Learn more about our 4 key retirement metrics—a yearly savings rate, a savings factor, an income replacement rate, and a potentially sustainable withdrawal rate—and how they work together in the Viewpoints Special Report: Retirement roadmap.

close

View Larger Image

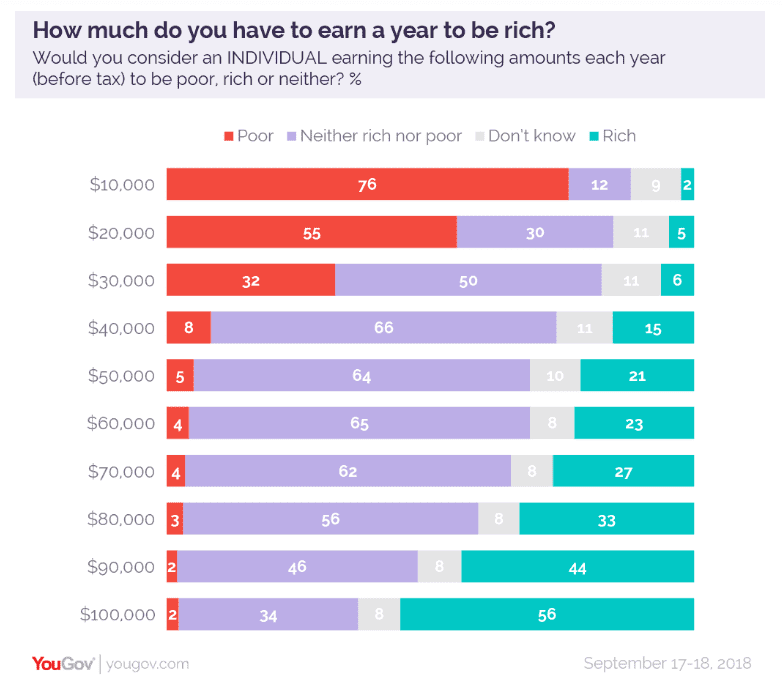

How much do you need to save for retirement? It's one of the most common questions people have. And no wonder. There are so many imponderables: When will you retire? How much will you spend in retirement? And for how long?

That's why we did extensive analysis to come up with age-based retirement savings factors that can help you plan—in spite of those uncertainties. These milestones are aspirational. You likely won't meet all of them. But they can serve as goalposts to help you make a plan to save enough to maintain your lifestyle in retirement.

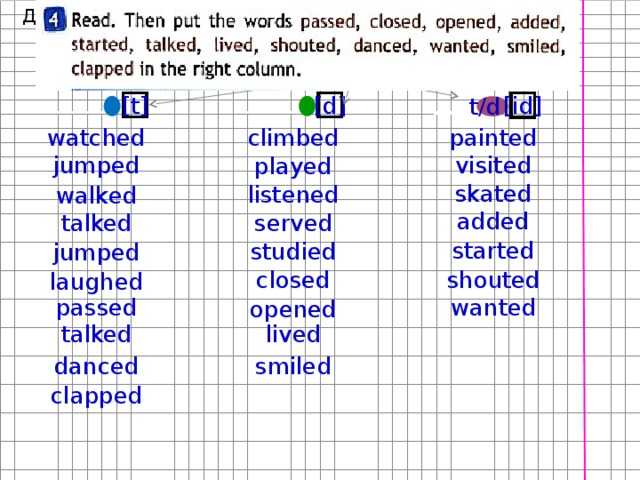

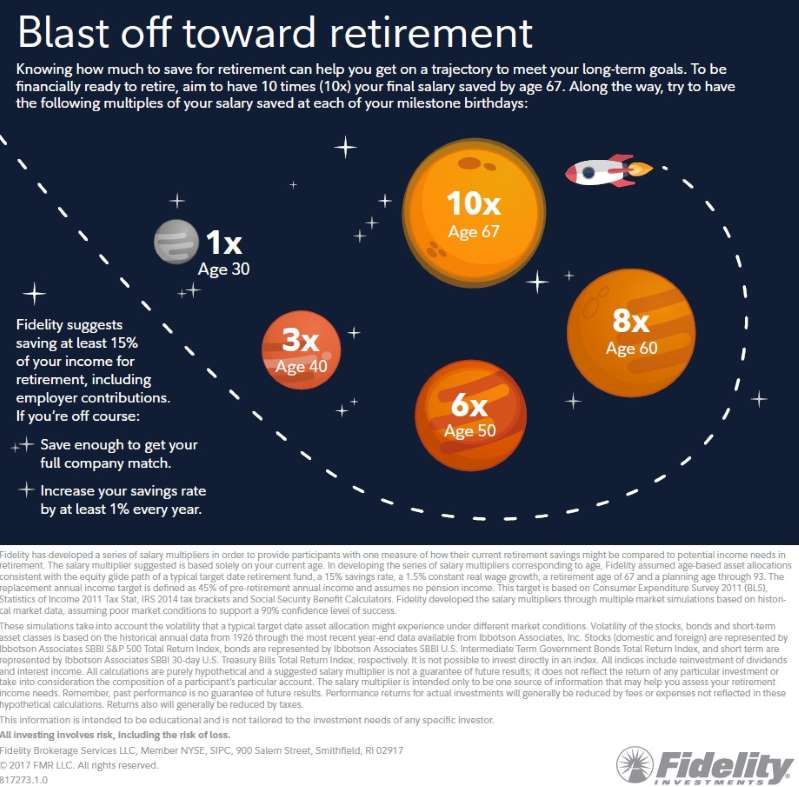

Our savings factors are based on the assumption that a person saves 15% of their income annually beginning at age 25 (which includes any employer match), invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their preretirement lifestyle in retirement (see footnote 1 for more details).

Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should help ensure that you have enough income to maintain your current lifestyle in retirement. That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60. Your personal savings goal may be different based on various factors including 2 key ones described below. But these guidelines can provide a starting point to help your build your savings plan, and assess your progress.

2,3

That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60. Your personal savings goal may be different based on various factors including 2 key ones described below. But these guidelines can provide a starting point to help your build your savings plan, and assess your progress.

2,3

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. That's because delaying gives your savings a longer time to grow, you'll have fewer years in retirement, and your Social Security benefit will be higher.

Consider some hypothetical examples (see graphic). Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you can't always choose when you retire—health and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

See footnote at the end of the article for more information.

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? That's average. If you expect your expenses will be more than they are now, that's above average.

Or will you spend as much as you do now? That's average. If you expect your expenses will be more than they are now, that's above average.

Let's look at some hypothetical investors who are planning to retire at 67. Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Our simple widget lets you see the impact of these 2 variables—when you plan to retire and what kind of lifestyle you want to live in retirement—on how much you need to have saved when you do retire, and on all the intermediate milestones.

What if you're behind? If you're under age 40, the simple answer is to save more and invest for growth through a diversified investment mix. Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks. If you're over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks. If you're over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

No matter what your age, focus on the goals ahead. Don't be discouraged if you aren't at your nearest milestone—there are ways to catch up to future milestones through planning and saving. The key is to take action, and the earlier the better.

See how small increases in contributions can add up over time.

Amount, account, and asset mix are important when saving for retirement.

Table of Contents

Table of Contents

How Much Do I Need to Save to Retire?

The 4% Rule

Retirement Savings by Age

Retirement Savings Confidence

How to Calculate Retirement Savings

Frequently Asked Questions

How Much Does a Couple Need to Retire?

What Is the 4% Rule?

How Much Should I Save Each Year?

The Bottom Line

Stay on Track for Retirement by Knowing How Much You Need to Save by What Age

By

Jim Probasco

Full Bio

Jim Probasco has 30+ years of experience writing for online, print, radio, and television media, including PBS. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. He has a bachelor's from Ohio University and Master's from Wright State University in music education.

His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. He has a bachelor's from Ohio University and Master's from Wright State University in music education.

Learn about our editorial policies

Updated September 09, 2022

Reviewed by

David Kindness

Reviewed by David Kindness

Full Bio

David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.

Learn about our Financial Review Board

Fact checked by

Suzanne Kvilhaug

Fact checked by Suzanne Kvilhaug

Full Bio

Suzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

Learn about our editorial policies

Investopedia / Sydney Saporito

A key part of retirement planning is to answer the question: How much do I need to save to retire? The answer varies by individual, and it depends largely on your income now and the lifestyle you want and can afford in retirement.

Knowing how much you need to save based on how old you are now is just the first step, but it starts you on the path to help you reach your retirement goals. There are a few simple formulas that you can use to come up with the numbers.

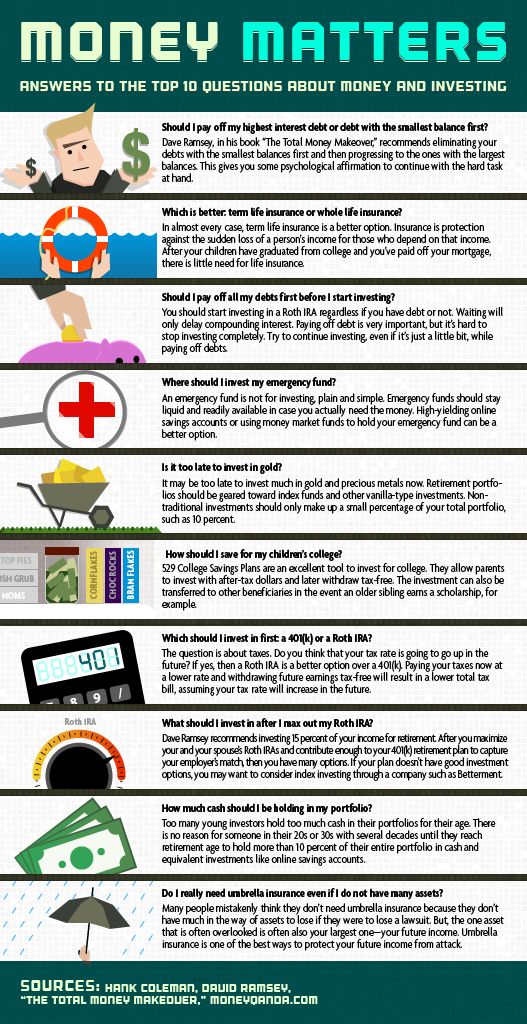

Many retirement experts recommend strategies such as saving 10 times your pre-retirement salary and planning on living on 80% of your pre-retirement annual income.

That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.

This amount can be adjusted up or down depending on additional sources of income, such as Social Security, pensions, and part-time employment, as well as factors like your health and desired lifestyle.

Order your copy of the print edition of Investopedia's Retirement Guide for more assistance in building the best plan for your retirement.

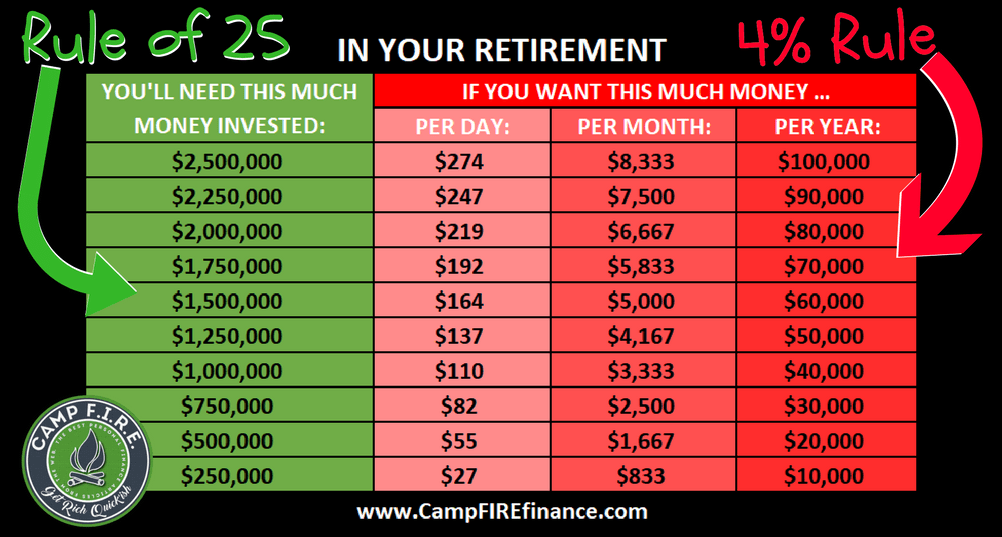

To determine just how much you will need to save to generate the income that you need, one easy-to-use formula is to divide your desired annual retirement income by 4%, which is known as the 4% rule.

For an income of $80,000, you would need a retirement nest egg of about $2 million ($80,000 /0. 04). This strategy assumes a 5% return on investments, after taxes and inflation, no additional retirement income, such as Social Security, and a lifestyle similar to the one you would be living at the time you retire.

04). This strategy assumes a 5% return on investments, after taxes and inflation, no additional retirement income, such as Social Security, and a lifestyle similar to the one you would be living at the time you retire.

In general, the 4% rule assumes that you will live for 30 years in retirement. Retired adults who live longer need their portfolios to last longer, and medical costs and other expenses can increase as you age.

Knowing how much you should save toward retirement at each stage of your life helps you answer that all-important question: “How much do I need to retire?” Here are a few useful formulas that can help you set age-based savings goals on the road to retirement.

To figure out how much you need to accumulate at various stages of your life, it can be useful to think in terms of saving a percentage of your salary.

Fidelity Investments suggests saving 15% of your gross salary starting in your 20s and continuing throughout the course of your working life. This should include savings across various retirement accounts as well as any employer contributions you receive to those accounts, assuming you have access to a 401(k) or another employer-sponsored plan.

This should include savings across various retirement accounts as well as any employer contributions you receive to those accounts, assuming you have access to a 401(k) or another employer-sponsored plan.

Fidelity also recommends the following benchmarks—based on a multiple of your annual earnings—for how much you should have saved for retirement by the time you reach the following ages.

| Target Retirement Savings by Age | |

|---|---|

| Age | Annual Salary |

| 30 | 1x annual salary |

| 40 | 3x annual salary |

| 50 | 6x annual salary |

| 60 | 8x annual salary |

| 67 | 10x annual salary |

Another, more heuristic formula holds that you should save 25% of your gross salary each year, starting in your 20s. The 25% savings figure may sound daunting. But don't forget that it includes not only 401(k) holdings and matching contributions from your employer, but also other types of retirement savings.

The 25% savings figure may sound daunting. But don't forget that it includes not only 401(k) holdings and matching contributions from your employer, but also other types of retirement savings.

If you follow this formula, it should allow you to accumulate your full annual salary by age 30. Continuing at the same average savings rate should yield the following:

Whether or not you try to follow the 15% or the 25% savings guideline, chances are your actual ability to save will be affected by life events such as the job loss many experienced during the COVID-19 pandemic.

Anxious that you aren't saving enough for retirement? You're not alone. As of 2021, there were roughly 60 million active 401(k) participants, in addition to former employees and retired adults. And while they may be active participants, people’s feelings toward retirement vary widely based on age.

As of 2021, there were roughly 60 million active 401(k) participants, in addition to former employees and retired adults. And while they may be active participants, people’s feelings toward retirement vary widely based on age.

According to the 2022 Investopedia Financial Literacy Study, the majority of adults expect that they will be able to retire. Among those surveyed, 57% of Generation Z and 62% of Millennials expect to retire. Nearly 66% of Generation X have such expectations.

Younger adults, ages 18 to 25, are most optimistic about retiring early—most of Generation Z believe they will retire by age 57.

Those are rosier numbers than what was found in the 2021 data from Natixis Global Retirement Index, which indicated a majority of adults expected to work longer than expected with about 40% saying it would “take a miracle” for them to retire comfortably. It is possible that data was impacted by anxieties around COVID-19 related economic instability.

In Investopedia’s study, not all adults are particularly confident in their understanding of retirement planning. Behind digital currencies and investing, retirement was the third least-understood concept. And retirement was the top personal finance concern for about one-sixth of all those surveyed.

Behind digital currencies and investing, retirement was the third least-understood concept. And retirement was the top personal finance concern for about one-sixth of all those surveyed.

In the early and middle years of your career, you have time to recover from any losses in your retirement accounts. That's a good time to take some of the risks that allow you to earn more with your investments.

In addition to using the above methods to determine what you should have saved and by what age, online calculators can be a useful tool to help you reach your retirement savings goals. For example, they can help you understand how changing savings and withdrawal rates can impact your retirement nest egg.

Although there are many online retirement savings calculators to choose from, some are much better than others. The T. Rowe Price Retirement Income Calculator and MaxiFi ESPlanner are two worth trying.

Much like an individual, how much a couple needs to save to retire comfortably will depend on their current annual income and the lifestyle they want to live when they retire. Many experts maintain that retirement income should be about 80% of a couple’s final pre-retirement annual earnings. Fidelity Investments recommends that you should save 10 times your annual income by age 67.

Many experts maintain that retirement income should be about 80% of a couple’s final pre-retirement annual earnings. Fidelity Investments recommends that you should save 10 times your annual income by age 67.

The 4% rule is a guideline used to determine how much a retiree can withdraw annually from a retirement account. It is intended to make retirement savings last for 30 years.

One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s and last throughout your working years.

Sometimes you'll be able to save more for retirement—and sometimes less. What’s important is to get as close to your savings goal as possible and check your progress at each benchmark to make sure you're staying on track.

A 401(k) might be a good place to start—if you have access to one. If not, consider an IRA. Because the importance of saving for retirement is so great, we've made lists of brokers for Roth IRAs and IRAs so you can find the best places to create these retirement accounts.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Fidelity Investments. "How Much Do I Need to Retire?."

RBC Wealth Management. "Sustainable Withdrawal Rates in Retirement: Utilize as a Guideline to Help Avoid Running Out of Money." Page 1.

Natixis. "2021 Global Retirement Index."

To imagine life in retirement, imagine that every day is a day off / Maksim Stulov / Vedomosti

For many years we earn, save, sometimes invest in many ways in order to comfortably meet old age. But have you ever thought about how much money you will need by the time you retire, and therefore how much you need to save up?

Typically, an estimate of a person's retirement costs is presented as a percentage of their last earnings. In the US, financial advisors traditionally calculate retirement plans for clients on a 70% basis. The so-called replacement rate at the level of 60-70% is a worldwide practice, points out Sergey Okolesnov, CEO of the Pension Partner consulting company. In Russia, the replacement rate is not legally fixed, he adds.

In the US, financial advisors traditionally calculate retirement plans for clients on a 70% basis. The so-called replacement rate at the level of 60-70% is a worldwide practice, points out Sergey Okolesnov, CEO of the Pension Partner consulting company. In Russia, the replacement rate is not legally fixed, he adds.

Meanwhile, in 2017, the average pension in Russia corresponded to 33.8% of the average salary, and after raising the retirement age, the replacement rate according to the plans of the government will reach 40%.

However, in reality, the expenses of a non-working person can be much higher than not only Russian, but also world standards, American researchers have found out. It is useful to estimate future expenses in advance in order to more or less accurately imagine how much money you need to accumulate by the time you retire.

Determining how much money you need in retirement is not a trivial task, point out Dan Ariely and Elin Holtsworth, retirees psychologists and behavioral economists at Duke University. When asked how much it could be as a percentage of earnings, you are unlikely to think for more than a minute, they note. “But just imagine for a second how many factors you need to take into account to come up with a more or less accurate answer - for example, the cost of living in the place where you will live in retirement, health costs, social benefits, inflation, risk level for your investment portfolio and especially how you want to spend your time in retirement,” write Ariely and Holtsworth in The Wall Street Journal. – Do you want to walk in the park or go to the fitness room? Drink water or expensive wine for dinner? Watch TV or go to ballet every week? If your children live in another city, how many times a year do you intend to visit them - two or four? How often do you intend to go to cafes and restaurants - once, twice or five times a week? Etc.".

When asked how much it could be as a percentage of earnings, you are unlikely to think for more than a minute, they note. “But just imagine for a second how many factors you need to take into account to come up with a more or less accurate answer - for example, the cost of living in the place where you will live in retirement, health costs, social benefits, inflation, risk level for your investment portfolio and especially how you want to spend your time in retirement,” write Ariely and Holtsworth in The Wall Street Journal. – Do you want to walk in the park or go to the fitness room? Drink water or expensive wine for dinner? Watch TV or go to ballet every week? If your children live in another city, how many times a year do you intend to visit them - two or four? How often do you intend to go to cafes and restaurants - once, twice or five times a week? Etc.".

Researchers interviewed hundreds of Americans of all ages, occupations, and incomes, asking what percentage of current earnings they estimate their retirement needs to be. Most immediately answered: about 70%. But the answers to additional questions showed that people did not come to this figure themselves, but heard it somewhere during discussions of the pension topic. “In other words, 70% is the conventional wisdom,” Ariely and Holtsworth say. “And it is wrong.”

Most immediately answered: about 70%. But the answers to additional questions showed that people did not come to this figure themselves, but heard it somewhere during discussions of the pension topic. “In other words, 70% is the conventional wisdom,” Ariely and Holtsworth say. “And it is wrong.”

They asked another large group of respondents specific questions about how people want to spend their time in retirement. Then they assessed these preferences (“the price tags were moderate”) and calculated how much money would be needed (as a percentage of salary) to lead the desired lifestyle. “The result was frightening - 130%; this means they need to save almost twice as much for retirement as they thought,” report Ariely and Holtsworth.

They explain it this way: “When we work (besides getting paid), we don't spend much. There is no time to spend money at work.” In addition, during this period, part of our expenses is borne by the employer company: at its expense, you can drink coffee and see the world during business trips, it can pay for mobile communications for employees and provide a social package covering medical expenses and life insurance, organize parties. When do we spend money? Mostly on weekends: we go shopping, have fun, travel, eat at a restaurant. And retirement is a continuous weekend: 8-10 hours that were spent daily on work and travel suddenly turn out to be free, and they need to be filled with something every day.

When do we spend money? Mostly on weekends: we go shopping, have fun, travel, eat at a restaurant. And retirement is a continuous weekend: 8-10 hours that were spent daily on work and travel suddenly turn out to be free, and they need to be filled with something every day.

Together with the financial technology company MoneyComb, Ariely and Holtsworth did a study and found that in order to roughly estimate their retirement expenses, it is convenient to break them down into seven categories - food, digital services, spending on yourself and recreation, travel, entertainment, shopping, basic needs.

To imagine life in retirement, imagine that every day is a day off, recommend Ariely and Holtsworth. Think about how much money you want to spend in each category? How would you like to spend the year? This does not necessarily mean “very expensive,” the researchers elaborate, but remember: the higher the costs, the more you have to sacrifice today to increase your retirement savings.

Try to answer the following questions as accurately as possible, taking into account many nuances. Do you like to cook, how much do you spend on average on food, how often do you want to visit cafes and restaurants in retirement, and in what price category? How much do you spend on digital services - mobile phone, Internet, digital television, electronic subscriptions (you won't refuse to subscribe to Vedomosti) and books? If you expect to live outside the city, do you need satellite TV? Do you like to pamper yourself and how - to read a book on the beach (and where to get it - to buy or in the library) or to pamper yourself in the spa? Do you want to sit at home watching TV or go to the theater, concerts or sporting events? Do you like to travel and how often? Around the country in your own car, abroad in a first-class plane or go on a sea cruise? Or maybe take a private jet to your own island? Do you like to give gifts to relatives and friends? How much do you spend on clothes, electronics and household appliances, household goods? And the most unpleasant, but necessary: how much money is spent on housing, taxes, health and other basic needs? Even small differences in preferences can quickly increase your spending by $20,000 a year, note Ariely and Holtsworth, who calculated desired retirement spending for the average respondent with an annual income of $160,000.

After calculating future expenses for certain categories, you need to add them all up, increase the amount, taking into account inflation forecasts by the time of retirement, and compare with your salary. But that's not all: the annual amount of spending must be multiplied by the number of years that you can spend in retirement. Now the average life expectancy of a Russian is 67 years, Russian women - 78. In the capital, according to statistics, they live longer: 74 and 81 years, respectively. There are other approaches to estimating life expectancy - for example, take the age of the main centenarian in your family and add 10 years.

But determining how much money you need for a comfortable old age is not all. The question is, will there be enough savings for this. To increase them, you may have to adjust your current lifestyle, understanding what you are ready to give up in retirement, and what now. It is also necessary to assess how much risk the investment portfolio (if any) needs to accept in order to achieve new goals. And yet: since for many the desired lifestyle in retirement may be out of reach, it is better to be as kind to your children as possible now, the researchers warn.

And yet: since for many the desired lifestyle in retirement may be out of reach, it is better to be as kind to your children as possible now, the researchers warn.

Photo gallery: What do officials think about pension reform

Media news2

Does advertising distract? With a subscription you won't see it on the site

Maria Voluyskaya

Estimated reading time: 2 minutes

38949

Category: Retirement

To assign an old-age insurance pension in Russia, three main conditions must be met: reach retirement age, have the necessary length of service and accumulate a certain number of individual pension coefficients (points). In 2022, the transitional period for raising the retirement age will continue, which also provides for changes in the minimum length of service and the number of pension points sufficient for retirement.

In 2022, in order to retire on a general basis, both men and women will need at least 13 years of service and at least 23.4 pension points, follows from the information on the website of the Pension Fund of Russia (PFR).

Residents of the Far North and equivalent areas have the right to early retirement five years earlier than the generally established retirement age. To do this in 2022, they will also need to have 23.4 points in their personal account. The required insurance period is 20 years for women and 25 years for men. There is also a mandatory requirement for northern experience: 15 calendar years in the regions of the Far North and 20 calendar years in equated areas.

Teachers, doctors, ballet dancers, circus gymnasts, opera singers and other employees who are granted a pension after acquiring a special length of service, i.e. by years of service. Depending on the profession, such a right comes with 25-30 years of experience. In the first half of 2022, those employees who completed the special experience in July-December 2020 and who managed to accumulate 23.4 points will be able to retire based on the length of service.

In the first half of 2022, those employees who completed the special experience in July-December 2020 and who managed to accumulate 23.4 points will be able to retire based on the length of service.

In January-July 2022, women who have reached the age of 56.5 years (i.e. born in July-December 1965), as well as men aged 61.5 years ( born in July-December 1960).

In the first half of 2022, residents of the Far North and equivalent areas will be able to retire early: men aged 56.5 years (born in the second half of 1965) and women who have reached 51.5 years of age (born in the second half of 1970 years).

You can find out about the length of service and the number of available pension coefficients by requesting an extract from the Pension Fund. This can be done online in your personal account on the PFR website or the State Services portal, as well as in the PFR mobile application.