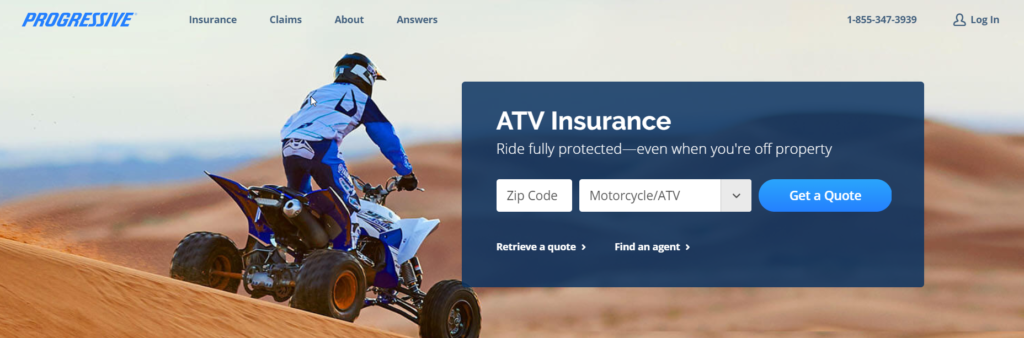

If you own an all-terrain vehicle (ATV) or utility terrain vehicle (UTV), then having appropriate ATV insurance is critical. Not only can insurance protect you (and your wallet) in case of accident or injury, but depending on where you live, it might be required by law.

Often, ATV insurance falls under the category of motorcycle insurance. For those looking to take out an ATV insurance policy, it’s important to know what the costs of coverage generally look like — as well as what factors can impact your premiums. In many cases, you may be eligible for various discounts that can lower the costs of your ATV and UTV insurance.

If you’re on the hunt for UTV or ATV insurance coverage, this guide can help. Learn about the average costs of ATV insurance, factors affecting your premiums, common discounts, and more below.

On this page:

Based on our collection of quotes, the average ATV insurance cost is about $100. 47 per month for a standard policy. This price can vary anywhere from $40.75 to $237.77 per month, depending on your desired level of coverage.

To obtain our quotes, we used the following details:

Here’s how each insurance premium quote varied by company:

| Company | Quote (Monthly) |

| Markel | Basic = $40.75 Standard = $53.42 Enhanced = $84.75 |

| Progressive | Basic = $47 Standard = $61.50 Enhanced = $69.33 |

| Nationwide* | Basic = $69. 75 75Standard = $93.17 Enhanced = $134.25 |

| Allstate* | Basic = $103 Standard = $114 Enhanced = $135 |

| GEICO | Basic = $145.37 Standard = $180.24 Enhanced = $237.77 |

| Average | Basic = $81.17 Standard = $100.47 Enhanced = $132.22 |

*Discounts were automatically added at checkout. The other insurers listed did not disclose any automatically added discounts.

Note: Not all issuers offer the same coverage levels. For this reason, we focused on mentioning the level of coverage (basic, standard, enhanced) rather than listing specific amounts.

Generally, the more ATV insurance coverages you select, the more reimbursement you want, and the lower your deductible, the higher your premium will be. The most comprehensive insurance policies with the lowest deductibles tend to be the most expensive.

Below, you’ll see various coverage options through Allstate. The basic insurance policy, which includes the lowest levels of coverage, costs $103 per month. The highest-coverage plan — the enhanced policy — is $135 per month.

| Coverage | Basic Policy | Standard Policy | Enhanced Policy |

| Bodily Injury | $30,000/person $60,000/accident | $100,000/person $300,000/accident | $250,000/person $500,000/accident |

| Property Damage | $25,000/accident | $50,000/accident | $100,000/accident |

| Medical Payments | $1,000/person | $2,500/person | $5,000/person |

| Uninsured or Underinsured | $30,000/person $60,000/accident | $100,000/person $300,000/accident | $250,000/person $500,000/accident |

| Collision and Comprehensive | $500 deductible | $250 deductible | $100 deductible |

| Quote | $103/month | $114/month | $135/month |

When looking for any type of auto insurance, it’s essential to strike a balance between affordability and appropriate coverage. Monthly cost matters, but remember: If you’re in an accident, the amount of coverage will determine how much you’ll spend out of pocket, so this is an important factor as well.

Monthly cost matters, but remember: If you’re in an accident, the amount of coverage will determine how much you’ll spend out of pocket, so this is an important factor as well.

In addition to coverage, several other factors can impact your ATV auto insurance rates.

As you can see above, the type and amount of coverage you choose can significantly impact your insurance premiums. Additionally, some factors influence cost, including things like:

If you’re riding your ATV or UTV to work each morning, or you plan to drive it 10,000 miles this year, you’ll probably pay a bit more.

If you’re riding your ATV or UTV to work each morning, or you plan to drive it 10,000 miles this year, you’ll probably pay a bit more.Unhappy with a quote you’ve gotten? Because there are so many factors that play into ATV insurance premiums, there are quite a few steps you can take to reduce your insurance costs.

To get cheaper ATV insurance, you have three options: 1) select less coverage or smaller limits, 2) qualify for a discount, or 3) lower your risk in one of the categories mentioned above. For tips on the two latter options, see below.

For tips on the two latter options, see below.

Insurance companies often offer discounts for policyholders as ways to lower premiums and encourage good habits. Though specific discounts vary by insurer, here are a few common ones we’ve seen for ATV and UTV policies:

Sometimes, paying your full year’s premium upfront (rather than monthly) can help, too.

You can also lower the risk you present to the insurer in one of the above categories (age, usage, etc.). Some examples include driving safer, taking a driver safety course, occasionally using your ATV, buying a lower-cost vehicle, or not allowing younger drivers on board.

Comparing your options is key when looking to get an ATV insurance policy. Use the table above to get an idea of what coverage costs, and reach out to individual insurance companies for more personalized quotes for your all-terrain or utility vehicle.

How do you want to share?

Facebook Twitter EmailATV insurance cost and rates depend on various factors, especially the extent of motorcycle insurance coverage you opt for depending on your state's minimum coverage requirements. For example, a basic policy with just bodily injury liability and property damage liability may be the least expensive option, but if you want comprehensive coverage or collision coverage, you'll have to add them to your policy for an additional cost. On top of the coverage options, the rate of insurance for your ATV will also depend on make and model, location, experience and driving history.

How fast your off-road vehicle can go, the size of the engine, and how easy it is to replace the parts are just a handful of things that can affect the cost of insurance.

Your ZIP code will help determine the insurance cost of your quad. That's because states have different minimum coverage requirements, and some neighborhoods may see more theft than others. The average distance you plan to drive the vehicle per year (e.g., taking it out once every few weeks versus driving it daily) can also factor into the cost of your policy.

ATV insurance rates will differ depending on your amount of riding experience. New riders, or experienced riders with new vehicles, are more likely to have accidents than riders who are very familiar with their vehicle, and thus have a higher insurance cost.

If you're a responsible driver with no accidents or cited violations on your recent record (the past three to five years), your insurance rate may be lower.

Pro tip:

If you're an experienced, responsible driver with no ATV accidents or cited violations on your recent record (the past three to five years), your insurance rate may be lower.

Depending on both your circumstances and the policy carrier, you may be eligible for discounts. The following situations often warrant reduced ATV insurance rates and motorcycle insurance discounts for ATV insurance, depending on the insurer:

You can often insure multiple ATVs under one policy at a discounted rate. And if you already have motorcycle insurance with one company, including Progressive, you can often add your ATV/UTV to that existing policy. Learn more about bundling insurance policies with Progressive.

Get an ATV quote online or call 1-855-347-3939 to get four-wheeler insurance and stay protected on and off the trail.

Related articles

How much is motorcycle insurance?

How to get cheap motorcycle insurance

Please note: The above is meant as general information to help you understand the different aspects of insurance. Read our editorial standards for Answers content. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

The popularity of ATVs has grown significantly over the past few years. ATVs are a great option for off-road trips and competitions, they are appreciated by hunters and fans of extreme riding. Many owners wonder if such a vehicle needs to be insured after purchase. This question is answered by the experts of the water-motor center "Sport Extreme".

Most often, ATVs are used for sports and entertainment. In our country, they are officially classified as self-propelled vehicles - those that are rarely used on public roads. By the way, snowmobiles, tractors and combines belong to the same category. And while there are no changes in the legislation of the Russian Federation on this matter, the owners of motorcycles decide for themselves the question of the need for insurance.

In our country, they are officially classified as self-propelled vehicles - those that are rarely used on public roads. By the way, snowmobiles, tractors and combines belong to the same category. And while there are no changes in the legislation of the Russian Federation on this matter, the owners of motorcycles decide for themselves the question of the need for insurance.

Every quad bike owner should remember: if he needs, even occasionally, to go to the city or to the highway on his "iron horse", he automatically becomes a road user. And here the law already operates: any vehicle is subject to compulsory insurance. Therefore, when deciding whether to insure or not, consider for the future what roads you plan to drive on.

On the one hand, an ATV is a vehicle, on the other hand, property. And you can insure it from a number of situations. When applying for a policy with an insurance company, the owner himself chooses from what situations he considers it necessary to protect his ATV: theft, damage (in an accident and not only, damage to equipment by third parties, natural disasters, including snow falling from the roof, etc. ) .

) .

If you are concerned about insured events both on the road and off it, make out CASCO, if only the first option is enough CMTPL.

The procedure will require a minimum package of documents. During a personal visit to the insurance organization, you must have with you:

If you are the owner of the vehicle, but another person will drive it, then you will need a passport (or a copy) of this driver to enter it into the insurance. There may be another situation: if you are not the owner of the ATV, then take the owner's passport with you.

Some companies offer to issue a policy remotely. In this case, the employee who will communicate with you via the Internet, by phone or in instant messengers, may additionally ask you to send your clear photo.

ATV is often used irregularly, so it is far from always profitable to make a policy for a year. Select the periods during which you plan to use the transport. It doesn't have to be a whole summer or fall season. You may well choose specific months (for example, you expect to work hard in the office until July, spend July at the resort, and already in August and September ride an ATV with a breeze.

You can find this out on the websites of insurance companies (as a rule, there are online calculators there) or by calling the contact numbers of these organizations. The cost of the service is calculated individually for each client. But there are a number of factors that can influence the final figure in one direction or another:

The model of the ATV also matters. The more expensive it is, the higher the insurance. For example, a CASCO policy will cost about 20% of the cost of the ATV itself.

Do not rush to contact the first company that comes across. Consider several options, call and discuss the conditions, ask questions. And then choose the most attractive, in your opinion, offer. Before signing, carefully study the contract, including information about what insurance covers and does not cover, about insurance premium payments.

The average cost of an MTPL policy for an ATV is several times lower than car insurance. At the same time, the risk of motorcycles getting into an accident is higher than that of conventional cars. This is definitely unprofitable for companies, but refusing a client means practically sending him to a competitor plus violating No. 40-FZ, Art. 1.

40-FZ, Art. 1.

Therefore, some insurers try to cheat, for example, offer additional paid products. They do not have the right to impose them, so before purchasing the recommended one, think about whether you really need it. It is your legal right to refuse additional services you do not need.

------------------------------------------------ -------------------------------------------------- ------

If you are just thinking about buying an ATV, take a look at the Sport-Extreme catalogue. Motor vehicles are presented here in a wide price range from leading domestic and foreign manufacturers:

On the website of the online store, you can order the delivery of motorcycles to any city in the Russian Federation.

The specialists of the powerboat center will help you choose

models suitable for your goals and expectations.

For a detailed consultation on availability, prices and features, just call +7 (4822) 65-65-03.

Benefits of OSAGO for an ATV in Ingosstrakh:

If you want to protect yourself from unexpected expenses, apply for Casco : The policy will cover the repair or damage to your car after an accident.

Issue Extend Calculate

Compensation

for damage to property

We will pay up to 400,000 ₽ to owners of property damaged in an accident through your fault

We will pay up to 400,000 ₽ to owners of property, damaged in an accident through your fault

Compensation

for damage to life and health

We will pay up to 500,000 ₽ to road accident participants injured through your fault

We will pay up to 500,000 ₽ to road accident participants injured through your fault

1. Calculate

Calculate

Find out the cost of the policy in the calculator

2. Pay

You can pay for the policy in a convenient way

3. Get

We will send the policy to e-mail and to your personal account

E-OSAGO has the same legal force as a paper-based policy.

You can calculate and issue an electronic MTPL online without inspecting the vehicle and visiting the office. The cost of e-OSAGO and a paper policy is the same.

Immediately after payment, the policy will be sent to your e-mail and will appear in your account. You do not need to print out the MTPL: the electronic version of the policy will always be at your fingertips. When the contract ends, you can quickly renew the policy online.

Issue