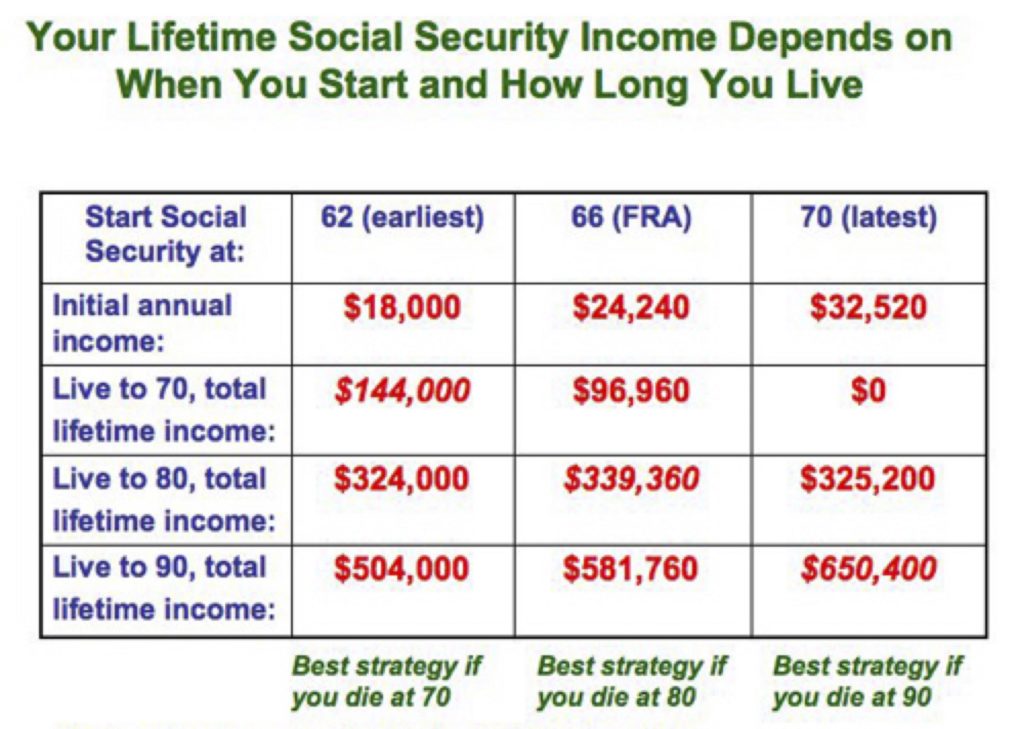

You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you and your family.

Each year, we review the records of all Social Security beneficiaries who have wages reported for the previous year. If your latest year of earnings is one of your highest years, we recalculate your benefit and pay you any increase you are due. The increase is retroactive to January of the year after you earned the money.

If you receive survivors benefits, the additional earnings could help make your retirement benefit higher than your current survivors benefit.

When you begin receiving Social Security retirement benefits, you are considered retired for our purposes. You can get Social Security retirement or survivors benefits and work at the same time.

However, there is a limit to how much you can earn and still receive full benefits.

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount.

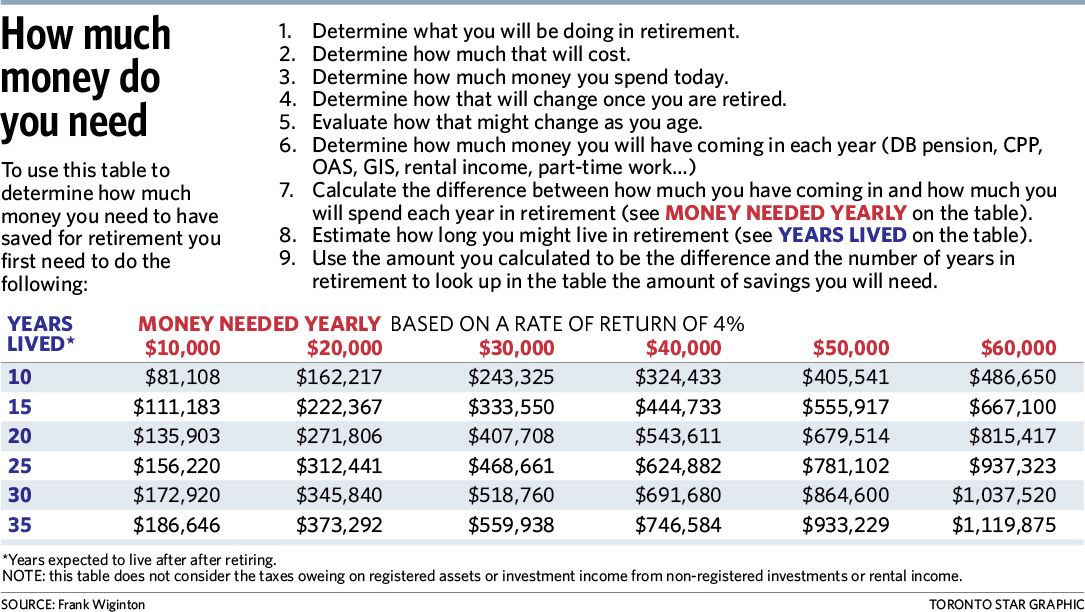

If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. In 2022, this limit on your earnings is $51,960. We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year.

If your earnings will be over the limit for the year and you will receive retirement benefits for part of the year, we have a special rule that applies to earnings for one year. The special rule lets us pay a full Social Security benefit for any whole month we consider you retired, regardless of your yearly earnings.

If you receive survivors benefits, we use your full retirement age, for retirement benefits when applying the annual earnings test (AET) for retirement or survivors benefits. Although the full retirement age for survivors benefits may be earlier, for AET purposes, we use your full retirement age for retirement benefits. This rule applies even if the beneficiary is not entitled to retirement benefits.

Read our publication, “How Work Affects Your Benefits,” for more information.

When you reach full retirement age:

In 2022, if you’re under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Let's look at a few examples. You are receiving Social Security retirement benefits every month in 2022 and you:

Are under full retirement age all year. You are entitled to $800 a month in benefits. ($9,600 for the year)

You work and earn $29,560 ($10,000 over the $19,560 limit) during the year. Your Social Security benefits would be reduced by $5,000 ($1 for every $2 you earned over the limit). You would receive $4,600 of your $9,600 in benefits for the year. ($9,600 - $5,000 = $4,600)

Reach full retirement age in August 2022. You are entitled to $800 per month in benefits. ($9,600 for the year)

($9,600 for the year)

You work and earn $63,000 during the year, with $52,638 of it in the 7 months from January through July. ($678.00 over the $51,960 limit)

When we figure out how much to deduct from your benefits, we count only the wages you make from your job or your net profit if you're self-employed. We include bonuses, commissions, and vacation pay. We don't count pensions, annuities, investment income, interest, veterans benefits, or other government or military retirement benefits.

If you are eligible for retirement benefits this year and are still working, you can use our earnings test calculator to see how your earnings could affect your benefit payments.

How old are you?Step 1 of 11

Select an answer181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465

Select an answer181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465

< backforward >

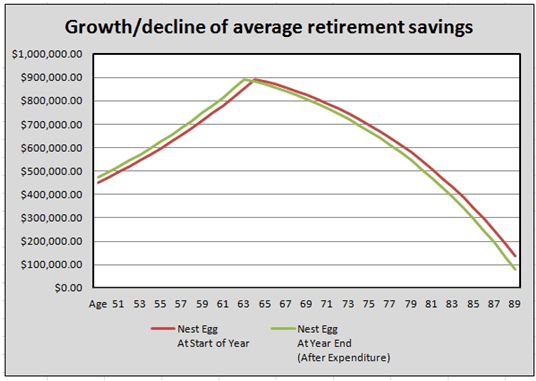

Because Social Security retirement benefits plus savings and other investments are often not enough to live on comfortably, many people keep working for at least a few years after they claim Social Security early retirement benefits. Other people keep their jobs or take new ones to stay active and involved in the world of work. If you keep working at a high enough salary, you may increase your lifetime earnings average, thereby slightly increasing your retirement benefits for the years to come.

Other people keep their jobs or take new ones to stay active and involved in the world of work. If you keep working at a high enough salary, you may increase your lifetime earnings average, thereby slightly increasing your retirement benefits for the years to come.

Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each year may reduce your Social Security retirement benefits (until you reach full retirement age). This reduction in benefits applies only to the years you're working. It doesn't have a permanent effect on the amount of benefits you'll receive in future years (and you can even make back some of the reduction in future years—more on this below). So you can earn any amount at age 62, but it might cause a reduction in your benefits.

How much you can earn when you retire depends on your age. Social Security has different rules for:

Until you reach full retirement age, the Social Security Administration (SSA) will subtract money from your retirement check if you exceed a certain amount of earned income for the year. This penalty limits the amount you can earn when you retire (and still have it be worthwhile to work). For the year 2022, the maximum income you can earn after retirement is $19,560 ($1,630 per month), without having your benefits reduced. The amount goes up each year. The maximum income limit doesn't change depending on your age; in other words, it's the same whether you're 62, 63, or 64.

If you're collecting Social Security retirement benefits before full retirement age and you make more than this amount, Social Security will reduce your benefits by $1 for every $2 you earn over the limit. Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit.

Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit.

Note that if you're working and you lose your job, you may collect unemployment benefits (assuming you otherwise qualify for them) even though you are also collecting your Social Security retirement benefits.

If you are already receiving your retirement benefits, a special higher earnings limit applies in the calendar year you turn your full retirement age (67 for folks born in 1960 or later). If you will reach full retirement age in 2022, you can earn up to $4,330 per month without losing any of your benefits, up until the month you turn 67. But for every $3 you earn over that amount in any month, you will lose $1 in Social Security benefits. Beginning in the month you reach full retirement age, you become eligible to earn any amount without penalty.

If you're self-employed, you may receive full benefits if, during the year you turn your full retirement age, there are any months in which you didn't perform what Social Security considers "substantial services. " The usual test for whether you worked substantial services is whether you worked in your business more than 45 hours during the month (or between 15 and 45 hours in a highly skilled occupation). In other words, if you work in your business more than 45 hours in a month before you reach full retirement age, Social Security may reduce your benefit.

" The usual test for whether you worked substantial services is whether you worked in your business more than 45 hours during the month (or between 15 and 45 hours in a highly skilled occupation). In other words, if you work in your business more than 45 hours in a month before you reach full retirement age, Social Security may reduce your benefit.

The SSA bases its retirement benefit calculations on earnings reported on W-2 forms and on self-employment tax payments. Most individuals are not required to send in an estimate of earnings.

But Social Security does request earnings estimates from some recipients: those with substantial self-employment income or those whose reported earnings have varied widely from month to month, including people who work on commission. Toward the end of each year, Social Security sends these people a form asking for an earnings estimate for the following year. The agency uses the information to calculate benefits for the first months of the following year. The SSA will then adjust the amounts, if necessary, after it receives actual W-2 or self-employment tax information in the current year.

The SSA will then adjust the amounts, if necessary, after it receives actual W-2 or self-employment tax information in the current year.

Once retirees reach full retirement age, Social Security will no longer check their income. Because there is no Social Security limit on how much a person can earn after reaching full retirement age, there is nothing to report.

The amounts of early retirement benefits you lose as a setoff against your earnings due to work are not necessarily gone forever. When you reach full retirement age, Social Security will recalculate your benefits to make up for the reduction. Using a complicated calculation, the agency will actually adjust upward the amount of your benefits to take into account the amounts you lost because of the earned income rule. The lost amounts will be made up gradually, a little bit each year. It will take up to 15 years to completely recoup your lost benefits. Unfortunately, the readjustment will not change the permanent percentage reduction in your benefits that was calculated when you claimed early retirement benefits (the early retirement penalty).

If you claim Social Security retirement benefits before your full retirement age, which is 67 for those born in 1960 or later, the SSA will permanently lower your benefits. Social Security does this to try to make the amount you receive over your life expectancy equal whether you claim at age 62 and get a reduced amount, 67 and get the standard amount, or 70 and get an increased amount.

The SSA will reduce your benefits by 5/9 of one percent per month for each month you receive benefits before your normal retirement age. This reduction is roughly equal to roughly .556% per month. For example, if you start claiming benefits 27 months before you turn 67, your monthly benefit will be reduced by 15% (27 x .556%). The reduction is permanent.

If you claim retirement benefits more than 36 months early, the per-month reduction is not quite as harsh. The SSA has a different calculation for the months over 36. For example, if you start claiming benefits 60 months before you turn 67, your benefit will be reduced by 30% (36 x . 556% plus 24 x .417%). The earliest you can claim retirement benefits is 60 months before your retirement age.

556% plus 24 x .417%). The earliest you can claim retirement benefits is 60 months before your retirement age.

To learn more about collecting Social Security benefits, you may want to consider reading Nolo's book, Social Security, Medicare, & Government Pensions: Get the Most Out of Your Retirement & Medical Benefits.

Updated May 16, 2022

German state pension insurance. Retirement age. The amount of insurance premiums. The size of the pension in Germany.

The idea of pension insurance in Germany is the same as in many other countries: each person receiving income is obliged to pay pension contributions to a state fund, from which a certain amount will be paid once a month in old age. At present, the state pension insurance contributions amount to 18.7% of gross monthly income. But half of the amount must be paid by the employer. As a result, 9 is subtracted from the gross salary. 35%. The amount is withdrawn when calculating salaries, so there is no need to worry where and how to transfer money.

35%. The amount is withdrawn when calculating salaries, so there is no need to worry where and how to transfer money.

The retirement age for everyone in Germany starts in different ways. There is a special scale where, depending on age, the retirement period is calculated. Young people, including me, must work until the age of 67. Older people retire between 65 and 67. It is allowed to retire earlier or continue to work after reaching retirement age. I did not know exactly what will happen in this or that case with the amount of payments, but such details can be clarified later. Now the possibility of working until the age of 80 is being discussed, but with salary restrictions and only for those who wish to do so.

After five years of uninterrupted pension contributions, provided that the contributor is over 27 years old, the fund sends a solemn letter informing that the employee is now entitled to a German state pension. It indicates what the pension will be if you stop working right now, if you continue to work for the same salary until reaching retirement age, and if you maintain the current rate of salary growth. Very good parameters, I must say! Everything becomes clear right away. If a person continues to pay contributions, the foundation sends out new numbers of achievements every year.

Very good parameters, I must say! Everything becomes clear right away. If a person continues to pay contributions, the foundation sends out new numbers of achievements every year.

The pension system remains a fundamental tool for maintaining the income of older Germans. In the future, the introduction of a minimum rent, stabilization of contributions to funds and payments to pensioners, improvement of conditions for retirement in case of disability, and further development of pension insurance are expected.

It is clear that if you rely only on money, this will not help much. Under capitalism, the state of the economy is considered healthy if inflation is observed at 1-4% annually. Money is constantly depreciating and losing purchasing power. As a result, 100€ now at 1.5% inflation in 30 years will be equal to 60€ today.

Fight it like this. Every year, a salary is set, which is considered "average" in Germany. For example, in 2016 this value was 36267 €. Pension contributions from this salary are taken as 1.0 - unit. Further, the salary of each employee is converted into these units and thus, in relation to his salary to the "unit" salary, it is calculated how many units he earned. I earned 20 pension points in 14 years of work in Germany.

Pension contributions from this salary are taken as 1.0 - unit. Further, the salary of each employee is converted into these units and thus, in relation to his salary to the "unit" salary, it is calculated how many units he earned. I earned 20 pension points in 14 years of work in Germany.

The point value is set in euros every year. Moreover, in the "old" lands of the former FRG, points are more expensive than in the "new" former GDR. For 2016 in Baden-Württemberg 1 pension point costs 30.45€.

No later than 2024 pensions in the West and East will be equal. The current estimate of the level of pension depends on the minimum wage in the east and west.

The rationale for such a policy is an increase in income levels. Older people should share the growth of wealth with the young. Pensions are going to be indexed annually.

With 20 points, if I retired right now, I would receive 600€. But I still have 30 years to work, I hope I will earn something more significant.

It happens that a person cannot work for health reasons. In this case, he has the right to apply for early retirement and the number of points increases. This process is very difficult, it is necessary to prove the complete loss of efficiency. If a person can work at least somehow, then most likely he will not receive a pension ahead of schedule.

Not only work brings points to pension insurance. Also, certain accruals are made for caring for relatives, for raising children, and serving in the army. Even if a person has lost his job and is looking for a new one, the state will pay for his pension insurance contributions during the year.

Elderly migrants move from Germany back to their home country and receive a German pension there.

Interestingly, it is allowed to receive a pension while living abroad. Once I saw a TV program about how German pensioners went to live somewhere in Africa and lived there in retirement, like local barons. But the bulk of the old people continue to live in Germany, although not everyone has enough money. Moreover, many continue to work further, just not for a full day. Still, the old men here are quite strong.

But the bulk of the old people continue to live in Germany, although not everyone has enough money. Moreover, many continue to work further, just not for a full day. Still, the old men here are quite strong.

Since 2000, the number of German pensioners permanently residing abroad has grown from 1.1 million to 1.5 million. Every seventh pension paid by the German state pension fund goes abroad.

Most - 26 thousand pensions - are transferred to Switzerland. Then follows the USA and Austria - 24300 pension payments. Germany transfers money to recipients of pension payments in 150 countries around the world.

The representative of the German pension fund explained that the increase in pension payments abroad is largely due to the return to their homeland of well-deservedly retired immigrants. Often pensions are transferred to Italy, Spain, Greece, the countries of the former Yugoslavia and Turkey.

Those wishing to earn German rent and return should take into account that the amount of money is indexed according to the level of income of the country where the pensioner permanently resides.

At the moment, the German pension system is shaking. The nation is aging, there are more and more older people, less and less work, including through the fault of the crisis. In the German media, it is constantly being discussed whether it is necessary to increase pension contributions or not.

The last increase in pensions took place in 2018: 3.2% in the west, 3.4% in the east. The level of pensions in the eastern lands has reached 95.8% Western. But in general, over the past 10 years, the purchasing power of German pensioners has fallen.

One of the proposed solutions, which I like, is to attract qualified young people to Germany to work and provide the Germans with old age. They play on such a subtlety: they propose to limit the stay of working foreigners to five years. Indeed, according to the law, those who have worked in Germany for less than five years do not count on a German pension. True, it is supposed to return the independently paid part of pension contributions, the same 9. 35% of salary. But the part that is paid by the employer is not returned to anyone else.

35% of salary. But the part that is paid by the employer is not returned to anyone else.

I came to Germany under the GreenCard program for programmers, which also required me to leave the country after 5 years. But already in the third year of my stay, I received a normal work visa, because the "green card" had already been canceled by that time. Now they have introduced the EU Blue Card on even more loyal terms to foreigners. Permanent residence can be obtained after 21 months.

Opponents of the idea say that immigrants will force the Germans themselves out of the market, especially since the number of jobs is shrinking against the backdrop of the refugee crisis. As a result, the part of the people that will remain without work will live on what the rest earn and everything will remain the same.

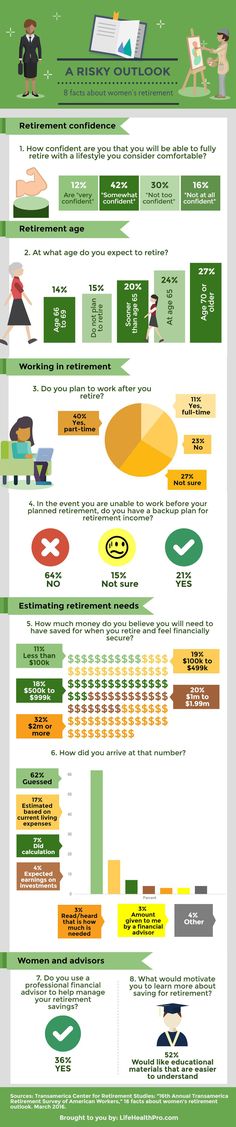

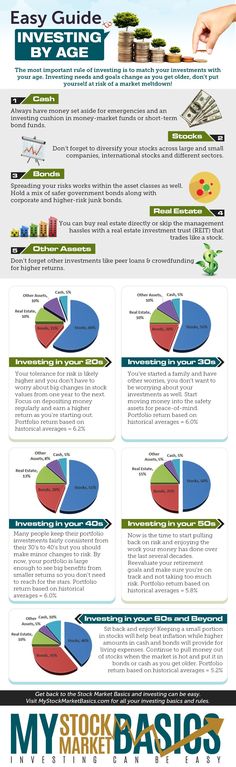

Economists say that those who are currently working will not be able to receive a high pension. Therefore, many recommend not to rely too much on providing old age only with pension contributions.

Our insurance services

Our insurance broker helps to insure in Germany in Russian with an individual approach to the situation of each client. Complete the questionnaire to find an insurance contract. The service is completely free.

QUESTIONNAIRE

Germany ranks first among European countries in terms of the number of elderly people living and second in the world.

According to the German Federal Statistical Office, as of 2017, 18 million burghers aged 65 and over live in the country. This is every fifth inhabitant, and in the future the figure will only increase. By 2060, it may reach 24 million people.

The share of working pensioners aged 65-69 has doubled over the past ten years. Not always the reason is a difficult financial situation, many continue to work voluntarily. But poverty in Germany also affected the elderly. Half of the 8.5 million pensioners receive less than 800 euros per month.

Burghers, who do not experience financial problems, in old age show a craving for everything new. Last year, 15,000 elderly students were registered in German universities. Even new technologies do not scare pensioners. Although social networks play a secondary role, older people have become more active in using the Internet: booking trips, getting information, communicating with loved ones.

Researchers have identified a recipe for longevity in Germans: a healthy diet with lots of vegetables and little meat, avoiding cigarettes and alcohol prolong the joy of life. Another factor is a positive attitude towards age. Retirees unanimously believe that an interesting occupation, an active lifestyle and communication with friends and family make life rich.

22-03-2018, Stepan Babkin

Typically, movement activists tend to retire around the age of 30-40 to do what they love without expecting financial returns from it. Or, just mess around. Lenta.ru and Otkritie Broker tell how it is possible to become a pensioner in your 30s.

Typically, movement activists tend to retire around the age of 30-40 to do what they love without expecting financial returns from it. Or, just mess around. Lenta.ru and Otkritie Broker tell how it is possible to become a pensioner in your 30s. Be independent

FIRE stands for financial independence, retire early (financial independence and early retirement).

Lenta.ru

Although the idea of leaving work and not being dependent on clients and boss sounds good, FIRE activists face a serious problem. A similar situation is experienced by pensioners who go on untimely leave closer to 60 - this is called retirement stress. Along with the crisis of self-identification, people are faced with the fact that there is too much free time, there is nothing to do with it in vain. Therefore, it happens that the first six months a newly-made pensioner spends corny watching Netflix.

While some never find themselves in a new way of life and return to the office, for many activists, early retirement becomes a dream life. They do what they love, but not for the sake of money, but simply for themselves, for pleasure; they travel, cook, raise children, spend time with a loved one and themselves.

They do what they love, but not for the sake of money, but simply for themselves, for pleasure; they travel, cook, raise children, spend time with a loved one and themselves.

The Chen family searched for answers to their questions for a year after leaving work. Chen traveled all over the world, and now, during the next trip, they realized that they live exactly the way they always wanted. They have no property, all their possessions are two backpacks, four pairs of shoes, several T-shirts and sweatshirts, two laptops, documents and almost one and a half million dollars in accounts.

How is it that people retire at the age of 30? Everything is very simple. For ten years they have worked hard, limiting financial spending to the maximum, sometimes putting aside not just 10 percent of the salary, as financial analysts recommend, but all 75. Of course, this is only possible if the work involves a high salary. It is worth noting that FIRE is popular mainly among the IT sector in North America.

Photo: Valentin Ogirenko / Reuters

Having accumulated about a million dollars, FIRE activists quit their jobs, invest money and live on the annual percentage. However, there are activists who do not quit their jobs completely, either by working part-time or earning money from their hobby.

The cornerstone of the FIRE movement is financial independence. The goal of activists is not just not to work, but not to depend on a monthly salary, on other people - and live their own lives. Financial independence - having enough income (from investments, passive business, real estate) to pay reasonable living expenses for the rest of your life. You have the freedom to do what you want with your time. Work (full or part-time), hobbies that generate income or other activities are no longer mandatory for you.

In Russia, it is also possible to receive passive income, and anyone can do it, regardless of age. You can start receiving it at the age of 45, or at 20, for example, by investing with the help of Otkritie Broker. First, it's easier than it looks. Secondly, the company's website has a lot of educational materials, which, coupled with the convenient interface of the mobile application, make the trading process accessible to anyone. Thirdly, your goal may not only be to retire earlier, but also to prepare financially for it by accumulating some capital.

First, it's easier than it looks. Secondly, the company's website has a lot of educational materials, which, coupled with the convenient interface of the mobile application, make the trading process accessible to anyone. Thirdly, your goal may not only be to retire earlier, but also to prepare financially for it by accumulating some capital.

Otkritie Broker was founded in 1995, the history of the Otkritie FC banking group began with it. Today, the broker is part of the FC Otkritie Bank group, which is among the ten largest in Russia in terms of assets and in the list of systemically important credit institutions in the country.

How to make a million dollars

Of course, if everything was simple, then, perhaps, every second person would have already been retired. Accumulating such a decent amount is difficult even with an income of 10 thousand dollars a month, because in order to accumulate a million in 10 years, you need to save 100 thousand annually, that is, just about 10 thousand a month. How can this be done?

How can this be done?

Savings, savings and more savings. This is another cornerstone of FIRE. You need to save on everything (within reason, of course, you don’t need to refuse lunch, but it’s worth taking care of choosing an institution with lower prices). The first step is to get rid of excesses. For example, why spend money on a car: on gasoline, on maintenance, on taxes, if humanity long ago invented an environmentally friendly and cheap way to travel - a bicycle? Why buy the latest model of an expensive smartphone if there are cheaper, but no less high-quality counterparts?

Photo: Thomas Peter / Reuters

FIRE activists are selling houses and moving to smaller housing, and sometimes even to trailers. In general, owning real estate is bad manners among activists. This is not an achievement, but a burden. Plus, it all depends on your retirement plans. If you are going to give birth to seven children, then, of course, a trailer is not your option, but planning to go around the world and spend the next 10 years in it, there is no need for property.

It often happens that at this age people have not yet paid off all their loans, and children have not yet graduated from college - all this requires considerable expenses. FIRE ideas can spur young people to be more responsible with their finances, so they will be more prepared for retirement than their parents or grandparents.

According to research, the level of financial literacy in the United States is higher than in Russia, but there are exceptions in both countries. Many Americans don't think about their future without keeping track of how much they spend. For example, Taylor Wrinks, the creative director of a large company, lived in a luxurious apartment overlooking the sea, drove an expensive business-class car and generally "littered the money." Once she calculated that she would be able to pay off all loans, taking into account current expenses, closer to 90 years, and if he starts to follow the principles of FIRE, he will be able to retire in 10 years.

Among the reasons why the FIRE movement was able to emerge, one can single out the dynamic growth in the value of shares that began after the end of the 2008 crisis. Thus, investing for passive income is a timely decision. In order to start investing, you need to open an account with Otkritie Broker. The Warm Welcome campaign is currently underway, according to which the company's clients receive cashback * in the form of bonus points for transactions and inviting friends to open an account with Otkritie Broker. The received points can be spent on the purchase of goods and services in the shop window of the loyalty program. By the way, cashback fits perfectly into the value system of the FIRE movement.

Thus, investing for passive income is a timely decision. In order to start investing, you need to open an account with Otkritie Broker. The Warm Welcome campaign is currently underway, according to which the company's clients receive cashback * in the form of bonus points for transactions and inviting friends to open an account with Otkritie Broker. The received points can be spent on the purchase of goods and services in the shop window of the loyalty program. By the way, cashback fits perfectly into the value system of the FIRE movement.

No longer idealists

Denver programmer Carl Jensen experienced an "awakening" in 2012. He did a tedious job documenting the activities of the US Food and Drug Administration (FDA). At the same time, his work was vital - and this is not an exaggeration. A mistake in the code could make a patient disabled or even take his life.

Jensen was making over $100,000 a year, but the money didn't pay off the stress that came with his job. There were not many opportunities to relax due to the crazy work schedule. In his rare free time, Jensen couldn't take a break due to burnout at work. He was rapidly losing weight and was rarely happy.

There were not many opportunities to relax due to the crazy work schedule. In his rare free time, Jensen couldn't take a break due to burnout at work. He was rapidly losing weight and was rarely happy.

Having finished yet another hard day at work, Jensen began to look for an option to retire early. That's how he learned about FIRE. After discussing everything with his wife, Jensen significantly cut costs and amassed one million two hundred thousand dollars in five years. After leaving the next weekend, Jensen called the boss and said that he was leaving.

One of the main books that FIRE activists are guided by is Trick or Treat, published way back in 1992. Vicki Robins, who wrote the book with Joe Dominguez, said FIRE was different from the people who followed her advice at 90 years. First of all, Robins urged not to leave work, but to reduce consumption, become more modest and live more environmentally.

Photo: Francois Lenoir / Reuters

According to Robins, FIRE supporters have no such ideals. But what makes people leave work so early? After all, they often did not work even 10 years. Robin has an answer: people in today's economy don't feel in control of their own lives, and they also feel like they're only replaceable cogs. To change this, they seek independence.

But what makes people leave work so early? After all, they often did not work even 10 years. Robin has an answer: people in today's economy don't feel in control of their own lives, and they also feel like they're only replaceable cogs. To change this, they seek independence.

Early retirement is not easy

Some critics of the movement argue that FIRE is for the rich, because how to save up the amount that you can live on for the rest of your life if the monthly salary fluctuates around the living wage? Another argument against FIRE is that the movement's supporters are poorly protected. There is no guarantee that activists will receive the same percentage throughout their lives, because it is simply impossible to predict what will happen in 30-40 years. In addition, there are many unforeseen expenses associated, for example, with diseases.

Don't forget about the limitations that come with financial independence. Among them are the rejection of the car, and living in regions where life is cheaper, and eating mostly at home. Many activists go further, refusing to have children - all for the sake of economy.

Many activists go further, refusing to have children - all for the sake of economy.

According to the Federal Reserve, 25 percent of US citizens do not have any retirement savings. Now the problem of retirement of numerous representatives of the baby boomer generation is more urgent in the country. According to statistics, a third of them managed to save less than $25,000 for retirement.

Still, people who retire early can be understood. Christy Shen began thinking about early retirement when a colleague passed out at the workplace due to working 14-hour days. Just like Shen, her colleague saved up money for real estate.

But, as Shen says, “It didn't matter how much you put off, that goal kept moving away from you. And I've watched people go out of their way to pay their mortgages. Our parents passed on to us a set of life rules that worked great at 19.70s. But we had to throw out that instruction and write a new one.”

Promotions "Warm welcome" and "Invest-hi!" are held from 11/06/19 to 12/31/19 and from 03/28/19 to 12/31/19, respectively.