security, your monthly benefit increases by 8%. While it may be tempting to get guaranteed money today by getting Social Security early, waiting can be very rewarding.

If you reach the age of 70, you are guaranteed a 32% increase in your monthly allowance. This extra income will be yours for the rest of your life. This extra money also affects those who receive survivor benefits. For people with long life expectancies, this extra money really goes up.

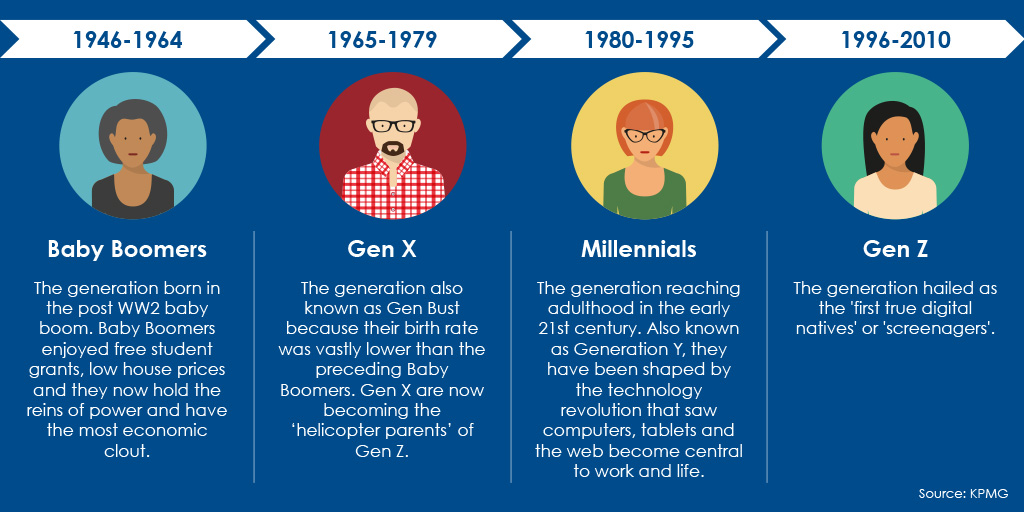

Baby Boomers, Definition

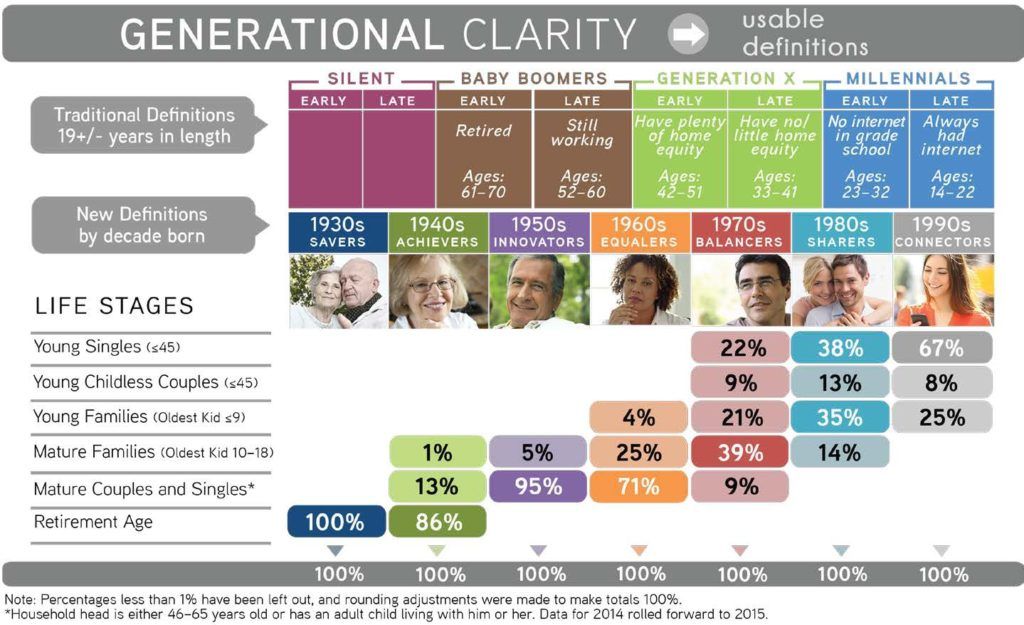

The Baby Boomer Generation is a nickname given to people born between 1946 and 1964. This generation spans over 20 years from birth, and most people consider it to be a homogeneous group of people. However, there is actually quite a lot of variation in the age, personality, experience, and goals of boomers.

Retirement age is generally considered to be when you turn 65 years old. However, this is not always the case. Social Security considers 66 to be the full retirement age for people born between 1943 and 1954, and 67 for anyone born after that. In addition, advances in medicine and nutrition are helping people live longer and enjoy healthier lives than is commonly believed. For example, the last two presidents of the United States, numerous members of Congress, the Supreme Court and the heads of major corporations are all over 65 years old.

Social Security considers 66 to be the full retirement age for people born between 1943 and 1954, and 67 for anyone born after that. In addition, advances in medicine and nutrition are helping people live longer and enjoy healthier lives than is commonly believed. For example, the last two presidents of the United States, numerous members of Congress, the Supreme Court and the heads of major corporations are all over 65 years old.

The first Boomers, born in 1946, reached 66 in 2012, and the last Boomers will not reach retirement age until 2031. Many boomers continue to work because they enjoy the job, and some are forced to work because they have not saved enough money. Others are retiring as a result of the growth in their wealth, achieved through record growth in the stock market and housing prices.

Total

Baby Boomers have an average retirement saving of just over $200,000. Since the last Baby Boomers will not retire until 2031, there is still plenty of time for them to increase their retirement savings. By contributing to retirement plans and using other accounts, they can use their top earning years to save extra money. This will increase market returns and current contributions to maximize your retirement egg and the income it generates. For personalized advice, we recommend that you consult a financial advisor to develop your retirement plan.

By contributing to retirement plans and using other accounts, they can use their top earning years to save extra money. This will increase market returns and current contributions to maximize your retirement egg and the income it generates. For personalized advice, we recommend that you consult a financial advisor to develop your retirement plan.

Tips for maximizing retirement income

.

Baby boomer is a term used to describe a person born between 1946 and 1964. The baby boomer generation makes up a significant portion of the world's population, especially in developed countries. He represents nearly 20% of the American public.

As the largest generational group in US history (until the Millennials slightly surpassed them), the Baby Boomers had – and continue to have – a significant impact on the economy. As a result, they are often the subject of marketing campaigns and business plans.

Baby boomers appeared after the end of World War II, when the birth rate around the world skyrocketed. The explosion of newborns became known as the baby boom. During the boom, nearly 77 million babies were born in the United States alone, representing nearly 40% of the American population.

Most historians say that the baby boomer phenomenon was most likely due to a combination of factors: people wanted to start families, which they put off during World War II and the Great Depression, and a sense of confidence that the coming era would be safe and prosperous. Indeed, at the end of 19The 1940s and 1950s generally saw rising wages, flourishing businesses, and an increase in the variety and quantity of goods available to consumers.

Indeed, at the end of 19The 1940s and 1950s generally saw rising wages, flourishing businesses, and an increase in the variety and quantity of goods available to consumers.

This new economic prosperity was accompanied by the migration of young families from the cities to the suburbs. The GI Bill allowed returning military personnel to buy affordable housing in tracts along the edges of cities. This led to the formation of an ideal family, consisting of a husband as a breadwinner, a wife as a housekeeper and their children.

As suburban families began to use new forms of credit to buy consumer goods such as cars, appliances and televisions, companies also targeted these rising boomers through marketing efforts. As boomers approached adolescence, many became dissatisfied with this ethos and the associated consumer culture that fueled the youth counterculture movement.60s.

This huge group of children grew up to pay 10 years of Social Security taxes that covered their parents' and grandparents' pensions. Millions of people are now retiring every year.

Millions of people are now retiring every year.

As the longest living generation in history, Boomers are at the forefront of what is called the longevity economy, whether they generate income in the form of labor or, in turn, consume the younger generation's taxes in the form of their Social Security checks. .

According to a recent AARP Bulletin, Baby Boomers spend $7 trillion a year on goods and services. And even though they are aging (the youngest boomers in 2019 are already over 50), they still have corporate and economic power - 80% of the country's personal wealth belongs to boomers.

Many people in previous generations worked as hard as they could, and only a few were lucky enough to have a pension that would be considered golden by today's standards. America's post-World War II prosperity improved the fortunes of the Greatest Generation, which benefited from a workforce of six for every retiree. Many people of this generation were able to retire at the age of 65.

America's post-World War II prosperity improved the fortunes of the Greatest Generation, which benefited from a workforce of six for every retiree. Many people of this generation were able to retire at the age of 65.

There has been one change since then: a large percentage of America's 77 million baby boomers are expected to live 10 to 25 years longer than their parents. Those who retire at age 60 can expect to live at least 25 more years. So they will have a longer retirement period.

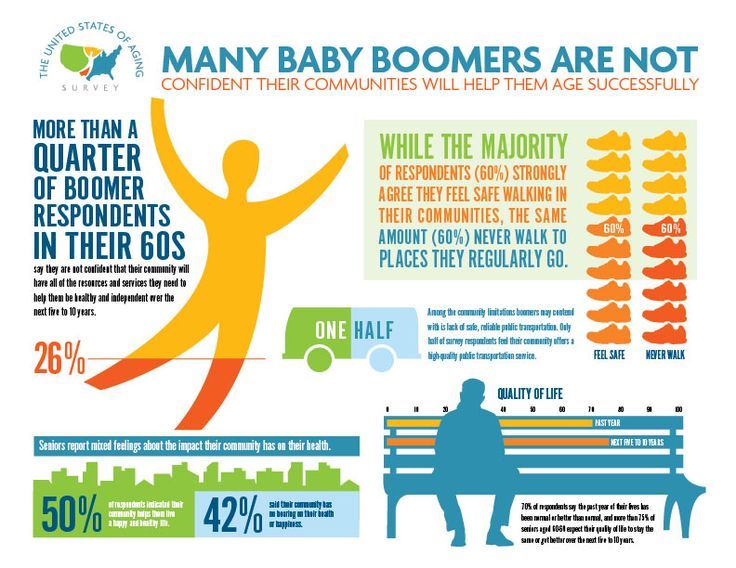

With greater health and energy—and their children growing up—boomers who can afford it expect to spend at least an early retirement, fulfilling travel dreams and other important affairs. Those now reaching retirement age are often healthy enough to run marathons, build houses, and even start businesses.

Instead of moving to retirement communities, many are migrating to smaller towns where there are opportunities for work and education. Other boomers choose to move to urban areas to enjoy amenities such as public transportation and cultural attractions.

Some of them, with more limited resources, are retiring outside the US to countries with a lower cost of living, such as Mexico, Portugal, and the Philippines. Forty-five percent have no retirement savings, according to a 2019 report from the Insured Pensions Institute.

The largest generation had relatively few investment options, mostly conventional bonds and certificates of deposit. But these are relatively safe forms of income. This is not true for boomers. Moreover, as life expectancy increases, there are more opportunities and the need to take on at least some investment risk in order to keep up with inflation.

Exotic investment opportunities

Today's boomers face an ever-expanding universe of income securities. The investment industry has provided many investing opportunities and many exciting new ways to lose it all.

Deregulation

If they were willing to take the risk, Baby Boomer parents might have bought some dividend-paying stock. At the time, most dividend-paying industries, such as finance and utilities, were heavily regulated. Decades of deregulation have made these industries less predictable and more risky. Therefore, the reliability of a previously anticipated dividend or return on investment is currently uncertain.

At the time, most dividend-paying industries, such as finance and utilities, were heavily regulated. Decades of deregulation have made these industries less predictable and more risky. Therefore, the reliability of a previously anticipated dividend or return on investment is currently uncertain.

In the 1980s, when the largest generation began to retire, interest rates were around 18%. It was good for the budget conscious (and terrible for homebuyers). In 2010, rates were about as low as they are, less than 1%. This continued decline in interest rates provided large returns for bond investors.

Boomers found themselves in a completely opposite situation. Instead of constantly decreasing interest rates, they face the possibility of constantly increasing interest rates during retirement.

The top generation could have had a lower 10.5% in 2018, according to the US Bureau of Labor Statistics. What's more, traditional corporate pensions are now largely phased out, giving way to 401(k) plans, IRAs, and other investment vehicles that place the burden of savings on individuals. Because they were the first generation to experience these changes, most boomers didn't start saving enough or early.

What's more, traditional corporate pensions are now largely phased out, giving way to 401(k) plans, IRAs, and other investment vehicles that place the burden of savings on individuals. Because they were the first generation to experience these changes, most boomers didn't start saving enough or early.

With regard to the federal pension, known as Social Security, there are concerns that it may not be sufficient. The problem is that the baby boomer generation is much larger than previous generations; Generation X that follows is much smaller; and even the millennial generation, which is larger than those who grew up as a result of the economic boom, is not large enough to compensate for the increase in boomer life expectancy.

Unless changes are made to the structure of social security, it is estimated that there will not be enough tax-paying workers to provide full social security payments to pensioners starting in 2034. Back in the years when baby boomers were in the workforce, there were six employees for every retiree. But it is estimated that by the time the entire baby boomer generation reaches retirement age, that ratio will drop to three to one.

But it is estimated that by the time the entire baby boomer generation reaches retirement age, that ratio will drop to three to one.

In addition to not saving enough money, the Boomers survived the Great Recession at a critical time for their retirement savings. Many boomers threw themselves into high-priced investments, mortgages, and startups in the late 1990s, only to find it difficult to make these payments after a few years; many found themselves completely disabled or lost their mortgages.

The sub-major crash of 2008 in the mortgage industry and the following stock market crash left many boomers scrambling to put together a sufficient nest egg. Many of them subsequently turned to equity borrowing as a solution to the problem. Even though real estate prices are starting to rise again, some people who are experiencing a period of economic boom still cannot make a substantial profit from selling their current home in order to find a cheaper one.

For those who have such debts, the savings are put on the back burner. What's more, the boomers who reacted to the Great Recession by turning into ultra-conservatives with their savings left over suffered a second blow: by not holding enough of their portfolios in stocks, they missed out on the huge bull market that followed and risked letting their eggs in the nest stagnate. . Meanwhile, for many segments of the population, wages did not rise significantly.

Some of these steps can help baby boomers to retire.

One idea might be the most unconventional: don't retire. Or at least postpone it until proverbial age 65 or 66 (depending on date of birth). Whether that means longer hours, counseling, or finding part-time jobs, being in the workforce can help boomers financially and emotionally.

If finances permit, boomers can also wait until they are 70 to receive Social Security benefits. By delaying their benefits, they can receive 132% of their original monthly stipend. This, combined with increased income and savings from continuing to work, will make retirement easier.

By delaying their benefits, they can receive 132% of their original monthly stipend. This, combined with increased income and savings from continuing to work, will make retirement easier.

Boomers who came of age in the free 1960s and 1970s often create the image that they will stay active forever—indeed, many of them are in better shape than their ancestors in the same age. However, the human body is not invulnerable. Obesity, diabetes, hypertension, and high cholesterol are inevitably on the rise in the boomer population. Cancer and heart disease are the main causes of death. And then there's dementia: According to the Institute for Dementia Research and Prevention, it's estimated that one in six women and one in ten men who live to age 55 will develop dementia during their lifetime.

According to the Pew Research Center, about 70% of Americans do not have a will that details their medical wishes, such as whether to use life support if they cannot articulate their wishes.