Katherine Tierney, CFA®

Senior Retirement Strategist, Client Needs Research

The bottom-line goal of retirement planning is deceptively simple: accumulating enough money to live the life you want once your career is no longer occupying most of your time or generating a regular paycheck.

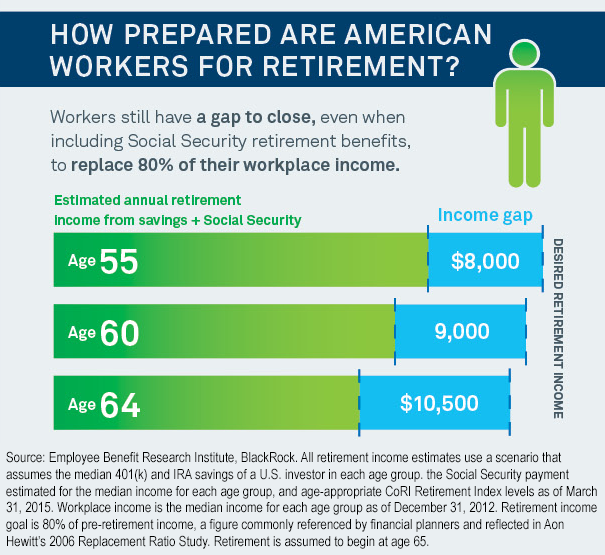

Achieving that goal requires asking questions that have no easy answers: How much money will you need? How can you measure your progress toward a target decades in the future?

A financial advisor can help you with those questions, then tailor a financial strategy to help you meet your individual goals.

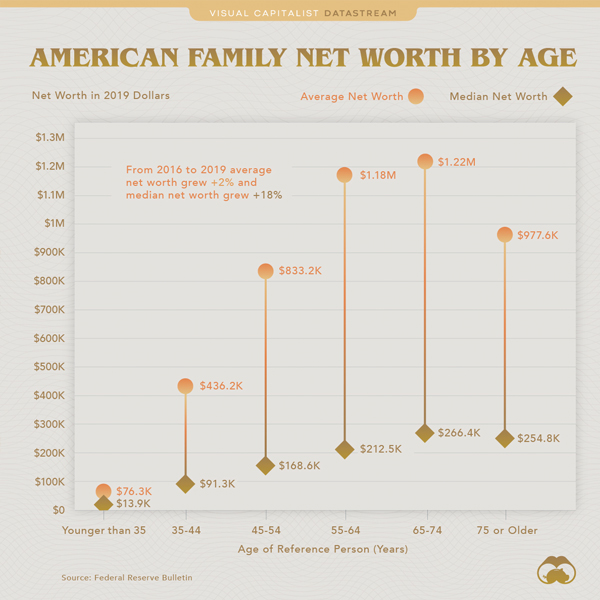

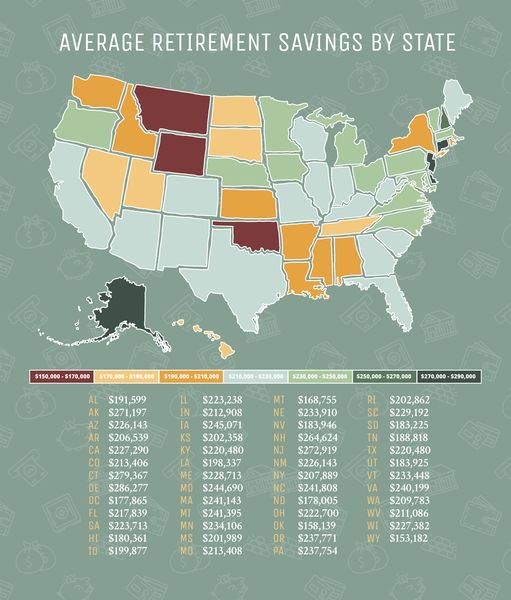

Often, people trying to figure out how well they’re doing begin by comparing their own savings with those of others in the same age bracket. If you’re curious how you stack up, data collected by the Federal Reserve in its 2019 Survey of Consumer Finances, shown below, can tell you. What those numbers can’t do, though, is tell you how close you are to your goal.

Using them as a gauge is a little like comparing your SAT score with the average of your graduating class in high school to determine whether it’s high enough to get you into a particular university.

The one piece of data that’s crucial is the average SAT score of the freshmen the university admitted. Without that data point, you have no idea whether your score meets the institution’s standards.

Without that data point, you have no idea whether your score meets the institution’s standards.

Source: Federal Reserve Survey of Consumer Finances, 1989-2019; https://www.federalreserve.gov/econres/scfindex.htm

It’s the same with retirement: The relevant data point isn’t what others your age have saved but how much money you need yourself. The answer depends almost entirely on you, your habits now and your plans for later.

For example, what’s your average monthly spending today and do you expect to maintain it after retirement? Do you expect to relocate? If so, will you live in a region where the cost of living is higher or lower than where you are now? How do you plan to spend your time — traveling the world in style or volunteering in your neighborhood and working in your garden?

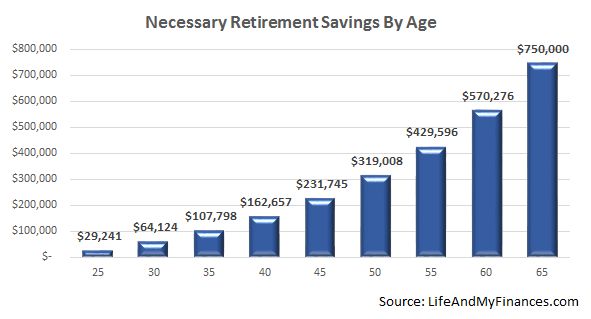

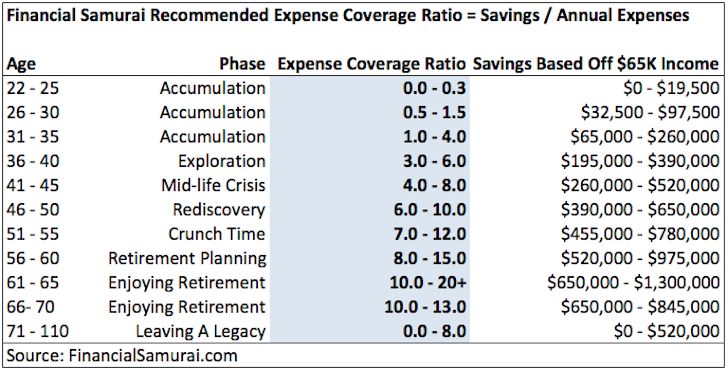

To help you begin evaluating your progress, we’ve developed generalized benchmarks, below, that are more useful, and more detailed, than average savings levels for someone retiring at age 65.

Below you'll find generalized age- and salary-benchmarks for investment levels that might let you retire comfortably, using broad assumptions about factors including taxes and spending preferences. For example, if you are 29, making $100,000, you would want a savings of $15,000 - $90,000 to maintain your current lifestyle. (The higher and lower ends of the range reflect differing assumptions about market volatility during your career.)

Having a ballpark projection of how much money you need to retire comfortably can be helpful. However, relying on broad-based assumptions, they can’t address individual circumstances such as your income, spending needs and risk tolerance.

That’s where a qualified financial advisor comes in. After you evaluate your status with these tools, schedule a face-to-face meeting with a financial advisor to set a more precise goal.

Retirement savings benchmarks notes on methodology and assumptions:

To estimate how much money you need in retirement, we created a lower and upper boundary based on the following methodology and assumptions about lifestyle and savings habits:

We calculate your current spending as current gross income minus savings and taxes.

We calculate your current spending as current gross income minus savings and taxes. We assume you pay taxes on 85% of that amount at the effective tax rate of 25%.

We assume you pay taxes on 85% of that amount at the effective tax rate of 25%.Lower Boundary: Our analysis assumes the portfolio grows at a constant rate of return each year in retirement and is entirely depleted at death.

Upper Boundary: Our analysis incorporates expectations for market volatility and is calculated so that the probability of the portfolio lasting until death is 80-90%.

When saving for retirement, going it alone can be risky.

If you’re interested in learning more about how Edward Jones can help you create an effective plan to reach your retirement goals, contact an Edward Jones financial advisor for a discussion today.

Katherine Tierney is a Senior Retirement Strategist on the Client Needs Research team at Edward Jones. The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Katherine has more than 15 years of financial services and retirement experience. She is a contributor to Edward Jones Perspectives and has been quoted in various publications.

The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Katherine has more than 15 years of financial services and retirement experience. She is a contributor to Edward Jones Perspectives and has been quoted in various publications.

Read Full Bio

Katherine Tierney is a Senior Retirement Strategist on the Client Needs Research team at Edward Jones. The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Katherine has more than 15 years of financial services and retirement experience. She is a contributor to Edward Jones Perspectives and has been quoted in various publications.

Read Full Bio

Getty Images

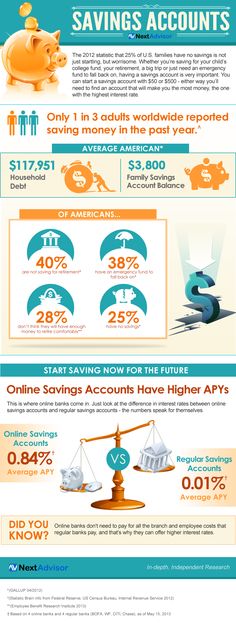

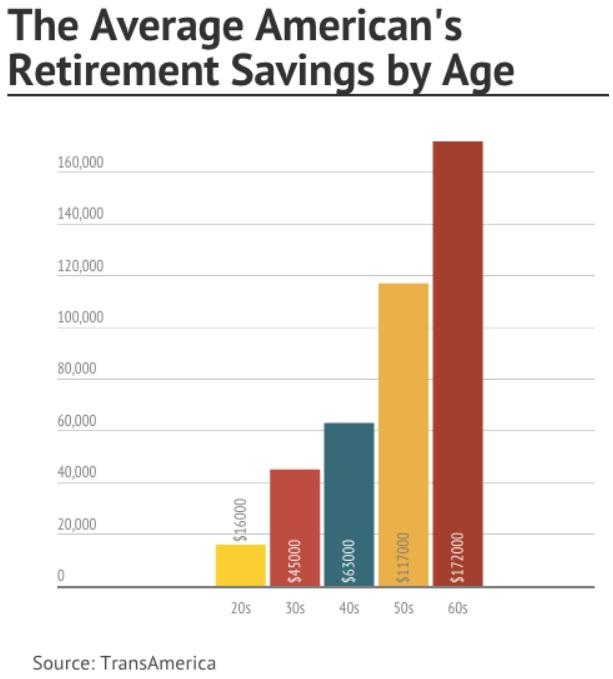

On average, Americans have around $141,542 saved up for retirement, according to the "How America Saves 2022" report compiled by Vanguard, an investment firm that represents more than 30 million investors.

However, most people likely have much less: The median 401(k) balance is just $35,345.

That means half of account balances are lower than this amount and half are higher. And since averages can be skewed by a few outliers, the median account balance is considered to be more representative of what most people actually have saved in their 401(k) accounts.

Here's a look at how much money Americans have saved for retirement, by age:

Besides age, many other factors influence retirement savings, such as income and how long an employee has worked for a company. Older employees who have been working longer tend to have higher account balances than employees who are just beginning their careers, for example.

But try not to fixate exclusively on your exact balance. "If you focus too much on your account balance, you may be tempted to react to short-term volatility at the expense of your long-term financial goals," says Nilay Gandhi, senior wealth advisor at Vanguard.

Instead, Gandhi encourages investors to focus on factors they can control, such as expenses, investment choices and their savings rate.

"We believe participants need to reach a total saving rate of 12% to 15%," including employer contributions, says John James, managing director of Vanguard's institutional investor group.

Don't panic if you're not there yet — most investors aren't.

Here's the average retirement savings rate for investors at every age:

Gandhi recognizes that reaching the recommended retirement savings rate of 12% to 15% can be daunting for employees, especially the ones who are just starting out.

It's OK to start with what you can afford. However, "be sure to save at least enough to get your employer's full match," Gandhi recommends.

From there, "increase your savings rate by 1% to 2% each year until you achieve the target savings rate of 12% to 15%."

Vanguard provides a free Retirement Income Calculator that anyone can use to estimate how much money they may need after they retire. The tool takes specific individual factors into account, including current age, anticipated retirement age, current income, savings rate, expected income needs in retirement and additional income sources.

The tool takes specific individual factors into account, including current age, anticipated retirement age, current income, savings rate, expected income needs in retirement and additional income sources.

You can also check out CNBC Make It's retirement planning tool that can help you calculate how much money you'll need to retire comfortably based on your age and income.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: Millennial and Gen Z workers aren’t saving enough for retirement—here are 3 tips to get on track

Rosstat in social networks

Subscribe and follow the activities of the Federal State Statistics Service in social networks

DOCX

Rosstat clarified data on the dynamics of household income in 2018-2021

18.43 Kb, 28.04. 2022

2022

HTM

Methodology

7.12 Kb, 08/07/2020

XLSX

Average per capita cash income of the population in the Russian Federation (new methodology)

15.14 Kb, 09/01/2022

XLSX

Average per capita monetary income of the population by constituent entities of the Russian Federation (new methodology)

57.08 Kb, 01.09.2022

XLSX

Real cash income of the population by constituent entities of the Russian Federation (new methodology)

48.26 Kb, 01.09.2022

XLSX

Volume and structure of monetary income of the population of the Russian Federation by sources of income (new methodology)

28.27 Kb, 30.08.2022

XLSX

Real disposable money income of the population in the Russian Federation (new methodology)

12. 91 Kb, 09/01/2022

91 Kb, 09/01/2022

XLSX

Structure of the use of cash income of the population of the Russian Federation (new methodology)

15.29 Kb, 09/01/2022

HTM

The volume of social payments to the population and taxable cash income of the population by municipalities, methodology

13.96 Kb, 15.12.2020

HTM

The volume of social payments to the population and taxable cash income of the population in the context of municipalities. Time series

12.77 Kb, 09/01/2022

HTM

Purchasing power of money income of the population, methodological explanations

8.6 Kb, 10.08.2021

XLS

Purchasing power of money income of the population, time series for 2011-2021

65.5 Kb, 31.08.2022

call_made WEB

Purchasing power of money income of the population

10. 09.2018

09.2018

XLSX

Balance of cash income and expenditure of the population (new methodology)

39.69 Kb, 11/30/2021

XLSX

The amount of funds allocated by the constituent entities of the Russian Federation for the provision of social support measures for the population (including federal budget funds) in kind in the Russian Federation as a whole

17.32 Kb, 01.07.2022

XLSX

The amount of funds allocated by the constituent entities of the Russian Federation for the provision of social support measures for the population (including federal budget funds) in kind by constituent entities of the Russian Federation

23.13 Kb, 07/01/2022

HTML

Methodology

5.08 Kb, 09/10/2018

XLSX

Average per capita monetary income of the population of the Russian Federation. Time series (new methodology)

Time series (new methodology)

11.81 Kb, 24.04.2020

DOC

Average per capita monetary income of the population, operational data for Russia

223.5 Kb, 09/10/2018

HTM

Average per capita monetary income of the population, operational data for the constituent entities of the Russian Federation

4.07 Kb, 29.10.2019

Average per capita monetary income of the population, time series

call_made WEB

Average per capita money income of the population, time series

09/10/2018

XLS

Volume and structure of monetary income of the population by sources of income, operational data

36 Kb, 09/10/2018

DOC

Real disposable money income of the population, current data

189.5 Kb, 10.09.2018

Volume and structure of money income of the population by sources of income, time series

XLSX

The volume and structure of the use of monetary income of the population, operational data

20. 59 Kb, 18.06.2019

59 Kb, 18.06.2019

XLS

Volume and structure of the use of monetary incomes of the population, time series

31.5 Kb, 06/26/2019

HTM

Purchasing power of money income of the population. Time series for 1970-2010 (retro)

326.61 Kb, 07/08/2019

call_made WEB

Volume and composition of money savings of the population

10.09.2018

XLSX

Balance of cash income and expenditure of the population

88.35 Kb, 10.09.2018

HTML

Balance of cash income and expenditures of the population, methodology

3.62 Kb, 10.09.2018

HTML

Basic pension indicators, methodology

4.48 Kb, 10.09.2018

DOCX

Basic indicators of pension provision, average pension (monthly)

43. 11 Kb, 29.09.2022

11 Kb, 29.09.2022

call_made WEB

Key indicators of pension provision, average pension in nominal terms granted to pensioners registered in the Pension Fund of the Russian Federation system by constituent entities of the Russian Federation (month)

11.02.2022

Main indicators of pension provision, average and real amount of the assigned pension (year)

Main indicators of pension provision, number of pensioners and average amount of pensions granted by types of pension provision and categories of pensioners

DOC

Key indicators of pension provision Receipt and expenditure of funds from the Pension Fund of the Russian Federation

90 Kb, 06/10/2021

DOCX

Key indicators of pension provision, key indicators of the non-state pension system

16.83 Kb, 06/24/2022

HTM

Implementation of measures of social support and social protection of the population, methodology

14. 04 Kb, 30.04.2021

04 Kb, 30.04.2021

DOC

Implementation of measures of social support and social protection of the population, total amount of social payments

77.5 Kb, 09/10/2018

DOCX

Implementation of measures of social support and social protection of the population, level and structure of expenses for the payment of benefits and social assistance

53.91 Kb, 10.09.2018

XLSX

Implementation of measures of social support and social protection of the population, the number of recipients of the monthly allowance for children

14.74 Kb, 01.07.2022

XLSX

Implementation of measures of social support and social protection of the population, the amount of the monthly allowance for a child, established in the constituent entities of the Russian Federation

24.1 Kb, 01.07.2022

DOCX

Implementation of measures of social support and social protection of the population, the number of certain categories of citizens who received social support measures for the expenditure obligations of the Russian Federation, the number of recipients of monthly cash payments (UDV) in the Russian Federation

32. 42 Kb, 04/29/2022

42 Kb, 04/29/2022

XLSX

Implementation of measures of social support and social protection of the population, the number of certain categories of citizens who received measures of social support for the expenditure obligations of the Russian Federation, the implementation of social support measures for certain categories of citizens in terms of sanatorium treatment

18.09 Kb, 29.04. 2022

Implementation of measures of social support and social protection of the population, the number of certain categories of citizens who received social support measures at the expense of the consolidated budget of the constituent entity of the Russian Federation, and the established amounts of cash payments

call_made WEB

Implementation of measures of social support and social protection of the population, expenses of the consolidated budgets of the constituent entities of the Russian Federation for the implementation of social support measures for certain categories of citizens

31. 03.2022

03.2022

DOC

Key performance indicators of state off-budget funds Receipt and expenditure of funds from the Social Insurance Fund of the Russian Federation

63 Kb, 06/10/2021

DOC

Key performance indicators of state off-budget funds Receipt and expenditure of funds from the Federal Compulsory Medical Insurance Fund

60 Kb, 06/10/2021

DOC

Key performance indicators of state off-budget funds Receipt and expenditure of funds from territorial compulsory health insurance funds

57 Kb, 06/10/2021

call_made WEB

Receipt and expenditure of state extra-budgetary social funds

13.02.2020

DOCX

Population income distribution, methodology

16.56 Kb, 26.04.2022

DOC

Population distribution by per capita money income, time series

46 Kb, 05/13/2022

DOC

Distribution of total cash income by 20% population groups and main indicators of socio-economic differentiation, time series

66. 5 Kb, 05/13/2022

5 Kb, 05/13/2022

DOC

Living wage methodology

44.5 Kb, 30.04.2021

DOC

Subsistence minimum for the Russian Federation as a whole

91 Kb, 06/22/2022

HTML

The subsistence minimum for the Russian Federation as a whole and for the subjects of the Russian Federation

4.53 Kb, 06/22/2022

The subsistence minimum for the main socio-demographic groups of the population in the Russian Federation as a whole for 2000-2003

call_made WEB

Subsistence minimum, subsistence minimum for the main socio-demographic groups of the population

09/10/2018

DOCX

Ratio of average per capita money income of the population with the subsistence minimum in the Russian Federation as a whole since 2021

26.13 Kb, 01.09.2022

Basic social guarantees established by the legislation of the Russian Federation

DOCX

The amount of basic social guarantees established by the legislation of the Russian Federation in relation to the subsistence minimum

39. 58 Kb, 20.04.2022

58 Kb, 20.04.2022

DOCX

Population with average per capita cash income below the poverty line (subsistence level) and cash income deficit, methodology

18.58 Kb, 26.04.2022 and money income deficit, time series

DOC

Population with cash income below the poverty line and cash income deficit

34.5 Kb, 04/27/2022

DOC

Distribution of poor households by main categories

70.5 Kb, 08/31/2022

DOC

Distribution of the poor by main socio-economic groups

103 Kb, 08/31/2022

DOC

Average per capita cash income and its deficit for the main categories of poor households

50.5 Kb, 08/31/2022

DOC

Structure of cash income and consumption expenditure in poor households

75. 5 Kb, 08/31/2022

5 Kb, 08/31/2022

Household income and expenditure on consumption, methodology

307.15 Kb, 09/10/2018

XLSX

Household income and expenditure on consumption, level and structure of disposable resources of households of various socioeconomic categories

37.6 Kb, 07/15/2022

XLSX

Household consumption income and expenditure, distribution of disposable resources by 20 percent population

14.71 Kb, 07/15/2022

XLSX

Household consumption income and expenditures, level and structure of household consumption expenditures of different socio-economic categories

24.34 Kb, 15.07.2022

XLSX

Household income and expenditure on consumption, distribution of consumption expenditure by 20% of the population

14. 63 Kb, 07/15/2022

63 Kb, 07/15/2022

XLSX

Household income and expenditure on consumption, level and structure of household consumer spending

43.41 Kb, 07/15/2022

XLSX

Household income and consumption expenditures, structure of consumer spending by 10% population

34.98 Kb, 15.07.2022

XLSX

Disposable resources of households depending on the place of residence in the constituent entities of the Russian Federation

34.92 Kb, 07/15/2022

XLSX

Income, expenses and consumption of households in the places of traditional residence and traditional economic activities of the indigenous peoples of the North, Siberia and the Far East of the Russian Federation

15.77 Kb, 15.07.2022

Household food consumption methodology

252.95 Kb, 09/10/2018

Household food consumption, nutritional and energy value of food in households

XLSX

Household food consumption, consumption, nutritional and energy value of food by 10% population

28. 3 Kb, 07/08/2021

3 Kb, 07/08/2021

XLSX

Household food consumption, nutritional and energy content of food in households with children

15.17 Kb, 07/08/2021

XLSX

Household food consumption, share of food purchases in household consumer spending by 10 percent of the population

24.59 Kb, 07/08/2021

XLSX

Household food consumption, structure of food spending by 10% population

25.3 Kb, 07/08/2021

XLSX

Household food consumption, value of basic food consumed in households

23.64 Kb, 07/08/2021

HTML

Household living conditions, methodology

9.86 Kb, 09/10/2018

XLSX

Living conditions of households, types and sizes of housing occupied, distribution of households by form of ownership and type of housing occupied

31. 22 Kb, 07/15/2022

22 Kb, 07/15/2022

XLSX

Living conditions of households, types and sizes of housing occupied, size of the total (useful) area of housing occupied by households

10.93 Kb, 15.07.2022

XLSX

Living conditions of households, types and sizes of housing occupied, distribution of households by size of the total (useful) area of housing occupied

30.23 Kb, 07/08/2021

XLSX

Living conditions of households, types and sizes of housing occupied, distribution of households by number of living rooms occupied

26.55 Kb, 15.07.2022

XLS

Living conditions of households, home improvement, living in houses equipped with various types of amenities

114 Kb, 09/10/2018

XLS

Living conditions of households, home improvement, availability of amenities in occupied housing

103. 5 Kb, 09/10/2018

5 Kb, 09/10/2018

XLS

Household living conditions, home improvement, drinking water sources

93.5 Kb, 09/10/2018

XLS

Household living conditions, home amenities, heat sources and fuels used

99 Kb, 09/10/2018

XLSX

Level and structure of household spending on housing and communal services

27.69 Kb, 15.07.2022

XLSX

Living conditions of households, availability of durable goods

52.39 Kb, 15.07.2022

XLS

Household living conditions, satisfaction with housing conditions and intentions to improve them, household assessment of housing constriction

119 Kb, 09/10/2018

XLS

Living conditions of households, satisfaction with housing conditions and intentions to improve them, assessment of the degree of satisfaction with housing conditions

117 Kb, 10. 09.2018

09.2018

XLS

Living conditions of households, satisfaction with housing conditions and intentions to improve them, assessment of the reasons for dissatisfaction with their living conditions

121.5 Kb, 09/10/2018

XLS

Living conditions of households, satisfaction with housing conditions and intentions to improve them, assessment of intentions to improve housing conditions

120 Kb, 09/10/2018

call_made WEB

Microdata from household budget sample surveys

09/10/2018

Consumer expectations of the population, methodology

246.9 Kb, 09/10/2018

XLS

Consumer confidence index

39 Kb, 09/21/2022

XLS

Private indices of consumer expectations of the population

48.5 Kb, 21.09.2022

XLS

Distribution of respondents' answers to the questions of the questionnaire survey of consumer expectations of the population, opinion of the population about the current financial situation

36. 5 Kb, 09/21/2022

5 Kb, 09/21/2022

XLS

Distribution of respondents' answers to the questions of the questionnaire survey of consumer expectations of the population, opinion of the population about the favorable conditions for large purchases

37 Kb, 21.09.2022

XLS

Distribution of respondents' answers to the questions of the questionnaire survey of consumer expectations of the population, the opinion of the population on the expected price changes during the year

35.5 Kb, 09/21/2022

XLS

Distribution of respondents' answers to the questions of the questionnaire survey of consumer expectations of the population, opinion of the population about the favorable conditions for the formation of savings

37 Kb, 21.09.2022

DOC

Methodology for calculating the main indicators of pension provision

79 Kb, 09/10/2018

Methodological provisions for the formation of aggregated indicators of income, expenditure and consumption of households based on the Sample Survey of Household Budgets

1. 47 Mb, 10.09.2018

47 Mb, 10.09.2018

RAR

Methodological provisions for calculating indicators of monetary income and expenditure of the population

243.65 Kb, 10.09.2018

HTM

On the approval of the rules for calculating the subsistence minimum per capita and for the main socio-demographic groups of the population as a whole in the Russian Federation

113.32 Kb, 10.09.2018

RAR

On approval of the list of food products - representatives for determining the level of consumer prices for food products when calculating the subsistence minimum

172.75 Kb, 10.09.2018

DOCX

Methodology for calculating distribution and differentiation indicators by income level of the population, indicators characterizing the level and distribution of low incomes

44.45 Kb, 26.04.2022

call_made WEB

Organizational and methodological provisions for household surveys

10. 09.2018

09.2018

RAR

Consumer expectations survey methodology

25.34 Kb, 09/10/2018

RAR

Basic methodological and organizational provisions for sampling observation of the quality and accessibility of services in the areas of education, healthcare and social services, promotion of employment of the population

39.15 Kb, 10.09.2018

RAR

Basic methodological and organizational provisions for comprehensive monitoring of the living conditions of the population

48.61 Kb, 09/10/2018

RAR

Main methodological and organizational provisions of sample observation of the diet of the population

37.88 Kb, 10.09.2018

Main methodological and organizational provisions of sample observation of population income and participation in social programs

494. 42 Kb, 26.04.2022

42 Kb, 26.04.2022

call_made WEB

Consumer expectations in Russia in Q2 2021

06/28/2021

XLS

Average per capita monetary income of the population

78 Kb, 29.04.2021

call_made WEB

Urgent information and information from Rosstat on topical issues

09/10/2018

call_made WEB

Social status and standard of living of the population of Russia

call_made WEB

Household income, expenditure and consumption

call_made WEB

Cash income and expenditures of the population

call_made WEB

Implementation of social support measures for certain categories of citizens

call_made WEB

Socio-economic indicators of poverty

call_made WEB

Household food consumption

call_made WEB

Russian Statistical Yearbook

call_made WEB

Regions of Russia. Socio-economic indicators

Socio-economic indicators

call_made WEB

Report "Social and economic situation in Russia" (monthly)

Diet of the population 2013

10.31 Mb, 09/10/2018

RAR. PDF

Collection "Comprehensive monitoring of the living conditions of the population. 2011"

4.2 Mb, 10.09.2018

|

| Department of Living Standards Statistics and Household Surveys | |

| Income, expenses and savings of the population | Kostina |

|

| Social security and social assistance | Gadfly |

|

|

| Grigoryeva Elena Anatolyevna |

|

| Distribution of income of the population | Penza Anastasia Sergeevna |

|

| Living wage | Serova Marina Vladimirovna |

|

| Poverty rate | Penza Anastasia Sergeevna |

|

| Income, expenses and living conditions of households | Lvova Elena Nikolaevna |

|

| Household budget survey microdata | Lvova Elena Nikolaevna |

|

| Consumer expectations | Lvova Elena Nikolaevna |

|

| Comprehensive monitoring of the living conditions of the population | Fatyanova |

|

| Selective observation of the quality and availability of services in the areas of education, health care and social services, promotion of employment | Fatyanova |

|

| Selective observation of the diet of the population | Kozyreva Natalya Anatolyevna |

|

| Selective observation of the use of the daily fund of time by the population | Fatyanova |

|

| Selective observation of income of the population and participation in social programs | Mironenko Olga Anatolyevna |

|

The Mercer rating calls the Danish pension system the best in the world: payments upon reaching the age of 65 allow Danish pensioners to live comfortably even if at a younger age a person had a low salary or for some reason did not work generally. A former resident of Ukraine, pensioners on the streets of Copenhagen, and experts told Real Time who and how much they receive in retirement in Denmark, and what these payments depend on.

A former resident of Ukraine, pensioners on the streets of Copenhagen, and experts told Real Time who and how much they receive in retirement in Denmark, and what these payments depend on.

The Danish pension system has two main elements - a pension from the state and a pension that a person receives from a pension fund. The state pension is calculated as follows: if a person had a high income and has large savings, it will be lower. And vice versa, if a person did not earn much or did not work at all, then the state will pay him more, says Torben Andersen, professor of economics at Aarhus University.

Every morning our mailing list is for you.

Subscribe

The state pension helps the elderly escape poverty, and the pension from the pension fund is proportional to his income during his working life.

Torben Andersen "Those who do not have pension savings receive the so-called basic pension and supplement. If a person lives alone, this amount is about 18 thousand Danish kroner (about $ 2,800)," says Andersen. Some taxes must be paid from this amount, but the money will still be enough to live in abundance.

If a person lives alone, this amount is about 18 thousand Danish kroner (about $ 2,800)," says Andersen. Some taxes must be paid from this amount, but the money will still be enough to live in abundance.

Poverty among the elderly in Denmark is a very unusual phenomenon, emphasizes the professor. As a rule, this only applies to people who moved to the country at an older age: they can only count on part of the state pension. And if we take as an example the average Dane, who is not very rich, then his pension will be about 65-70% of his earned income. This, in principle, allows you to maintain the usual standard of living - after all, at retirement age you no longer have some expenses.

Olga Fruerlund is 76 years old, she came to Denmark 18 years ago from Sevastopol. At that time in Ukraine, she had already retired - at the age of 55. He says that life was very difficult, but somehow managed. The woman moved to Europe to help her daughter. But it so happened that the daughter died, and three grandchildren remained in the care of Olga.

But it so happened that the daughter died, and three grandchildren remained in the care of Olga.

Olga got married in Denmark, learned the language and went back to work. At that time she was about 60 years old. Five years later, Olga retired from the position of the head of the department in the store. And then it turned out that she would not be able to receive a full-fledged basic pension, and there would also be very little money in her personal pension fund due to her short work experience in the country.

"At that time I lived in Denmark for 8 years, and to get a full basic pension you have to live here for 40 years. Naturally, my pension was small. But the administration of the commune (an administrative unit in Denmark - NV) considered my case. And they added me to the subsistence level," says Olga.

Then Olga's husband died, she was left alone, which also affected her situation. Under Danish law, when one of the spouses of retirement age dies, a widow or widower receives part of his savings. The amount depends on the features of the pension plan in the fund and on the age at which the person died. If early, then the amount will be higher, and vice versa. In addition, in the event of the death of a spouse, the state pension is also changed so that the person does not fall below the poverty line.

The amount depends on the features of the pension plan in the fund and on the age at which the person died. If early, then the amount will be higher, and vice versa. In addition, in the event of the death of a spouse, the state pension is also changed so that the person does not fall below the poverty line.

"If you don't have enough pension money, then you go to the Commune and talk to your rådgiver - this is the person who will help you find the right solution. For example, I needed to get a dental prosthesis - the state partially paid for it. But they look on your income: if you are able to pay for it yourself, they may refuse,” says the pensioner.

There are many benefits for pensioners in Denmark. Basically, this is an additional payment for rent and free medicine.

A visit to Olga's doctor is paid for by the state, and medicines are paid for depending on the person's income. “For example, I have problems with blood pressure - 85% of the cost of medicines is paid for by the state,” the woman explains.

Those who live in the country for a long time and have savings can afford to buy a house and live in great prosperity, says Olga Fruerlund. She also rents a cheap and small (45m²) apartment in Copenhagen, an area where many older people live. “I didn’t have time to give this state what I gave to my state,” she says. “But, nevertheless, I was given the opportunity to live in a separate apartment.”

She has been on the waiting list for this apartment for a year. The municipality covers part of the rent due to its not very high pension.

"In general, it turns out that I pay 3,000 Danish kroner for rent together with utility bills (about 470 dollars - HB). But again, this is the cheapest housing," the pensioner explains.

According to Olga, she doesn't save on food - "it's impossible, especially for old people." She spends as much on food as on an apartment.

This year she can't afford to go on holiday abroad because she had her dentures done, but she hopes to raise money for next year. "But everything is modest, everything is very modest in terms of expenses. In a year I can collect 3,000-4,000 crowns ($ 470-620) for a trip - to relax or see something. But my grandchildren also help me."

"But everything is modest, everything is very modest in terms of expenses. In a year I can collect 3,000-4,000 crowns ($ 470-620) for a trip - to relax or see something. But my grandchildren also help me."

Recalling her life in Ukraine, Olga Fruerlund says that in Denmark older people are given more attention: "When I retired, it felt like my life had just begun - there are a lot of opportunities for older people in the country."

There is an Aeldre Sagen branch in every district of Copenhagen. It helps older people and makes it possible, for example, to learn foreign languages or buy inexpensive excursions and trips.

"There are discounts on travel, you can go in for sports. For example, I go to the choir and Pilates. I dance for free - not because I want to perform, but for my development, in order to escape from dementia," Olga lists.

In addition to the state pension, which all elderly Danes can count on, there is a funded system in the country. “For example, you work for a private company, and an amount equal to 12% of your salary is transferred to a pension fund: of which 4% is paid by you, and 8% is paid by your employer,” says financial consultant Mark Hansen.

“For example, you work for a private company, and an amount equal to 12% of your salary is transferred to a pension fund: of which 4% is paid by you, and 8% is paid by your employer,” says financial consultant Mark Hansen.

Entrepreneurs and owners of small companies, he said, may not have savings agreements. In this case, the employees of these small firms do not accumulate retirement savings and remain unprotected.

According to Mark, taxes in Denmark are usually around 40%, but if a person's income is above a certain limit, then taxes increase to 57%.

"Of course, this may be a lot for some, but thanks to these taxes, we have a reliable welfare system," explains Mark Hansen. , and it is formed from the taxes that people pay."

Mark Hansen believes that giving people an airbag is a very noble idea. “I mean state pensions, despite the fact that people cannot afford the same standard of living on them as if they were working.

everyone is capable of doing it, on the other hand, people can decide for themselves whether they want to save or not. ”

”

Birte, 86 years old

My husband had a pension, and now I receive my husband's pension and at the same time receive a state pension.

He had a good salary, and I have a widow's pension after him (enkepension), so I live well. Probably, there are those who are dissatisfied with the system, but I live well.

Gorm, 53

The system is good because it promotes broad social protection. But we have several systems, private pensions or premature pensions, for those who managed to save before retirement age. But in general, we have a strong social protection, and people who grow old in Denmark are not poor or very poor. I think, in general, the system is good.

Doris, 74 and Kirsten, 64

- I invested my personal money in my pension, I don't think I get anything special, but this way I was safe.

- When a person retires, does he have the opportunity to travel?

- Yes, of course, I think it's too expensive to be in Denmark. That's how we met, we were in Goa.

That's how we met, we were in Goa.

– But we still complain.

– Yes, we always complain.

- Although we live well.

Torben Andersen, Professor of Economics at Aarhus University, tells how the system of funded pensions was introduced in Denmark. The government, he said, encouraged people to save for retirement, including with tax breaks: given the high level of taxation in Denmark, for many this turned out to be beneficial in the end.

“In the 1980s and 1990s there was a lot of discussion about this, but there was also a lot of will to do it,” he recalls. prerequisites for its abolition. Now everyone sees that it was a good idea, and most people are satisfied with the funded pension system. Employers also supported this idea."

"In Denmark, everyone was afraid of one problem: you pay into the pension fund, and he invests this money. But where? But in reality this question did not become a big problem. The managers of pension funds quickly realized that they should serve the interests of the people, that is, the most "It's beneficial for people to invest their money. Now the work of pension funds is very transparent: there are many rules to avoid situations when money is used for the wrong purposes," Andersen emphasizes.

The managers of pension funds quickly realized that they should serve the interests of the people, that is, the most "It's beneficial for people to invest their money. Now the work of pension funds is very transparent: there are many rules to avoid situations when money is used for the wrong purposes," Andersen emphasizes.

There are many pension funds in Denmark: there is a half-state ATP, there are non-profit, there are private commercial ones: people have a lot of choice.

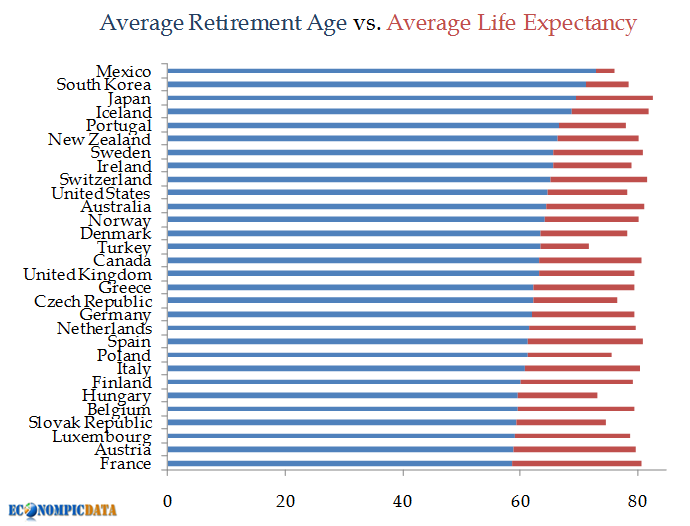

Both men and women currently retire at age 65 in Denmark. But recently it was decided to increase the retirement age to 67 years and then link it to life expectancy.

“The authorities explained the need for these changes well,” Andersen says. “Everyone understands that the state is not going to steal anything. It is part of the social contract. Medicine is provided by the state, education is also free. taxes. They go to pensions, education, benefits, healthcare, etc. It's a social contract: people are willing to pay high taxes because they see that their taxes are being wisely managed, the money goes to the right things.